By Daniel Newman

EIG is tracking COVID-19’s impact on prospective entrepreneurial activity in the United States with weekly data on business formation provided by the U.S. Census Bureau. The statistics below focus on “high-propensity” business applications, a specific subset of applications for new EIN numbers identified by the Census Bureau as having a high likelihood of becoming active businesses with employees within several months after filing. We refer to these high-propensity applications as “likely employers” here.

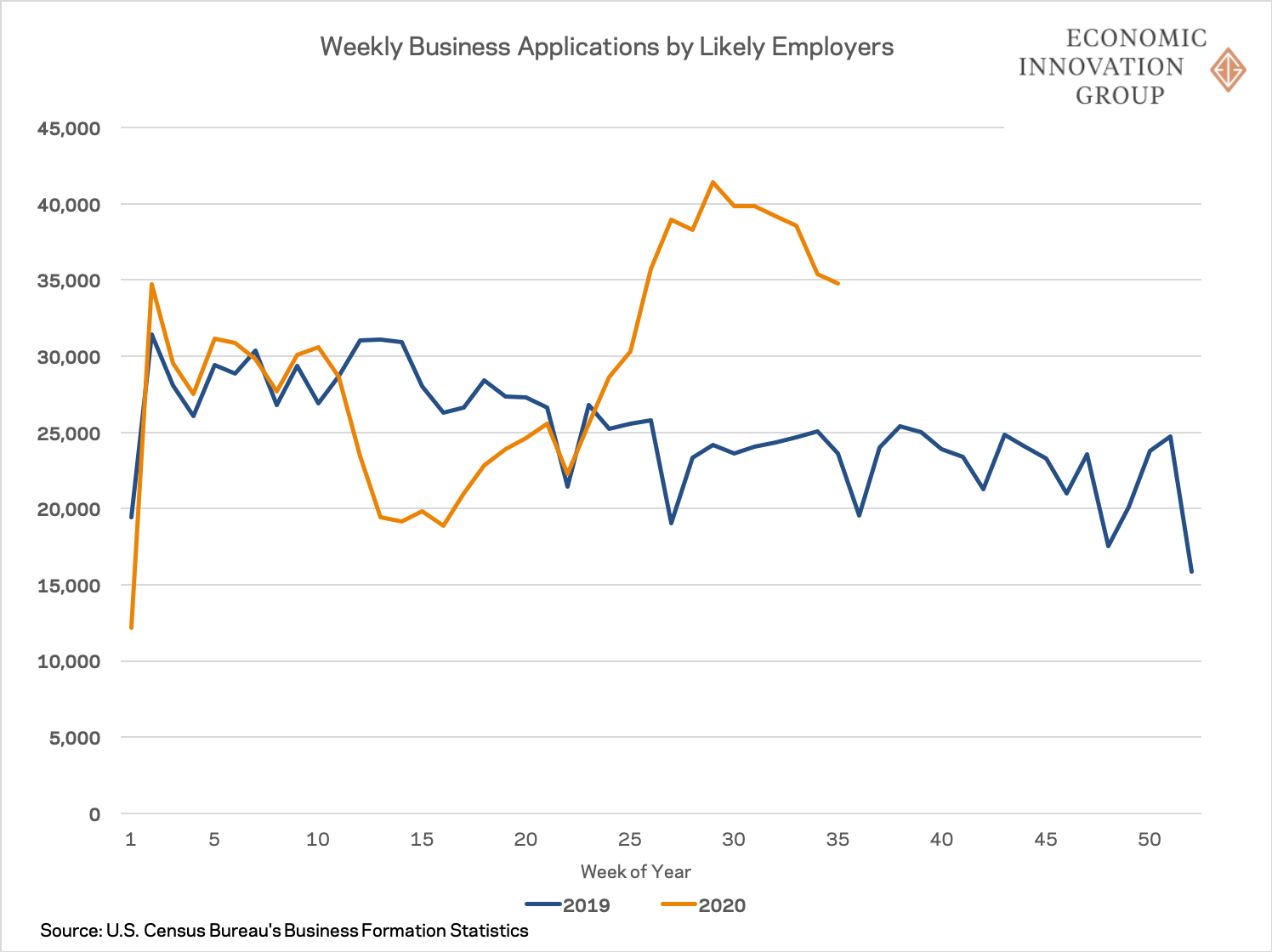

In the wake of an abrupt dropoff in nationwide business formation at the start of the pandemic, business applications from likely employers remained elevated well above historical levels in the week ending August 29th (week 35 of 2020), thanks to a recent surge that began in late May. Even though the burst of filings has begun to taper off, 34,790 applications were submitted by likely employers last week, representing a substantial jump of 47 percent over the same week in 2019. The gap in new business filings that opened up during the initial stages of the pandemic has been more than compensated for by the past few months of unusually high application numbers.

The severe dropoff in the number of promising new business applications initially appeared in March, opening up a hole that persisted through the end of May, but the summer months brought a surge of new applications. By late August, the number of likely employer applications filed since the onset of COVID-related shutdowns in early March had exceeded those submitted over the same period last year by 90,570, or 13 percent. Since the start of the year, likely employer applications have totaled 1,020,090—a jump of more than 10 percent over the same period in 2019. Despite the nationwide uptick, 15 states still trail the number of likely employer applications recorded through the same week in 2019. Three of those states were still down by more than 5 percent: Massachusetts, Oregon, and New Hampshire.

It is not entirely clear why applications are so elevated relative to historical trends when many existing businesses are struggling amid COVID-related restrictions and levels of consumer spending that still trail pre-pandemic trends. Some of the surge over the past few weeks probably reflects a backlog of delayed applications finally being submitted. Applications are a forward-looking measure of new business starts, so many would-be entrepreneurs may have only temporarily shelved their business plans in the early weeks of the pandemic. However, the data also captures applications indicating the purchase of an existing business, so a portion of the upswing could represent a churn in business ownership rather than actual anticipated new business formations.

The surge could also be powered by newly unemployed individuals opting to start their own businesses, either by choice or out of necessity. In addition, applications tagged in the manufacturing, retail, health care, and restaurant industries are automatically included in the data as businesses likely to hire employees. Absent industry data, we cannot tell whether crisis-era idiosyncrasies in the roiled healthcare, retail, or food services industries are driving the national bounce. Finally, some of the surge could also represent future entrepreneurs seeking opportunity in the crisis. The available data does not allow us to estimate which force or combination of forces is at work.