Originally published on October 3, 2024, this analysis was republished on November 5, 2025, to reflect updated data.

By Sarah Eckhardt and Benjamin Glasner

The tax-advantaged retirement savings system in the United States is one of the most effective wealth-building programs in the world. Too many working Americans, however, are left behind. Their access to employer-provided retirement plans is limited, and the incentives in the retirement system fail to encourage lower-income workers to save.

Just how many Americans are left out of the retirement savings system today? We publish here the most up-to-date estimates of who lacks access to an employer-provided retirement savings plan, who does not receive matching benefits, and who does not participate. We use data from the Survey of Income and Program Participation (SIPP) published by the Census Bureau.[1] A detailed explanation for why we use SIPP over other sources of retirement data can be found in the appendix at the end of this article.

Who lacks access?

The latest data show that 42.0 percent of full-time working Americans do not have access to retirement plans, 44.1 percent do not participate, and 50.5 percent do not receive an employer match. (Note that these figures are for employed workers between the ages of 18 and 65, excluding government and self-employed workers.)

Coverage is even scarcer for part-time workers, who typically lack access to similar benefits as their full-time peers — 79.0 percent of part-time employees aged 18 to 65 lack access to any retirement plan, 80.4 percent do not participate in a plan, and 83.2 percent do not receive an employer match on their retirement savings.

In absolute figures, for full-time workers between ages 18 and 65, 40.6 million American workers lack access to any employer-provided retirement plan at all. Adding in part-time workers raises the number to 53.7 million workers.[2]

As for employer matching benefits, 48.8 million full-time workers report lacking them, with the figure rising to 62.6 million total workers without a match when including part-time workers.

Income plays a prominent role

SIPP provides rich detail on individual and household income, allowing for a portrait of the segments of the income distribution most left out of the current retirement savings system.

The gaps between high and low earners are stark. A staggering 78.7 percent of full-time workers in the lowest-earning decile (earning less than $27,400 a year) lack access to a retirement plan, compared to just 18.2 percent in the highest-earning decile (earning more than $180,600 a year).

Zooming out to the top half of American workers by income, only a quarter of them lack access to a plan — versus 65.2 percent of the bottom half.

This inequality exists for employer matches as well. In the bottom decile of the earnings distribution, 82.1 percent of workers do not receive employer matches to their retirement savings, compared to only 20.3 percent of workers at the top of the earnings distribution.

In other words, a far greater share of high-income workers — for whom saving for retirement is easier in the first place, given their greater discretionary income — receive employer top-ups to encourage and force-multiply their retirement savings, while less than a quarter of low-income workers are so fortunate.

One characteristic in particular is illuminating for policy considerations: At high-income levels, meaningful portions of the workforce participate in retirement savings plans even if they do not receive an employer match. Presumably, such high-earning workers have the means to save, and the main federal tax benefit — deferring one’s income tax bill for retirement contributions until old age, when individuals will likely fall into a lower tax bracket — is sufficiently motivational.

At the bottom of the income distribution, however, the majority of workers who participate in retirement plans do so with an employer match. Of the 17.8 percent participating, 86.1 percent receive a match. This finding suggests that efforts to maximize participation among low-income workers are more likely to succeed when combining expanded access with matching benefits, rather than simply relying on expanded access alone.

Low-skilled and minority workers see wide gaps, too

These income-based differences in access, participation, and matching interact with the other key characteristics associated with Americans’ labor market outcomes and opportunities today, namely race, ethnicity, education, and gender.

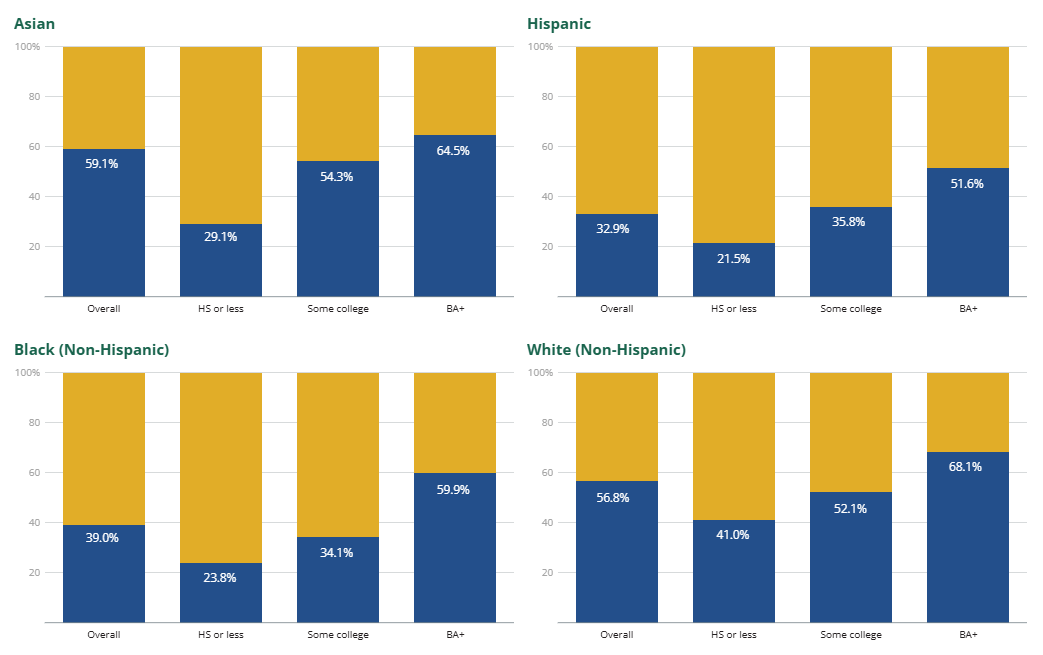

More than 50 percent of Asian and non-Hispanic White workers report receiving matched employer contributions to their retirement accounts, making them the most likely to receive employer matches across the country’s major demographic groups.

By contrast, 39.0 percent of Black workers and only 32.9 percent of Hispanic workers report receiving matched employer contributions.

Across groups, the more education a worker has received, the more likely that worker is to have access to matched contributions. This is consistent with incomes being highly correlated with education, on the one hand, and participation in the nation’s prevailing retirement savings system, on the other. Only 31.4 percent of workers with a high school diploma or less receive matched employer contributions to their retirement plans — a number that falls to 21.5 percent for Hispanic workers.

Within the education group that faces the largest barriers to employer-based retirement savings, women are at an even greater disadvantage. Women without a high school diploma lag behind men with the same education level by approximately 2 percentage points for participation and access. The reasons for this disparity include lower earnings, a greater likelihood of working in low-access industries such as leisure and hospitality or personal care services, and having their labor force participation affected by dependent care.[3]

Closing the gap

Lawmakers in both parties are taking notice of the persistent gaps in access and participation covered in this brief. The Retirement Savings for Americans Act (RSAA) is designed to address the policy question introduced here: how to close the private retirement savings gap for those left out of the current system. It would immediately make all full-time and part-time workers who lack access to a workplace retirement account eligible for what it calls the American Worker Retirement Plan.

The RSAA is designed not just to widen access but also to increase participation by getting the incentives right — matching contributions for low-income workers, specifically.

In the United States today, roughly 51.6 million workers earn annual incomes of $42,200 or less.[4] Of these workers, 79.4 percent — about 41 million workers — currently lack access to an employer-provided retirement plan and would therefore be eligible to participate in an American Worker Retirement Plan and receive full matching benefits under the plan. Specifically, they would be eligible for a 5 percent matching contribution offered through a refundable tax credit. This group of low-income and moderate-income workers who currently lack access represents 28.5 percent of all privately employed workers nationwide.[5]

These retirement accounts would be the property of workers and thus portable, meaning that workers take the accounts with them as they switch jobs or move in and out of the labor force. And because the accounts belong to them, workers also would have more options to pause or increase contributions when they are able.

The United States retirement system is in desperate need of reform. Tens of millions of workers — especially low-income workers — lack access to any type of retirement account. RSAA would put millions of hardworking Americans on the path to financial security and comfortable retirements.

Appendix: Which Survey to Use?

There are four major surveys that include data on worker participation in retirement savings programs:

- National Compensation Survey from the Bureau of Labor Statistics

- Current Population Survey Annual Social and Economic Supplement from the Bureau of Labor Statistics and the Census Bureau

- Survey of Consumer Finances from the Federal Reserve

- Survey of Income and Program Participation from the Census Bureau

Each survey has its strengths. The National Compensation Survey, for example, surveys employers and provides a good estimate of how many of them report providing retirement plans to their workers, and of how many workers are associated with such employers. This survey contains very little demographic information on who is covered by employer plans, however, and it struggles to capture differences in eligibility within the same firm (for example, if new employees can only join the plan after a set period of time). It also fails to capture certain segments of the labor force, like gig workers.

The Current Population Survey, for its part, is the only survey that provides detailed geographic information to allow for state by state comparisons, but its respondents seem to systematically under-report whether they have access to a plan.[6]

The Survey of Consumer Finances very effectively illuminates the role that retirement savings play in the picture of overall household wealth, but that focus on households means it is somewhat less effective at providing estimates on individual worker-level access and participation. Because of its focus on the components of household wealth, it also tends to oversample high-income households who hold more assets.

For purposes of identifying policy solutions to increase worker access to and participation in employer-provided retirement plans, the Survey of Income and Program Participation (SIPP) is the best source.

SIPP is one of two surveys that provide information not only on whether workers have access to a retirement plan, but whether the employer offers a matching contribution as well. Matching contributions are one of the most important incentives to encourage workers to participate in plans and one of the most essential design features of retirement plans that aim to widen participation among lower-income populations. Uniquely, SIPP also oversamples low-income households, a population of special interest for understanding who lacks access to or does not participate in retirement plans.

This report therefore uses SIPP to establish the best estimates of the number and characteristics of those who do and do not have access to, and participate in, employer-provided retirement plans.

Explore more of EIG’s work on retirement security here.

Notes

- Estimates are updated each year, following the Census Bureau’s data release.[↩]

- According to the 2024 CPS ASEC, there were 96.6 million full time workers (>34 hours per week) and 16.6 part time workers (<35 hours per week) in 2024. (Note that these figures do not include government and self-employed workers.) [↩]

- Transamerica Center for Retirement Studies, 23 Facts About Women’s Retirement Outlook (2023); BLS, Women in the Labor Force: A Databook (2023); BLS, Employment Characteristics of Families (2023).[↩]

- This estimate comes from the Current Population Survey ASEC supplement for 2023.[↩]

- These figures include all full-time and part-time workers aged 16 and older, reflecting RSAA eligibility. The match begins to fade out by $75 for every $1,000 above the median income of $42,200, up until an income of $70,367, for which there is no match.[↩]

- Researchers suspect this is due to question phrasing. Munnell, Alicia H. and Chen, Anqi, “Do Census Data Understate Retirement Income?” (Dec 2014) No. 14019, Center for Retirement Research[↩]