The latest and greatest research and commentary from the field.

Entrepreneurship scholars ended 2016 and ushered in 2017 with a flurry of great research and commentary. Unsurprisingly, given the excitement of the election, some of the best scholarship focused on the big picture question of how and why the U.S. economy has grown less dynamic over time. The debate about whether the economy is becoming more or less innovative continued to rage alongside. Academic scholars were especially busy refining their insights into the relationship between startups and productivity growth. New numbers gave researchers the opportunity to uncover new insights on the future of work and the face of entrepreneurship too. Much more below. Enjoy!

The Big Picture: Dynamism

Dynamism in Retreat: Consequences for Regions, Markets, and Workers

Economic Innovation Group

February 2017

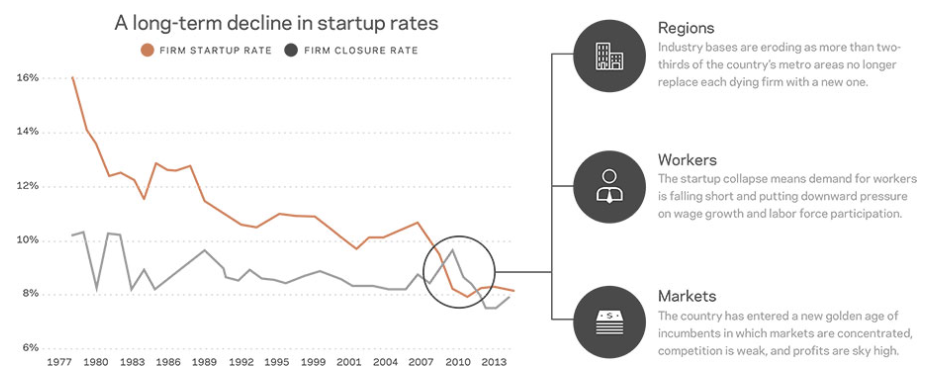

On all available measures—the startup rate, the job turnover rate, the domestic migration rate—the U.S. economy has been growing gradually less dynamic over time. The Great Recession accelerated the decline so dramatically that for the first time on record more businesses were closing than opening in the United States. The rate of “creation” in the economy now barely outpaces the forces of “destruction.” The report traces the impact on regions, markets, and workers, and asks how we can restore the country’s storied dynamism.

Is the U.S. Economy Too Dynamic, or Not Dynamic Enough?

Neil Irwin, The New York Times

February 4, 2017

By standard macroeconomic measures, the U.S. economy is performing pretty well. What explains the widespread dissatisfaction weighing on individuals and communities across the country, then? The economy needs a boost of dynamism to ensure that growth reaches more people in more places.

The Entrepreneurial Way to 4% Growth

Carl J. Schramm, The Wall Street Journal

November 16, 2016

“Simply put, the U.S. will never reach full employment without more startups.” The policy agenda that will boost growth, the author argues, is the one that enables the launch of a million new businesses a year.

Trump and Carrier: How a Modern Economy is Like a Parking Garage

Justin Wolfers, The New York Times

December 1, 2016

“A parking garage stays full, and an economy stays healthy, only if it is being constantly refreshed,” writes Wolfers. Wise words for anyone who does not think the path to renewed economic vitality lies in boosting churn and increasing, rather than restraining, dynamism.

The Big Picture: Innovation and Disruption

Is Tech Disruption Good for the Economy?

Edmund Andrews, Insights by Stanford Business

January 23, 2017

A major new study puts empirical evidence behind an important intuition: innovation is good for growth. Drawing on a database of patents from 1926 to 2010, the authors find that patenting boosts a company’s market value, boosts its performance relative to peers, and boosts economy-wide growth.

A Few Unicorns Are No Substitute for a Competitive, Innovative Economy

Gary Hamel and Michele Zanini, Harvard Business Review

February 8, 2017

With so much attention and money thrown at so-called unicorns, it’s easy to miss the bigger picture: The United States is not as startup friendly as it likes to think, and the economic power of large companies is growing. Unicorn-hunting won’t fix what ails the economy.

The Economy’s Hidden Problem: We’re out of Big Ideas

Greg Ip, The Wall Street Journal

December 2016

Productivity numbers are languishing near recent-historical lows, even as STEM workers and intellectual property pile up. The scale and scope of our innovations has shrunk. Is it because our ambitions have too? In this multi-part series, Ip tries to find out what went wrong, and where.

Harvard Business Review

December 2016

Explore this series of short essays by some of today’s greatest thinkers in innovation and entrepreneurship.

2016 State Technology and Science Index

Ross DeVol, Milken Institute

October 2016

The Milken Institute’s annual index of science and technology index is out, and Massachusetts, Colorado, Maryland, California, and Washington lead the pack. The index includes measures of entrepreneurial activity.

In-Depth: Productivity

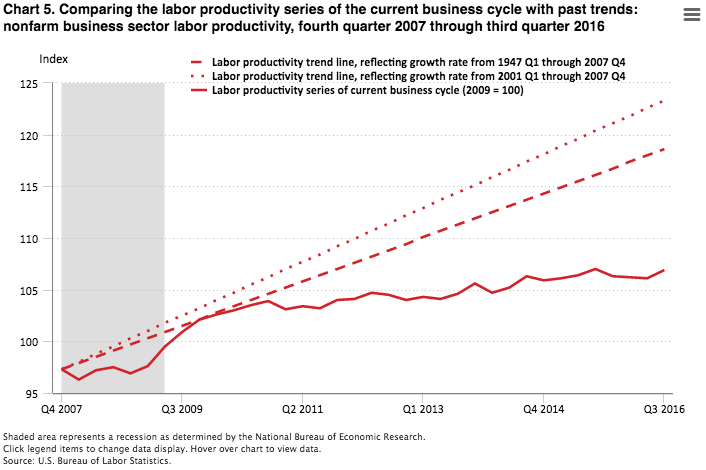

Below Trend: The U.S. Productivity Slowdown Since the Great Recession

Shawn Sprague, Bureau of Labor Statistics

January 2017

This short data brief provides a comprehensive look at just how much damage the Great Recession inflicted on the economy and how far below the long-term growth trends in output and productivity we remain now more than seven years into a lackluster recovery. A must read.

Declining Dynamism, Allocative Efficiency, and the Productivity Slowdown

Ryan Decker, John Haltiwanger, Ron Jarmin, and Javier Miranda, U.S. Census Bureau

February 2017

Declining dynamism and the slowing reallocation of economic activity from less productive firms to more productive ones accounts for a significant portion of the overall slowdown in productivity economy-wide.

The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries

Dan Andrews, et al., Organization for Economic Cooperation and Development

January 2017

Are zombie firms draining OECD countries of their productivity and growth potential? Devouring capital and labor that would be more productively employed by new or healthier firms? The evidence suggests the answer is yes: Companies are now hanging on to life longer than they should be, crowding out new ones and slowing transitions into new industries in the process.

High Growth Young Firms: Contribution to Job, Output, and Productivity Growth

John Haltiwanger, et al., U.S. Census Bureau

November 2016

Adding revenue measures to the Census’ official business database, the authors find that high-growth young firms account for outsized shares of job, output, and productivity growth. Roughly half of all labor productivity growth within an industry is accounted for by the shift of economic activity from less to more productive firms. High growth young companies, which are on the decline, are a critical force in the process.

See also: Business Dynamics Statistics of High Tech Industries by Nathan Goldschlag and Javier Miranda

The Right Way to Increase Productivity

Keith Hennessey, The Washington Post

October 27, 2016

If productivity growth is to accelerate—as it must if we are to maintain our standards of living—experimentation in technology and business models must accelerate, too. For that to happen, the regulatory state is going to have to get out of the way, or at least change how it sets the rules of the game. Simplicity, transparency, and restraint should characterize the approach.

In-Depth: The Entrepreneur

Dane Stangler, Washington Monthly

January 2017

Relatively recent investments in data collection provide us with most of what we know about the state, face, and magnitude of entrepreneurship in the United States today. Such novel resources are what make evidence-based policymaking possible. Here, a researcher from the Kauffman Foundation, a key philanthropy behind those data investments, reviews how they have been used to improve policymaking over the past decade.

Taking the Leap: The Determinants of Entrepreneurs Hiring Their First Employee

Robert Fairlie and Javier Miranda, University of California and U.S. Census Bureau

November 2016

What makes a self-employed individual become an employer of others? The authors identify the characteristics that increase the likelihood that an entrepreneur makes the jump: incorporating the business, owning intellectual property, and purchasing assets. If a business does not hire its first employee by year five, it is unlikely to ever do so.

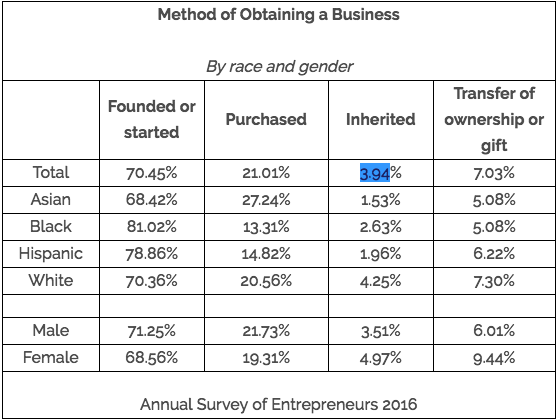

How Business Owners Get Their Companies: A Look at Founders, Purchasers, and Heirs

Emily Fetsch, Kauffman Foundation

October 26, 2016

The Annual Survey of Entrepreneurs, a new dataset with detailed information on current business owners and their enterprises, includes information on how entrepreneurs of different genders and backgrounds obtained their businesses. Within each mode of acquisition, Blacks were most likely to have started a business, Asians to have purchased a business, and whites to have inherited a business. Women were more likely than men to have inherited or been transferred a business.

Steve Glickman and John Lettieri, Entrepreneur

November 4, 2016

The country needs a bottom-up infusion of entrepreneurial activity. To make that happen, leaders across the country should facilitate access to capital, level the playing field, and build relationships with their entrepreneurial communities.

In-Depth: Future of Work

The Great American Bargain Is at Risk

Sen. Mark Warner and Mitch Daniels, Time

February 6, 2017

The sitting Senator and former governor, co-chairs of the Aspen Institute’s “Future of Work” initiative, outline three initiatives for securing inclusive growth in the years ahead: portable benefits, profit- and ownership-sharing opportunities, and incentives for worker training. Read more of Aspen’s agenda here.

Understanding the Changing Nature of Work

Jim Spletzer, U.S. Census Bureau

November 21, 2016

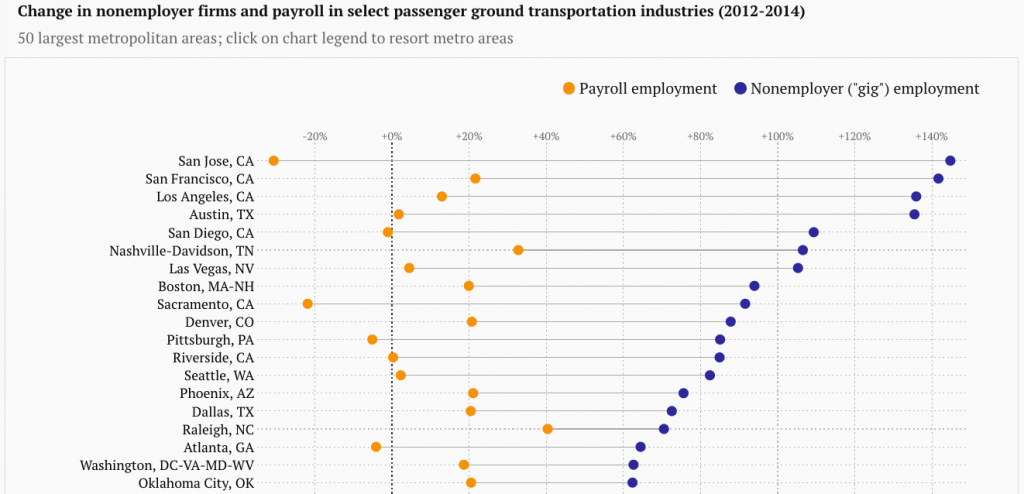

The nature of work seems to be changing everywhere except in official statistics, right? Not quite: Although the number of people reporting to be self-employed has fallen in recent years, the “gig economy” is evident in the rise in “nonemployer” businesses.

Tracking the Gig Economy: New Numbers

Ian Hathaway and Mark Muro, Brookings Institution

October 2016

“Gig economy” jobs are finally showing up in the numbers, if you know where to look. An analysis of Census statistics on “nonemployer firms” finds that new work arrangements aren’t yet displacing traditional ones, although that could change. The AirBnBs and Ubers of the world are having the most impact in cities.

In-Depth: Inclusive Entrepreneurship

Including People of Color in the Promise of Entrepreneurship

Emily Fetsch, Kauffman Foundation

December 6, 2016

Minorities are far less likely to become entrepreneurs than whites, and when they do, they do so more out of necessity than opportunity. Education, assets, and exposure account for much of the gap—and point towards areas to focus policies and support.

Hispanic-Owned Businesses on the Upswing

Minority Business Development Agency

December 2016

The number of Hispanic-owned businesses increased by more than 1 million—46.3 percent—from 2007 to 2012, according to the Survey of Current Business Owners, more than 23 times the national increase of 2 percent.

A Progressive Agenda for Inclusive and Diverse Entrepreneurship

Kate Bahn, Regina Willensky, and Annie McGrew, Center for American Progress

October 2016

The entrepreneurial ambitions of women and minorities are hampered by the wealth gap, uneven access to capital, and education and training barriers. Policies to boost entrepreneurship and make it more inclusive at the same time should target those three areas.

In-Depth: Access to capital

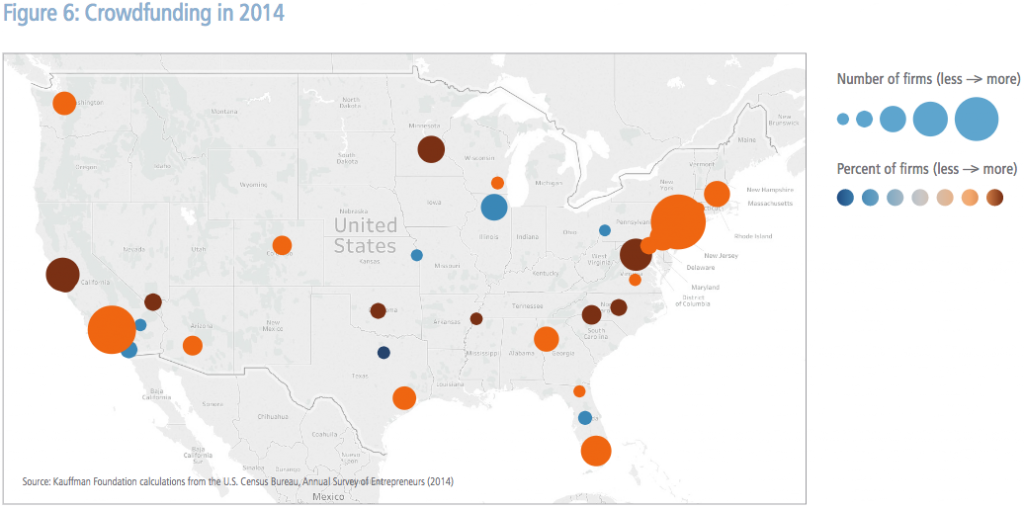

Trends in Venture Capital, Angel Investment, and Crowdfunding Across the 50 Largest U.S. Metro Areas

Dane Stangler, Inara Tareque, and Arnobio Morelix, Kauffman Foundation

December 2016

Tapping into a brand-new dataset, the U.S. Census Bureau’s Annual Survey of Entrepreneurs, Kauffman researchers examine the extent to which entrepreneurs in different metro areas rely on three widely-discussed sources of financing: venture capital, angel capital, and crowdfunding. They find that fewer companies rely on crowdfunding than rely on the other sources of funding, but that crowdfunding investments are much more geographically distributed than either angel or venture capital.

You Too Can Invest in a Startup Likely to Go Bust

Adam Satariano, Bloomberg Technology

November 7, 2016

Britain moved quickly to embrace equity crowdfunding, but poor early returns have more and more people wondering how much money-making potential such platforms actually hold for retail investors. To what extent are current problems just the growing pains of a young and still fast-growing industry? Time will tell.

In-Depth: The Labor Market

Locked in? The Enforceability of Covenants Not to Compete and the Careers of High-Tech Workers

Natarajan Balasubramanian, et al., U.S. Census Bureau

January 2017

Researchers find that noncompete agreements, which place restrictions on workers’ ability to switch employers freely in the same industry, reduce job turnover rates and suppress wages.

Blame Monopolies for Short-Changing U.S. Workers

Noah Smith, BloombergView

January 26, 2017

The author reviews two new papers that attempt to answer why workers have been receiving a smaller and smaller share of the economy’s income and wealth. In for questioning: monopolies, and other beneficiaries of imperfect competition.

Read the two papers:

David Autor, et al., “Concentrating on the Decline in the Labor Share”

Simcha Barkai, “Declining Labor and Capital Shares”

Books

Failure to Adjust: How Americans Got Left Behind in the Global Economy

Edward Alden, Council on Foreign Relations

December 2016

This book title comes from a prescient memo written by the first White House Council on International Economic Policy in 1971. In the years since, policy has failed millions of Americans, not by enabling free trade, but by failing to deal adequately with its well-known side effects. It’s now more urgent than ever to start doing what we should have done long ago: Help individuals adjust to the economic forces that enable society to thrive.

The Innovation Illusion: How So Little Is Created by So Many Working So Hard

Fredrik Erixon and Bjorn Weigen

November 2016

Creative destruction has ground to a halt. Capitalist markets are old, concentrated, and conservative. The desire for predictable returns have sapped the economy of the animal spirits that make it hum. Regulations have slowed the diffusion of technology. The authors argue that the economic and social challenges confronting the West require restoring innovation and dynamism. We have the map, but caution: roadblocks ahead.