By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey (SBPS) provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of August 23rd to August 29th.

Here are the six things we learned about the small business economy last week:

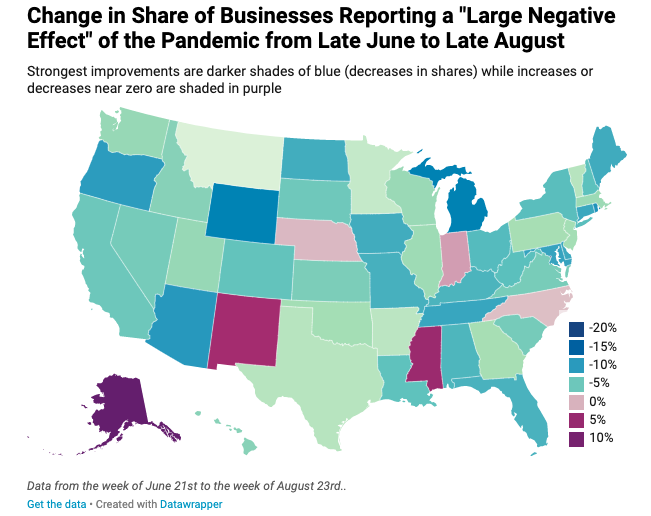

- The share of businesses reporting a “large negative effect” of the crisis has steadily declined over time, but beneath this topline is an ever shifting geography of the pandemic. Since late April, the average share of businesses reporting a large negative effect of the pandemic fell from 51 percent to 33 percent nationally. Underneath the steadily declining average, however, state fortunes have shifted considerably over the past several months. Michigan, for example, has charted consistent improvements since April when it was hard hit with the virus, while the fortunes of other states such as Alaska and New Mexico have deteriorated more recently.

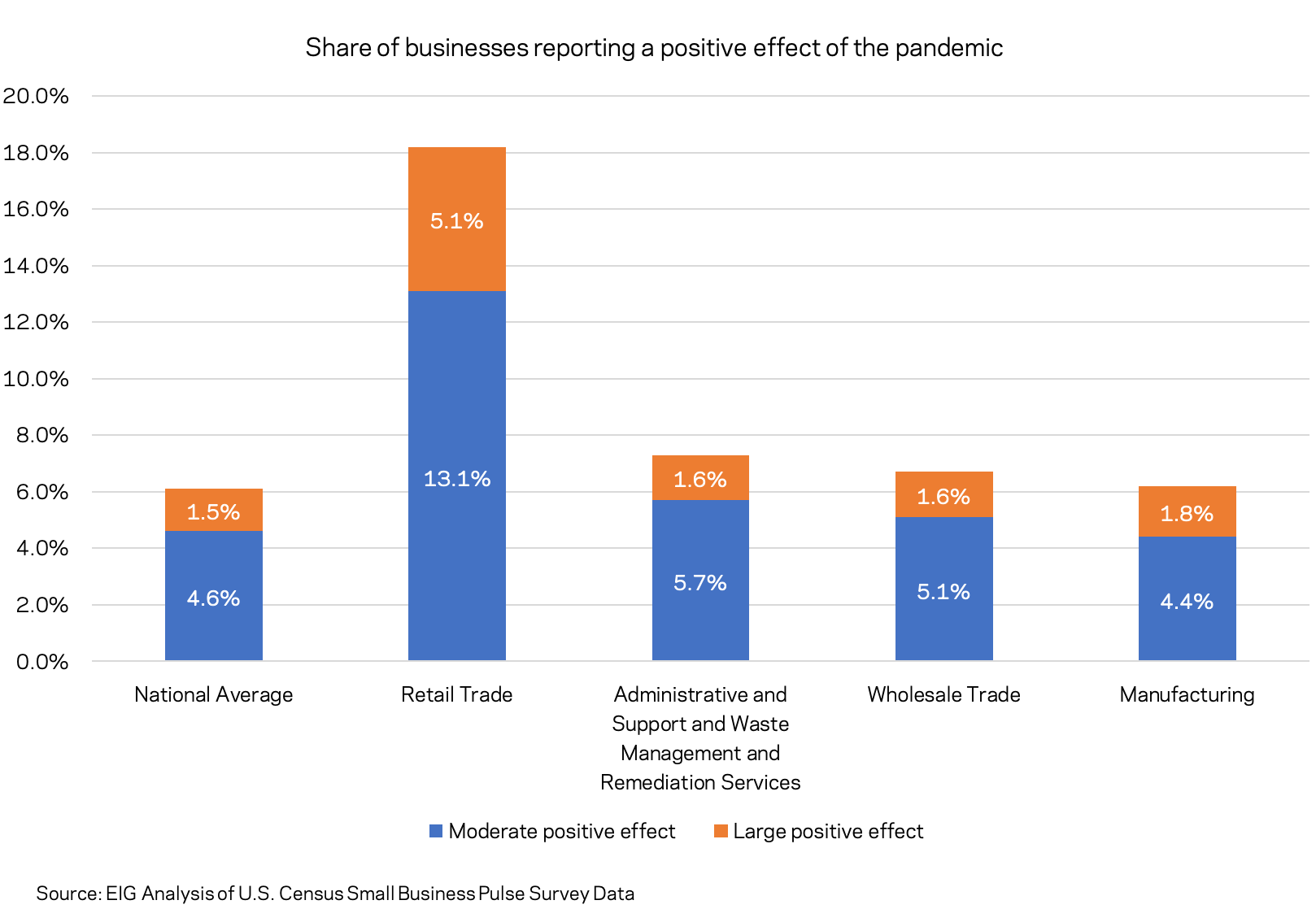

- Some small businesses are thriving during the pandemic, especially in retail. Eighteen percent of businesses in the retail trade sector report a positive effect of the crisis, with 5 percent reporting a strong positive effect. The three industries with the highest shares of businesses reporting positive pandemic effects are retail (18 percent), administrative and support and waste management services (7 percent), wholesale trade (7 percent), and manufacturing (6 percent). These gains are notable but not without explanation. Manufacturers that produce personal protective equipment, retailers that sell goods such as home office supplies, and contractors helping to adapt office and commercial spaces to new public health requirements are all in lines of business that one would expect to see boosted by the pandemic.

-

- Business activity in states hit early in the pandemic is ramping back up – 1 in 13 respondents in the state of New York hired an employee last week. The state of Vermont far outpaces the rest of the country in terms of the share of respondents adding employees in the week of August 23rd, but several states that experienced high cases in the early summer are now seeing increasing shares of firms hiring employees and adding employee hours. The scatter chart below gives a sense of which states are experiencing employment growth (top right hand quadrant) and offers a bit of hope for battle-tested states such as New York, Michigan, and Georgia. Recent case spikes in Mississippi, by contrast, seem to have affected business sentiment but do not seem to be interrupting hiring activity yet.

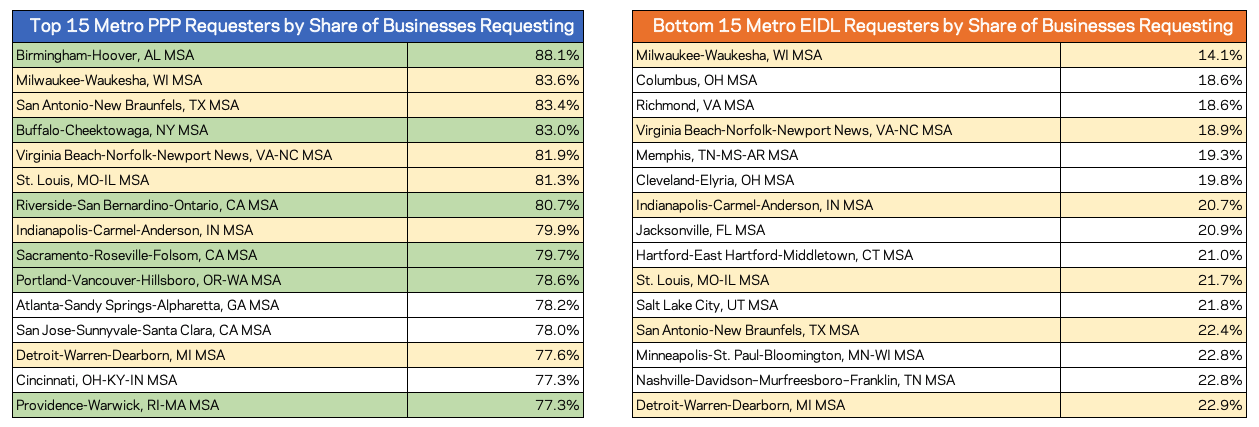

- Some metros lead the pack in requesting Paycheck Protection Program loans but lag behind the rest in requests for Economic Injury Disaster Loans. Six of the 15 metros with the highest shares of businesses requesting PPP loans are also among the 15 metros with the lowest number of requests for Economic Injury Disaster Loans. There is no immediately apparent pattern in the metros that applied for one loan or the other. Further research should investigate what caused businesses in different metro areas to gravitate towards one assistance program or the other.

Note: MSAs colored green were also in the top 15 metros requesting EIDL

- Disruptions in supply chains and delivery delays are widespread across sectors. Right now, 19 percent of businesses are experiencing delays in delivery/shipping to customers, and 29 percent are having domestic supplier delays. Fourteen percent of businesses were also limited in their own operating capacity due to the availability of non-PPE supplies or inputs used to provide goods or services.

- Beneath resilient national averages, a small minority of respondents report being near collapse. Four percent of businesses have no cash on hand available for operations. Eight percent of businesses report that they will likely never return to their pre-pandemic level of operations. In New Mexico, 7 percent of businesses report they have no cash on hand available for operations; in New Jersey, that figure stands at 6 percent. Fourteen percent of businesses in Rhode Island and Hawaii do not think they will ever return to their pre-pandemic level of operations. The percent of businesses expecting to need to close in the next six months held mostly steady for a third straight week around 5 percent. These numbers paint a bleak picture, but they may ultimately underestimate the pain experienced by many small businesses, as the most ailing are least likely to respond to a survey.