By August Benzow

Metro areas that saw robust growth before the pandemic see strong employment increases, but a “V-shaped” recovery still eludes many metro areas

The recovery from the Great Recession was led by just a handful of major metro areas. Many others took years to recover the jobs they lost, and some never did. An even narrower base of primarily mid-sized metro areas are on track to lead the recovery from the COVID-19 recession. At the same time, many of the country’s “superstar” metro areas have seen their economies plateau at record low employment numbers, based on data available through December 2020. While a rapid recovery is not impossible for at least some of these lagging metro areas, it seems likely that some jobs will never come back. Restoring lost employment in these places won’t be as simple as “flipping the lights back on,” especially since the economy of the 2020s is shaping up to be structurally different in many ways from the economy of the 2010s.

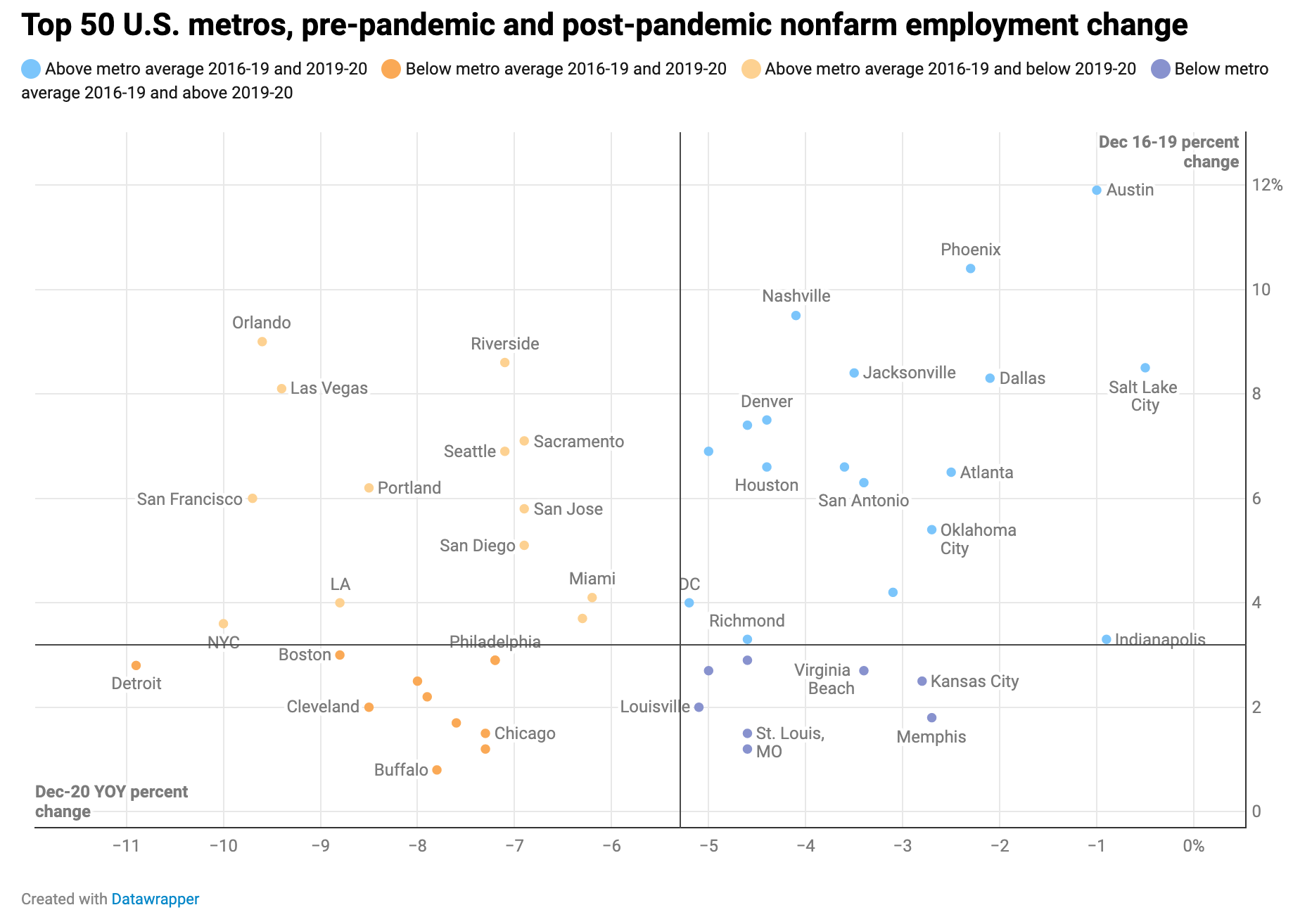

In the scatterplot below the top right quadrant shows metro areas that experienced above average employment growth before the pandemic and an above average recovery so far. The Sunbelt and the Mountain West are over-represented here with Indianapolis as the only Midwestern city and no cities from either the Northeast or the West Coast featured at all. The inverse of this category is in the bottom left quadrant. These metro areas saw sluggish growth before the pandemic and are struggling to regain their footing in the current crisis. As an example of how dire it is for some of the metro areas in this quadrant, Buffalo was down 18,400 jobs year-over-year during the worst month of the Great Recession and it closed out last year down 44,700 jobs.

In the top left quadrant are metro areas that had above average growth before pandemic, but aren’t seeing that translate into a strong recovery. The West Coast is well-represented here, as are entertainment hubs like Las Vegas and Orlando. San Francisco has roughly the same-sized employment base as Phoenix, but it suffered five times the employment loss over the year to December. Its manufacturing employment was down 15,900 over the year and government employment was down by 31,800. The bottom right quadrant shows metro areas that have so far shown resilience to the COVID-19 recession, despite sluggish pre-pandemic growth. Many of these metro areas, like Memphis, have played a role as distribution hubs. Baltimore had a small gain in manufacturing jobs, possibly helped by the AstraZeneca vaccine manufacturing plant there.

Just one-third of the country’s metro areas have experienced a V-shaped recovery from the COVID-19 crisis and are well-positioned for robust employment growth in 2021. A V-shaped recovery is defined here as having an over-the-year employment loss in December 2020 that’s less than one-third the size of the over-the-year employment loss in April 2020 (the month with the highest employment loss for most metro areas). Meanwhile, 103 metro areas went into the current crisis having not fully recovered from the Great Recession, with employment levels below what they were in December 2007. This number jumped to 187 in December 2020, or about half of all metro areas.

Many of the metro areas that went into the COVID-19 recession with the weakest growth are now struggling the most to climb out. Employment had already declined over the year to December 2019 in more than one-third of all metro areas, even as national job growth hummed along at 1.3 percent. These same metro areas were among the places hardest hit by the COVID-19 recession. In April 2020 these metro areas experienced a 14.4 percent average decline in employment relative to the year prior, compared to a 10.4 percent decline for metro areas with the fastest growth heading into the COVID-19 recession. These metro areas with the weakest recent performance actually emerged from the Great Recession strongly and in line with peers. However, their recovery flagged early in the 2010s, and low growth had persisted for several years before turning negative. Recovery trajectories may yet change, but for now it seems that the COVID-19 recession served to exacerbate many underlying economic vulnerabilities in struggling areas.

Comparing two similarly-sized metro areas side by side shows just how different the COVID-19 recession is from the Great Recession. San Francisco had a much shallower trough during the Great Recession than Phoenix, and by mid-2012, employment was rising by 4.2 percent over the year, compared to 2.8 percent for Phoenix. By mid-2017 their fortunes had reversed, as San Francisco began seeing a slowdown in employment growth. In February 2020 San Francisco added jobs at almost half the rate of Phoenix. By April 2020, the worst month of the pandemic for employment losses, San Francisco had lost 14.8 percent of its April 2019 employment, more than double its Great Recession trough. In the same month, Phoenix only experienced a 6.9 percent employment loss, a smaller shock than its worst month in the Great Recession. By the end of 2020 San Francisco had around one-quarter million fewer jobs than it did in 2019, while Phoenix was short just around 50,000 jobs.

June 2009 is the official trough of the Great Recession (beyond which the national economy began to recover), and June 2020 is the unofficial trough of the COVID-19 recession. By December 2009, the 50 largest metro areas (ranked on population) all still posted a negative over-the-year change in employment. A similar situation can be seen in December 2020, even though the virus that triggered the recession continues to suppress economic activity everywhere. The worst off metro in December 2020, Detroit, registered a 10.9 percent decline in employment over the year, while the worst off metro in December 2009, Las Vegas, suffered a 7.2 percent decline in employment. However, the best off metro in December 2020, Salt Lake City only posted a 0.5 percent decline in employment, while the best off metro in 2009, Washington DC, was slightly worse off with a 1.2 percent decline.

Although the leisure and hospitality sector was the hardest hit by the initial shock of the pandemic, the economic pain has spread to most corners of the economy and varies widely across metro areas. Unlike the last recession, the financial activities sector has been one of the least affected sectors by the COVID-19 recession, but in some large metro areas, like Portland, OR, it saw significant declines in employment. In December 2020 the Portland metro was down 5,100 financial jobs over the year. By contrast, Austin, a similarly-sized metro, added 11,600 jobs. The leisure and hospitality sector still has the widest gap between metro areas. Detroit shed 86,300 jobs in this sector over the year in December 2020 while its Midwest neighbor Indianapolis only lost 1,700 leisure and hospitality jobs. Even metro areas much larger than Detroit, such as Atlanta and Dallas, saw fewer absolute losses in this sector.

Many of the country’s legacy communities never fully recovered from the Great Recession and now it seems likely that some of them will never get back to their pre-pandemic employment numbers either. While many of these challenges pre-dated the pandemic, the current crisis is inflicting disproportionate harm on places that were economically vulnerable even when the country as a whole was experiencing record growth. At the same time, metro areas that have been dependable employment engines for decades, like New York City and San Francisco, have been sidelined so far in the recovery. As it becomes more likely that there will be a robust national recovery in 2021, it is even more important not to lose sight of the economic challenges still facing so many places in the country.