By Daniel Newman

EIG is tracking COVID-19’s impact on prospective entrepreneurial activity in the United States with weekly data on business formation provided by the U.S. Census Bureau. The statistics below focus on “high-propensity” business applications, a specific subset of applications for new Employer Identification Numbers (EINs) identified by the Census Bureau as having a high likelihood of becoming active businesses with employees within several months after filing. We refer to these high-propensity applications as “likely employers” here.

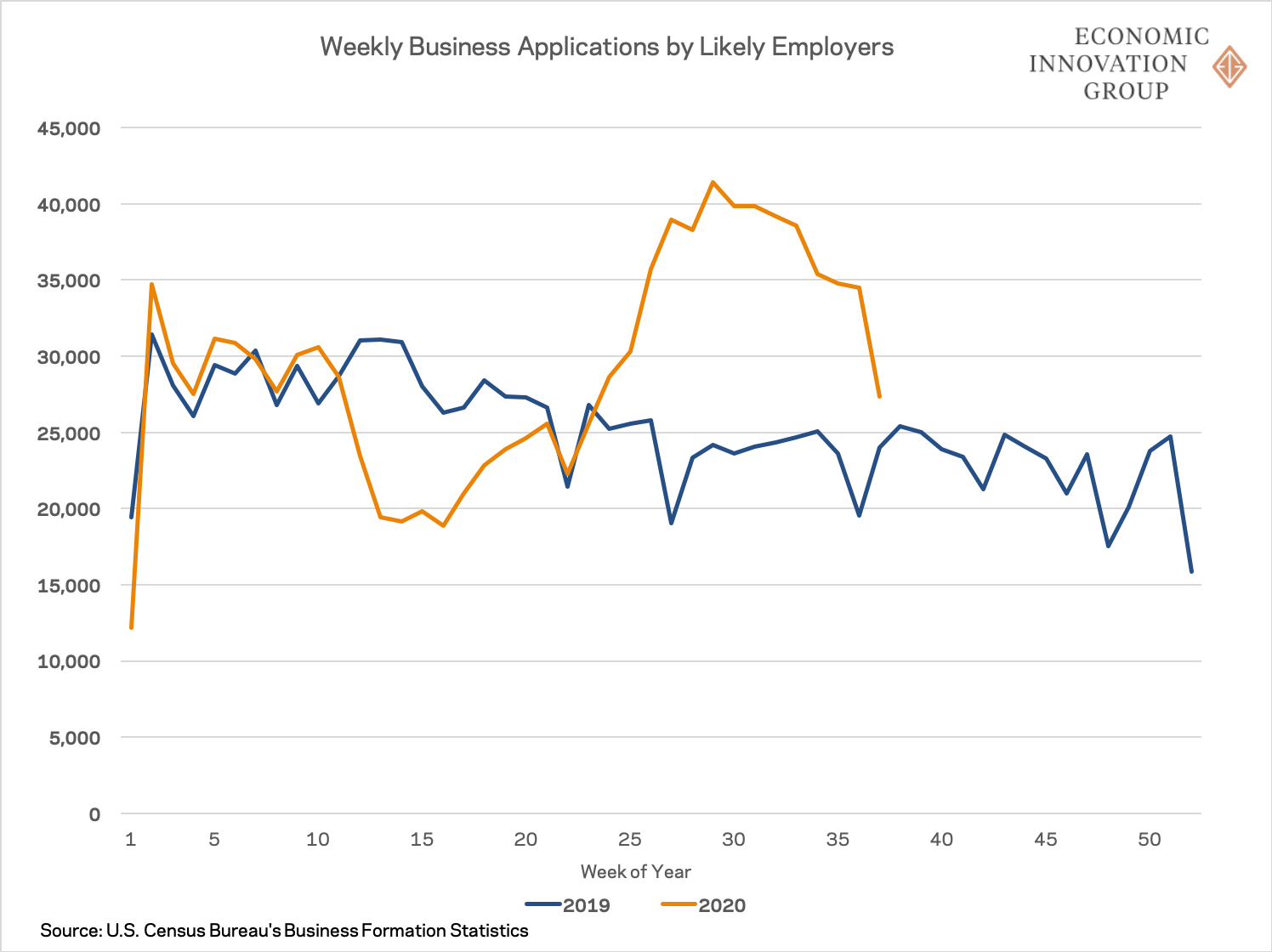

In the wake of an abrupt dropoff in nationwide business formation at the start of the pandemic, business applications from likely employers remained elevated above historical levels in the week ending September 12th (week 37 of 2020), continuing a surge that began in late May. Likely employers submitted 27,360 applications last week, representing a relatively modest increase of 14 percent over the same week in 2019. The latest figure likely reflects fewer filings due to the Labor Day holiday, which fell one week later into the year than in 2019. Even though the rate of filings is slowly returning to its pre-pandemic trend, the past few months of unusually high application numbers have more than compensated for the initial gap in business formation that opened up during the early stages of the pandemic.

The severe dropoff in the number of promising new business applications initially appeared in March and opened up a hole that persisted through the end of May. But the summer months brought a surge of new applications, and by mid-September, the number of likely employer applications filed since the onset of COVID-related shutdowns in March exceeded those submitted over the same period last year by 108,940, or 15 percent. Since the start of the year, likely employer applications have totaled 1,081,960—a jump of nearly 12 percent over the same period in 2019. Despite the nationwide uptick, 11 states still trail the number of likely employer applications recorded through the same week last year, although all now lag by less than 5 percent.

It is not entirely clear why applications are so elevated relative to historical trends when many existing businesses are struggling amid COVID-related restrictions and levels of consumer spending that still trail pre-pandemic trends. Some of the surge over the past few weeks probably reflects a backlog of delayed applications finally being submitted. Applications are a forward-looking measure of new business starts, so many would-be entrepreneurs may have only temporarily shelved their business plans in the early weeks of the pandemic. However, the data also captures applications indicating the purchase of an existing business, so a portion of the upswing could represent a churn in business ownership rather than actual anticipated new business formations.

The surge could also be powered by newly unemployed individuals opting to start their own businesses, either by choice or out of necessity. In addition, applications tagged in the manufacturing, retail, health care, and restaurant industries are automatically included in the data as businesses likely to hire employees. Absent industry data, we cannot tell whether crisis-era idiosyncrasies in the roiled healthcare, retail, or food services industries are driving the national bounce. Finally, some of the surge could also represent future entrepreneurs seeking opportunity in the crisis. The available data does not allow us to estimate which force or combination of forces is at work.