by Kenneth Megan

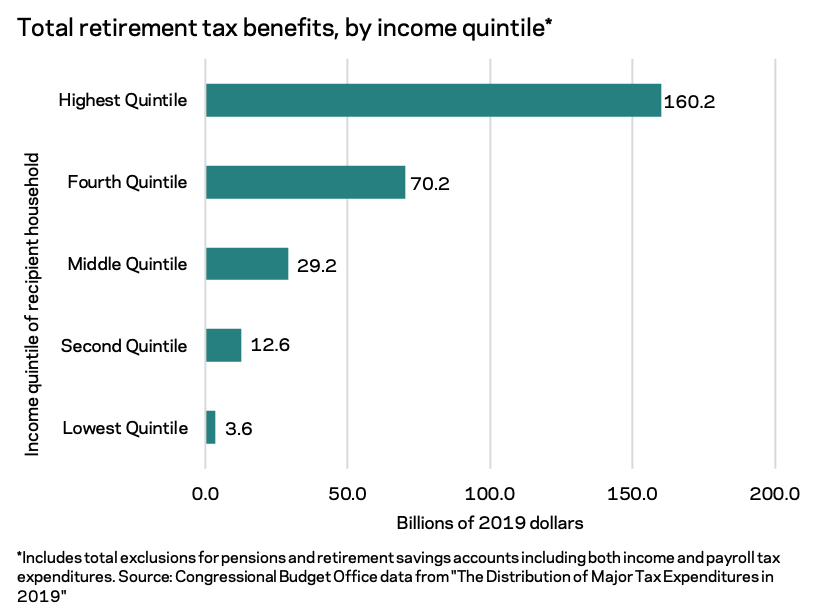

The Congressional Budget Office (CBO) released a report last week on the distribution of major federal tax expenditures in 2019, which found that the tax benefits designed to encourage retirement savings mainly accrue to higher-income Americans. Totaling $276 billion in 2019, tax expenditures for pensions and retirement savings rank near the very top of all expenditures. Fully 84 percent of these subsidies went to households in the top two income quintiles, with the top quintile alone receiving over 40 times more in retirement tax benefits than the bottom quintile.

Explaining the Upside Down Retirement System

According to estimates from the Boston College Center on Retirement Research, roughly 50 percent of households will not be able to maintain their pre-retirement standard of living in retirement. And while the federal government offers generous tax benefits to incentivize retirement savings among higher-income workers, those benefits are poorly targeted to low- and middle-income workers—precisely those who are at the greatest risk of financial insecurity. According to the CBO report, just 19 percent of households in the bottom income quintile benefitted from these incentives, compared to 77 percent in the top income quintile.

The CBO report identifies the three key reasons why affluent workers capture the lion’s share of federal retirement subsidies:

- Low-income workers are far less likely to have access to an employer-sponsored retirement savings plan. Workers in low-income industries tend to have the lowest rates of access to any plan at all. For example, just 33 percent of workers in the Leisure and Hospitality sector have access to employer-sponsored retirement plans, compared to 93 percent in Finance and Insurance. Ultimately, just around 40 percent of families in the bottom half of the income distribution contribute to a retirement savings account, compared to over 90 percent in the top income decile. While it is true that workers without an employer plan could open an IRA on their own, behavioral science research suggests that auto-enrollment can greatly boost participation rates.

- The generosity of employer-sponsored plans increases with income. Employers in high-income industries tend to spend more on retirement benefits than low-income employers, such as by offering generous matching or automatic contributions for their workers. For example, workers in Management, Business and Financial occupations carry an average wage of $51 per hour, and these workers receive roughly three times more in retirement benefits on average than workers in Office and Administrative Support occupations, where average wages are just $21 per hour.

- The higher a worker’s income, the more valuable the tax benefit. Under the current system, savers deduct their retirement contributions against their federal tax liability (this is a feature of “traditional” employer-sponsored retirement plans). Therefore, because a higher-income worker is subject to higher marginal tax rates, the value of the deduction for a dollar saved is greater for them than it is for a lower-income worker. Furthermore, many workers in higher tax brackets today can expect to be in lower tax brackets when savings are withdrawn in retirement. All of this helps to explain why disproportionate tax benefits flow to higher-earners. According to CBO, only 5 percent of the federal government’s retirement subsidies flow to the bottom 40 percent of households.

How to Create More Savings Opportunities for All American Workers

To address the deep imbalances in the U.S. retirement system, EIG has called for a new program that would provide low- and middle-income workers with enhanced access to retirement benefits, as well as to better support all workers whose employers do not offer a retirement savings plan or those who work for themselves.

Under EIG’s approach, workers who lack access to an employer-sponsored retirement account would be automatically enrolled in a program that draws inspiration from the Thrift Savings Plan (TSP), the successful retirement plan for federal workers started in 1986. Key features of the plan would include:

- Access to retirement savings plans among workers who currently are not offered an employer-sponsored plan. This would disproportionately support lower-income workers, who are less likely to have an employer-sponsored plan.

- Federal matching contributions for low- and middle-income workers of up to 5 percent of income for qualifying workers, phased out as a worker’s income increases.

- Automatic enrollment, which would reduce administrative hurdles for workers and boost participation.

- Simple, low-cost investment options, such as life-cycle funds, index funds, Treasury bonds, and an annuity option.

Ultimately, federal policy has justifiably recognized the need to encourage and support retirement savings, and America’s private retirement system has been a huge success for those workers with access to an employer plan, including those who work for the federal government. But due to a combination of limited market access and poor policy design, the generous tax benefits for retirement savings flow overwhelmingly to higher-income workers who are at the lowest risk of retirement insecurity.

A new program modeled after the TSP would complete the country’s retirement security safety net by filling the wide gaps in the current system, so that low- and middle-income workers can receive the support needed to live out their golden years financially worry-free, with dignity, and in comfort.