By Daniel Newman

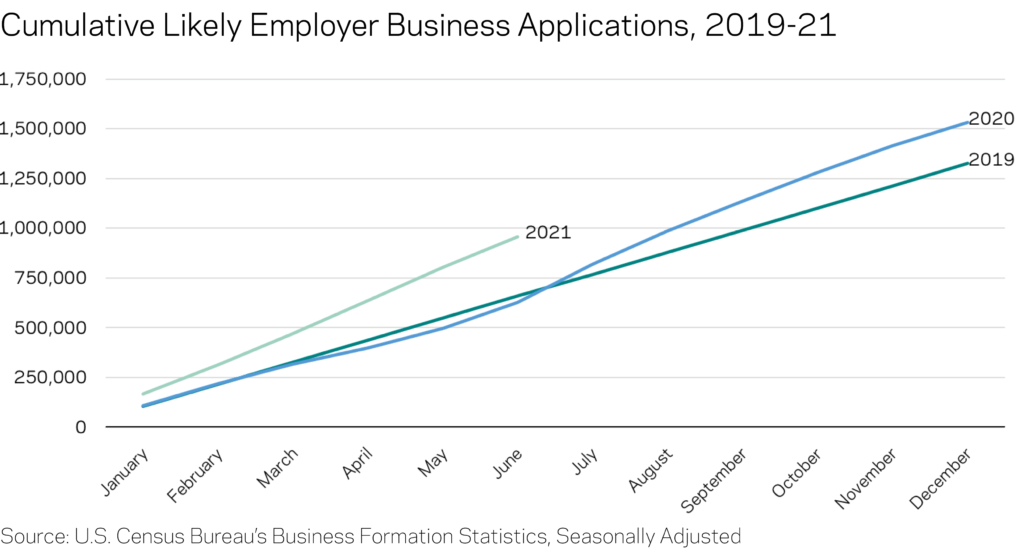

The latest release of Census Bureau’s Business Formation Statistics data shows that nearly 1 million applications have been filed to form new businesses likely to hire employees in 2021 — the most on record through the first six months of the year. Likely employer businesses are a subset of total applications capturing those most likely to hire employees if and when a business becomes operational (Census labels them as “high propensity applications”). The brisk pace means there have been roughly 300,000 more filings so far in 2021 than at the same point in 2019 or 2020. This surge in new business formation began to take off in the middle of 2020 and shows no signs of letting up, an indication of the trend’s staying power.

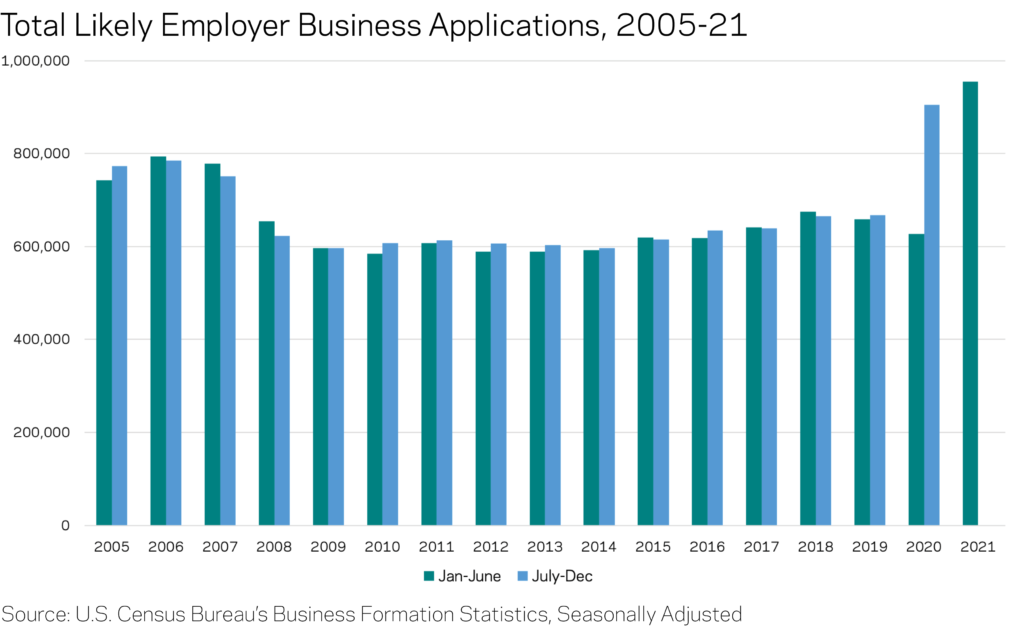

The lack of strong new business formation in the wake of the Great Recession hindered the country’s economic recovery for years, but the economic resurgence from the pandemic is shaping up quite differently. Last year, applications to form new businesses—both sole proprietorships and businesses likely to hire and grow—reached unprecedented levels, with likely employer applications totaling around 1.5 million by year’s end—just over 205,000 more than in all of 2019. Entrepreneurial interest seems just as high in 2021, which now claims three of the top five months for likely employer business filings on record. The shock of the pandemic appears to have caused significant restructuring of certain industries and a realignment of some relationships between businesses and customers, bringing an end to the startup stagnation that defined the post-Great Recession economy.

Business formation appears to be on a record setting pace in 2021

A record-breaking 955,100 applications to form new businesses likely to hire employees were filed in the first six months of 2021, 45 percent more than at this point in 2019 (including nonemployers, all business applications are up by 61 percent). The pace has surpassed even the exceptional volume filed in the second half of 2020, when 905,000 applications were tallied amid an unexpected boom in potential business formation. New business formation among likely employers stands roughly 300,000 applications ahead of the previous two years at the midway point of the calendar. It remains to be seen whether the elevated pace of 2021 is sufficient to surpass the record-breaking total of 2020, but it seems likely.

Industries highly affected by the pandemic showed the largest gains

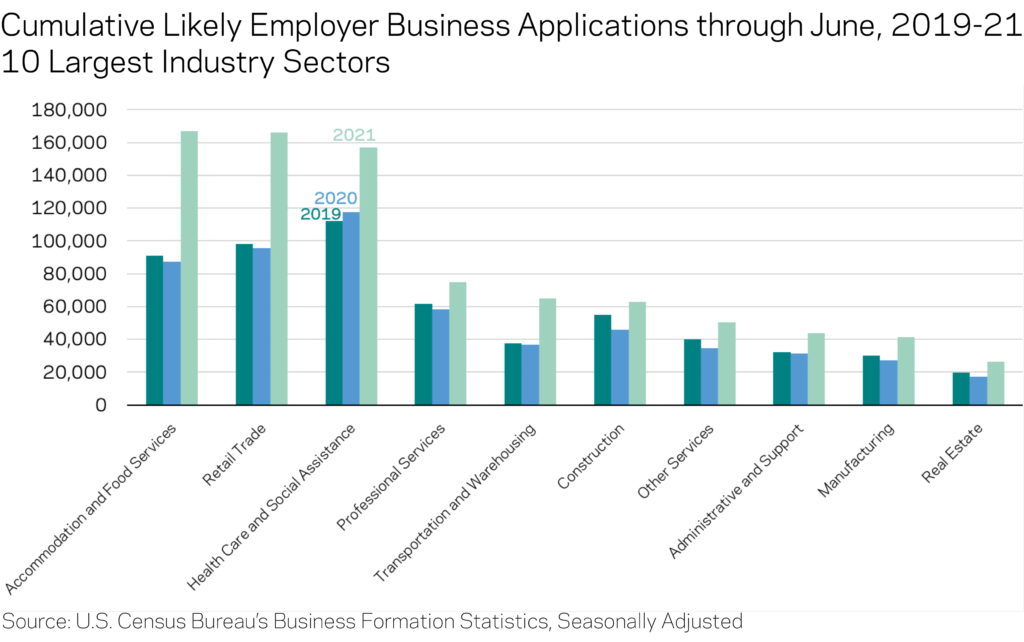

The new business surge is broad-based and happening across almost every industry sector, as applications for new likely employer businesses through June were up across all major industry categories except agriculture and mining relative to 2019 and 2020.

Despite this pervasiveness, new applications are concentrated in areas of the economy most affected by the pandemic. Nearly two-thirds of the gains over 2019 levels appear in just three industry sectors: accommodation and food services; retail trade; and health care and social assistance. These sectors typically produce large numbers of business applications under normal economic conditions, but they have also seen some of the largest relative increases since 2019: Applications to form businesses related to accommodation and food services are up 83 percent over the same point in 2019, while the retail trade sector is up 69 percent, and health care and social assistance is up 40 percent. The transportation and warehousing sector has also experienced rapid increases in potential business formation—up 73 percent so far this year from the same point in 2019.

These high-growth sectors experienced extreme shocks to their normal operations throughout 2020. The jump in intent to form new businesses likely reflects a necessity to adapt in response to job losses during the downturn as well as an opportunity to fill new economic needs amid changing consumer preferences, supply chain issues, and novel circumstances brought on by the pandemic.

Business formation rose fastest in the Southeast and Great Lakes

Similarly, every state in the country has recorded an increase in likely employer business applications, although there has been significant regional variation. Fifteen states clustered in the Southeast and Great Lakes are up by at least 50 percent from 2019. The five states with the largest 2019-21 percent change were: Alabama, Georgia, Louisiana, Mississippi, and South Carolina. By contrast, several states in the Pacific Northwest, Upper Midwest, and New England regions are seeing their likely employer business application grow at a much slower rate. Recent research from the Peterson Institute for International Economics finds that the uptick in applications in 2020 was somewhat correlated with higher state unemployment rates, suggesting that some of the increase in business applications comes from a need to find new employment opportunities (so-called “necessity entrepreneurs”).

The business formation surge covers rural and urban areas

More detailed county-level data only extending through the end of 2020 shows just how large and expansive the percentage increases in the number of total applications to form both employer and nonemployer businesses were, particularly across the Southeast. Even though relatively few business applications are filed under normal conditions in many of these rural southern counties (a decent number of which are also high poverty and disproportionately home to Black Americans), they have consistently reported some of the greatest relative increases compared with the prior year.

In metro areas, the predicted mass exodus of residents and companies from U.S. cities never materialized to the extent some anticipated, and nearly every populous county recorded respectable gains in the number of likely employer business applications throughout 2020. A notable exception is Manhattan, where business formation ticked down by 1.7 percent from a year earlier.

A promising development for the U.S. economy

While the surge in new business applications is certainly promising, it will be some time before the extent of business closures due to the pandemic can be tallied and we have a full picture of the net effect of the pandemic on the country’s business and entrepreneurial landscape. It will also take months to evaluate how many of these expressions of entrepreneurial intent actually turn into new businesses that go on to hire workers, but research shows there historically has been a high correlation between the number of applications and true business formation. If the past is any guide and a substantial number of these applications turn into real new firms, their survival and growth will help power the economic recovery.

At the same time, there are still many reasons to interpret the data cautiously. Even though elevated application levels have now continued for over a year, individuals and corporations may still be reacting to the pandemic in ways that register in the data but that we do not yet fully understand. Not only is the number of true startups in the pipeline still unknown, but the Peterson Institute found that firms launched in recessions also tend to remain smaller than those launched during good times—leaving their potential impact on job creation unknown, too. Nevertheless, ensuring that many of these likely employer applications do in fact turn into successful businesses with paid employees will help smooth our transition out of this pandemic. This entrepreneurial reaction to the economic shock is a testament to the U.S. economy’s underlying resiliency. Maintaining this high level of new business formation will be crucial in placing the economy on a strong and durable path to its recovery and helping eliminate the startup deficit that had built up in recent years.