By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of February 15th to February 21st.

Here are five things we learned about the small business economy last week:

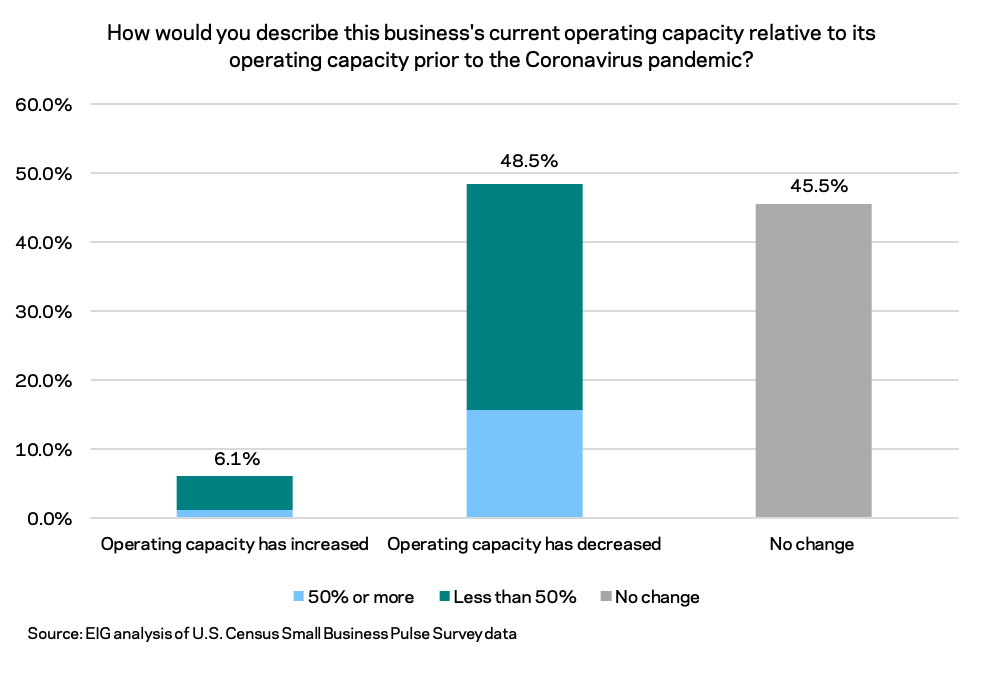

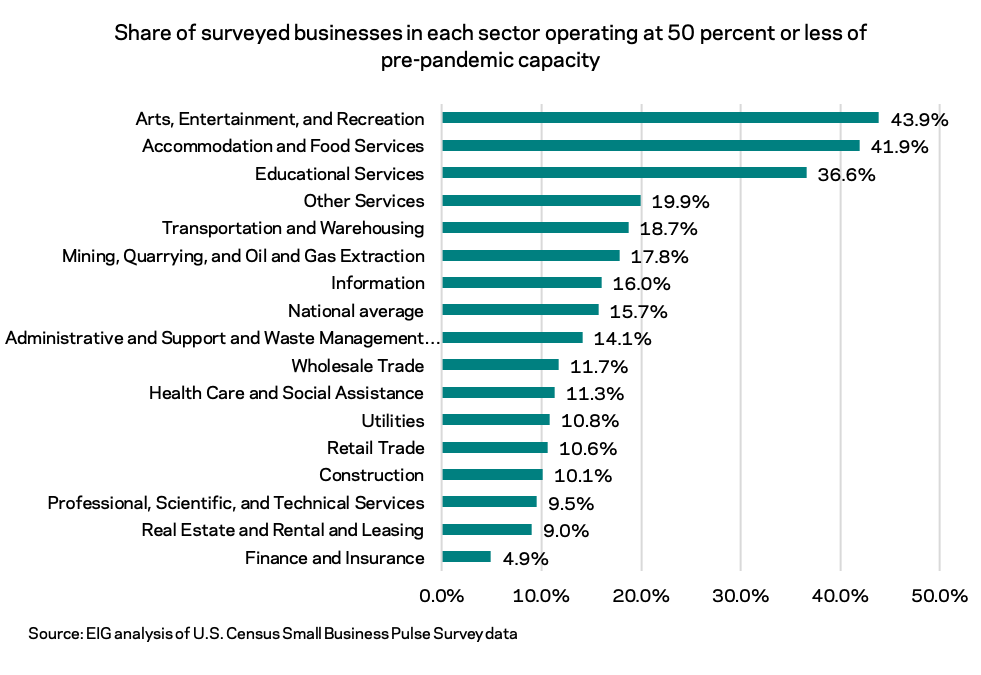

- The week of February 15th marks the first time in the series that a majority of businesses reported operating at full, pre-pandemic capacity or higher. Only a slim majority of small businesses are currently able to operate at or above their pre-pandemic capacity level, however, with 48.5 percent of businesses still operating with decreased capacity. While the share has fallen slightly since early January, 15.7 percent of surveyed businesses are still operating at 50 percent or less of their pre-pandemic capacity. The arts, entertainment, and recreation, accommodation and food services, and education sectors are those in the greatest pain, with greater than 35 percent of all surveyed businesses in each sector operating at 50 percent capacity or less. On the flip side, 6.1 percent of businesses have increased their capacity above pre-pandemic levels.

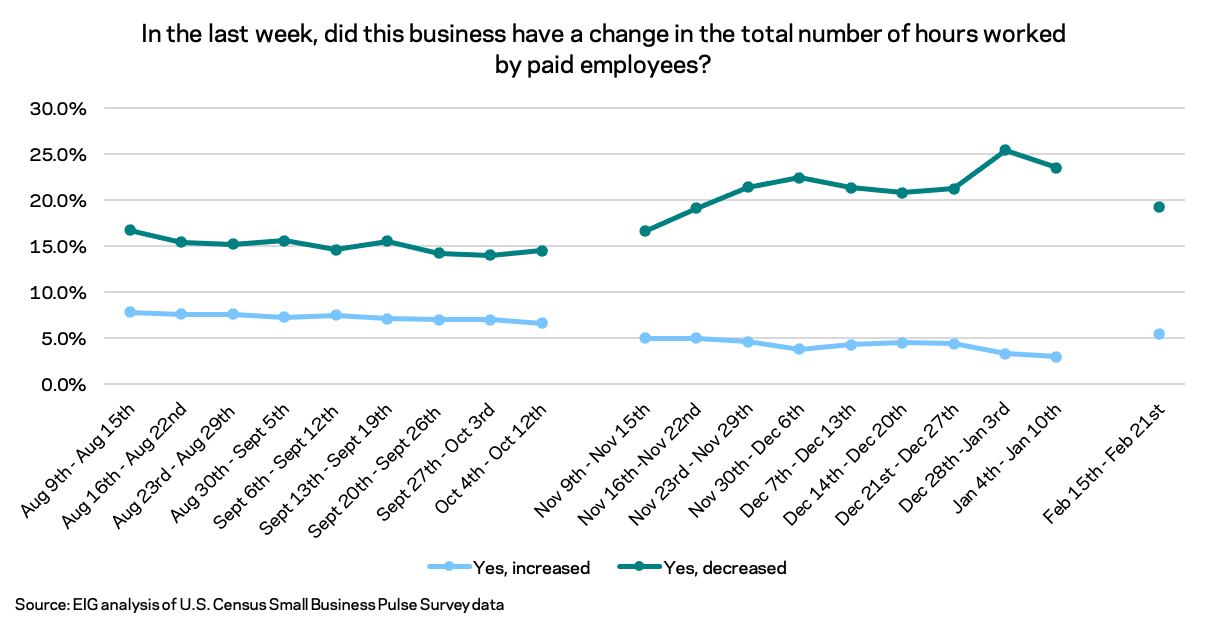

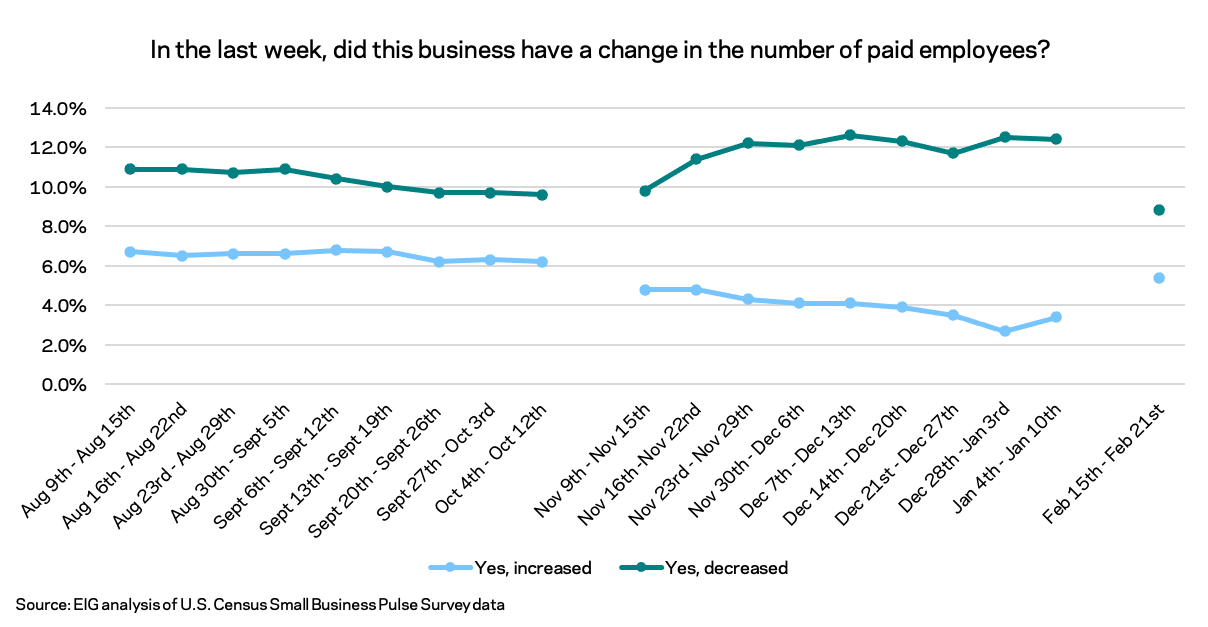

- The share of small businesses cutting hours and employees each week is finally falling. In the week beginning February 15th, more businesses cut employee hours than added them, but the gap between the two shares has narrowed significantly. More businesses still report cutting hours than adding them, as they have every week of the pandemic in this data series. However, the share of businesses adding employee hours ticked up to 5.5 percent from 3.0 percent in early January and the share of businesses cutting hours ticked down from 23.5 to 19.2 percent. The short term effects of the cold front that rocked the south central region are visible in the nation-leading shares of businesses reporting decreasing employee hours the week of February 15th. These spikes in hour cutting in the most weather-affected states may have depressed the national averages in the short term, leading to a potential underestimation of the strength of the rebound. While still far apart, the changes are notably positive, and further narrowing of this gap would indicate a distinct turn towards recovery. A similar narrowing occurred between the share of businesses adding and cutting employees, with the share cutting employees in the last week remaining higher (8.8 percent) than those adding employees (5.4 percent).

- Nationally, 10 percent of businesses required employees to test negative for COVID-19 before coming to work. A new set of questions on the Small Business Pulse Survey tracks the COVID test and vaccination requirements businesses impose on their workers. As of last week, only a meager 2.2 percent of businesses required employees to provide proof of vaccine before physically coming to work, while 10 percent required a negative COVID test. Just under 20 percent of businesses did not have employees coming into work at all in the last week. New data in coming weeks will allow tracking of vaccine requirement changes as the share of workers coming to work in person increases, as well as the share of individuals receiving the vaccination.

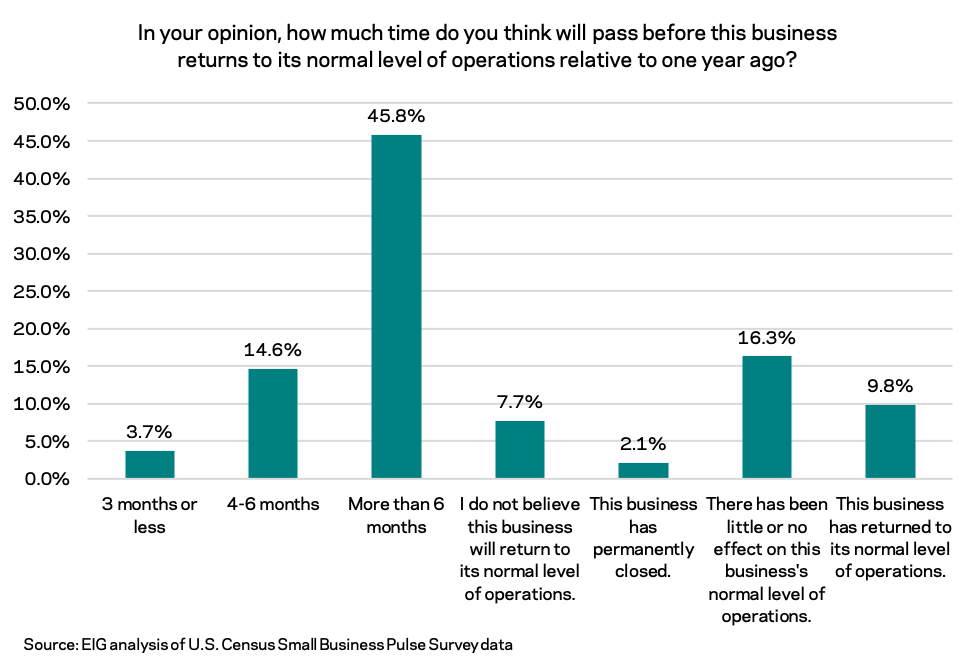

- The share of businesses expecting a full recovery to take longer than six months hardly moved from early January to mid February, hovering around 46 percent in both periods despite vaccine rollout and declining case numbers. In a sign of the deep economic damage wrought by the pandemic, 45.8 percent of surveyed businesses expect a full recovery to come later than August. In addition, rather than improving, the share of businesses not expecting to ever return to their previous level of operations rose slightly from early January to mid February.

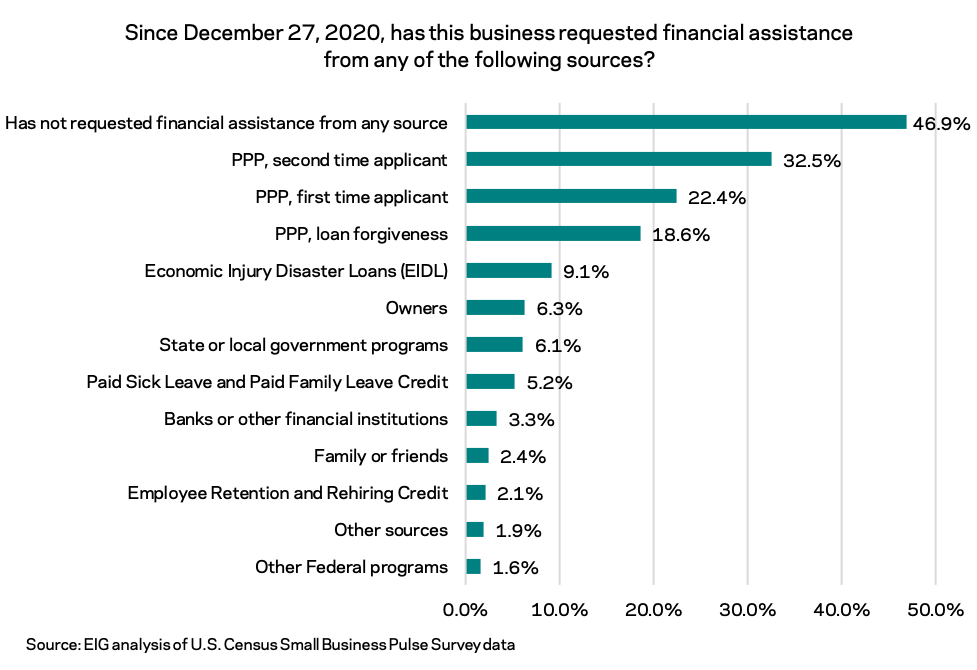

- Only 46.9 percent of surveyed businesses have not requested additional assistance since December 27th, implying that over half of the surveyed small businesses are still actively seeking assistance to survive the pandemic. Only 46.9 percent of businesses have not requested financial assistance from any source since December 27th. The most commonly sought form of assistance is the Paycheck Protection Program, with 32.5 percent of businesses applying as second time applicants and 22.4 percent as first time applicants. Updates to the program were captured in a recent EIG post.