By August Benzow

Key Takeaway

The past few months of the COVID-19 pandemic have stifled economic activity in almost every state and the number of businesses reporting a decrease in revenues is rising again. For example, South Dakota, which has eschewed restrictions on businesses despite soaring case numbers, has seen increasingly fewer trips to retail and recreation businesses, as consumers respond to the threat of the virus. The consequence: an elevated share of businesses in the state are reporting a decrease in revenue compared to three months ago. By contrast, Hawaii has used business restrictions among other measures to drive down case numbers, and it has experienced a steady increase in trips to retail and recreation businesses, while the share of businesses reporting a decrease in revenue has fallen from a few months ago. The takeaway: without getting the virus under control, which now seems unlikely for most states until a vaccine is available, economic pain is unavoidable and potentially devastating. More federal assistance is urgently needed to bridge the gap and prevent a double-dip recession before a vaccine can bring the virus to heel.

Introduction

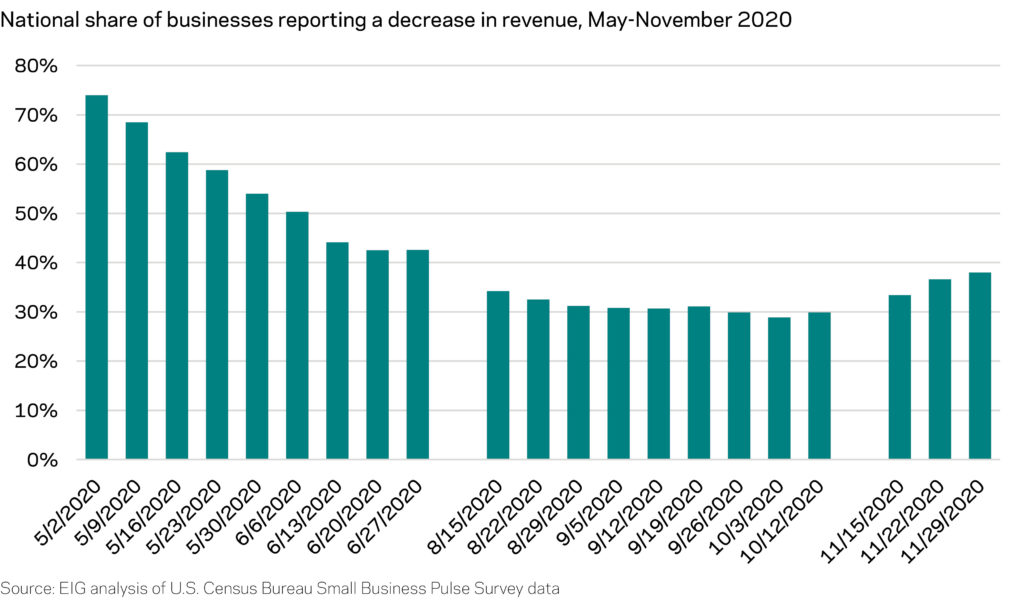

The spring phase of the COVID-19 pandemic had a quick and devastating impact on businesses across the country. Smartphone data provided by Google shows that even in states that chose not to lockdown in response to the threat of the virus, trips to retail and recreation businesses dipped sharply as many people chose to stay home out of an abundance of caution. This corresponds to business survey data from the Census Bureau, which began collecting data at the end of April, and shows that by the beginning of May over 70 percent of American businesses were reporting decreases in revenue. With the arrival of summer, community mobility increased in many states and businesses began showing signs of recovery, buoyed by stimulus dollars as well. The fall phase of the pandemic has been characterized by reversals to all those slight improvements. While the numbers are not as stark as they were at the start of the pandemic, every state has sunk below its January baseline for retail and recreation activity, and the share of businesses reporting a loss of revenue is rising in most states. As the economy sputters going into the winter, the data shows the danger that it will stall completely, especially as the country sets record numbers of COVID-19 cases and deaths.

Retail and recreation activity is on the skids going into the holidays

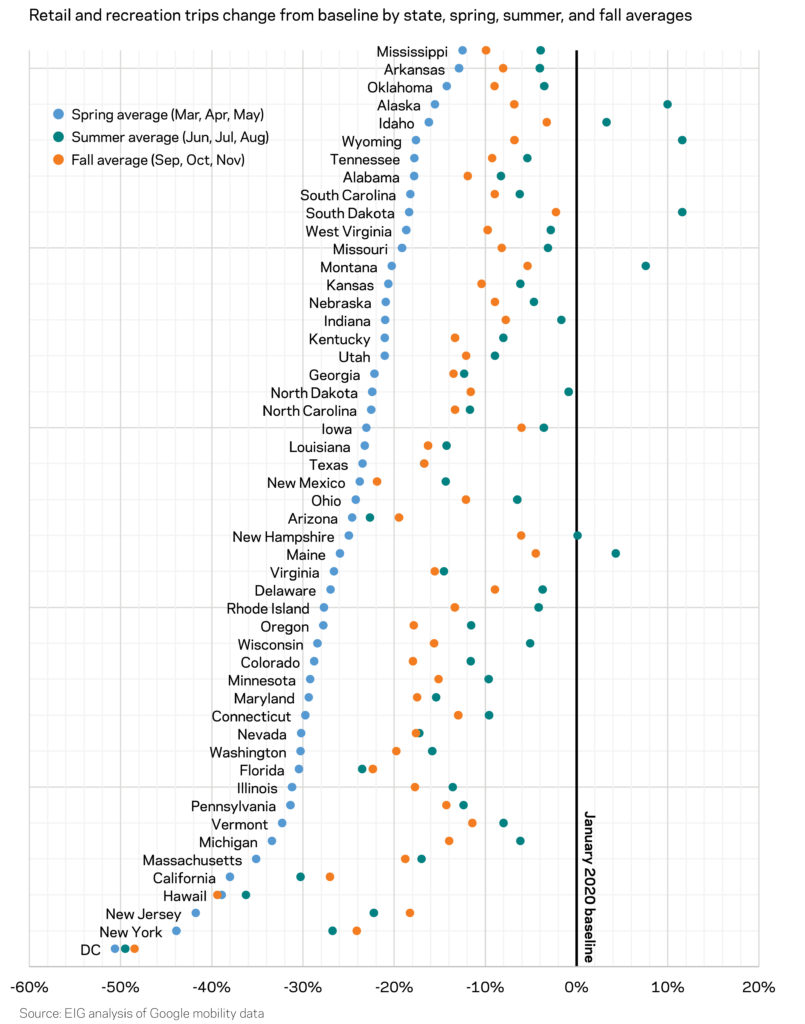

Google has published smartphone data on individual movement during the course of pandemic in aggregate statistics, which makes it possible to track over time whether a state’s population is staying at home more or flocking to retail and recreation options. The values of these indexes are expressed as the percentage change from the baseline value, which is the median mobility in January 2020 for each state. The data is published as a daily number and converted to a monthly average for this analysis to smooth out weekly swings in activity.

Almost every state has seen its nascent recovery in retail and recreation economic activity rollback in the fall months (September, October, November). The average number of trips to retail and recreation businesses was 25.6 percent below a January baseline for the typical state in the spring months (March, April, May). That number improved to 9.5 percent below baseline in the summer months (June, July, August), but dropped to 14.2 percent in the fall, and in just November the average was 18.7 percent below baseline. Only six states had managed to climb back above the January 2020 baseline over the summer and all those states fell back below that baseline in the fall.

South Dakota, for example, was on average 11.6 percent above its January baseline over the summer, but fell sharply to an average of 2.3 percent below its baseline in the fall. Its November average was -9.8 percent, which is comparable to what Minnesota averaged over the summer, a state that imposed restrictions on businesses to contain the virus. Some states that were hit early by the pandemic, like New York, Arizona and California, moved slightly closer to their January baseline in the fall compared to the summer, likely benefitting from stable COVID-19 caseloads. This slight progress, however, is not enough to bring these states anywhere close to the levels of retail and recreation activity that they were experiencing before the pandemic. In general, the population size and density of states seems to more closely correspond to how the pandemic has affected its retail and economic activity versus political leanings. In the fall months, retail and recreation activity in red states like Texas and Florida was on average as far from baseline as activity in blue states like Illinois and New York, while West Virginia was comparable to Vermont.

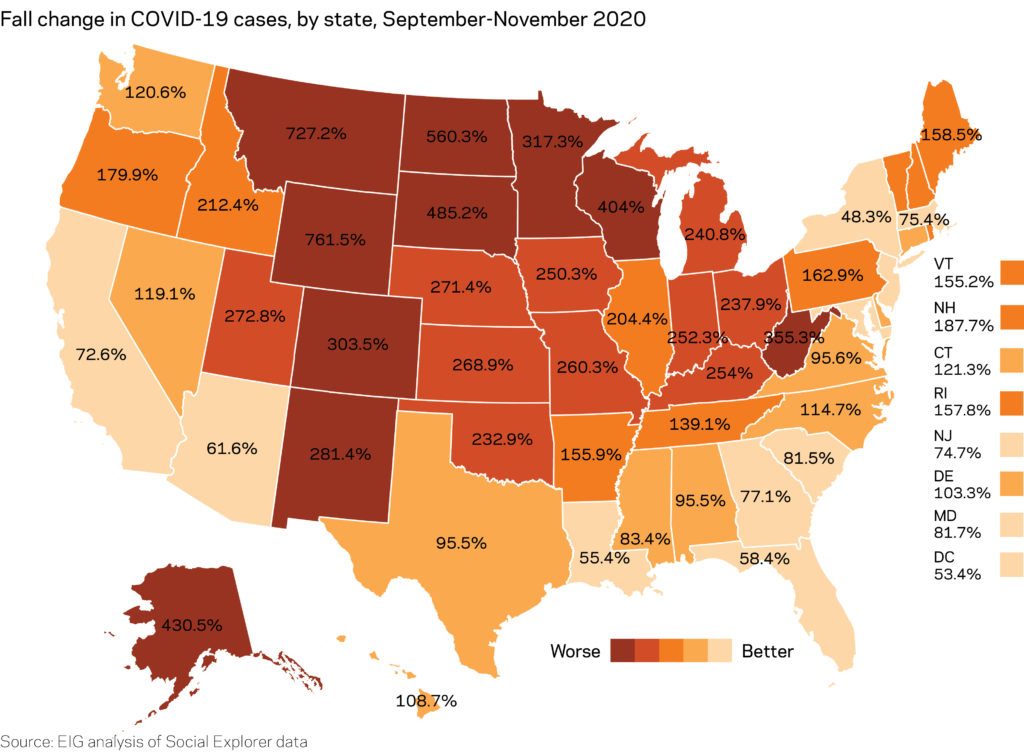

Declining retail and recreation activity tracks with surging COVID-19 cases

Many states that saw their economic activity at retail and recreation businesses reverse in the fall have also experienced a surge in cases. Wyoming, which saw its retail and recreation activity plummet from 11.6 percent above baseline on average in the summer to 6.8 percent below baseline in the fall, experienced the highest percent increase in COVID-19 cases, 761.5 percent, from September to November. Although Wyoming is a very low population state, it experienced 1.6 times more COVID cases this fall than Delaware, a state with twice the population and 84 times the population density. By contrast, states like Florida and New York, that have seen very little change in retail and recreation activity between the summer and the fall have also seen relatively modest increases in cases since September. Most states that saw a swift rebound in retail and recreation activity over the summer were in short order inundated with COVID-19 cases, and are now struggling economically even without strict business restrictions.

Businesses are seeing decreased revenue in most states, compared to the summer

Data from the U.S. Census Bureau’s Small Business Pulse Survey shows how these same trends are hitting the brakes on the economic recovery nationally. During the week ending on October 3rd, the share of surveyed businesses reporting a decrease in revenue hit its lowest number since the start of the survey in early May, 28.9 percent. That number has been steadily increasing since the middle of November, and hit 38 percent in the week ending on November 29th.

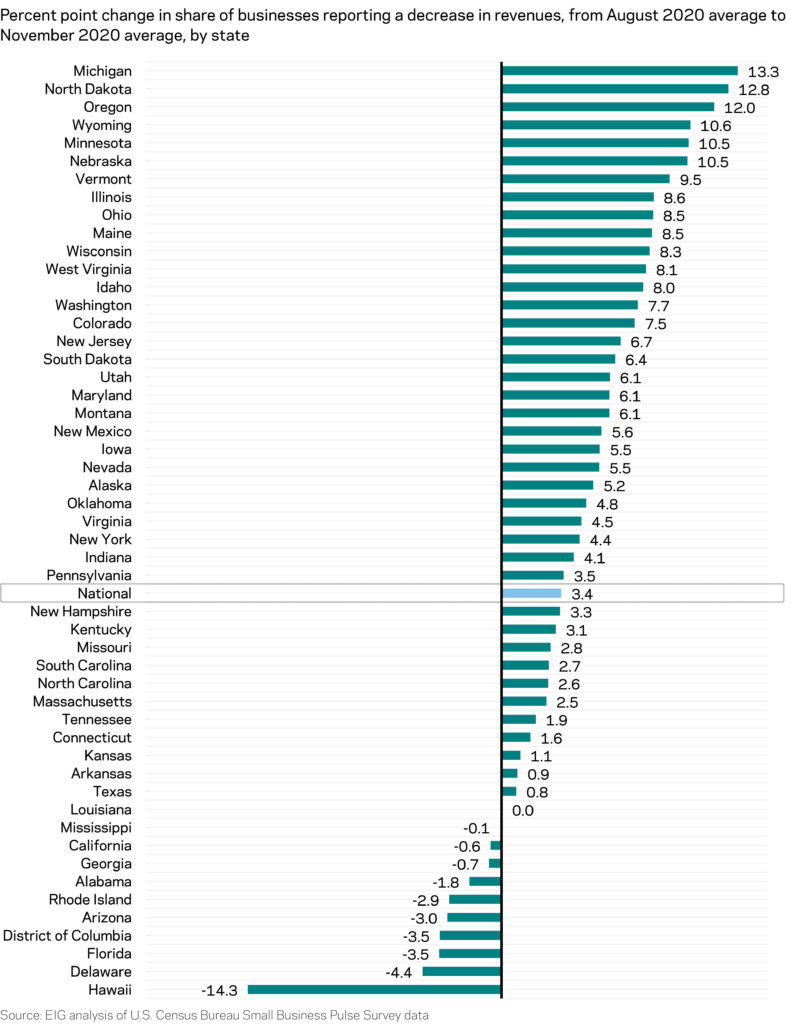

Only ten states, including the District of Columbia, had on average fewer businesses reporting a decrease in revenue in November compared to August. All of these states had a lower increase of COVID-19 cases in that time period compared to the national average. While they have this trend in common, they are dissimilar in size and political leanings, with Alabama joining blue states like Delaware and large swing states like Arizona, a state that had a 903.2 percent increase in cases over the summer and just 61.6 percent in the fall. At the other end of the spectrum states with exceptionally high autumn increases in COVID-19 cases also experienced a growing share of businesses reporting a decrease in revenue. Even a state like North Dakota, that has resisted putting restriction on businesses, has seen its share of businesses reporting a decrease in revenue increase from 24.9 percent in the average week in August to 37.7 percent in the average November week.

A tale of two states: The spread of the virus and the economic fallout in South Dakota compared to Hawaii

It would be difficult to pick two states more politically and demographically different than Hawaii and South Dakota. Hawaii has not selected a Republican presidential candidate since 1984, while South Dakota has not gone to a Democratic presidential candidate since 1964. South Dakota is 81.5 percent non-Hispanic white, while Hawaii is just 21.5 percent non-Hispanic white. Hawaii has around 530,000 more people than South Dakota and much higher population density. They are both geographically isolated in their own way, with South Dakota surrounded by other sparsely populated Midwestern states and regarded as a “fly-over” state, while Hawaii is a “fly-to” state.

These differences play out in how these states have responded to the COVID-19 pandemic. Hawaii has embraced a proactive approach to managing the pandemic and has responded to surges in cases with stay-at-home orders and strict quarantines for visitors. Its out-of-state visitors declined from 863,000 in January 2020 to 77,000 in October, a trend that has decimated its economically critical tourism industry (around one-fifth of Hawaii’s labor force was employed in leisure and hospitality in 2019). This dependence on tourism explains its stubbornly high unemployment rate of 14.3 percent in October, compared to 3.6 percent for South Dakota. South Dakota, by contrast, has rejected a range of restrictions, including mask mandates and stay-at-home orders, on the grounds of personal liberty and its state-level government has taken a hands-off approach to managing the virus.

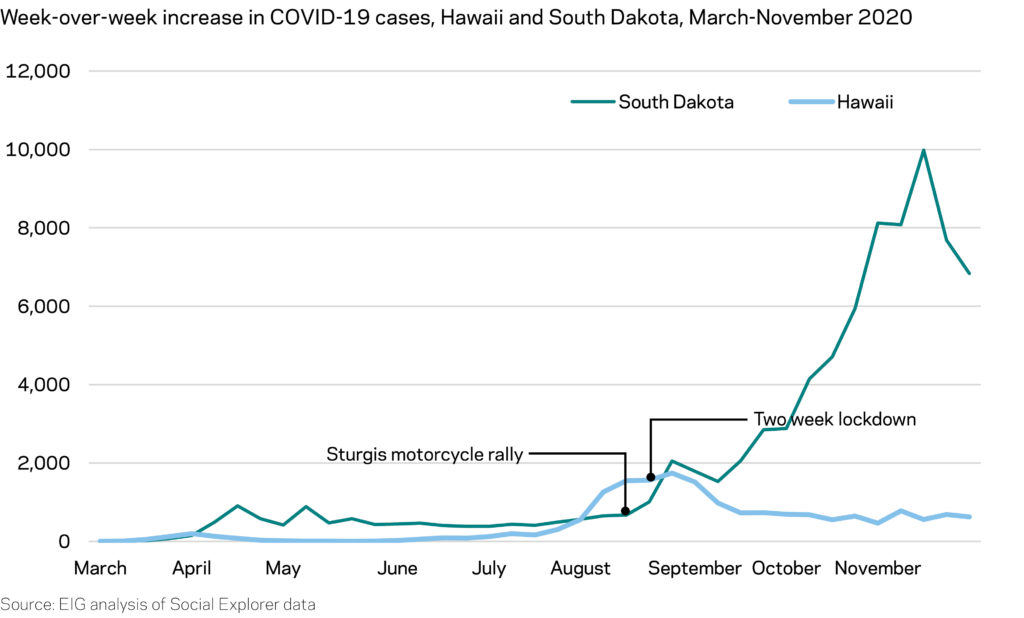

As of the end of November, Hawaii had the third lowest per capita COVID-19 case rate after Vermont and Maine with a stable rate of new week-over-week cases. South Dakota, by contrast, ranks second after North Dakota for the most cumulative COVID-19 cases per capita. Hawaii had a modest surge in cases in August and responded with a controversial second lockdown. Post-lockdown, it has kept its number of weekly new cases below that summer peak. South Dakota, by contrast, enjoyed relatively low case numbers throughout the summer before its case numbers began rapidly climbing in the early September, almost immediately after it hosted the Sturgis motorcycle rally, which attracted nearly a half million people to a small community in the western portion of the state. Over the course of the pandemic, South Dakota has had 4.2 times as many cases of COVID-19 as Hawaii and 3.5 times as many deaths, despite having less than two-thirds the population. In the second week of November, South Dakota had more new cases than Hawaii has had from the beginning of September to the end of November.

Over the course of the pandemic, South Dakota has had over 4.2 times as many cases of COVID-19 as Hawaii and 3.5 times as many deaths, despite having less than two-thirds the population.

It is a common misconception that there is a choice to be made between keeping the economy alive and keeping people alive. The assumption here is that without restrictive government interventions, like stay-at-home orders, business capacity limits, and closing of non-essential businesses, the economy will continue to thrive even in the midst of a pandemic. The comparison between businesses in Hawaii and South Dakota provides evidence that this is a false choice.

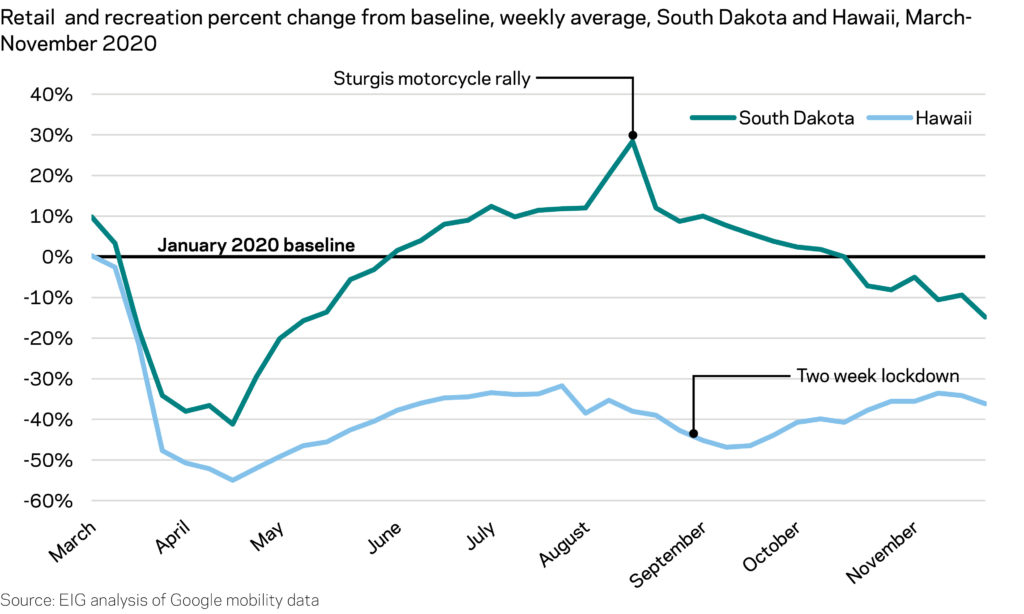

Using Google smartphone data to compare these two states it becomes clear that the threat of the virus is the ultimate determinant of individual behavior. Like almost every state, individuals in both South Dakota and Hawaii responded initially to the perceived threat of the pandemic by staying at home a lot more. The decrease from baseline was sharper in Hawaii than South Dakota but profound in both states. Both states maintained very low case rates throughout the spring and early summer, but individuals in South Dakota quickly abandoned their initial caution, and by June trips to retail and recreation businesses had climbed above the state’s January baseline, while Hawaiians remained much more cautious with a very modest increase in retail and recreation activity even after the initial lockdown was lifted.

Retail and recreation activity in Hawaii declined at the beginning of August as cases surged. This downward trend began several weeks before the governor authorized a second lockdown. Around the same time, retail and recreation trips in South Dakota surged during the weeks of the Sturgis bike rally. By the end of August, cases were climbing in South Dakota, and even without any restrictions, retail and recreation began a steady decline. Meanwhile in Hawaii, with its rate of new cases stabilized after lockdown, retail and recreation trips began to climb again until a slight dip during Thanksgiving week. Although South Dakota is still much closer to its January baseline than Hawaii and many other states, its downward trend in absence of government restrictions shows how the virus can suppress economic activity even in a deep red state.

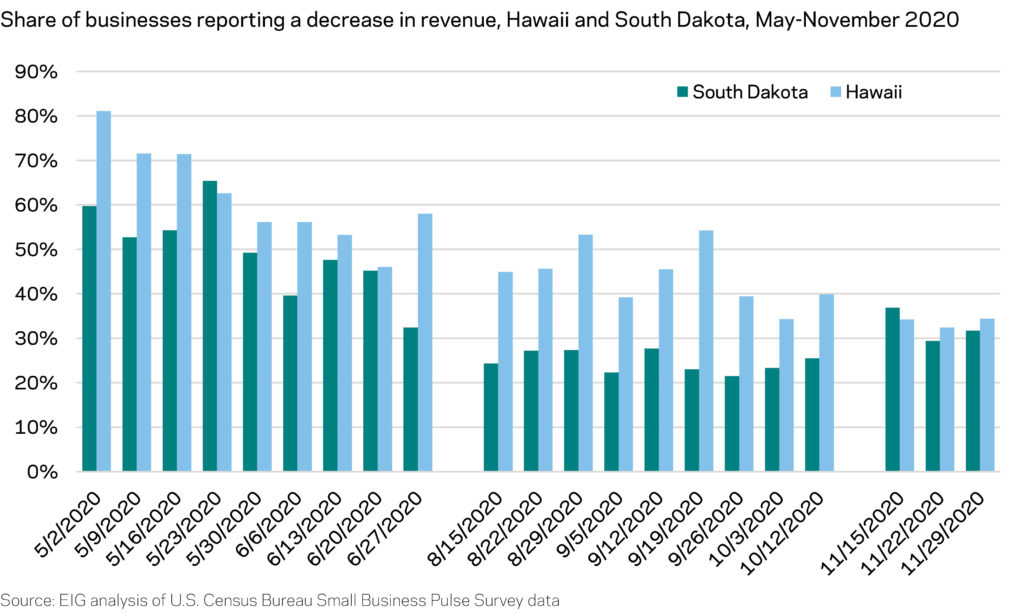

This downward trend in individual mobility is also closely correlated with a negative effect on businesses in South Dakota. Using the Census Bureau’s Small Business Pulse Survey data to compare the state with Hawaii, there is clear evidence that South Dakota enjoyed a robust advantage over Hawaii for most of the spring and summer. In the survey ending on September 19th, 54.2 percent of businesses in Hawaii reported a decrease in revenue, compared to just 23 percent of businesses in South Dakota. In the ensuing months, the states have crept closer to parity as the share of businesses reporting a decrease in revenue climbed in South Dakota and declined in Hawaii. In the week ending on November 15th, more businesses in South Dakota were reporting a loss of revenue than in Hawaii, 36.9 percent compared to 34.2. While Hawaii had a slightly higher share in the last two weeks of the month, it is nonetheless shocking that the states are so close. Hawaii’s economy will continue to struggle so long as it is cut off from the tourists it depends on, but the state has managed to stabilize its economy by getting the virus under control. Businesses in South Dakota, on the other hand, appear to be hamstrung by the uncontrolled spread of COVID-19, despite a more favorable industry mix and few restrictions.

Conclusion

It cannot be stressed enough that the economy is not on a safe recovery trajectory yet. While real GDP did increase substantially in the third quarter of 2020 after experiencing its largest quarterly plunge in activity ever in the second quarter, many economists are predicting a slowdown or contraction by the first quarter of 2021. In some ways the threat to the economy this time is more insidious than it was in the spring, when an unprecedented decline in economic activity within a few short weeks was enough to marshall an aggressive federal response. As economic activity roared back in many states over the summer, it was easy for some to believe that no further federal intervention was needed, but this data clearly shows that the “return to normal” was short-lived and as residents of every state are grappling with the spreading threat of the virus the economic outlook appears increasingly dire.