By Jimmy O’Donnell

EIG is tracking COVID-19’s impact on prospective entrepreneurial activity in the United States with weekly data on business formation provided by the U.S. Census Bureau. The statistics below focus on “high-propensity” business applications, which are a specific subset of applications for new Employer Identification Numbers (EINs) identified by the Census Bureau as having a high likelihood of becoming active businesses with employees within several months after filing. We refer to these high-propensity applications as “likely employers” here.

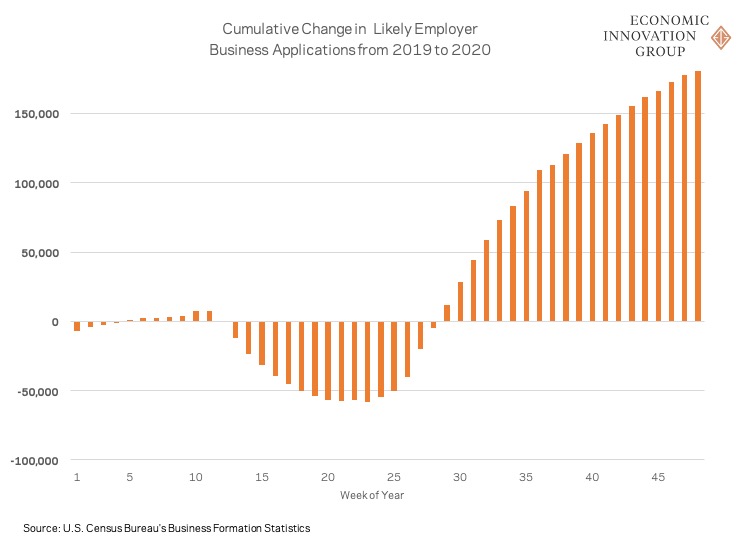

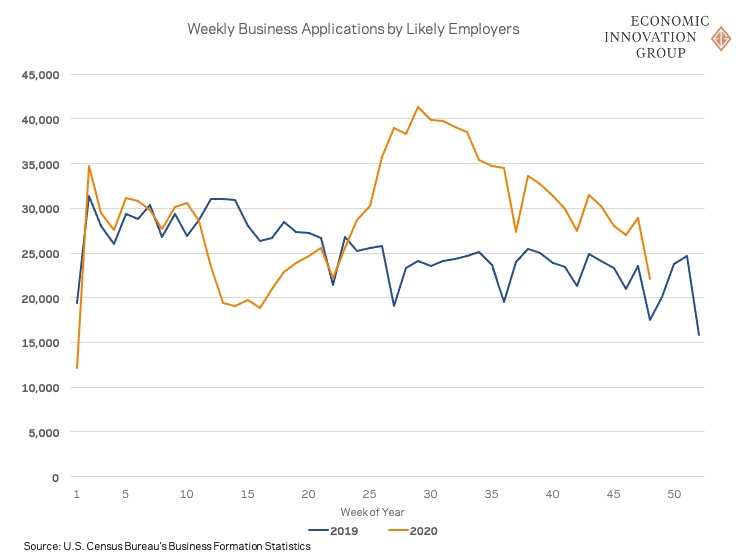

In the wake of an abrupt falloff in nationwide business formation at the start of the pandemic, business applications from likely employers have surged in recent months. Nearly 183,000 additional applications have been filed so far in 2020 compared to this point last year. The elevated numbers have more than compensated for the initial gap in business formation that opened up early in the pandemic: Likely employer applications through week 48 total more than 1.4 million—a jump of 15 percent over the same period in 2019.

Even though the rate of filings is slowly drifting back down toward pre-pandemic levels, the pace nationwide remains well-above last year’s. In the week ending November 28th (which included Thanksgiving), likely employers submitted 22,120 applications, representing a substantial 26 percent increase over the same week in 2019. However, four states, including major hubs of business formation such as Washington State and Oregon, still slightly trail the number of likely employer applications recorded through the same period last year.

Industry-specific data released in October 2020 covering all business formations—not just those likely to hire employees—show that a handful of diverse sectors are powering the surge. The leading sector is non-store retailers that are likely to sell goods online or directly to consumers via home delivery, which account for just over one-third of the increase in applications through early October relative to last year. The entrepreneurial boom in this sector would seem to represent an accelerating restructuring of the economy, as entrepreneurs and consumers adapt to a new economic reality.

Other industries such as truck transportation have also spiked amid shifting consumer habits during the pandemic. Somewhat surprisingly, personal and laundry services as well as food and drinking establishments, both of which were hit hard by springtime lockdowns and social distancing measures, have seen significant upticks in business formation, perhaps as owners and entrepreneurs pilot new business models. In total, applications are at or above last year’s levels in well over half of the detailed industry categories the data tracks.

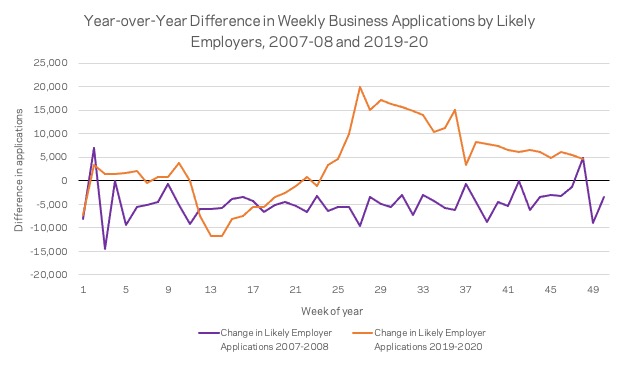

The effect of the current crisis on business formation is playing out quite differently from the Great Recession more than a decade ago. That downturn resulted in a consistent decline in business formation in its initial year: Through all 52 weeks of 2008, there were only 3 instances where weekly new applications exceeded their level in the same week of 2007; by contrast, week 48 in 2020 marked the 25th consecutive week that business applications exceeded their level in the same week of 2019. By year’s end, there were 230,000 fewer applications submitted in 2008 compared to 2007 (again, 2020 is on course to have over 200,000 more). After the Great Recession, startup rates remained depressed all the way through at least 2018.

One potential explanation for this difference is the fact that the financial system has remained healthy and house prices and asset prices generally buoyant throughout the pandemic recession could provide one explanation for why indicators of entrepreneurial activity look so healthy—the capital sources many entrepreneurs rely on to launch their businesses remain relatively unaffected by the crisis.

Despite this seemingly promising trend in new business formation, the net effect on the overall count of businesses will be tempered by the scope of closures this year. Nearly 30 percent of all small businesses were shuttered as of mid-November compared with the start of the year, based on data tracked by Opportunity Insights. While the surge in new business applications is certainly promising, only time will tell how many of these expressions of entrepreneurial intent actually turn into new businesses, and how many of those new businesses go on to survive from there. Many of the new entrepreneurs captured by the data may be finding opportunity in crisis, but others may be striking out on their own out of necessity. Such entrepreneurs are less likely to create the employer-firms that will fuel a rapid jobs recovery, and their businesses may disappear once the labor market returns to health and more traditional employment opportunities open up again. Despite these uncertainties in the data, one thing is clear: Sustaining this healthy bump in entrepreneurship will be vital for placing the U.S. economy on a path to successfully recover and adapt to whatever new normal lies ahead.