By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of November 30th to December 6th.

Here are five things we learned about the small business economy last week:

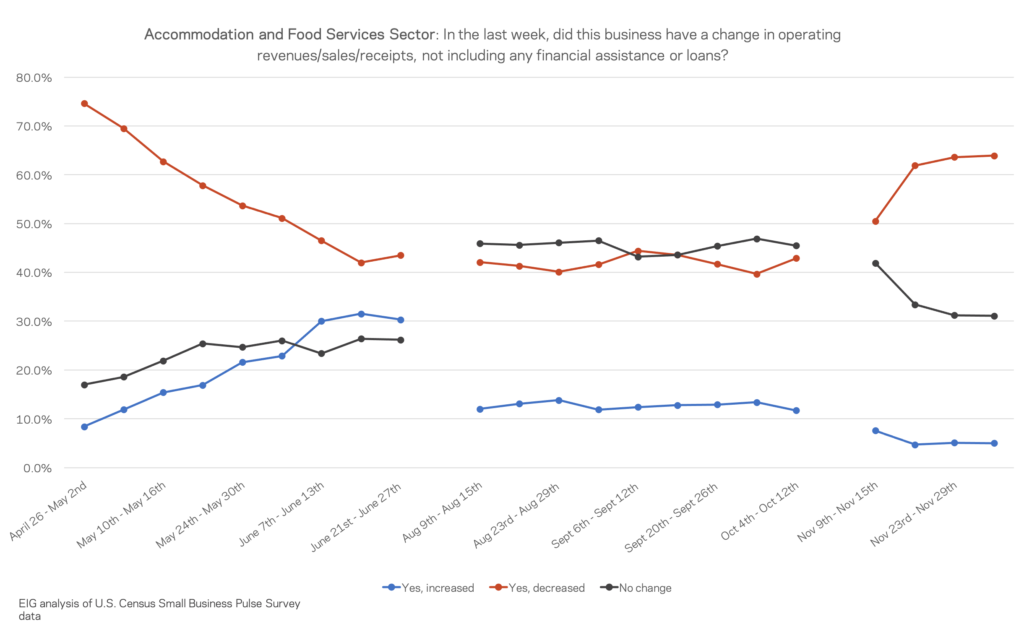

1. The fallout from COVID’s advance is clear and devastating in the accommodation and food services sector. Last week, over 60 percent of businesses in the accommodation and food services sector reported losses in revenue, 25 points higher than the national average for the week and 24 points higher than the industry’s lowest recorded share in late September.

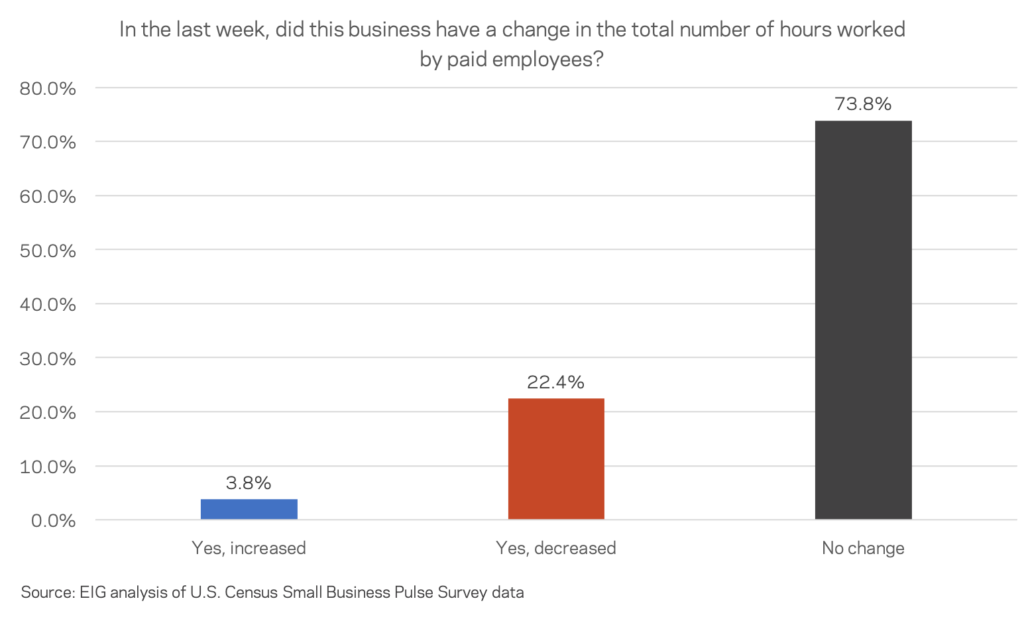

2. For the second week in a row, over 20 percent of businesses cut employee hours. The measure indicates that much of the country’s small business sector is coming under increased economic distress, as 22.4 percent of small businesses report reducing hours last week compared to the 3.8 percent that report increasing them. There was significant variation across states, however. In West Virginia, 33.8 percent of respondents cut employee hours while only 7.1 percent did so in Mississippi.

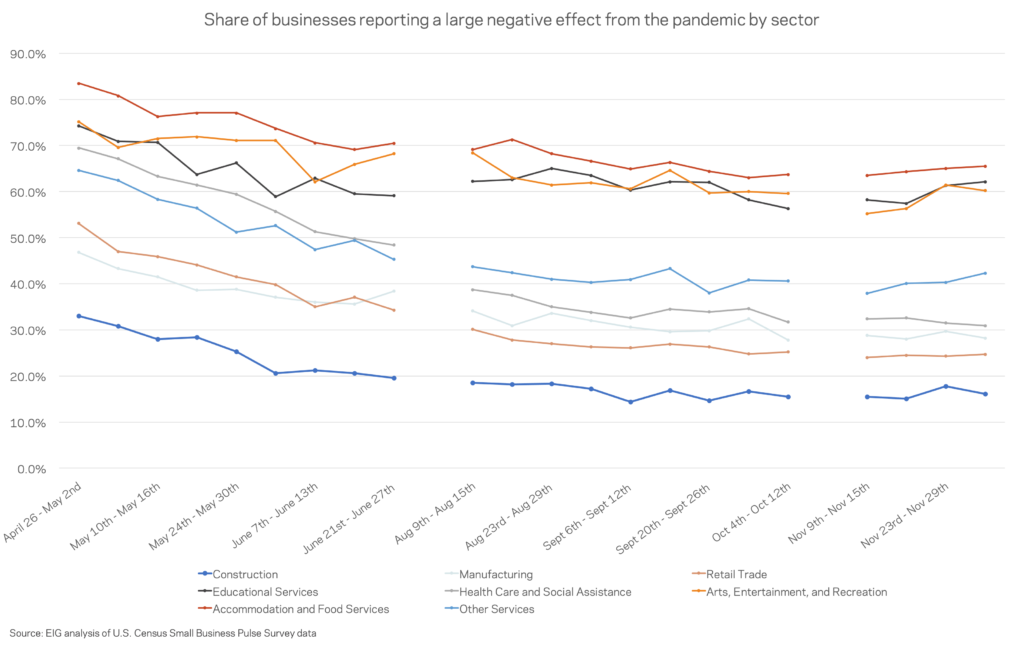

3. The share of businesses reporting a large negative effect of the pandemic has gradually fallen across all sectors since April, but some sectors remain in acute distress. The share of all businesses reporting a large negative effect of the pandemic has fallen below 40 percent in 13 of the economy’s 18 sectors. The three sectors in the most acute distress—education; arts, entertainment and recreation; and accommodation and food services—have seen smaller declines from initially higher bases. Across the hard-hit trio, more than 60 percent of respondents report a large negative effect of the pandemic—a figure that is rising again along with shares in other sectors over the past few weeks.

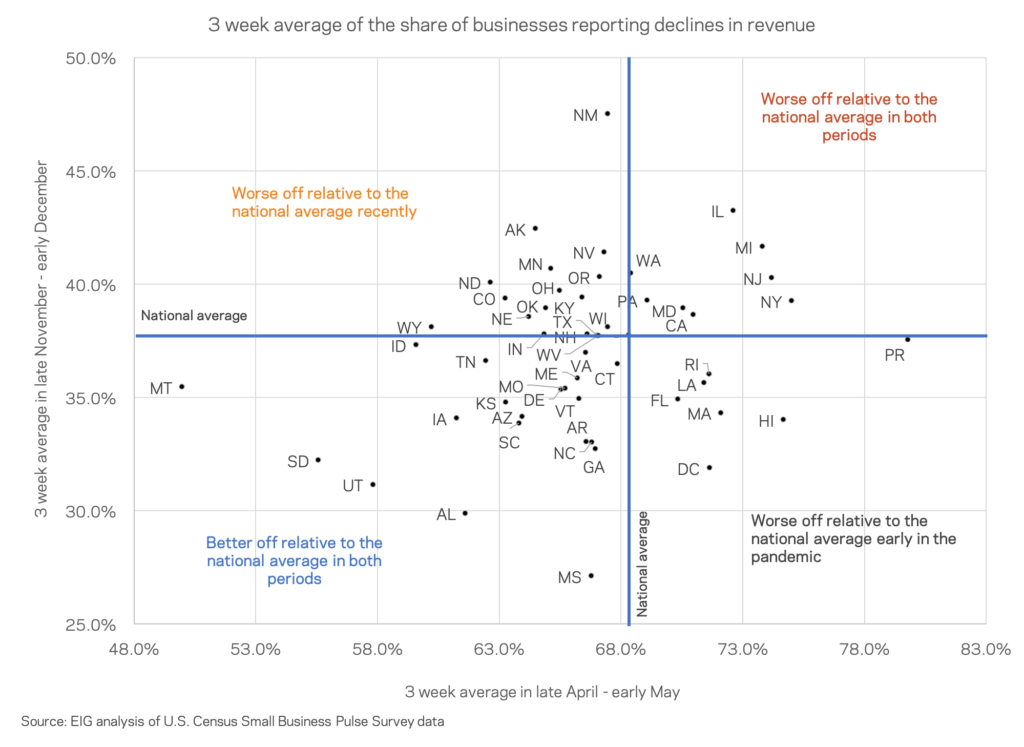

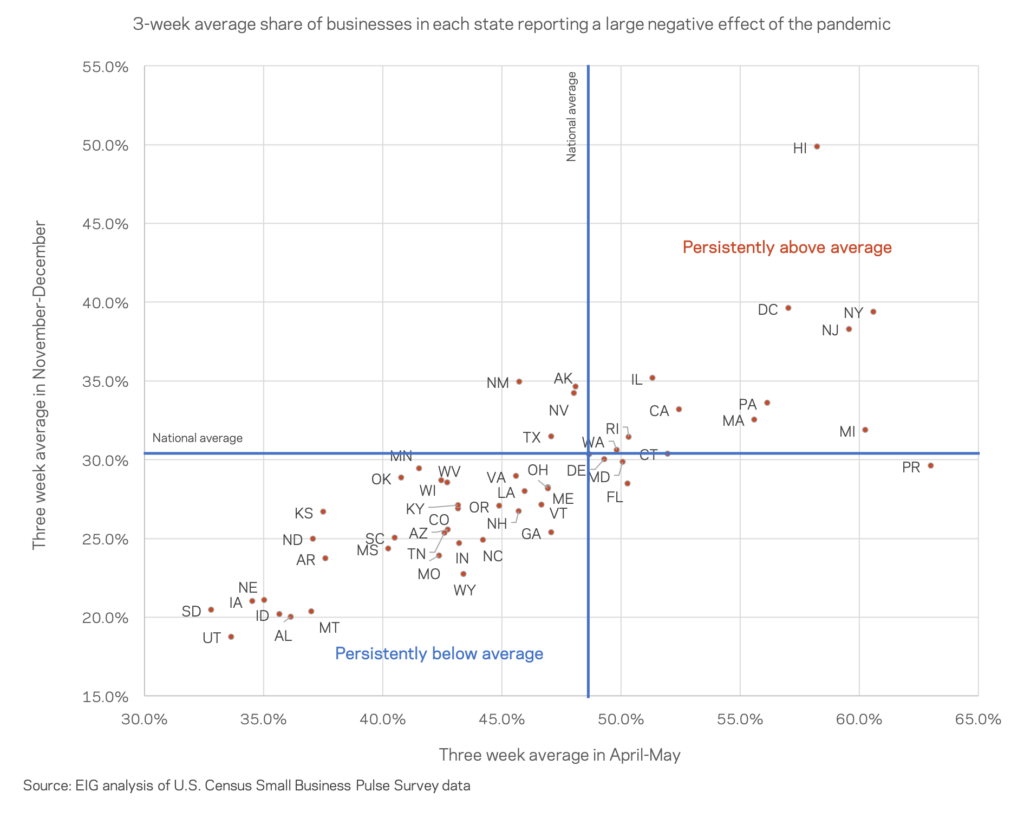

4. The places where the highest share of small businesses are currently reporting the worst effects of the pandemic are generally the same that experienced the worst start to the pandemic. As of November and the first week of December, the states with the largest shares of businesses reporting a large negative effect of the pandemic are roughly the same places that were hurting the most in late April and early May, near the start of the pandemic. Many states hit hard early in the Northeast had a higher share of deeply affected businesses in both periods while a rural cluster of states from the Midwest and West reported the lowest shares. Alaska, New Mexico, Nevada, and Texas are states that have gradually come to report more distress than the national average over time.

5. Places with surging COVID caseloads are not the ones with the largest shares of businesses reporting falling revenues—yet. The share of businesses reporting falling revenues in a given week provides a sense of where businesses are experiencing acute pain. Interestingly, many states with surging COVID caseloads per capita such as South Dakota have lower shares of businesses reporting weekly revenue decline than states where the virus appears to be somewhat more under control. Some states may simply have economies more exposed to sectors slammed by the virus like entertainment and tourism, but the gap between on the ground public health realities and business sentiment is conspicuous. These indicators will be critical to monitor in coming weeks as recent analysis indicates that economic activity may slow significantly as the virus spreads.