Yesterday, the Internal Revenue Service (IRS) hosted a public hearing on the notice of proposed rulemaking for Investing in Opportunity Funds released last October. The hearing itself was a testament to the enthusiastic interest in the incentive: the line to get into the building was 90 minutes long at times, the auditorium was filled to capacity (in part due to the lack of a livestream of the event), and the testimony lasted nearly five hours with 23 scheduled speakers.

The speakers’ testimonies, as well as the nearly 175 comment letters submitted to IRS on the regulations, converged upon several key issues on which investors and community stakeholders need additional clarity to unlock the Opportunity Zones market. In particular, there was a constant refrain around the need for the regulations to support investments in operating businesses that carry the potential for positive economic growth in distressed communities – the fundamental intention of the provision.

Opportunity Zones became law more than one year ago to address the issue of geographic inequality that plagues our country’s economic health by providing a new incentive for equity capital investment to flow to America’s distressed communities. One finding from the latest Distressed Communities Index helps to illustrate the trend of widening geographic inequality: As of the end of 2016, less than one quarter of U.S. counties had gained back the number of businesses they lost to the recession. The excitement and optimism about this tool is palpable in these communities, and investments are starting to take place, from the development of affordable homes in Watts to the reactivation of a vacant school turned senior care facility in rural Heflin, Alabama. This equity incentive was designed to be complementary to existing community development tools and debt financing products, and flexible enough to meet the diverse needs of a wide range of communities. The lack of regulatory guidance from Department of the Treasury has stymied investment into operating businesses–more complicated than investment into structures but ultimately a more powerful force for sustainable and inclusive growth–in underserved areas. If critical issues that would open the door for business investments are not addressed, Opportunity Zones will fail to achieve its full potential.

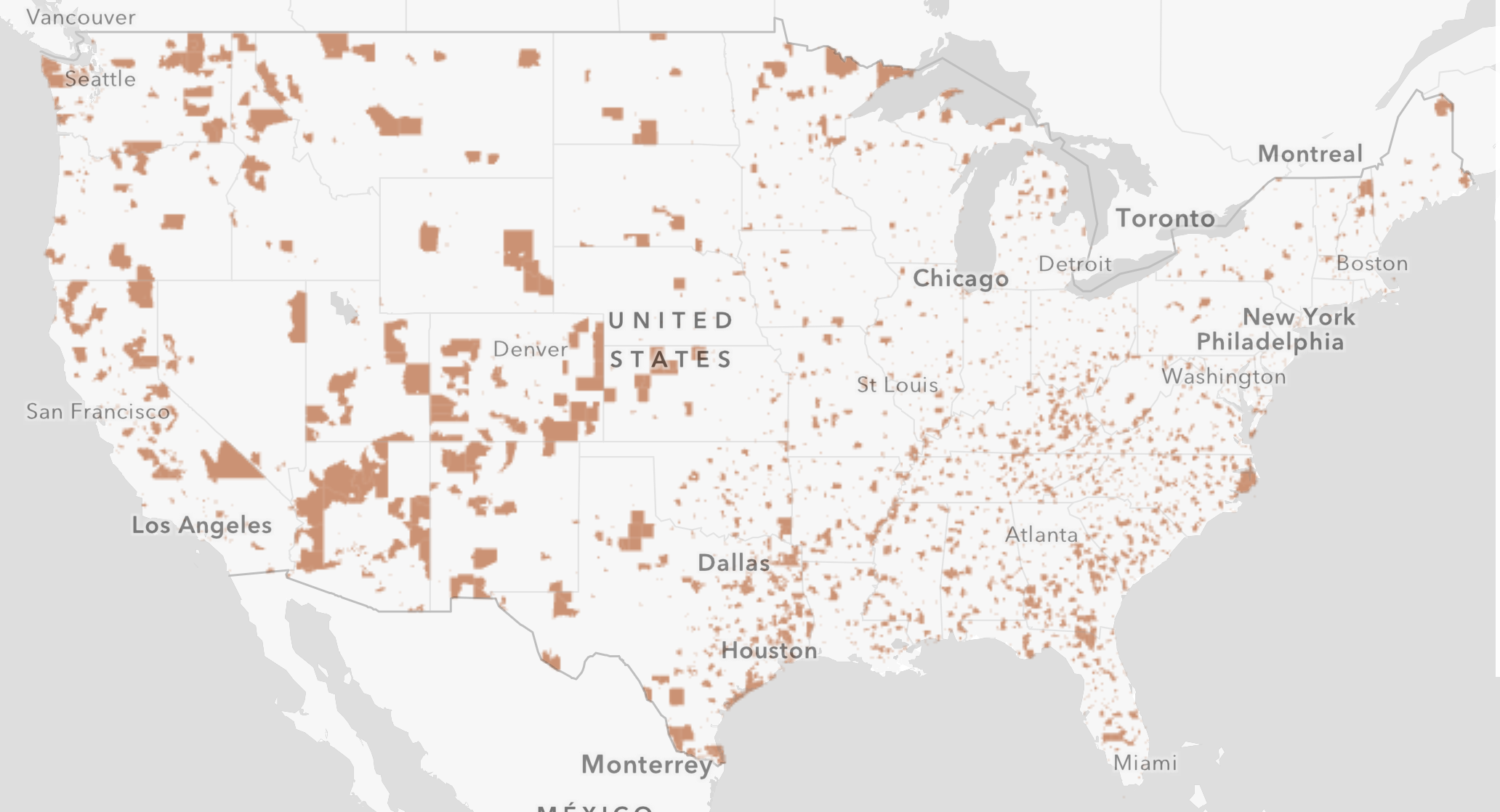

Let’s first start with the zones themselves. Opportunity Zones were designated by governors and state executives of all 50 states, DC, and the U.S. territories and certified by Treasury in June 2018. Such state and local input in selecting zones was critical, since their long-term engagement will be essential to maximizing the positive impact of what is otherwise only a marginal tax incentive. EIG’s comprehensive analysis of the zones revealed that Opportunity Zones demonstrate a higher-need across nearly every available measure than both the full universe of census tracts that were eligible for a zone designation and the subset of low-income census tracts that did not receive designation. Of the 31 million residents of Opportunity Zones nationwide, over 14 million live in communities that saw median incomes decline over the recovery period and nearly 19 million live in ones in which poverty rates rose. Seventy-one percent of Opportunity Zones meet the U.S. Treasury Department’s definition of “severely distressed.” The average designated tract has a poverty rate nearly double the national average. More than one-fifth of all Opportunity Zones have poverty rates of 40 percent or higher, which is true of only around 5 percent of communities nationwide.

Despite a small subset of tracts that have fueled skepticism and concerns over gentrification and displacement risk, more than 96 percent of the designated zones do not show signs of gentrification. Governors prioritized highly distressed places, many of which also have strong foundations for investment. These communities are primed and ready for transformative investments that are not flowing at the levels they could with the necessary regulatory guidance.

Our testimony at yesterday’s hearing focused on the following three areas where guidance from Treasury and IRS is urgently needed. This request was echoed in many speakers’ testimonies, as well.

- First, IRS needs to promulgate regulations that support the formation of multi-asset Opportunity Funds, by allowing timing flexibility for funds to raise and deploy capital, and ensuring the intended 10-year tax benefit is preserved and available to investors. Multi-asset funds are imperative so that investors can spread risk across multiple zones, investments, and asset classes, and ultimately reach the Opportunity Zones where returns are less certain. Investing in operating businesses in particular is only practically possible at scale via a multi-asset fund.

- Broadly, the rule-writing process should be guided by Congress’s clear intent for operating businesses to be core beneficiaries of Opportunity Zones capital. Of particular importance – and an issue that was raised repeatedly throughout the hearing – was the regulations’ added geographic requirement for qualifying Opportunity Zone businesses that 50% of the gross income must come from its active trade or conduct in the zone, which would deter investments in businesses with growth potential that would be attractive to investors and beneficial to a community’s economic health.

- Third, future regulations should include more transparency, reporting requirements, and anti-abuse provisions. The collection of data on Opportunity Fund activity and transactions will help ensure benefits are going to distressed communities, and provide important information on the efficacy of the provision.

You can read the Opportunity Zones Coalition comment letter to IRS here.

Other issues that surfaced throughout the hearing included additional flexibility for both businesses and real estate projects to meet the substantial improvement test, support for the working capital safe harbor with the caveat that it should be accessible to small businesses in addition to real estate, support for the proposed 70% substantially all threshold, and clear rules for the exiting of an Opportunity Fund.

Outside of Washington, the past several weeks have seen a flurry of promising Opportunity Zones activity that should generate broad excitement about the prospects of this nascent young policy as an organizing principle for new approaches to economic and community development. The impact investing community firmly planted its flag as a leader and market-shaper in this space by launching a reporting framework for Opportunity Funds. Numerous cities have embraced the investment prospectus framework, led by Bruce Katz and Accelerator for America, as a way to steward capital towards community priorities. The states of Maryland and Colorado have prioritized complementary programming to influence outcomes in inclusive and impactful directions, and the state of California’s draft budget sets out to embrace OZs to invest in green technologies and affordable housing with the assistance of the newly forged California Opportunity Zone Partnership. Concerns that rural areas may get left behind are fading as investment announcements trickle in, thanks to the organizing efforts of entities like Opportunity Alabama, which is connecting investors with investable assets in Alabama’s Opportunity Zones.

Yet success is by no means guaranteed. We hope Treasury and IRS will take yesterday’s comments and valuable perspectives into close consideration as they finalize the first tranche of regulations and issue additional rounds of guidance in the coming months. The potential for Opportunity Zones is great – the testimonies and comment letters speak to the excitement about this new tool for communities across the country – but it is currently stymied by the lack of regulatory guidance. In order for Opportunity Zones to fulfill its intended potential as a lifeline to entrepreneurs in underserved and overlooked areas of our country, Treasury must build a regulatory framework that will encourage investments in operating businesses.