By Catherine Lyons

On June 3, the Senate passed the Paycheck Protection Program (PPP) Flexibility Act by unanimous consent. The legislation, which passed in the House last week with a 417-1 vote, makes important structural changes to PPP that address many of the most significant challenges borrowers have faced in accessing the program.

The PPP Flexibility Act incorporates several of EIG’s recommendations to strengthen PPP and address its structural limitations, which have made navigating the program challenging for borrowers in the midst of the COVID-19 crisis. EIG’s recommendations were widely endorsed by industry associations representing businesses most deeply impacted by the COVID-19 pandemic. Namely, the PPP Flexibility Act extends the program’s timelines for loan forgiveness, rehiring, repayment, and the loan’s covered period, as well as eases limitations on how much a business needs to spend on payroll expenses to receive forgiveness. The bill also establishes a safe harbor for businesses that can demonstrate their inability to fill vacant positions by the deadline.

Specifically, the PPP Flexibility Act makes the following improvements:

- Lengthens the loan maturity to a minimum of five years for all future borrowers. This is the only provision that would not be extended retroactively to borrowers who received their loans before the date of enactment.

- Extends the loan’s covered period from June 30, 2020, to December 31, 2020. No new loans will be authorized after June 30, but loan proceeds can now be applied to expenses incurred through the end of the year.

- Extends the period for calculating loan forgiveness expenses from eight weeks to the earlier of 24 weeks after the loan’s origination date or December 31, 2020. Borrowers who already have a PPP loan have the option of sticking with the original eight week period if they prefer.

- Extends the deadline from June 30, 2020, to December 31, 2020, for borrowers to rehire employees in order to receive full loan forgiveness. Borrowers who can demonstrate the inability to rehire or find other qualified employees by the deadline, or document “an inability to return to the same level of business activity as such business was operating at before February 15,” will be able to receive loan forgiveness without penalty.

- Reduces the amount of the loan that must be spent on payroll expenses to receive loan forgiveness from 75 percent to 60 percent, allowing 40 percent of loan proceeds to be spent on non-payroll expenses.

- Eliminates the six-month payment deferral for PPP loans and replaces it with a deferral on payments until the date the amount of loan forgiveness is remitted to the lender.

- Requires borrowers to apply for loan forgiveness within 10 months of the end of the covered period. Borrowers who do not apply within 10 months will be required to start submitting payments on principal, interest, and fees of the loan.

- Allows employers to receive the deferral of payroll taxes included in the CARES Act even if they also receive forgiveness for a PPP loan.

At the request of Senators Ron Johnson (R-WI) and Mike Lee (R-UT), Chairman Rubio (R-FL) and Ranking Member Cardin (D-MD) of the Small Business and Entrepreneurship Committee, along with Reps. Phillips and Roy, signed a letter clarifying that the Act does not authorize new PPP loans to be issued after June 30, 2020. The bill instead allows for loans originated before June 30 to be used for expenses through December 31, 2020.

Some senators have expressed concern about a potential drafting error in the legislation that would unintentionally grant no forgiveness, instead of proportional forgiveness, to borrowers who use less than 60 percent of their loan on payroll expenses. SBA and the Department of the Treasury have not yet commented on how they will interpret the legislation and its impact on loan forgiveness. However, because the legislation allows 24 weeks to meet the required payroll expense threshold, most borrowers should face little risk from the “forgiveness cliff” — even if Treasury and SBA take a strict interpretation of the provision.

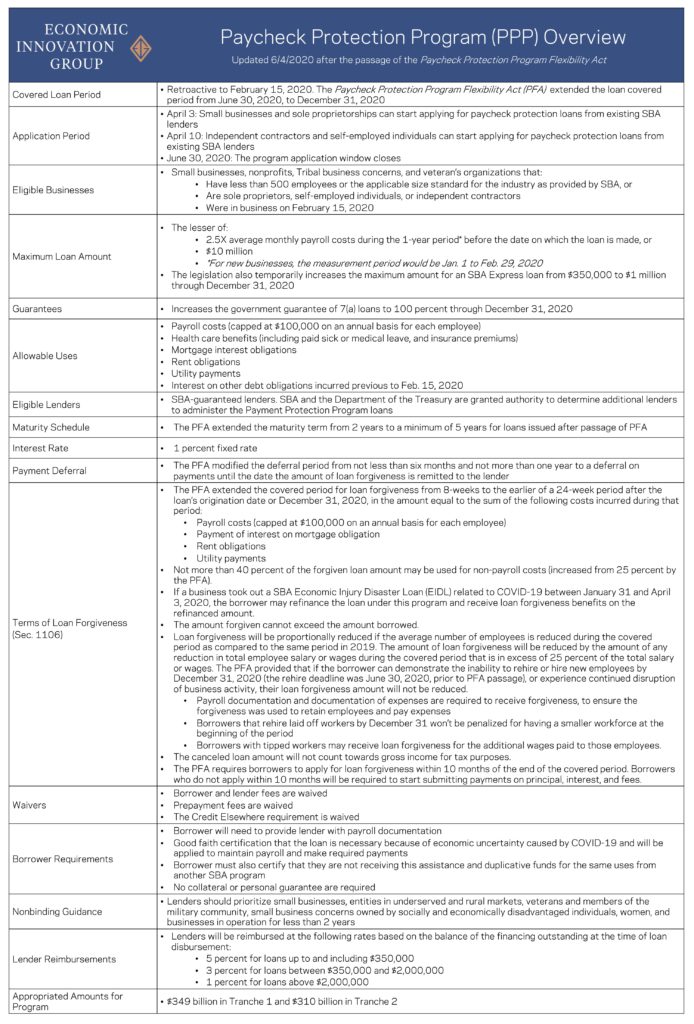

Click here for an updated explainer chart on the Paycheck Protection Program.