By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from August 30th to September 5th.

Here are seven things we learned about the small business economy last week:

- Ten percent of small businesses required proof of employee vaccination before employees could physically come to work. This share will be one to watch in light of President Biden’s announcement of a new mandate requiring all businesses with 100 or more workers to require employees to get vaccinated or get tested for the virus weekly. While the share requiring proof of vaccination sat at only 10.1 percent, that was nearly double the share in mid-July. Moving forward, the effect of the mandate should be clearly visible as survey respondents are businesses with anywhere from 1 to 499 employees.

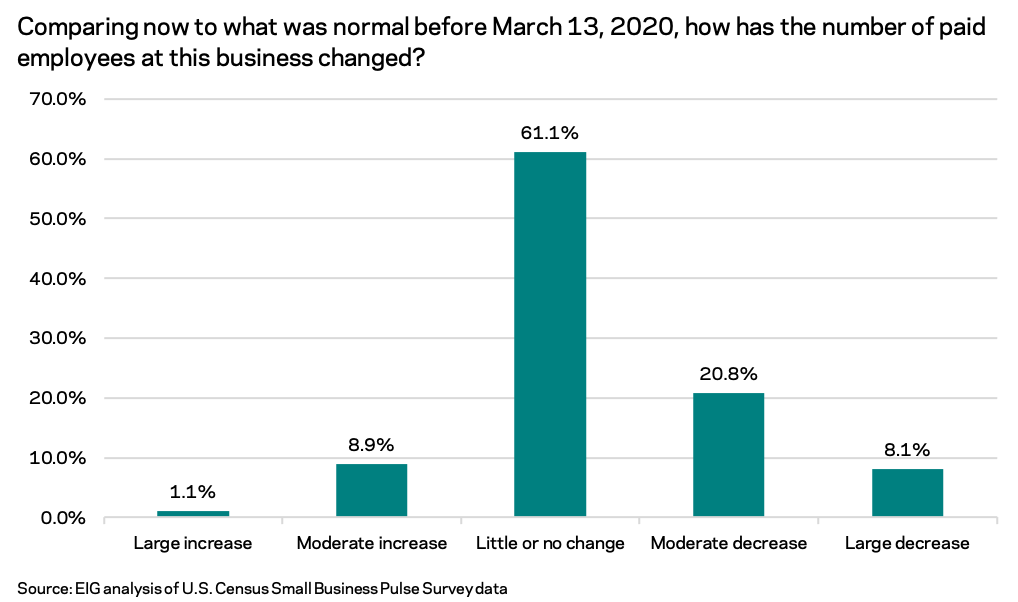

a - More than one in four small businesses have had at least a moderate decrease in the number of paid employees since the start of the pandemic. Just over 8 percent of businesses have had what they considered to be a large decrease in the number of paid employees since the start of the pandemic, according to a newly added survey question. An additional 20.8 percent have experienced a moderate decrease in the number of paid employees. The surge in demand for many products and services during the pandemic did not generally translate into job gains in the small business sector writ large: only 10.0 percent reported a moderate or large increase in the number of paid employees since the onset of the pandemic.

a

a

a

- Over half of surveyed small businesses in the accommodation and food services sector have experienced a decrease in the number of paid employees since the start of the pandemic. At 52.2 percent of small businesses, the accommodation and food services sector is far and away the sector with the greatest share of small businesses reporting a net decrease in the number of paid employees since the onset of the pandemic. On the opposite end of the spectrum, several sectors saw less than 20 percent of small businesses having to significantly decrease the number of employees, including utilities, finance and insurance, real estate, and wholesale trade.

a

a

a

a - Only 15.2 percent of small businesses nationwide have experienced a moderate to large increase in the number of hours worked from home. While much attention has been paid to the shift to remote work, many small businesses appear to have been largely left out of the transition. Nationally, fewer than one in five small businesses has seen a significant increase in the number of hours worked from home by paid employees. Many small businesses are in sectors less likely to benefit from remote work: four of the five sectors with the greatest small business employment are among the 10 sectors with the lowest potential for remote work.

a - Certain sectors of the small business economy have significantly higher shares of businesses reporting shifting to remote work. Just as research on which sectors and occupations have the highest potential for remote work would suggest, the professional, scientific, and technical services, information, education, and finance and insurance sectors have the greatest share of businesses reporting a significant increase in the number of hours worked from home compared to before the onset of the pandemic. Nearly one in three small businesses in the professional, scientific, and technical services sector reported an increase of remote work, while at least one in four reported doing so in the information, education, and finance and insurance sectors.

a

a

a - Over a quarter of small businesses have seen large increases in the prices they pay for goods and services since the start of the pandemic, with inflationary pressures affecting the construction, manufacturing, and accommodation and food services sectors most acutely. With inflationary pressures driving prices up, 28.2 percent of surveyed small businesses report experiencing large increases in the prices of goods and services relative to before the pandemic. The construction sector, slammed by soaring lumber prices in the early part of the year, was the sector with the greatest share of businesses reporting price increases (52.4 percent). Over 40 percent of businesses in the manufacturing and accommodation and food services sectors also reported large price increases.

a - The share of businesses reporting weekly decreases in revenue has held steady for three straight weeks at elevated levels not seen since March. Between 24 and 25 percent of surveyed small businesses reported weekly decreases in revenue from August 16th to September 5th. That elevated share, paired with the decreased share of businesses reporting weekly increases in revenue (only 8 percent), provide evidence that the small business recovery may be stalling in the face of Delta’s resurgence.