A Lifeline for Small Businesses Included in the Phase III COVID-19 Relief Bill

By John Lettieri and Catherine Lyons

What is the Paycheck Protection Program?

Title 1 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act is the Keeping American Workers Paid and Employed Act, which provides relief for small businesses and their employees who are adversely affected by the outbreak of COVID-19. The cornerstone provision is the “Paycheck Protection Program,” an emergency lending facility, administered by the Small Business Administration (SBA) under its 7(a) lending program, to provide small business loans on favorable terms to borrowers impacted by the current state of economic uncertainty. At $349 billion in new lending capacity, it accounts for the vast majority of the small business assistance provided in the Phase III legislation, and is one of the most important — if somewhat overlooked — aspects of the Congressional response to the pandemic thus far.

Congress intended the Paycheck Protection Program to accomplish two fundamental goals: 1) help small businesses cover their near-term operating expenses during the worst of the crisis, and 2) provide a strong incentive for employers to retain their employees. In short, it is intended as a partial revenue replacement program to allow deeply affected businesses to hibernate through a period of severe disruption without making drastic changes to their footprint.

How does it work?

The program generally targets businesses, nonprofits, Tribal businesses, and veteran’s organizations with 500 employees or less as eligible for federally insured, partially forgivable loans that can be used to cover short-term operating expenses during the economic crisis. The maximum loan size is equivalent to 250 percent of the employer’s average monthly payroll costs (e.g., roughly 10 weeks of payroll expenses) or $10 million, whichever is less. Payroll costs are defined broadly to include wages, salaries, retirement contributions, healthcare benefits, covered leave, and other expenses.

The program includes a number of generous features for borrowers, including six months to one year of deferred repayment, fee waivers, and streamlined application requirements. Most importantly, borrowers are eligible for loan forgiveness equivalent to the sum spent on covered expenses during the eight-week period after the loan is originated. Those covered expenses include the bulk of a typical business’s fixed operating costs: payroll, rent, utilities, and mortgage interest obligations. The forgivable nature of these loans in effect turns them into grants, meaning that qualifying businesses will not see a significant increase in their debt burdens. But to qualify for forgiveness, employers must maintain their pre-crisis level of full time equivalent employees, or else face a reduction in forgiveness proportional to the reduction in headcount. Since many businesses have already been forced to make staffing reductions in response to vanishing customers and lost revenues, the legislation includes a clause that allows them to qualify for loan forgiveness if they have re-hired back to pre-crisis levels by June 30, 2020.

Congress made the terms generous and the barriers to entry low in an effort to ensure resources would be made available as quickly as possible to needy businesses. Borrowers do not need to demonstrate actual economic harm in order to qualify. Instead, they simply need to make a series of good faith certifications, principally that current economic conditions necessitate the loan to support ongoing business operations, and that the funds will be used to maintain payroll and address other covered expenses. While this streamlined approach will certainly make it easier for vulnerable businesses to receive support on an expedited basis, it may also lead some otherwise healthy businesses to take advantage of the program at the expense of those whose survival depends upon it.

Why is this needed?

The U.S. small business sector is facing an unprecedented crisis as a result of the pandemic. Already, a wave of businesses have closed their doors, helping fuel a record number of new unemployment claims. Many others have seen their revenues dry up, making it impossible to keep up with basic operating costs for much longer. These businesses need immediate access to capital that can replace their lost revenue and help them weather the crisis until normal operations can resume. The more small businesses that survive the crisis, the stronger the recovery we can expect once it is over.

Will it be enough?

Probably not. Economists Michael Strain of the American Enterprise Institute and Glenn Hubbard of Columbia Business School estimate the cost of replacing lost revenue for affected firms for three months to be $1.2 trillion. The initial $349 billion in new lending will no doubt help many businesses survive a short-term crisis, but mass closures have already begun, and many more will follow if Congress is slow to extend additional lending capacity. Indeed, the amount currently allocated may not even be enough to meet demand during a short-term crisis; it will almost certainly not be adequate for helping small businesses survive the plausible scenario of a protracted crisis followed by a slow return to normal.

What happens next?

The Paycheck Protection Program is a critically-needed lifeline for American small businesses. However, Congress should immediately begin preparing for an extension of the program so that new lending is made available before the current resources are exhausted. Congress should also consider complementary approaches to providing small business relief in the weeks ahead, such as the one outlined in a recent post, “How to Rescue Main Street from Coronavirus Before It’s Too Late.”

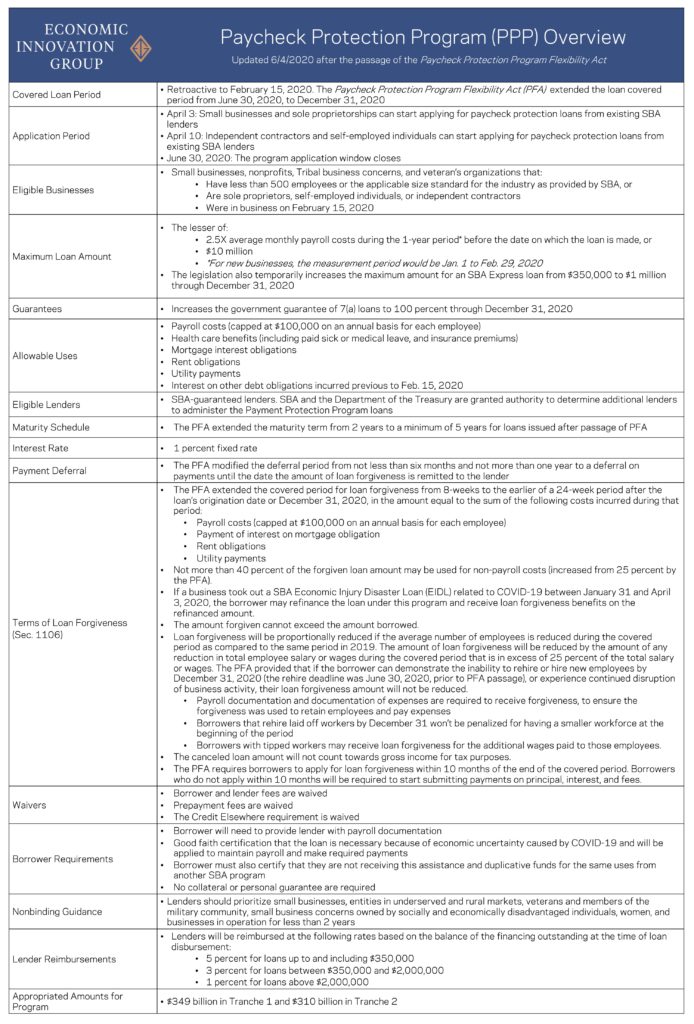

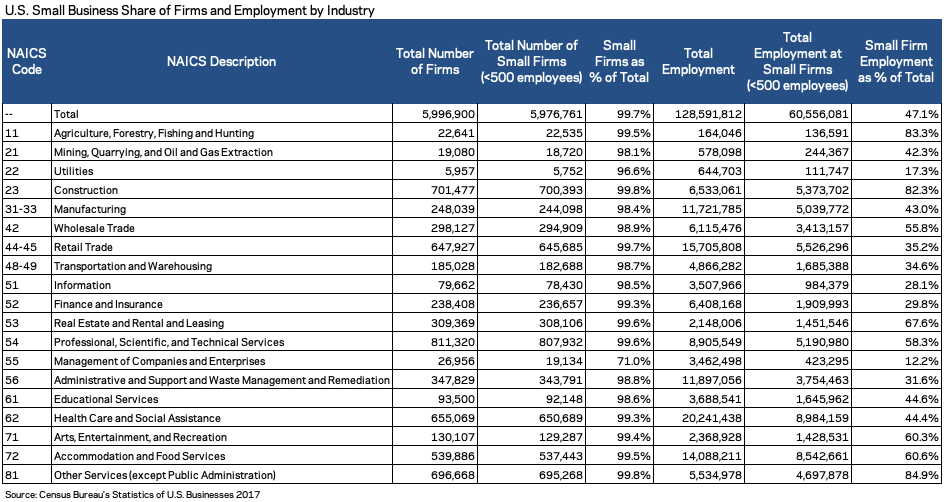

Below we’ve outlined the key elements of the program as well as an industry breakdown of firms with fewer than 500 employees.

Additional Resources for Small Businesses and Lenders

- EIG’s Paycheck Protection Program overview chart was updated on 6/4/20.

- EIG’s analysis of the Paycheck Protection Program Flexibility Act, passed 6/3/20, can be accessed here.

- Watch EIG’s webinar on the Paycheck Protection Program here.

- Access the U.S. Treasury Department’s Paycheck Protection Program website here.

- Access the U.S. Treasury Department’s latest FAQ on PPP loans here. (updated 5/19/20)

- Access the U.S. Small Business Administration’s (SBA) Paycheck Protection Program website here.

- If you are a borrower, access the final borrower application form for Paycheck Protection Program loans here and download the U.S. Treasury Department’s Paycheck Protection Program information sheet for borrowers here.

- If you are a lender, access the final lender application form for Paycheck Protection Program loans here and download the U.S. Treasury Department’s Paycheck Protection Program information sheet for lenders here.

- Access the U.S. Small Business Administration’s (SBA) interim rules here.

Read EIG’s April 9th blog, “How Congress Can Fix the Paycheck Protection Program,” here and our April 16th blog, “The Paycheck Protection Program Needs Fundamental Improvements, Not Just More Funding” here. Additionally, you can access EIG’s analysis of the first tranch of PPP loans here and our comparison of the first and second rounds of PPP loans here.

John Lettieri is President and CEO and Catherine Lyons is Manager of Policy and Coalitions of the Economic Innovation Group.