The latest and greatest research and commentary from the field.

The third quarter of 2016 saw a flurry of entrepreneurship-related research. Scholars examined the linkages between access to credit and startup rates, business dynamism and productivity, and competition and growth rates. New Census Bureau data products provided novel insights into the scale, demography, and geography of entrepreneurship in the United States. And Millennials’ entrepreneurial aspirations were found to far exceed their near-term career goals. The best new pieces of insight are listed below. Enjoy!

Reports

To Grow New Businesses, Improve Access to Credit

David Brown and Emily Liner, Third Way

September 2016

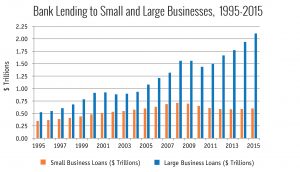

Lending to big business increased dramatically post-recession, while small business lending remained well-below pre-recession levels. The authors explore four possible explanations for the gap: borrower creditworthiness, consolidation within the banking sector, regulatory barriers, and market imperfections. They find evidence that much of the problem may exist on the demand side—that there are simply fewer creditworthy small businesses applying for lending. They propose a number of supply-side steps to increase the availability of capital nonetheless.

Source: Third Way

Declining Entrepreneurship, Labor Mobility, and Business Dynamism: A Demand-Side Approach

Mike Konczal and Marshall Steinbaum, Roosevelt Institute

July 2016

Challenging common supply-side explanations such as high housing costs in booming locales, tightening regulations, or overly restrictive occupational licensing regimes, the authors hone in on weak demand for labor as a leading cause of the decline in measures of business dynamism such as falling startup rates, rising employment in large old firms, and slowing job turnover rates. Workers encounter stagnant wages and fewer job offers in the labor market today and are rarely rewarded for switching employers, all pointing to subdued demand for their services. A healthy labor market acts as a safety net, enticing more individuals to take the risk of entrepreneurship. Analyzing local markets, the authors observe that declining job turnover rates and falling wages go hand in hand, opposite of what the supply-side arguments would produce.

Declining Business Dynamism: Implications for Productivity

Ryan Decker et al, Brookings Institution

September 2016

Scholars explore the relationship between business dynamism and productivity growth. They find that the relationship between firm growth rates and productivity levels has broken down: In the past, high productivity firms would expand payrolls faster than low productivity ones; that’s less true today. The gap between the most and least productive firms has also widened. Meanwhile, fewer high growth new firms—disproportionately responsible for productivity growth—are being born. Increasing frictions and weakening competition economy-wide could explain this gradual slowing of economic dynamism in its tracks: absent robust competition and insurgent startups, weak and unproductive firms live on.

The Role of Startups in Structural Transformation

Robert Dent and colleagues, U.S. Census Bureau and Federal Reserve Bank

August 2016

Do startups usher in the future? The authors explore the role that startups play in driving the evolution of the U.S. economy. They find that startups are responsible for about half of the shift in industrial composition in the economy (the rest is accounted for by existing firms evolving themselves), evidenced by relatively higher firm entry rates in ascendant sectors. The authors also show that the startup deficit has partially slowed the economy’s transition into new industries, and that the cumulative impact of the slowdown will grow.

The Many Impacts of Kickstarter Funding

Ethan Mollick, Wharton School at the University of Pennsylvania

July 2016

One of the few early attempts at quantifying the impact of crowdsourcing platforms, this survey of over 60,000 successful Kickstarter projects revealed that users leveraged every dollar of Kickstarter funding to get $2.46 in outside funding. Projects also resulted in over 2,600 patent applications and generated an employment impact of over 5,000 ongoing full time jobs and over 160,000 temporary jobs.

Commentary

Mayors Must Be Policy Entrepreneurs

John Lettieri, Growthology

October 2016

Mayors must be at the vanguard of making entrepreneurship more demographically and geographically inclusive in the United States. They can get started by placing entrepreneurship at the center of their local economic development strategies, advocating on behalf of their startup communities’ needs at the state and federal level, and making it easier to start a business locally. In tackling America’s startup problems, mayors should emulate entrepreneurs themselves: be bold, move quickly, and embrace new ideas.

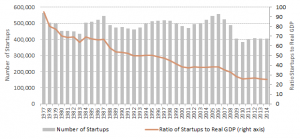

Number of Startups vs. Startups per $1 billion of Real GDP

Source: EIG analysis of U.S Census Bureau, Business Dynamics Statistics data

Dear Next President: Lend a Hand to Our Entrepreneurs

Steve Glickman and John Lettieri, The Daily Beast

July 2016

U.S. economic growth is increasingly concentrated geographically, leaving millions of people and their communities in decline while super-performing metropolitan centers enjoy vibrant growth. Twenty counties alone accounted for half of the nation’s net new businesses post-recession. The government can assist entrepreneurs in generating more widespread economic growth by increasing access to capital, cutting red tape, and improving the quality and quantity of the economic data it collects.

Comment on Proposed International Entrepreneur Rule

Economic Innovation Group

October 2016

EIG comments on the Department of Homeland Security’s (DHS) efforts to move forward with a “startup visa” to attract entrepreneurs to the United States absent legislative action. We advise to give applicants “bonus points” if they locate their business in a startup- and investment-starved distressed community.

Latest Census Data Confirms Stagnation in U.S. Startup Landscape

Economic Innovation Group

September 2016

The release of the U.S. Census Bureau’s Business Dynamics Statistics (BDS) data for 2014 confirms a stagnation in the country’s startup rate post-recession. America can and does still produce new firms, but its startup capacity remains diminished relative to the country’s past, and the geography of startups remains too uneven.

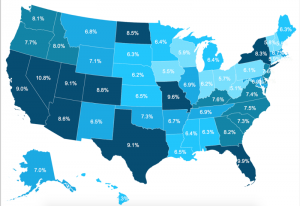

Startups’ Share of Total Firms by State

Source: U.S Census Bureau, Business Dynamics Statistics

St. Louis is the New Startup Frontier

Ben Casselman, FiveThirtyEight

September 2016

According to the latest startup data from the U.S. Census Bureau, St. Louis saw the biggest uptick in firm formation of all major metro areas in the United States from 2013 to 2014. Its peers across the state performed similarly well. The author visits the city to understand why.

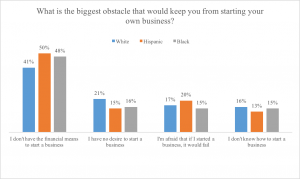

In-Depth: Millennials

EY and the Economic Innovation Group

September 2016

EY and EIG polled 1,200 Millennials on their economic concerns, outlook, and career goals. Millennials admire entrepreneurship, but many do not see a clear avenue to it for themselves. Instead, they are far more likely to choose a risk-averse path: hoping to achieve career advancement by sticking with one company. Millennials universally lack confidence in traditional institutions, but African American women are the likeliest to channel that dissatisfaction into charting their own course.

Source: EY and the Economic Innovation Group

Read the coverage:

Millennials: You Can’t Afford a Startup. Time to Get a Job

Suzanne Woolley, Bloomberg

September 2016

We Expect Millennials to do Great Things. Maybe We Shouldn’t

Ana Swanson, The Washington Post

September 2016

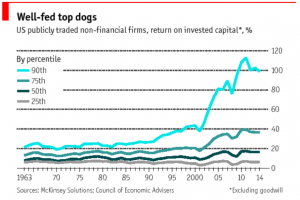

In-Depth: Competition

The Economist

September 2016

“Disruption” may be the buzzword of the moment, but in reality we’re not seeing enough of it. Today’s corporate behemoths have amassed huge amounts of power as they’ve balanced broadening their reach with narrowing their focus in order to minimize competitive pressures. With corporate profits at record highs and corporate tax avoidance mastered, a backlash against big business is building across the developed world. A healthy dose of competition is needed so that the economy, rather than angry politics, can lead the disruption of the status quo.

Read more in The Economist’s Special Report on The World Economy

Derek Thompson, The Atlantic

October 2016

The authors claim that the stagnant economy of the past few decades, illustrated by low entrepreneurship rates and increase in average firm age, is the result of federal policies making it easier for large companies to dominate their markets. Capitalism needs churn, not because big is always bad, but because stagnation is.

A Fair Fight: Entrepreneurship and Competition Policy

Chris Jackson and Jason Wiens, Kauffman Foundation

July 2016

Kauffman researchers identify three areas of focus for efforts to rekindle competition in the American economy: labor markets, firm formation, and innovation. Reigning in non-competes agreements, ensuring that occupational licensing regimes do not not become barriers to self-employment, and revisiting patent laws are all good places to start.

Beyond Antitrust: The Role of Competition Policy in Promoting Inclusive Growth

Jason Furman, President’s Council of Economic Advisors

September 2016

On the heels of the President’s Executive Order to promote competition and inclusive growth in the digital age, the head of the President’s Council of Economic advisors shares its latest assessment on the state of competition in the U.S. economy. He builds the case for a pro-competition policy agenda that focuses on intellectual property and patent reform and worker bargaining power, to name a few themes, before reflecting on the unique challenges confronting policymakers in the Internet era.

American Antitrust Institute

July 2016

With market concentration increasing across the economy and barriers to entry rising, the role of competition policy in protecting and facilitating entrepreneurial growth is more important than ever. With this in mind, the AAI proposes a number of recommendations for the next administration to rekindle competition in the United States, including: heighten scrutiny of mergers, streamline antitrust litigation, and mitigate innovation-sapping abuses of intellectual property protections.

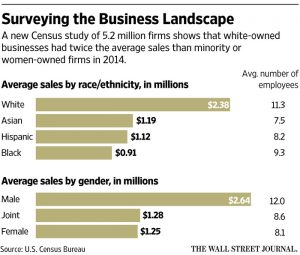

In-Depth: Inclusive Entrepreneurship

Blacks Lag in Business Ownership, but Gap is Narrowing

Ruth Simon and Paul Overberg, Wall Street Journal

September 2016

Data from the U.S. Census Bureau’s new Annual Survey of Entrepreneurs shows that only 2.1 percent of the country’s companies with employees are black-owned, well below their 13.3 percent of the population. Women are also underrepresented, owning only 20 percent of employer-firms. Minority- and female-owned firms have fewer sales, too. Promisingly, the racial and gender gaps have started to close since the recession.

CrunchBase

April 2016

CrunchBase surveys the venture capital industry based on two important measures of gender inclusivity: the share of true investing partners that are women and the share of firm-backed startups that have at least one woman founder. They find that 7 percent of partners in the top 100 venture firms are women. In addition, only 10 percent of global venture dollars went to companies with at least one female founder from 2010 to 2015.

Prison to Proprietor: Entrepreneurship as a Re-Entry Strategy

Joyce Klein and Lavanya Mohan, FIELD at the Aspen Institute

September 2016

Business ownership offers previously incarcerated individuals a chance at stable employment and can put them on the path towards independence and wealth creation rather than recidivism, which is all too common. This report profiles a number of different initiatives across the country aimed at providing reentering individuals with the skills and networks required to become independent entrepreneurs.

The Arrival of the Immigrant Entrepreneur

Daniel Wilmoth, SBA Office of Advocacy

October 2016

Immigrant entrepreneurs, long symbols of the United States’ entrepreneurial zeal, are an increasingly significant feature on the country’s startup landscape. The percentage of the country’s self-employed who were born abroad more than doubled between 1994 and 2015 to 19.5 percent, or nearly one-fifth. The rising heft of immigrant entrepreneurs is the product of three forces: rising immigration, rising self-employment among foreign-born individuals, and a decrease in self-employment in the native-born population.

The Ascent of the Senior Entrepreneur

Daniel Wilmoth, SBA Office of Advocacy

August 2016

In 1988, 4.2 percent of seniors were self-employed. By 2015 that figure had risen to 5.4 percent. The increase is driven by the rapid rise in the share of seniors who are employed at all. The share of employed seniors that are self-employed, by contrast, has fallen steadily (as it has for non-seniors). Senior entrepreneurship would be boosted by efforts to increase rates of entrepreneurship economy-wide.

Testimony

Struggling to Grow: Assessing the Challenges for Small Businesses in Rural America

Testimony before the U.S. House of Representatives Subcommittee on Economic Growth, Tax, and Capital Access

John Dearie

September 2016

Rural areas have felt the national decline in entrepreneurship particularly acutely, seeing a sharp reversal of fortunes over the past couple of decades. Having toured the country talking to entrepreneurs, the author heard remarkably consistent concerns: skill shortages; misguided immigration policies; limited access to capital; burdensome regulations; tax complexity; and policy uncertainty emanating from Washington. Policymakers have the ability to act on all fronts; the will still seems to be missing.

Books

Dag Detter and Stefan Foelster

June 2017

The authors give urban leaders a roadmap for investing in the long-term prosperity of their cities. They urge a balance sheet approach to public asset management and propose Urban Wealth Funds on the sovereign model to manage infrastructure investments that unlock the wealth of cities. This book is on pre-order and due to be released in Spring 2017.