Tomorrow, seven Republican presidential candidates will gather at the Kemp Forum on Expanding Opportunity in Columbia, South Carolina, to discuss poverty and its causes, as well as their strategies for expanding economic opportunity in the United States (check C-SPAN or here for the live stream).

EIG is proudly co-sponsoring the forum because the topic couldn’t be more important or more urgent. One in seven Americans lives in poverty today. While the condition is passing for some, approximately half of the people who manage to leave poverty in any given year will fall back into it within five years. With wages for low-skilled workers stagnant or declining in real terms, today’s economy offers too few good jobs for even the working poor to feasibly bootstrap themselves up. Meanwhile new research draws a direct link between the level of economic distress in a child’s neighborhood and their life chances.

To set the stage for this forum, EIG has compiled 10 key questions every candidate competing for votes this year should answer about poverty and opportunity in the United States today.

Part I: Framing Questions

1.

What should be the role of government in alleviating poverty? As President, how would your approach to fighting poverty differ from that of your predecessors?

46.7 million Americans lived in poverty in 2014, equal to 14.8 percent of the population. The poverty rate has not changed for four straight years. Poverty is measured by total family income; official thresholds vary by household size and do not count non-cash government assistance such as food stamps. In 2014, the poverty threshold stood at approximately $19,000 per year for a two-parent household with one child.

The poverty rate for the white non-Hispanic population stood at 10.1 percent, the black population at 26.2 percent, the Hispanic population 23.6 percent, and the Asian population 12.0 percent.

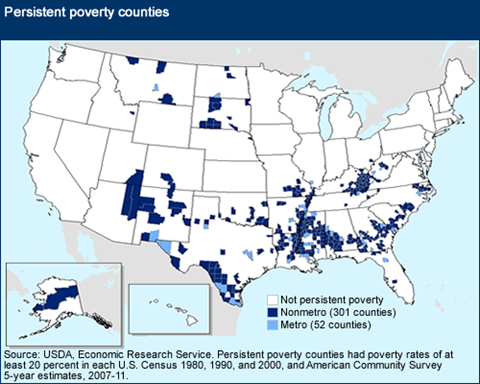

Poverty rates are highest in the South (16.1 percent) and West (14.7 percent) and lowest in the Midwest (12.9 percent) and Northeast (12.7 percent). Roughly half of those who leave poverty in any given year will fall back into it within five years. Persistent poverty remains an especially severe problem in the rural South. The region is home to 84 percent of persistent-poverty counties, where the poverty rate has stood at or above 20 percent for the past 30 years.

Sources: U.S. Census Bureau; U.S. Department of Agriculture Economic Research Service; and Singe-Mary McKernan et al., “Transitioning In and Out of Poverty” (Washington: The Urban Institute, 2009).

2.

In today’s economy it is difficult for those without a college degree to find jobs that pay enough to support a family without relying on some kind of government assistance. How would your administration help needy Americans acquire the skills to get ahead?

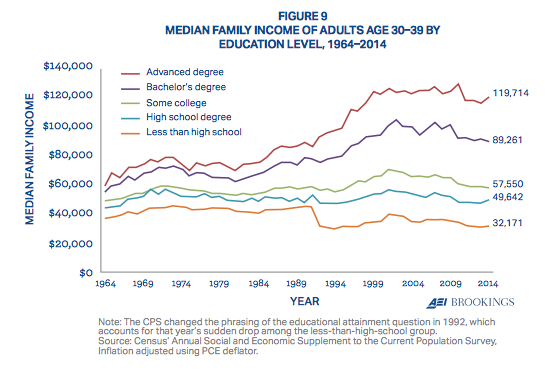

The dividends to higher education have grown in recent decades. At the same time, the incomes of those with only a high school degree or less have stagnated or fallen, as seen in the table below. This makes the acquisition of skills that the market will reward more important than ever.

While providing support for job training and higher education—and holding those programs accountable for preparing participants with skills the market will reward—is important, it is also important to consider areas where stricter credentialing requirements today are creating unnecessarily high barriers to entry. Recent estimates suggest the number of U.S. workers in jobs requiring licenses has risen from 5 percent in the 1950s to 29 percent—nearly one in three workers—today. Moreover, in a slow growing economy with lax labor market demand—like today’s—employers will often find candidates with more education than necessary to fill open positions—shutting even more doors for the less educated.

Source: “Opportunity, Responsibility, and Security” (Washington: American Enterprise Institute-Brookings Working Group on Poverty and Opportunity, 2015).

3.

A broad bipartisan consensus exists in support of anti-poverty programs that reward and encourage work. The Earned Income Tax Credit (EITC), which lifted 6.2 million people out of poverty in 2013, is the most prominent example. Do you believe in the philosophy underlying the EITC, and what are your plans to reform it?

The EITC is a tax credit available to tax filers who work. It encourages work and fights poverty at the same time by increasing a worker’s after-tax income. In 2011, 27.9 million tax filers received the credit at a total cost of $62.9 billion. The amount of the credit depends on filing status, number of qualifying children, and earned income.

In 2014, the amount received by filers varied from $496 for childless earners to $3,305 for a family with one child to $5,460 for a family with two children. One of the main challenges facing the EITC is the misfiling rate: The IRS estimates that approximately one-quarter of payouts are made erroneously.

Proposals to build upon the EITC’s history of encouraging work and decreasing poverty involve reducing that error rate as well as expanding eligibility for the credit to childless adults—a proposal supported by both President Obama and Speaker Ryan—and non-custodial parents; expanding the credit given to one-child families to be on par with two-child families; and expanding the credit for married couples to reduce the potential of a “marriage tax.”

Source: Hilary Hoynes, “Improving Safety Net and Work Support, Proposal 11: Building on the Success of the Earned Income Tax Credit” (Washington: The Hamilton Project, 2014).

4.

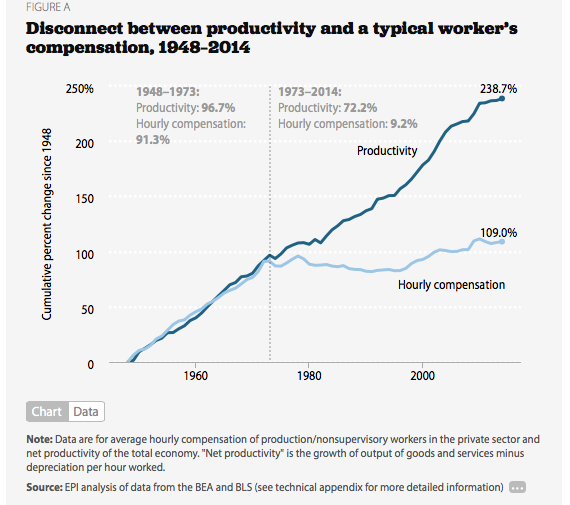

The country’s jobs crisis is abating, but a major underlying tension in the labor market remains unresolved: ever since the 1970s, workers have enjoyed smaller and smaller shares of the output they generate. What policies would you pursue to restore a link between productivity and wages?

While productivity and workers’ hourly compensation increased together in the decades following World War II, since 1973 that relationship has decoupled. Productivity has continued to rise while workers’ pay has stagnated. Decoupling has only accelerated recently, with productivity growing 21.6 percent since 2000 but hourly compensation increasing only 1.8 percent.

There are a number of hypotheses for why this decoupling has happened, including the impact of globalization and the movement of manufacturing jobs overseas. Other explanations include declining unionization rates and the concentration of returns to productivity among managerial positions rather than accruing widely to all workers.

Source: Josh Bivens and Lawrence Mishel, “Understanding the Historic Divergence Between Productivity and a Typical Worker’s Pay” (Washington: Economic Policy Institute, 2015).

II. The Geography of Opportunity

5.

The United States is known as the land of opportunity and economic mobility, where anyone who works hard can get ahead. But mounting evidence shows that one’s chance at realizing the American Dream is tightly tied to one’s zip code at birth. As President, what would you do to ensure that a child’s life prospects are not determined by something so arbitrary?

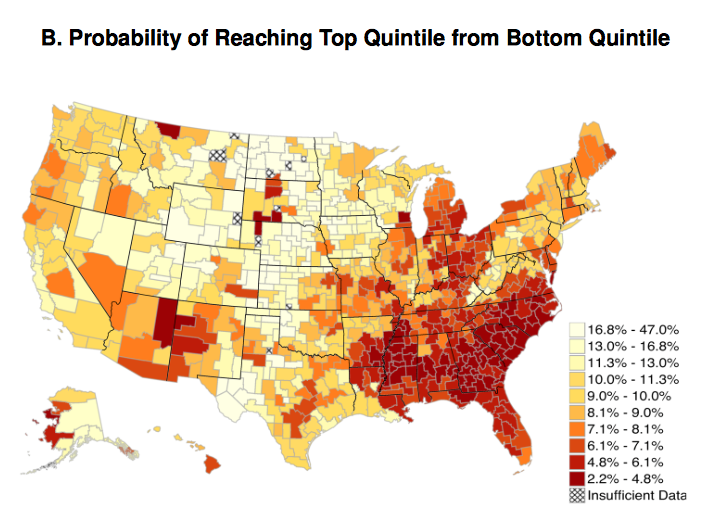

Rates of intergenerational economic mobility vary significantly across the United States, recent research from Raj Chetty and colleagues with Harvard’s Equality of Opportunity Project show. Metro areas such as Salt Lake City and San Jose register mobility rates that equal those of egalitarian Scandinavian countries. Other metro areas such as Atlanta and Milwaukee, by contrast, post some of the lowest economic mobility rates in the developed world.

The authors find that prospects of lifetime economic mobility are largely determined in childhood. Mobility rates are lower in areas where minorities constitute large shares of the population, segregation is high, and urban sprawl prevails. The quality of K-12 education also correlates significantly with economic mobility. Areas with high rates of mobility enjoy strong social capital, and the strongest predictor of upward mobility is family structure.

Source: The Equality of Opportunity Project, Harvard University. Raj Chetty, Nathaniel Hendren, Patrick Kline, and Emmanuel Saez, “Where is the Land of Opportunity? The Geography of Intergenerational Mobility in the United States,” Quarterly Journal of Economics 129 (4) (2014): 1553-1623).

6.

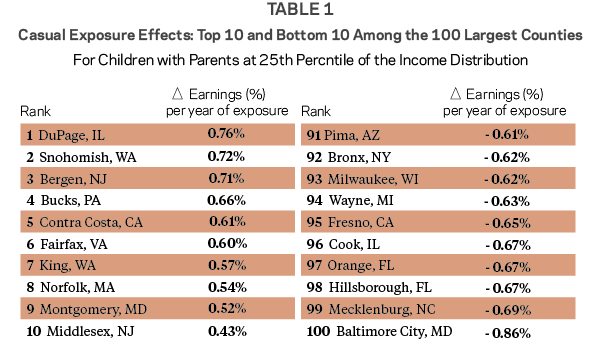

New research adds an element of urgency to the discussion of poverty. It shows that the location of one’s childhood home has a significant, causal impact on lifetime earnings, and that the effect is dynamic: The more years spent growing up in a distressed county, the lower future earnings (and vice versa).

Yet barriers to moving to opportunity can be very high, especially for poor families. Should the government provide support for families to move to places that increase future earnings as a way to decrease future demand on the social safety net?

Recent academic studies show that geography itself can actually cause individual poverty. Geographic concentrations of poverty, joblessness, and marginalization often perpetuate themselves in vicious circles that ensnare children before they acquire the means to escape. The locations themselves, in other words, directly influence life outcomes even after controlling for demographic and income characteristics.

For example, scholars have found that every year a child spends growing up in affluent Bergen County, NJ, increases earnings by 0.71 percent—a 15.2 percent boost after a full 20 years of childhood. By contrast, exposure to neighboring Bronx County, NY, reduces a child’s future earnings by 12.4 percent after a full childhood.

In related research, the authors found that moving from a high poverty neighborhood to a low poverty one increased children’s earnings by 31 percent upon entering the labor market. It also boosted marriage and college attendance rates.

Source: Raj Chetty and Nathaniel Hendren, “The Impacts of Neighborhoods on Intergenerational Mobility: Childhood Exposure Effects and County-Level Estimates.” Working Paper (Harvard University, 2015). Raj Chetty and Lawrence Katz, “The Effects of Exposure to Better Neighborhoods on Children: New Evidence from the Moving to Opportunity Experiment,” American Economic Review, forthcoming.

7.

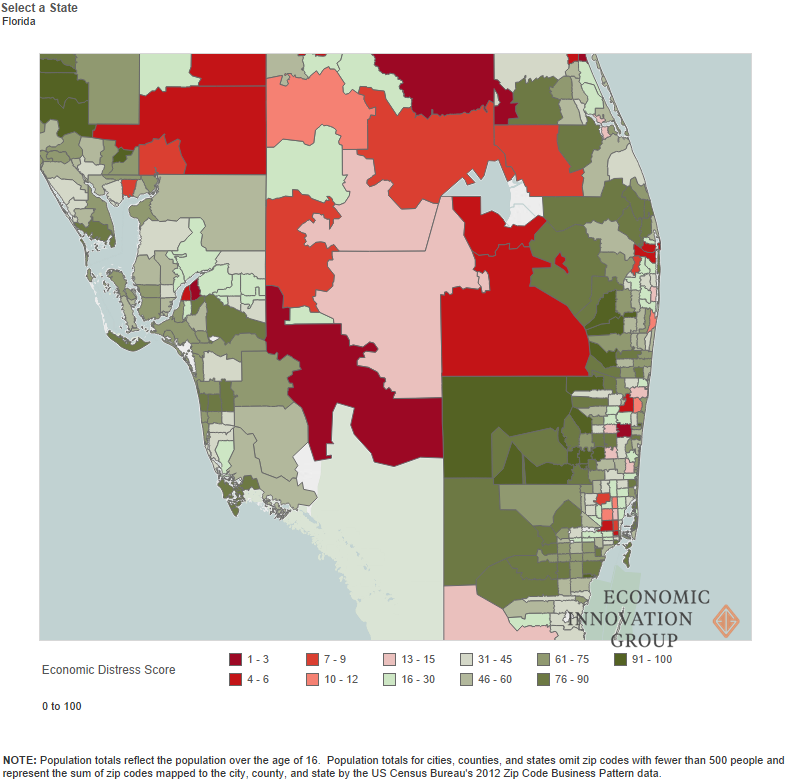

Inequality is increasing on all scales: nation-wide, across regions, and within cities, too. Do you support the concept of geographically targeted incentive programs as a way to direct capital investment and economic opportunity towards places the market, left alone, would leave behind?

As the map below demonstrates, even in generally prosperous regions such as South Florida, well-being can vary widely by neighborhood. Low rates of educational attainment often coincide spatially with the places where jobs are scarce and public and private investment are limited, trapping residents in poverty.

A number of place-based federal programs aimed at disrupting this disequilibrium have enjoyed broad bipartisan support, such as empowerment zones, renewal communities, enterprise communities, and the New Market Tax Credit. Such programs have produced some positive results, but have been limited in their impact by a variety of political and administrative challenges.

New place-based incentive strategies to encourage private investment at scale could build on the accumulating lessons of past initiatives and finally bring investment—and therefore markets and opportunity—to the corners of the country that need it most.

Source: “Distressed Communities Index 2013” (Washington: Economic Innovation Group, 2015).

III. How Entrepreneurship Expands Opportunity for Those in Need

8.

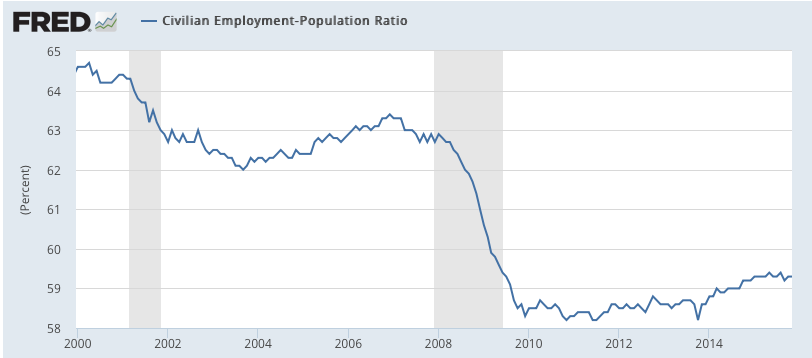

The U.S. labor market is becoming less dynamic, meaning the rates at which workers voluntarily switch employers and firms hire and fire are trending downward—and the trend pre-dates the recession.

The decline in labor market dynamism threatens the economic prospects of young, low-skilled, and other marginally attached workers the most. As President, how would you help these people find stable footing on the first rung of a career ladder?

Economists have identified a multitude of factors behind declining labor market dynamism. Among the most benign are demographics. Older workers, who account for an increasingly large share of the labor force, tend to switch jobs less frequently than younger workers. Other secular trends include a shift towards larger, older, and relatively stable firms in the economy.

A related—and more concerning—corollary is the declining rate of new business formation and accompanying new job creation in the United States. These forces have combined to produce falling rates of worker churn. Lower employment to population ratios result, as a less dynamic labor market makes work less attractive—and less available—to those who are least competitive in the first place, namely the already unemployed, young people, and those with few or obsolete skills.

Source: Federal Reserve Bank of St. Louis. For more information, see Steven J. Davis and John Haltiwanger, “Labor Market Fluidity and Economic Performance.” Paper Presented to the Federal Reserve Bank of Kansas City’s “Reevaluating Labor Market Dynamics” Symposium (Jackson Hole, WY, 2014).

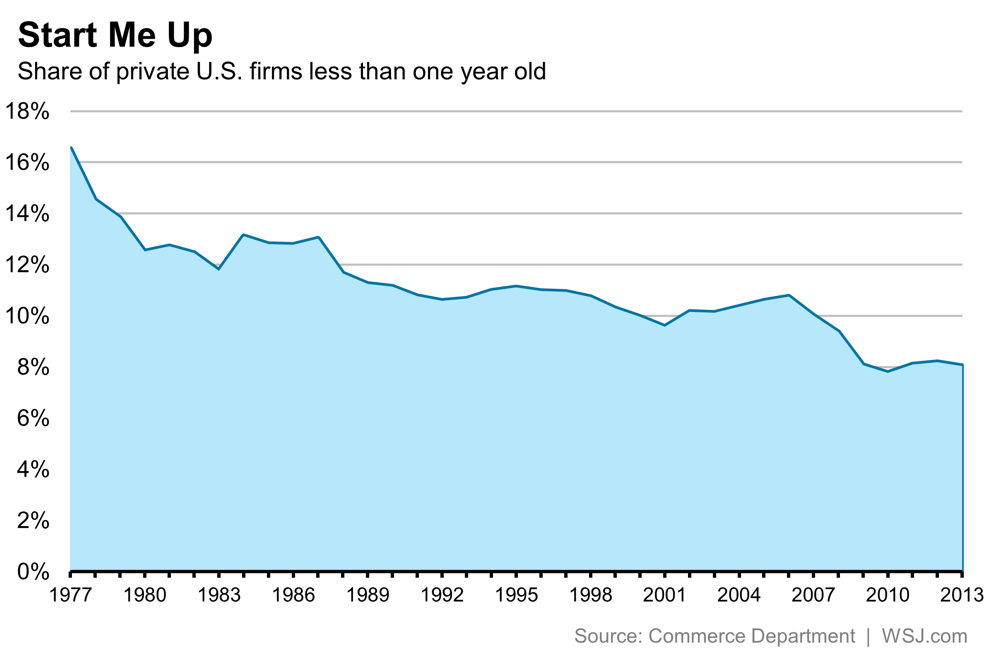

9.

The declining rate of startups in the U.S. economy threatens future job creation, productivity, and wage growth. As President, what would you do to encourage more Americans to become entrepreneurs? And how would you ensure the policy and regulatory environment is welcoming to startups?

Despite the hype, entrepreneurship in the United States is on the decline—even in California, and even in high-tech industries. Startups accounted for only 8.0 percent of U.S. businesses in 2013 (near 2010’s all-time low) and employed only 2 percent of U.S. workers (an all-time low). Economists suspect that many factors lie behind the trend, from increasing healthcare costs for the self-employed and rising indebtedness among young people to low levels of immigration, rising barriers to entry in many industries, increasing economic complexity, and reduced tolerance for risk.

Whatever the causes, the consequences are dire: Startups are vital for disseminating innovations, driving productivity growth, and keeping labor markets fluid and healthy. What is more, in most years startups account for all net new job creation—the demand that is needed to draw the unemployed and marginally attached back into work. Without a reversal of this trend, opportunity will be an increasingly rare find in U.S. labor markets.

Source: The Wall Street Journal and Steven J. Davis and John Haltiwanger, “Labor Market Fluidity and Economic Performance.” Paper Presented to the Federal Reserve Bank of Kansas City’s “Reevaluating Labor Market Dynamics” Symposium (Jackson Hole, WY, 2014).

10.

Entrepreneurs tend to be white, male, and from relatively comfortable backgrounds. What do you see as the role of public policy in providing individuals from disadvantaged backgrounds the tools they need to make entrepreneurship a viable career choice?

Entrepreneurship is central to the American Dream, but it is also a high-risk career choice in which few truly go it alone. Entrepreneurs require not only a good idea, but often experience, financial acumen, business relationships, access to capital, and a high tolerance for risk (where familial wealth can come in handy) in order to be successful.

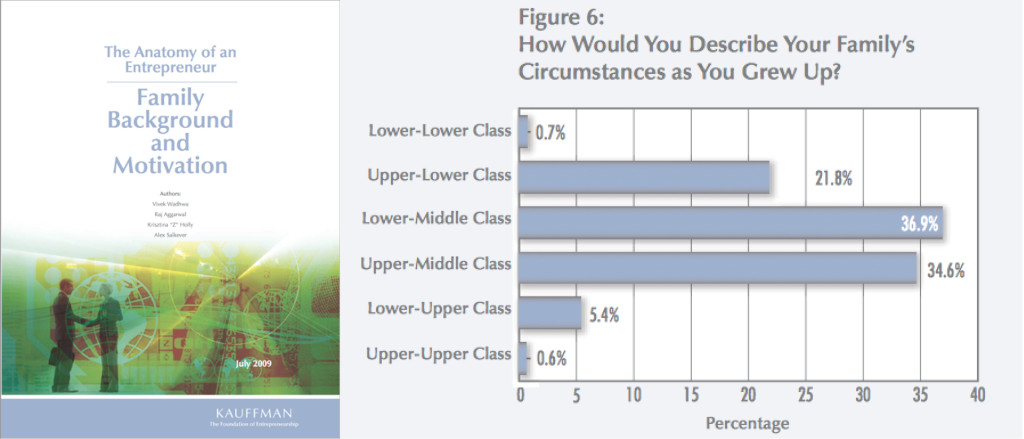

In order to finance their ambitions, entrepreneurs typically tap into their own savings as well as personal and professional networks before taking on debt too—the latter of which requires a solid credit history. Not surprisingly, more than 75 percent of entrepreneurs describe their upbringing as middle- or upper-class, according to a Kauffman Foundation survey. One in five entrepreneurs claim to come from an upper-lower class background, which bodes well for economic mobility, but fewer than 0.7 percent grew up in a lower-lower class (i.e. poor or working poor) background.

Source: Vivek Wadhwa, et al., “The Anatomy of an Entrepreneur: Family Background and Motivation” (Kansas City, MO: Ewing Marion Kauffman Foundation, 2009). See also Ross Levine and Yona Rubinstein, “Smart and Illicit: Who Becomes an Entrepreneur and Do They Earn More?” Working Paper No. 19276 (Boston: National Bureau of Economic Research, 2013).

Download our Ten Questions Every Candidate Should Answer About Poverty and Opportunity in America