By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from March 8th to March 21st.

Here are 5 things we learned about the small business economy last week:

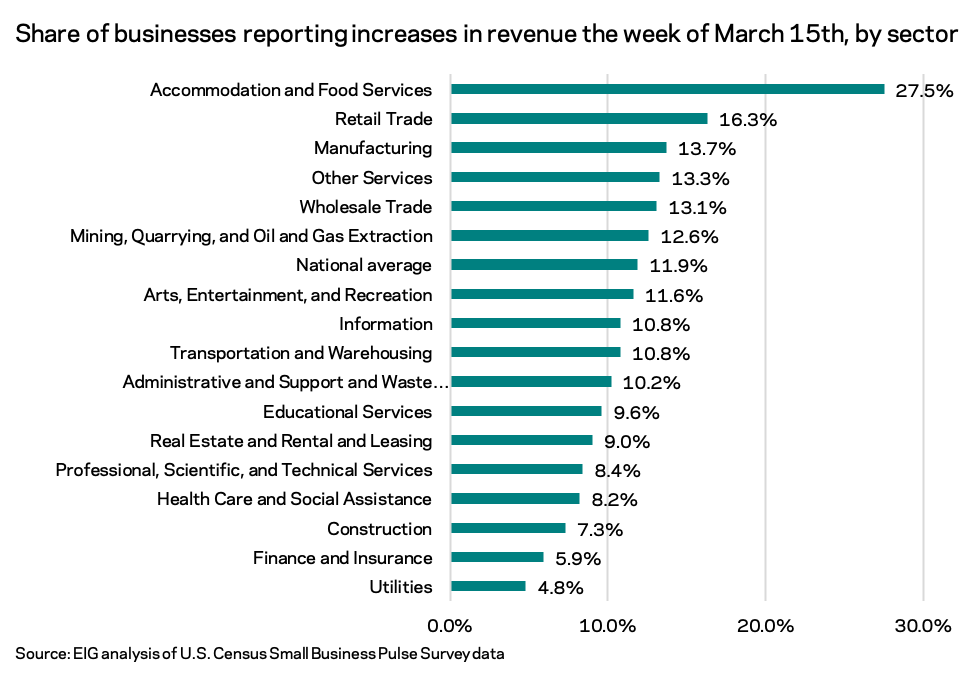

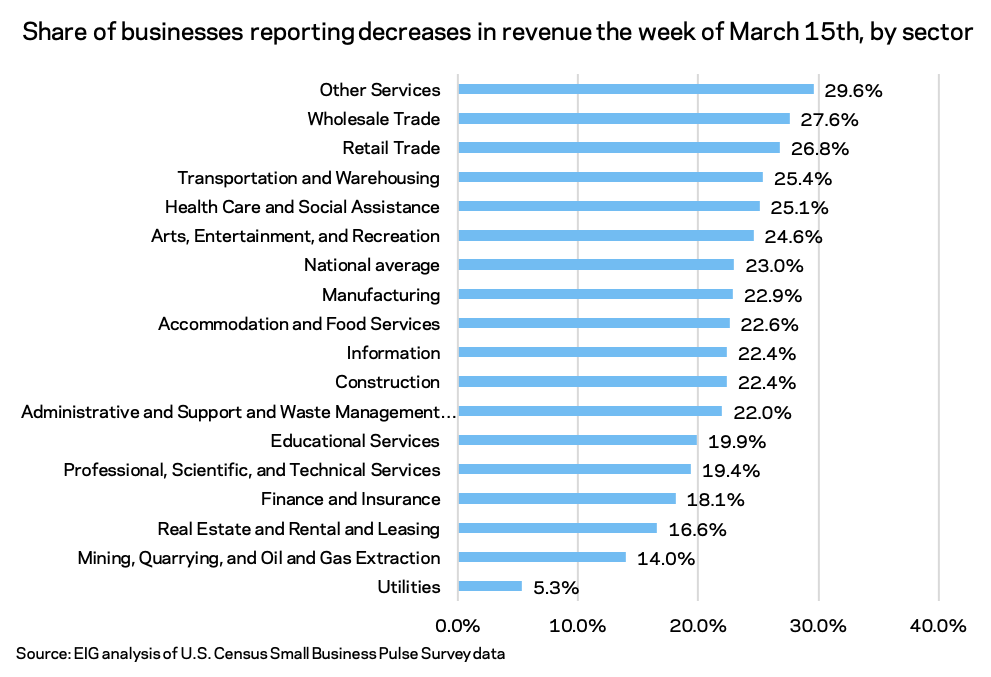

1. The share of firms increasing revenues is scaling up, especially in the accommodation and food services and retail trade sectors. Nationally, 11.9 percent of businesses reported increasing revenue, the highest share since last summer. While almost double that figure reported experiencing decreasing revenue in the same week (23.0 percent), that share has been on a downward trend. For the first time in the pandemic-era data series, more firms in the accommodation and food services sector are increasing revenue than decreasing revenue. It is the only sector where more firms were increasing than decreasing revenue the week of March 15th.

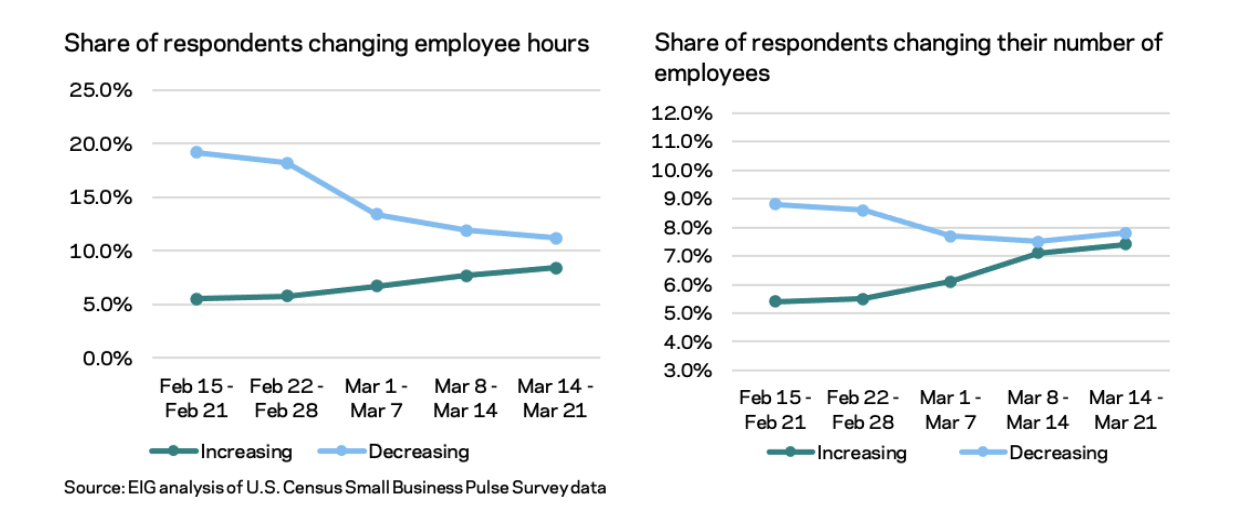

2. The gap has closed between the shares of firms cutting headcount and hours and those adding them. Nationally, 7.4 percent of firms added employees the week of March 15th and 7.8 percent cut them. This convergence is the culmination of a weeks-long trend and represents the first time the two shares have been in balance since the start of the pandemic (still-shrinking small businesses have consistently outnumbered expanding ones in the series). A similar narrowing occurred in the number of firms adding and cutting employee hours.

Beneath the national numbers, some sectors have already crossed over into clear recovery territory, with expanding firms more numerous than shrinking ones. Although the large majority of firms report no change in the number of employees across all sectors, in seven sectors—mining, quarrying, and oil and gas extraction, manufacturing, information, real estate, education, arts, entertainment, and recreation, and accommodation and food services—more firms added employees than cut them the week of March 15th.

3. Just over 30 percent of small businesses expect to need to hire new employees in the next six months. The share of businesses expecting to need to identify and hire new employees in the next six months has been rising after little movement for much of the pandemic, a sign of small business optimism and increasingly strong recovery expectations. While that 30 percent share is positive, its interpretation should be tempered by an understanding of just how sustained job losses were for much of the pandemic crisis and how difficult it may be to fully recover: since the start of the pandemic, the Pulse survey has typically recorded at least 10 percent of small businesses reducing headcount in any given week.

4. New Orleans, New York, San Francisco, and Los Angeles are the metros where the highest share of businesses report a large negative effect of the pandemic. Metros in the same regions fall on opposite ends of the spectrum of self-reported small business pain. New Orleans has the highest share of surveyed small businesses reporting a large negative effect of the pandemic of any of the top 50 metros* but fellow Southern tourist hub Nashville does considerably better on the measure. None of the largest Northeastern MSAs come in among those with the smallest share of businesses reporting a large negative effect, while the fate of the West diverges, with comparatively better off Phoenix standing opposite San Francisco, Los Angeles, and Las Vegas. (Note: Birmingham, Jacksonville, and Memphis were excluded because data was not available to average multiple weeks over the period in question)

5. Since the end of December, 35.4 percent of surveyed businesses have applied for PPP funds for the second time. A second PPP application is the most commonly sought form of financial assistance in recent months although just under 25 percent of businesses reported applying for PPP for the first time and 10.0 percent applied for Economic Injury Disaster Loans in the same period. The education, accommodation and food services, and mining, quarrying and oil and gas extraction sectors reported the highest share of businesses requesting PPP for the second time the week of March 15th. Since late December, 43.4 percent of businesses have not applied for assistance from any source.