By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of September 27th to October 3rd.

Here are five things we learned about the small business economy last week:

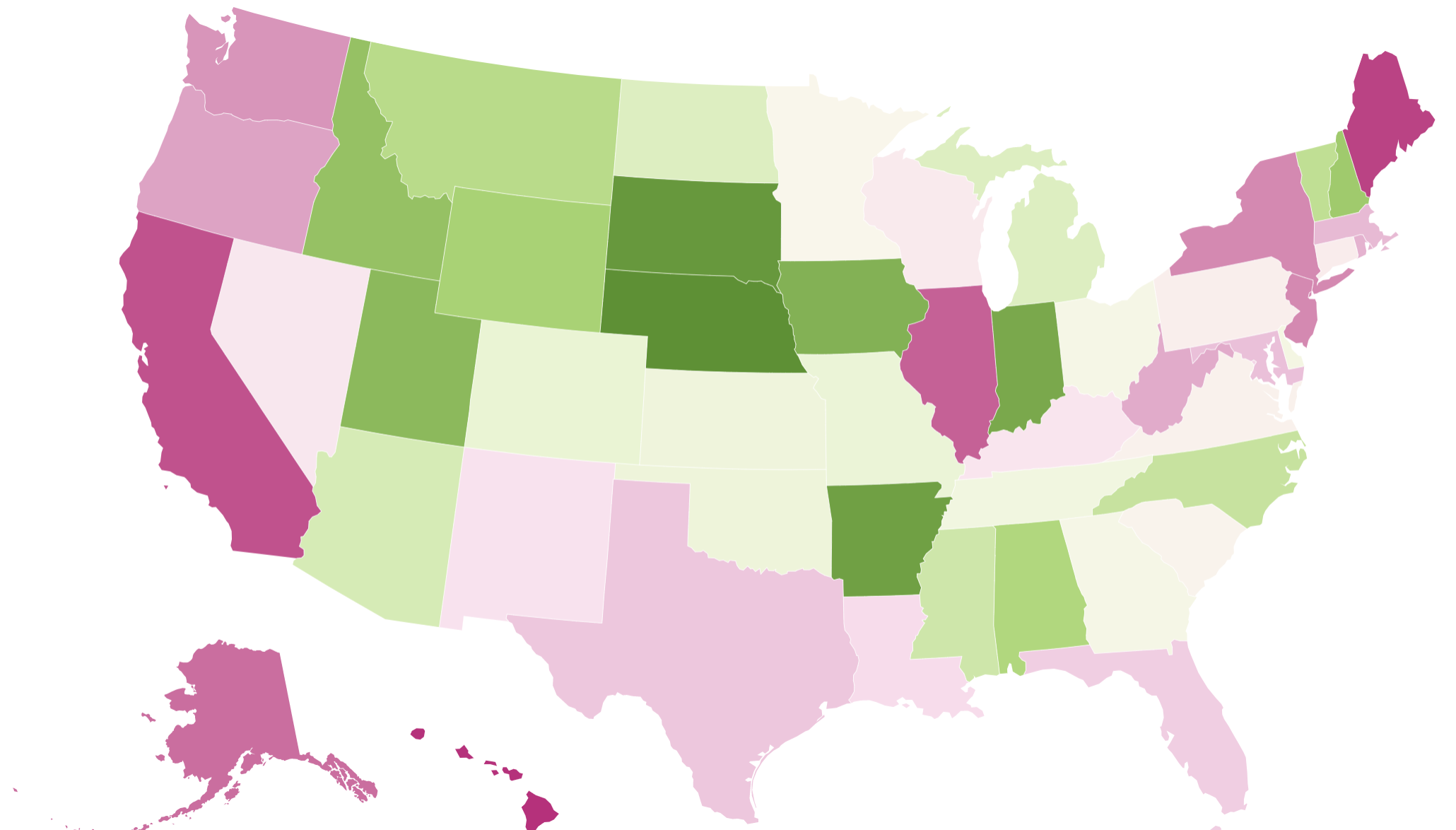

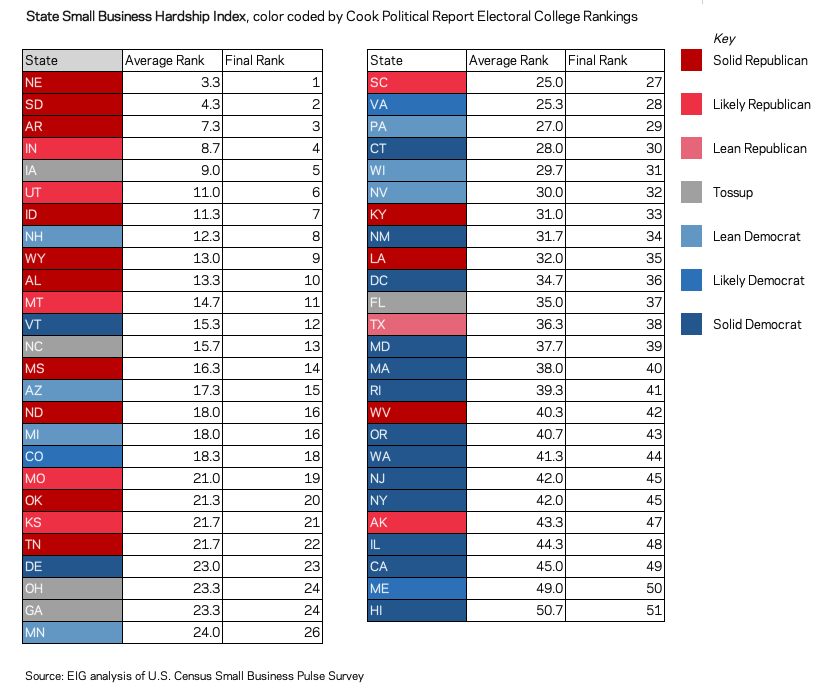

- Hawaii, Maine, and California top EIG’s State Small Business Hardship Index. In an effort to determine which states are struggling the most relative to others, EIG crafted a State Small Business Hardship Index based on the three-week averages for three key indicators of small business distress: the share of businesses reporting decreasing revenue, the share of businesses reporting decreasing employee hours, and the share of businesses reporting a large negative effect of the pandemic generally. The measure contains the three metrics in an attempt to capture both general pain and recent increases in hardship. A lower score indicates lower levels of hardship and thus a lower rank relative to other states. The index ranks each state on the various metrics, takes the average of the ranks, and finally ranks the average to produce the final number below.

- Swing states land all across the index, with businesses in Iowa performing comparatively well while businesses in Maine look to be particularly challenged. Texas and Florida trend toward higher pain as well. North Carolina appears to be experiencing less hardship than average, while Ohio and Georgia appear to be middling. Many rural states appear to be doing better on the index, while early COVID-19 peak states on the coasts cluster on the opposite side of the spectrum. The exception among early peakers is Michigan, whose relatively better off businesses stand out. Nebraska, South Dakota, Arkansas, Indiana, and Iowa round out the bottom of the index, meaning they have the lowest levels of small business hardship, as measured by the index, relative to other states.

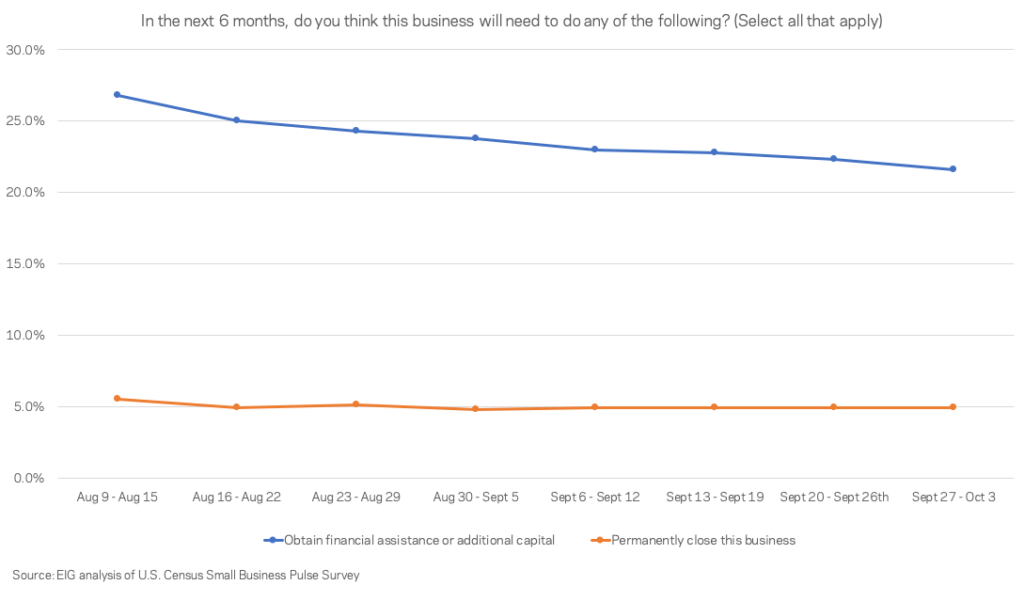

- Nationally, 21.6 percent of businesses expect to need additional capital or financial assistance in the next six months, but with Hill relief talks in flux, businesses may need to seek aid elsewhere or fend for themselves. The share expecting to need additional assistance has only dropped 5 percent over the last seven weeks, and in certain sectors it remains very high. The share of businesses expecting to need to permanently close in the next six months has held steady at 5 percent for eight consecutive weeks, but that share is one to watch given the up-and-down nature of relief talks in Washington.

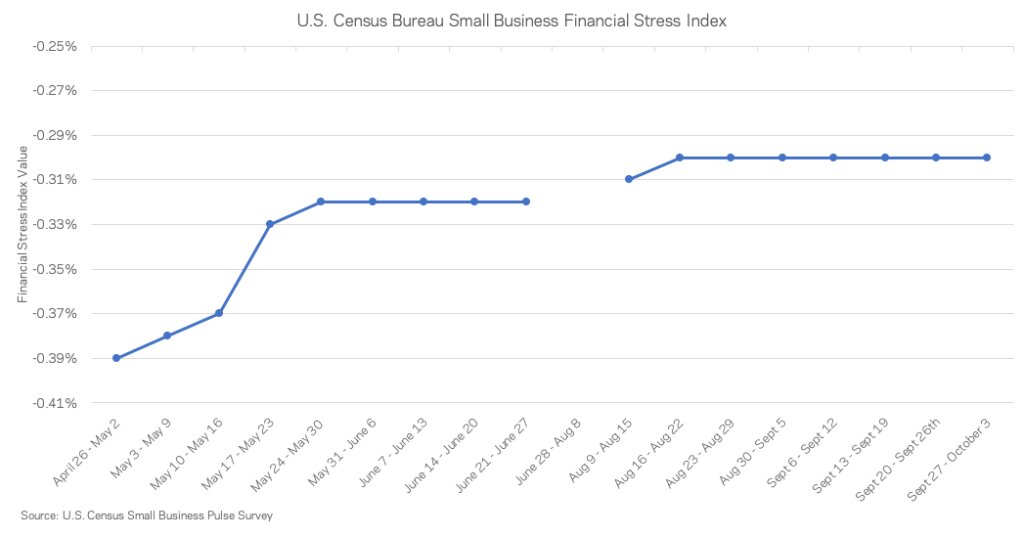

- The U.S. Census Bureau’s Small Business Financial Stress Index has not improved for 6 weeks. The Census Bureau’s Financial Stress Index, a Census Bureau aggregate measure of the amount of financial stress small businesses are under, has stagnated for the past two months. The measure expresses what many small business owners already know to be true: small businesses are stuck in a suspended state of financial precarity that has shown little sign of improvement over the past two months.

- Domestic supplier delays are hitting rural states and non-coastal regions the hardest, while foreign supplier delays are having a mixed geographic effect on small businesses. Domestic supplier delays are affecting 27.5 percent of businesses on average, but those numbers are much higher in the interior of the country as well as parts of the Northeast. Foreign supplier delays, on the other hand, are affecting 9.2 percent of businesses and are experienced much more evenly across the country.