By Kenan Fikri, Research Director, Economic Innovation Group

The innovation- and technology-led economic development model of the past couple of decades rested on two beliefs that, in retrospect, were overly optimistic: That, within countries, technology would be a force both for economic diffusion geographically and for economic inclusion socially. Yet, instead of spreading economic activity, technology has concentrated it. We have gone from “the death of distance” to “winner takes all” economic geography in a few short years. In the United States, we have layered this geographic fracturing on top of deep-seated social and economic inequalities that fracture even further along lines of race, ethnicity, and education. The prospect of automation threatens to shatter the mosaic even further. The United States may have, characteristically, carried these developments to extremes, but in general they reflect the recent experiences of most advanced economies and reveal important lessons for Canada as it strives to forge a more inclusive model of innovation-driven growth.

Faulty assumptions

Innovation-driven and technology-based economic development strategies blossomed throughout the United States and peer countries in the 1990s and 2000s, extensions of the national competitiveness strategies of the 1980s. Initiatives were often predicated on the assumption that every place had a fair shot—or at least a decent one, if they went to the trouble of building and executing a strategy—at cultivating thriving technology clusters.

That is not the only assumption that looks quaintly naïve in retrospect. Economists, policymakers, and economic developers blithely assumed that they could simply focus their efforts on cultivating high-end, high-wage, frontier-of-the-economy sectors and sit back, relax, and watch the benefits spread to the rest of the economy.

A new economics

Where did things go awry? First and foremost, we vastly underestimated the strength of the forces of agglomeration that would consolidate new innovation sectors into a small number of superstar hubs. These misplaced expectations for the future were grounded in the patterns of the past, notably from the manufacturing sector. The clustering of complementary economic activities into certain corners of the map has long been a feature of modern industrial society. Yet the forces that drew businesses together—deepening supply chains, minimizing transaction costs, and pooling of specialized labour—were offset by other countervailing forces that also propelled firms away from each other. For example, the natural resources that manufacturers tapped, from mineral deposits to waterways, were geographically dispersed. Margins were thin enough that labour costs truly mattered, and firms would leave locales that became too congested or where competition for workers became too intense. As a result, manufacturing peppered the landscape with cities and towns of varying sizes. It gave us the very places that the next wave of technological development would proceed to leave behind.

The forces for geographic dispersion in the new innovation economy are far weaker. Consider that from 2010 to 2014, the nine counties comprising the San Francisco Bay Area region garnered 9 percent of the US economy’s earnings growth with only 3 percent of the new jobs the country added over those five years. For every 1-USD raise that the median American family received between 2013 and 2017, households in the San Francisco and San Jose metro areas received $3. Effectively, labour costs barely matter for the region’s lean, platform-enabled technology giants that mint money on a global scale. The sheer complexity of modern technology makes maintaining a presence in the geographic heart of its evolution an absolute business imperative. This is not true just for tech giants, but for tech-enabled businesses of all stripes: just look at the number of automakers that now maintain R&D laboratories in the Bay Area.

Second, there was little precedent for the network effects that would take hold in the technology industry. Even in the 1990s, it seemed like there was a real chance for unexpected places to become industry leaders. Upstate New York, where I grew up, was home to a crop of promising software and technology companies that blossomed up alongside the corporate behemoths whose technological prowess and skilled workforces ushered in the computing age over the decades prior. It looked like the country was genuinely on the brink of an explosion of distributed economic development. From 1992 to 1996, 125 counties (home to 32 percent of the US population) together powered 50 percent of the national rise in the number of business establishments over that five-year period. Albuquerque, NM; Akron, OH; Birmingham, AL; Grand Rapids, MI; and Portland, ME were all powering nationally-significant expansions in enterprise. As network effects strengthened, however, the small players slowly blinked out. By 2002 to 2006, it took only 64 counties (home to 27 percent of the population) to power half of the economy’s increase in business establishments. By 2010 to 2014, only 20 counties home to 17 percent of the population carried the same weight. The internet age saw the US economy transform from one powered by distributed growth to one powered by concentrated growth.

From technology’s gilded enclaves, innovation did diffuse throughout the economy. It very often unlocked new value. But it also made the outsourcing and offshoring that gutted so many American communities possible. Now it is powering both automation and the rise of the gig-proletariat. It has not generally powered inclusion—at least not yet.

Yet for all the shortcomings of the modern era, slowing the rate of innovation is clearly not the answer. Instead, policymakers should strive to both expand the innovation sector from its current narrow geographic and industrial base while also increasing access to it. How? Through education and entrepreneurship.

If you know the educational attainment rate of a community, you can know with near certainty how it performs on a host of other metrics, from poverty rates and income growth to obesity or mortality.

Education is the ticket

It is no mystery what the special ingredient in a successful innovation-based economy today: it’s a critical mass of highly-educated people. Education—the more the better—is the ticket into both innovation sectors and thriving places. American adults with at least a four-year college or university degree barely suffered from the Great Recession. The US economy has added 10.4 million jobs for college graduates between 2012 and 2018, compared to 1.6 million for those with only a high school degree, and eliminated 206,000 jobs for those without either.

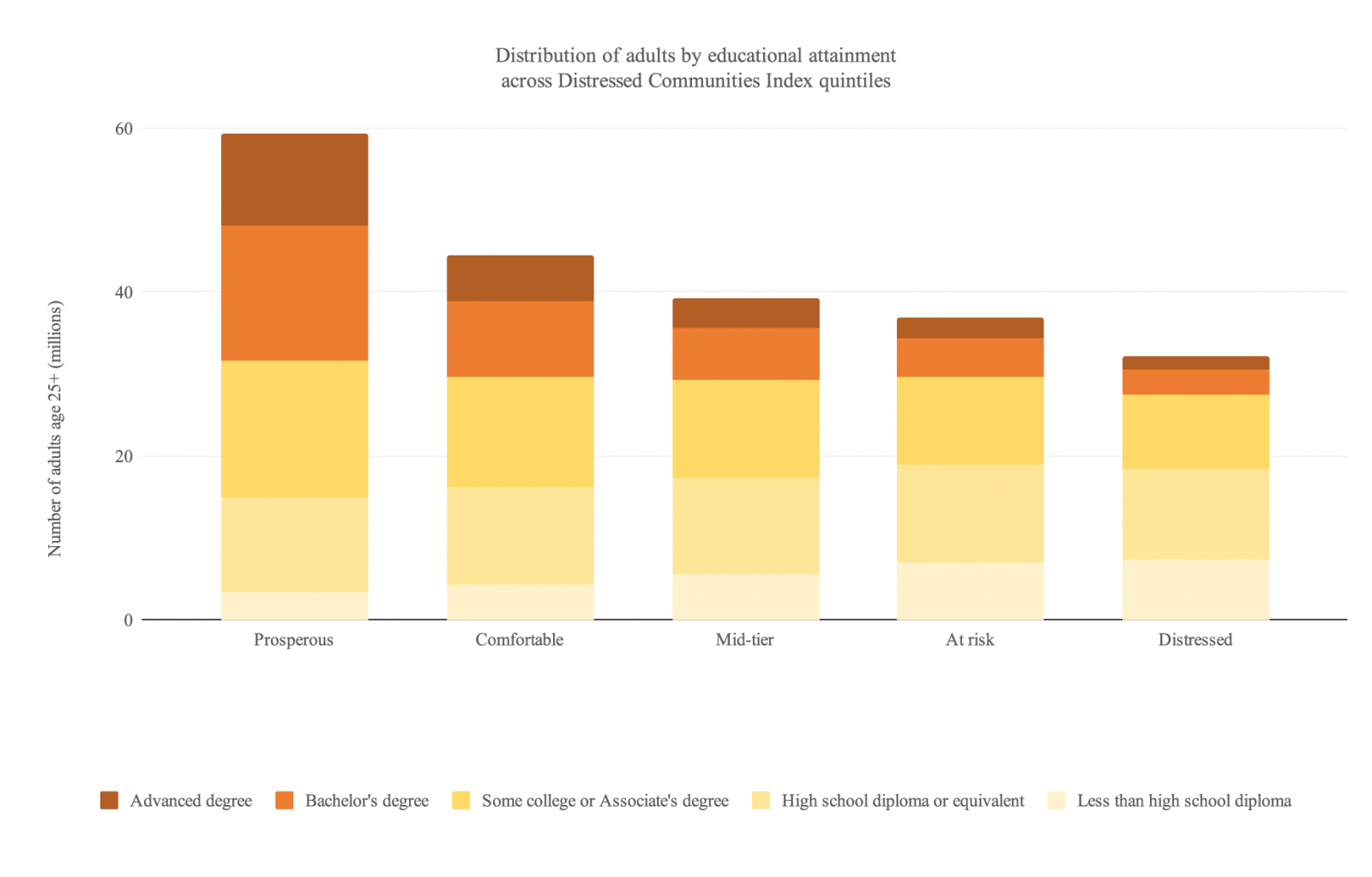

Indeed, the education advantage is fast becoming a new law of economic geography. EIG’s Distressed Communities Index ranks the economic well-being of every US zip code and groups them into quintiles. In total, 86.5 million Americans reside in a “prosperous zip code” in the top-performing quintile, a 20 million-person lead over the next best group, “comfortable zip codes.” The population differential across quintiles on our index is almost entirely accounted for by the distribution of college-educated Americans across the five tiers of places. All five geographic groups, prosperous through distressed, contain approximately 30 million Americans each with some college, an Associate’s degree, or less education. On top of that base, however, prosperous zip codes contained another 27.7 million adults with a bachelor’s degree or higher, almost six times the number that lived in distressed zip codes. If you know the educational attainment rate of a community, you can know with near certainty how it performs on a host of other metrics, from poverty rates and income growth to obesity or mortality.

A look at metro areas reinforces the education advantage. Seven of the 10 major metro areas in the US with the largest shares of their populations in prosperous zip codes also ranked in the top 10 for bachelor’s and advanced degree attainment. All are technology and innovation hubs. Conversely, six of the 10 major metro areas with the largest shares of their populations living in distressed zip codes ranked in the bottom 10 on college degree attainment. Bakersfield, CA, for example, ranked last on both fronts.

The roots of the innovation economy run even sparser outside of metropolitan areas. In part this comes down to connectivity gaps in both digital and physical infrastructure, which investment can close. Research shows that once-daily air service to a major hub can empower a rural area to perform as well as thriving metro areas in terms of economic development, at least in the American West. Yet physical infrastructure investments in isolation will come up short. The other critical variable is human capital, and here too many rural areas lag far behind their metropolitan peers and are failing to catch up. The metro-to-non-metro education gap in the United States continues to grow. For a future innovation economy to be inclusive of the tens of millions of Americans who live in rural areas, too, this education deficit must be closed.

Clearly, an education agenda is the cornerstone of an inclusive growth agenda. The quicker and more cost-effectively workers, especially mature ones, can obtain competitive skills and credentials, the better. This upskilling deep into the labour force may help reduce the firm-level productivity gap between frontier superstar companies that have mastered technology, and the long tail of lagging firms in lagging regions that have not. We need new programs and delivery mechanisms, to be sure. But in the United States, where livelihoods of the working classes are already precarious and most educational courses prohibitively expensive, we also need new financing options, too. Income share agreements, or ISAs, elegantly align incentives of students, educators, and financiers behind positive labour market outcomes and seem to be a promising innovation.

Entrepreneurship

A central paradox of this era of breathless (or so we’re told) innovation is that it has actually been marked by a steep decline in entrepreneurship across every sector, including high-tech ones. We know that one critical juncture on this downward trend was approached around the year 2000 and the other coincident with the Great Recession, but we still know too little about the underlying causes.

As the economy’s entrepreneurial dynamism has faded, innovation in the classic Schumpeterian sense has ground to a halt; it’s only in narrower incremental, computing-specific, or Internet-based senses that innovation seems to be truly alive and well. To be sure, technological advances are being made, but apart from the app store and a few gig platforms that provide more of a safety net than they do new paths to upward mobility, few wholly new markets have been created. The economy’s most innovative companies are by now quite old, and older incumbents innovate in a characteristically distinct way from radical upstarts. And the same economics that allow tech giants to reap earnings on unprecedented scales provide an infinite supply of golden arrows (i.e. capital for acquisition) with which to ward off disruption and slay tomorrow’s competition.

We tend to think of entrepreneurs as creators of new technologies, products, services, and business models, but we undercount their role in devising new ways to deploy human labour itself. In the United States, 3/4 of all workers are employed in firms at least 16 years old, up from 60 percent in the early 1990s. To over-generalize a bit, such firms with established business models and operating at efficient scale generally treat labour as a spreadsheet line-item cost that is to be reduced. Entrepreneurs, on the other hand, value labour first and foremost as a creative input. They try to unlock the latent value of human potential in novel ways (which sounds an awful lot like what we need more of today, does it not?). Too few innovations in how to deploy workers productively and remunerate them gainfully have come online in today’s innovation economy to offset the labour-saving technologies that continue to be produced apace. The fact that the startup rate has halved over the past two decades could partially explain why.

The drying up of the country’s pipeline of new businesses plays out geographically. Prior to the 2008-2009 financial crisis, fewer than 20 percent of the US’s metropolitan areas would see more firms die out than start in any given year, including recessions. In the years since, the figure has been over 60 percent. If you consider every regional industry cluster or metropolitan area as a piston in a national economic engine, it becomes immediately obvious that only a handful are firing optimally. Organic, endemic innovation to these economic units via entrepreneurial experimentation needs to be the centerpiece of any national agenda for renewal.

Unfortunately, there are no silver bullets for rekindling entrepreneurship. Thankfully, there is also no shortage of places to start supporting dynamic entrepreneurial ecosystems. Vigorously enforce competition law, and err on the side of more competition rather than less. Ban non-compete agreements, which obstruct spin-offs from established companies and make it harder for budding entrepreneurs to hire the talent they need. Embrace skilled immigration and find ways to encourage newcomers to settle in second or third-tier places that desperately need more human capital (on this front the US has much to learn from Canada’s successful Provincial Nominee Program). On the financial side, expand access to scarce equity risk capital, as the new Opportunity Zones incentive intends to do in the US. And fix the student loan problem that limits young entrepreneurs’ ability (and often desire) to tap into debt financing to build companies.

Catch that tugboat

To boil it down: we used to conceptualize the tech-enabled innovation economy basically as a really powerful tugboat that pulled the lumbering rest of the economy along behind it. It seemed logical to simply concentrate investments into that tugboat for maximum leverage. Only in the wake of the financial crisis did society realize that, somewhere along the line, the tugboat had become untethered. And after years of upgrades, the plucky little thing had actually transformed into a gleaming super yacht, plying the high seas far out of the reach of the rest of us and largely unaccountable.

So how do we strengthen the ties between the bulk of the economy and its leading sectors? A more inclusive future rests on investing in people and cultivating market conditions that encourage entrepreneurs to take risks, experiment, fail, succeed, and through that process, usher in the future. Entrepreneurs will be the ones, not bureaucrats and certainly not corporate incumbents, who ensure that the next wave of innovation will be more inclusive and opportunity-rich than the present. For that entrepreneurial, innovation-driven, opportunity-rich economy to take root in more parts of the United States and Canada, however, human capital pools will have to deepen. Only countries that build a culture of lifelong learning—and the programs, delivery mechanisms, and financing structures to deliver on the promise—will succeed in empowering broader swathes of society to join those already prospering at the modern economy’s frontier.

This article was originally published by the Brookfield Institute for Innovation + Entrepreneurship as part of its ongoing series on building inclusion and equity into Canada’s innovation economy. Illustration by: Sophie Berg