By Catherine Lyons

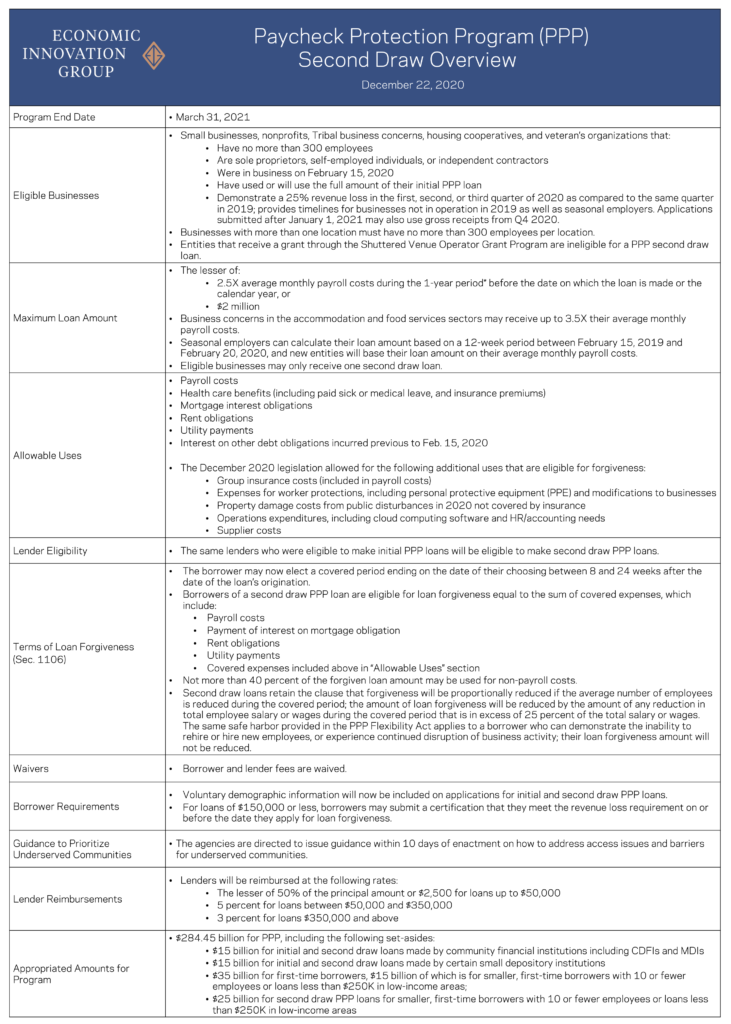

The White House announced earlier this week changes to the Paycheck Protection Program (PPP) to help prioritize underserved small businesses. Starting today and ending March 9th, the Small Business Administration will only accept applications from businesses with fewer than 20 employees to better allow smaller firms to take advantage of the forgivable loan program before it is set to expire at the end of March. Congress passed a renewed and second draw of PPP as part of the Coronavirus Response and Relief Supplemental Appropriations Act that was signed into law in December 2020. As noted in EIG’s blog outlining the changes administered to the program following the bill’s passage, PPP has and continues to provide much needed relief and an immediate lifeline to small businesses impacted by the pandemic, but a longer-term recovery program is needed.

In addition to the two-week limitation on small business applications, the Biden administration announced several additional changes to the program aimed at facilitating more underrepresented small business owners to apply for assistance through the PPP, including:

- Revising the loan calculation formula for sole proprietors, independent contractors, and self-employed individuals so they can apply for more funding, and establishing a $1 billion set aside for these types of businesses in low- and moderate-income (LMI) communities,

- Removing an exclusionary restriction that prevents small business owners with prior non-fraud felony convictions from obtaining a PPP loan (this change does not apply to businesses owners who are incarcerated at the time of the application),

- Eliminating an exclusionary restriction that prevents small business owners who are delinquent on federal student loan payments from receiving a PPP loan, and

- Ensuring PPP application access for non-citizen small business owners who are lawful U.S. residents by clarifying they can use their Individual Taxpayer Identification Numbers (ITINs) to apply.

In their announcement, the White House also committed to continue addressing waste, fraud, and abuse across federal programs, conducting outreach to stakeholders on how the emergency relief programs are working, increasing transparency with the PPP by improving the application, and improving SBA’s online platform to access information about and applications for emergency relief programs.