By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from September 20th to October 3rd.

Here are five things we learned about the small business economy last week:

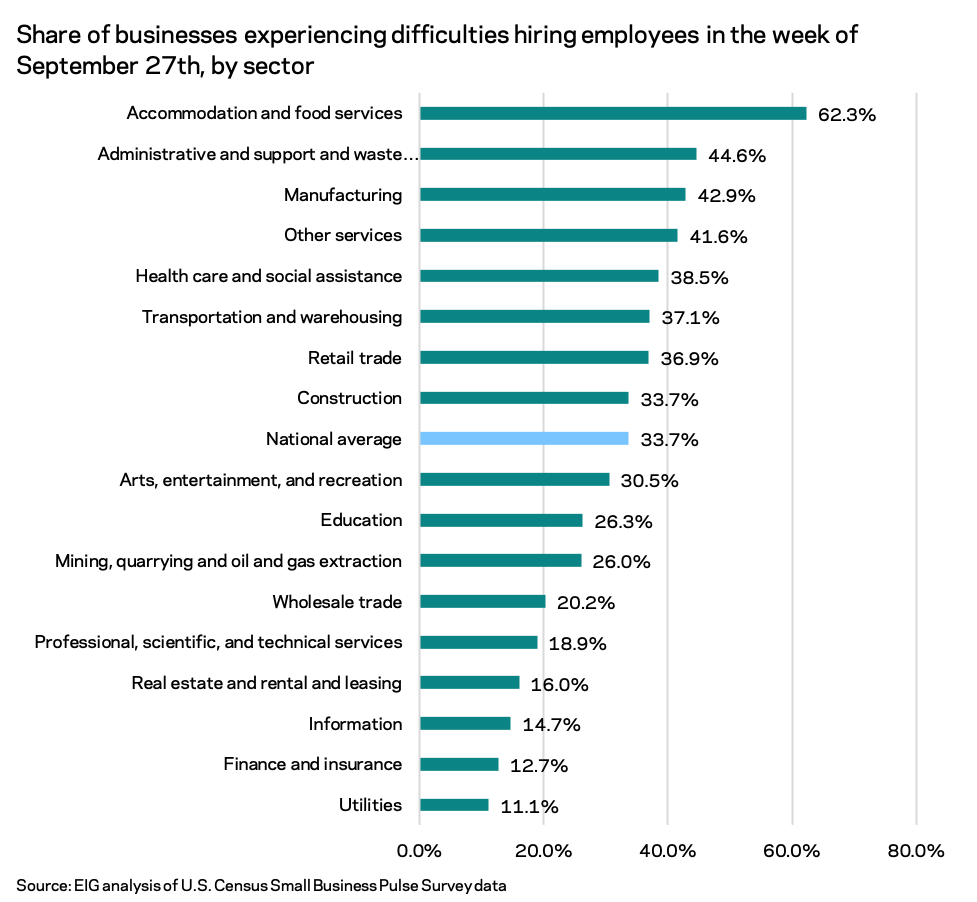

- A third of small businesses reported difficulties hiring paid employees the week of September 27th. This difficulty was worst in the accommodation and food services sector, where 62 percent of respondents reported struggling to hire. More traditionally white collar sectors fell at the other end of the spectrum, with fewer than 20 percent of surveyed businesses in the information, finance and insurance, real estate, and professional, scientific, and technical services sectors reporting difficulties hiring.

a

a

a

- As supply chain issues and labor shortages bear down on the economy, more small businesses see a need to fill labor gaps than shift supply chains. With supply chain pressures pinching small businesses— 44 percent of small businesses reported domestic supplier delays and 25 percent reported delays in delivery to customers— one in five expect to need to identify new supply chain options. While significant, that number is still well below the 40 percent of small businesses that expect to need to identify and hire new employees. This pattern holds across all sectors except for wholesale trade: in the wholesale trade sector, the share expecting to need to identify new supply chains (34 percent) is greater than the share of businesses expecting to need to hire new employees (28 percent).

a

a

a - Since the start of the pandemic, demand for goods and services has risen and fallen for about equal shares of small businesses. Almost a third (30.6 percent) of surveyed businesses reported a moderate to large increase in demand for their goods or services and the exact same share reported a moderate to large decrease since the onset of the pandemic. Various periods of the pandemic have had clear winners and losers in the broader economy, with sales of durable goods spiking in the early months of the pandemic as services fell off dramatically. Services enjoyed a rebound as vaccinations began and pent up individual savings hit the market, but that recovery faltered somewhat as the Delta variant surged. While the demand effects of the pandemic vary based on industry and location, this top line finding underscores the fact that in the medium term, demand wasn’t universally devastated despite the unprecedented nature of the pandemic economic crisis.

a

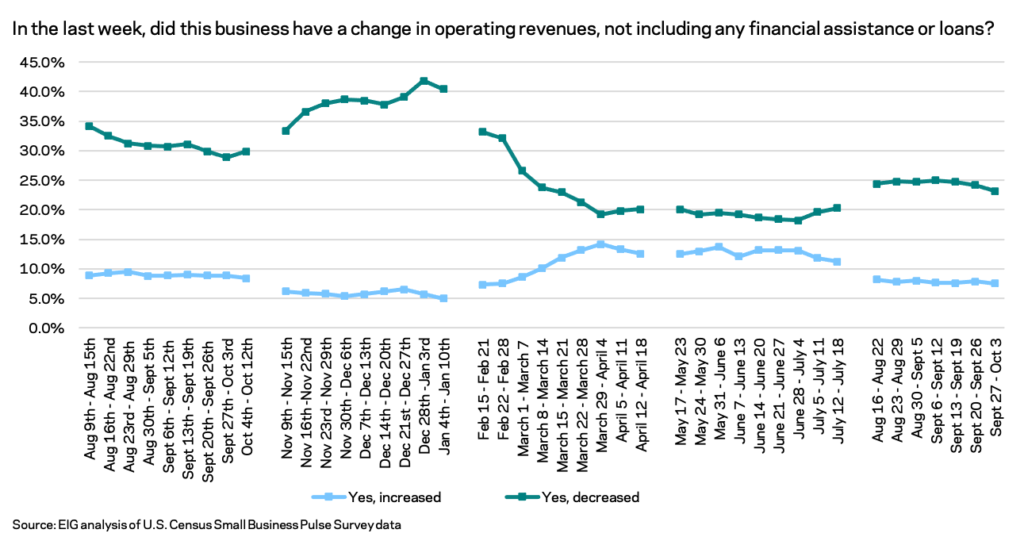

- The share of small businesses reporting declines in revenue has ticked down slightly in the past two weeks. After a period of stagnation in which one in four small businesses experienced revenue declines in a given week, the share reporting declines ticked down slightly over the past two weeks to 23.2 percent. While the slight decline is potentially a good sign, the share remains at a level not recorded since March of 2021.

a

a

a - Hawaii, Louisiana, Idaho, Mississippi, and Georgia top the list of states with the greatest share of businesses experiencing short term economic distress. Several states across the southeast have some of the highest shares of businesses experiencing short term economic distress, proxied here by the average share of businesses reporting decreases in revenue in a given week. While a handful of the states where short term pain is most acute have a relatively smaller share of their population vaccinated, the relationship between vaccination rates and short term distress does not appear to be consistent across all states, with economic structure and other issues coming into play as evidenced by the distress in tourism-dependent Hawaii.

a