By Daniel Newman

EIG is tracking COVID-19’s impact on prospective entrepreneurial activity in the United States with weekly data on business formation provided by the U.S. Census Bureau. The statistics below focus on “high-propensity” business applications, a specific subset of applications for new Employer Identification Numbers (EINs) identified by the Census Bureau as having a high likelihood of becoming active businesses with employees within several months after filing. We refer to these high-propensity applications as “likely employers” here.

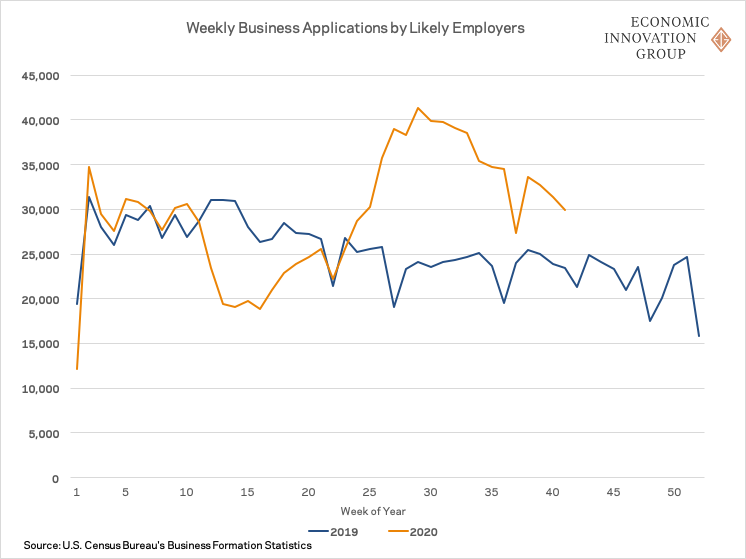

In the wake of an abrupt falloff in nationwide business formation at the start of the pandemic, business applications from likely employers remained elevated above historical levels in the week ending October 10th (week 41 of 2020), extending the surge that began in late May. Total applications recorded from July through September were the highest quarterly amount on record. Likely employers submitted 29,920 applications last week, representing a substantial 28 percent increase over the same week in 2019.

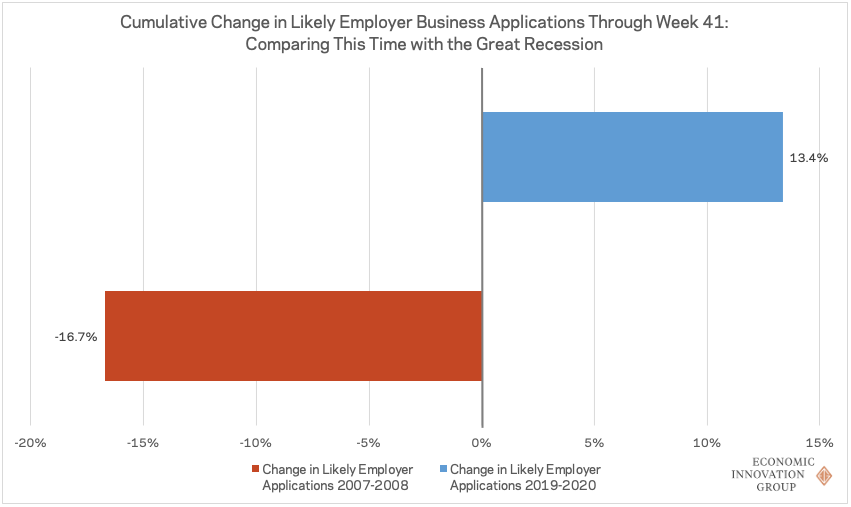

Even though the elevated rate of filings is slowly drifting back down toward a pre-pandemic trend, applications remain well-above last year’s totals—a dramatic turnaround from the springtime dropoff. The past few months of unusually high numbers have more than compensated for the initial gap in business formation that opened up early in the pandemic, and since the start of the year, likely employer applications have totaled nearly 1.2 million—a jump of more than 13 percent over the same period in 2019. Even with the nationwide uptick, ten states still trail the number of likely employer applications recorded through the same week last year, although all lag by 4 percent or less.

Despite this seemingly promising trend in new business formation, the net effect on the overall count of businesses will be tempered by the scope of closures this year. Almost a quarter of small businesses were shuttered as of late September compared with the start of the year, based on data tracked by Opportunity Insights.

It is not entirely clear why applications are so elevated relative to historical trends when the future is so uncertain and many existing businesses are struggling to adapt to changes in consumer behavior due to the virus. The effect of the current crisis on business formation is playing out quite differently from the Great Recession more than a decade ago. That downturn resulted in a steady decline in business formation in its initial year: Through week 41 of 2008, the total number of applications from likely employers were down nearly 17 percent. After that crisis, startup rates remained depressed all the way through at least 2018, when the United States produced fewer startups than it did during the 2001 recession.

Applications tracked here are a forward-looking measure of new business starts, and part of the explanation for the mid-year bump could be that many aspiring entrepreneurs only temporarily shelved their business plans in the early weeks of the pandemic. Nevertheless, the sustained and unprecedentedly high rate of new business applications hints that the current crisis could be part of an accelerating restructuring of the economy, as entrepreneurs adapt to a new economic reality.

The surge is likely also at least somewhat powered by newly unemployed individuals starting their own businesses, either by choice or out of necessity. However, such individuals tend to start non-employer firms in recessions (opting for self-employment), not the likely employers discussed here. Much of the surge may therefore represent the real thing: entrepreneurs finding opportunity in the crisis.

The available data does not allow us to estimate which force or combination of forces is at work, however, and there are several reasons to interpret the data with caution: Applications in the manufacturing, retail, health care, and restaurant industries are automatically tagged in the data as businesses likely to hire employees. Without industry data, we cannot tell whether crisis-era idiosyncrasies in the roiled healthcare, retail, or food services sectors might be driving the national bounce. Finally, the data also captures some purchases of existing businesses, so a portion of the upswing could represent a churn in business ownership rather than actual anticipated new business formations. Nevertheless, anecdotal evidence provides good reason to believe that much of the bump is real.