By Daniel Newman

EIG is tracking COVID-19’s impact on prospective entrepreneurial activity in the United States with weekly data on business formation provided by the U.S. Census Bureau. The statistics below focus on “high-propensity” business applications, a specific subset of applications for new Employer Identification Numbers (EINs) identified by the Census Bureau as having a high likelihood of becoming active businesses with employees within several months after filing. We refer to these high-propensity applications as “likely employers” here.

In the wake of an abrupt falloff in nationwide business formation at the start of the pandemic, business applications from likely employers remained elevated above historical levels in the week ending September 19th (week 38 of 2020), extending the surge that began in late May. Likely employers submitted 33,610 applications last week, representing a substantial 32 percent increase over the same week in 2019. The latest figure shows a rebound from the prior week when the Labor Day holiday limited the number of filings.

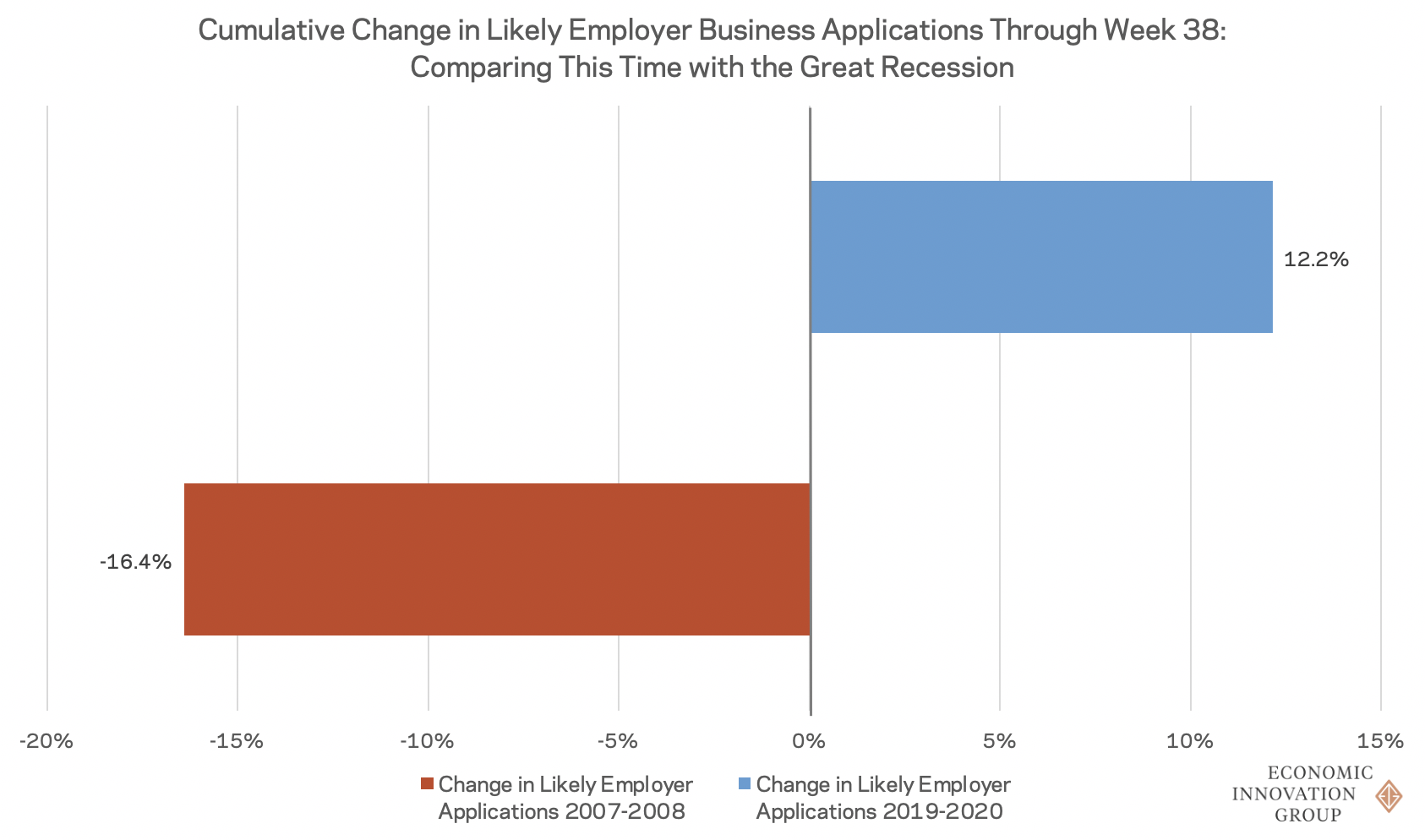

Even though the elevated rate of filings is slowly drifting back down toward a pre-pandemic trend, applications remain well-above last year’s totals—a dramatic turnaround from the springtime dropoff. The past few months of unusually high numbers have more than compensated for the initial gap in business formation that opened up early in the pandemic. Since the start of the year, likely employer applications have totaled 1,115,570—a jump of more than 12 percent over the same period in 2019. Even with nationwide uptick, 11 states still trail the number of likely employer applications recorded through the same week last year, although all now lag by less than 5 percent.

Despite this seemingly promising trend in new business formation, the net effect on the overall count of businesses will be tempered by the scope of closures this year. Nearly 24 percent fewer smaller businesses were open as of mid-September compared with the start of the year, based on data tracked by Opportunity Insights.

It is not entirely clear why applications are so elevated relative to historical trends when the future is so uncertain and many existing businesses are struggling to adapt to changes in consumer behavior due to the virus. The effect of the current crisis on business formation is playing out quite differently from the Great Recession more than a decade ago. That downturn resulted in a steady decline in business formation in its initial year. By week 38, the total number of applications from likely employers were down over 16 percent in 2008. In that crisis, startup rates remained depressed all the way through 2015.

Part of the initial surge over the past few weeks may have reflected a backlog of delayed applications finally being submitted. Applications are a forward-looking measure of new business starts, and many would-be entrepreneurs may have only temporarily shelved their business plans in the early weeks of the pandemic.

The surge could also be powered by newly unemployed individuals opting to start their own businesses, either by choice or out of necessity. However, such individuals tend to start non-employer firms in recessions (opting for self-employment), not the likely employers discussed here. Some of the surge may therefore represent the real thing: entrepreneurs finding opportunity in the crisis.

The available data does not allow us to estimate which force or combination of forces is at work, however, and there are several reasons to interpret the data with caution: Applications for new EIN numbers in the manufacturing, retail, health care, and restaurant industries are automatically tagged in the data as businesses likely to hire employees. Without industry data, we cannot tell whether crisis-era idiosyncrasies in the roiled healthcare, retail, or food services sectors might be driving the national bounce. Finally, the data also capture some purchases of existing businesses, so a portion of the upswing could represent a churn in business ownership rather than actual anticipated new business formations. Nevertheless, anecdotal evidence provides good reason to believe that much of the bump is real.