By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from September 6th to September 19th.

Here are five things we learned about the small business economy last week:

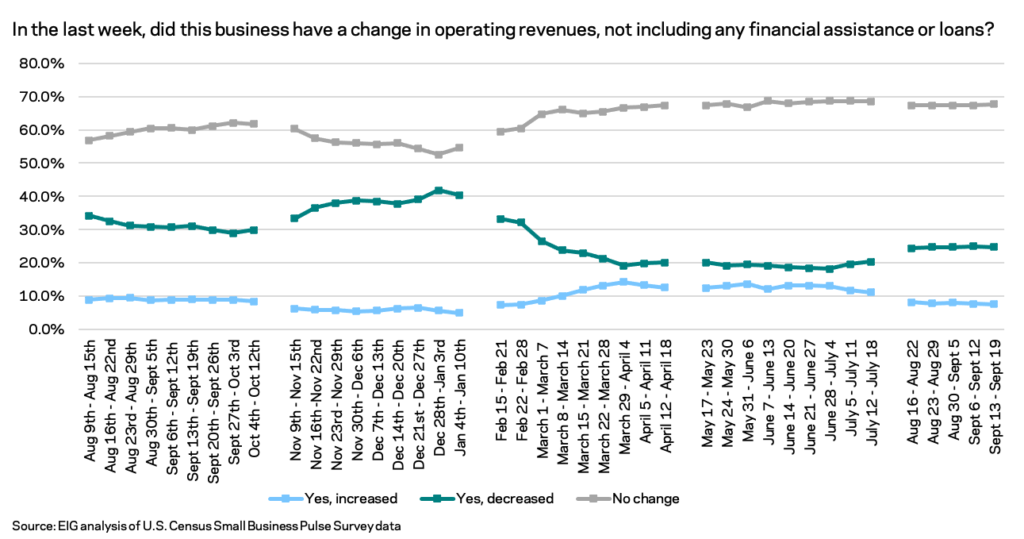

- For the fifth straight week, a quarter of small businesses reported experiencing revenue declines. This measure of distress remains at levels not seen since March of 2021, confirming that the Delta variant has rewinded the clock on the nation’s small business recovery. While the share of businesses experiencing revenue declines isn’t climbing weekly as it did in November and December of last year, it appears that the small business economy is locked into a period of distress with few signs of a fortuitous turn in the near future. Further evidence of the clouded outlook can be found in small businesses’ recovery expectations, which remain stagnant after worsening significantly from July to August.

a

A

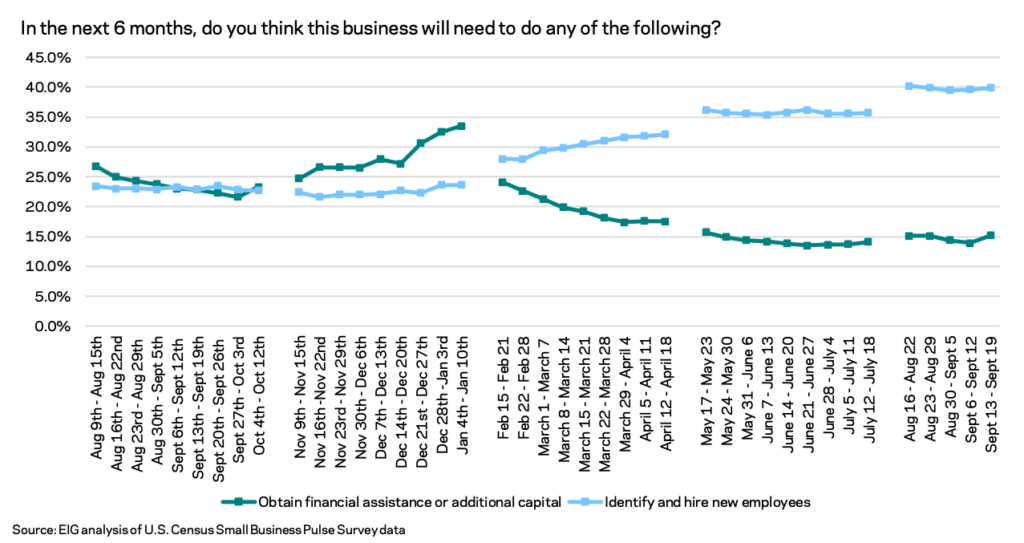

A - As Delta surges, small businesses do not appear to need financial assistance to the degree they did earlier in the pandemic. Only 15 percent of surveyed small businesses expect to need financial assistance or additional capital in the next six months. By comparison, at its recorded peak at the start of this year, at least one-third of small businesses expected to need financial assistance. If that 15 percent share is extrapolated to the full small business economy, up to 4.9 million businesses¹ might still expect to need assistance in coming months; however, that share is dwarfed by the 40 percent that expect to need to identify and hire new employees.

a

a

a - Inflation and supply chain delays continue to put pressure on small businesses, with just under 30 percent reporting a large increase in the prices paid for goods and services since the start of the pandemic and over 40 percent reporting domestic supplier delays. Small businesses are feeling the interrelated pressures of inflation and supply chain delays. In total, 69 percent of small businesses report feeling either a large or moderate increase in the prices they pay for goods and services. Meanwhile, 43 percent report domestic supplier delays, 25 percent report delays in delivery to customers, and 18 percent report foreign supplier delays.

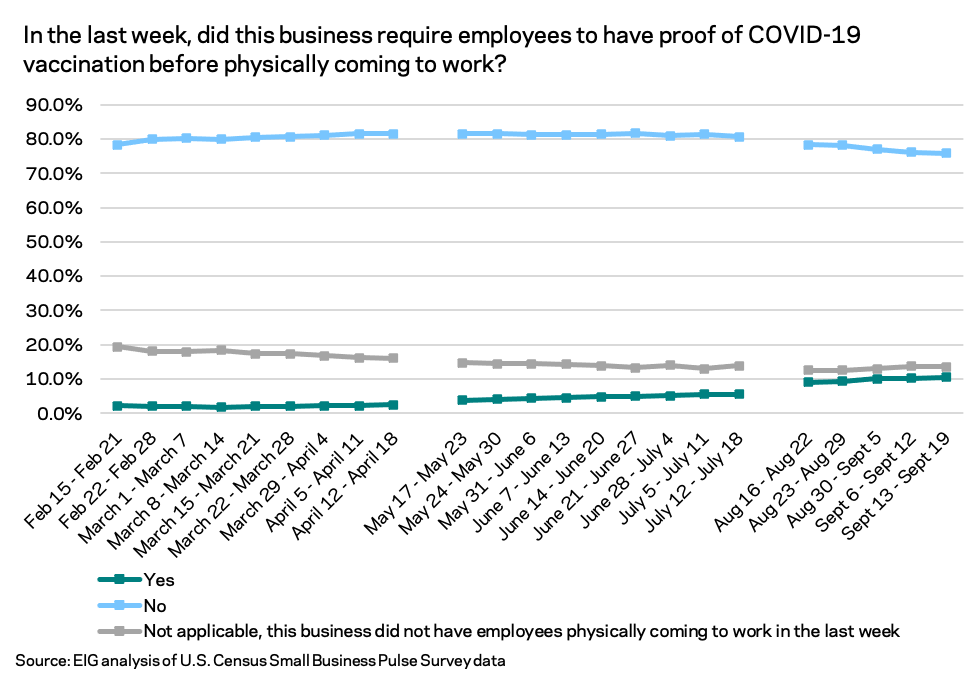

a - Small businesses do not appear to be jumping to institute Biden’s vaccine mandate. While the share of businesses requiring proof of vaccination before employees physically come to work rose several percentage points from mid-July to mid-August, there’s been less than a two percentage point increase since then. On September 9, President Biden announced a new mandate requiring businesses with over 100 employees to either require vaccinations or weekly virus testing. The survey captures some of these businesses, with respondents ranging from 1-499 employees, yet the share of surveyed businesses requiring proof of vaccination stood at 9.1 percent the week of August 16th and had only risen to 10.5 percent by the week of September 13th.

a

a

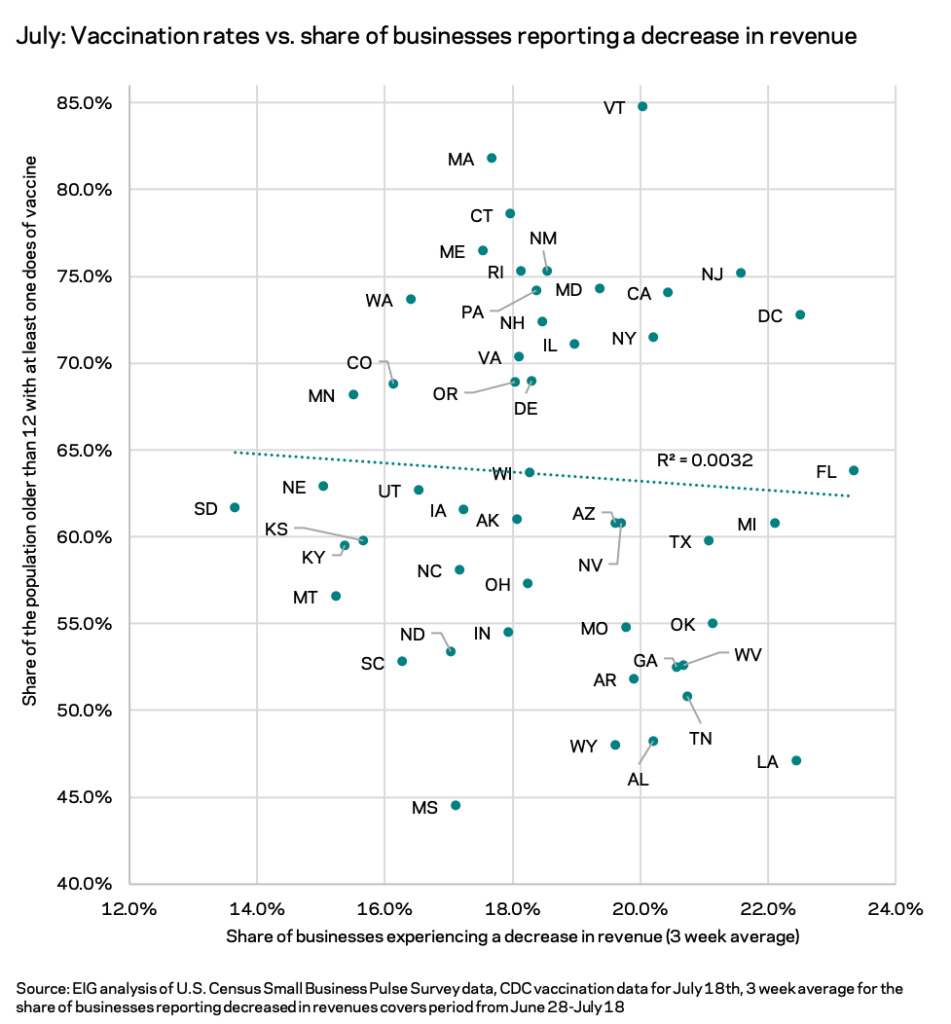

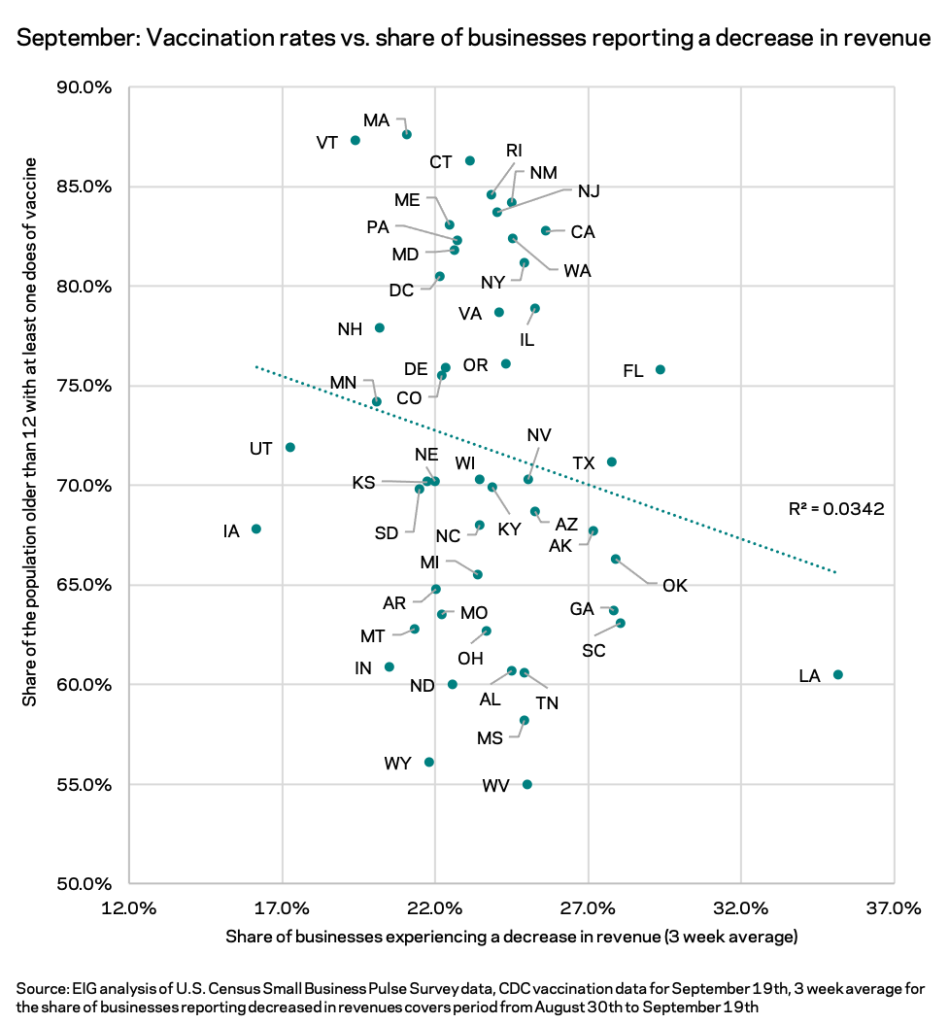

a - The emerging state-level relationship between vaccination rates and short term economic pain for small businesses that first appeared in August is persisting into September. Since first observed in August, the weak but clear relationship between state vaccination rates and short term small business pain—proxied by the average share of businesses reporting decreases in revenue in a given week—has remained stable. In recent weeks, vaccination shares and measures of small business pain have both been on the move, with some states that were lagging on vaccinations seeing the largest percentage point increases in the share of the population age 12+ with at least one vaccine. Other factors, such as local economic orientation and supply chain issues, are also shaping the geography of small business pain, and as the Delta surge wears on, the relationship between vaccination rates and distress may evolve. At present, Hawaii is a strong example of how local economic structure is hobbling small businesses, as the state’s unique tourism-dependent economy seems to be struggling despite a relatively high vaccination rate. It is the only state at this particular stage in the pandemic where the relationship with vaccination rates appears to be playing out much differently than the rest.

a

a

Note: Hawaii was excluded from the scatter plots above because it is an outlier in terms of the scale of the increase in the average share of businesses reporting decreased revenues from one period to the next.

- Uses 2021 Small Business Profile information from SBA