Economic decline is pervasive and gentrification rare according to new analysis

Washington, D.C. — Today, the Economic Innovation Group (EIG) released a new study, “The State of Socioeconomic Need and Community Change in Opportunity Zones.” The study demonstrates that, despite a small share of outliers, Opportunity Zones are marked by pervasive economic stagnancy and decline.

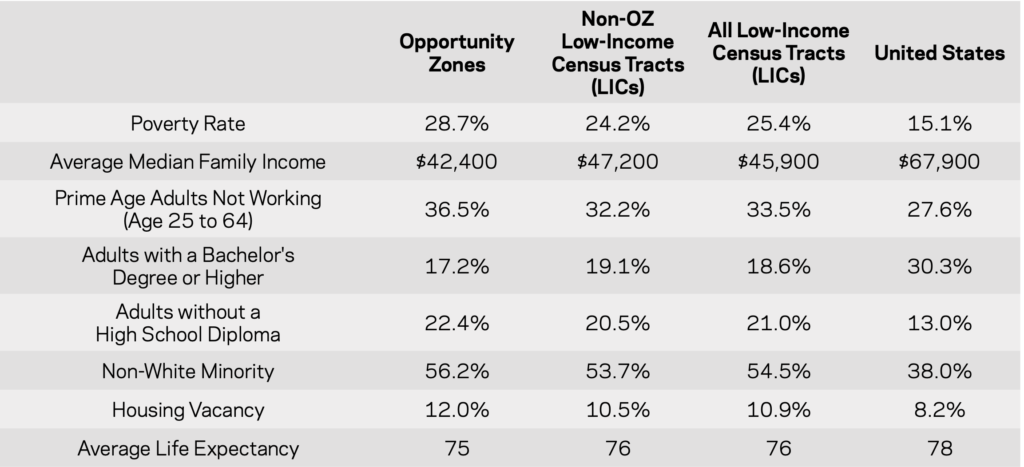

After decades of disinvestment, most cities have untapped capacity—and clear need—to put new investment to use for community revitalization. Communities selected as Opportunity Zones are higher-need across nearly every available measure than the eligible areas that were not selected:

Comparing census tract averages across measures

Source: 2012-2016 American Community Survey 5-Year Estimates

“Opportunity Zones are among the highest-need communities in the United States,” according to John Lettieri, president and CEO of the Economic Innovation Group. “This policy has put long-overlooked communities back into focus, but it is not a panacea. Success depends upon networks of leaders and stakeholders across public, private, non-profit, and philanthropic sectors to work together to create lasting progress.”

The challenges affecting these communities extend beyond poverty and income. In an era in which education attainment is increasingly critical to local prosperity, more adult Opportunity Zones residents lack a high school diploma than have obtained a college degree. Startlingly, life expectancy is on average four years shorter than it is for non-zone residents.

Additional findings from the study include:

- Seventy-one percent of Opportunity Zones meet the U.S. Treasury Department’s definition of “severely distressed.”

- The average designated tract has a poverty rate nearly double the national average. More than one-fifth of all Opportunity Zones have poverty rates of 40 percent or higher, which is true of only around five percent of communities nationwide.

- The median family income of the median Opportunity Zone is only $42,400, or 40 percent below the national average.

- Of the 31 million residents of Opportunity Zones nationwide, over 14 million live in communities that saw median incomes decline over the recovery period and nearly 19 million live in ones in which poverty rates rose.

- Minorities comprise a majority of Opportunity Zones residents, and one third of black and Hispanic households are owner-occupied. This translates to 1.4 million minority households who could see their wealth improve as a result of local reinvestment.

- Over 96 percent of Opportunity Zones do not show readily observable signs of gentrification according to two independent, multidimensional measures.

- The ratio of Opportunity Zones losing population compared to those showing signs of gentrification is more than 12 to 1.

Opportunity Zones are the federal government’s boldest place-based economic and community development initiative in at least a generation, with the potential to drive significant new private investment to struggling communities over the coming decade. The incentive encourages taxpayers to reinvest their capital gains into so-called Opportunity Funds, which are dedicated to making qualifying investments that spur new economic activity in designated Opportunity Zones. It represents a novel new effort to harness the returns of the recovery to lift the very places it left behind.

The zones were selected by governors under criteria set out in the legislation related to local income levels and poverty rates. Governors were allowed to nominate up to a quarter of their qualifying low-income census tracts to become Opportunity Zones and used their own analytics, local knowledge, and policy goals to narrow their selections and determine where this market-based incentive could be put to best use.