By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of September 20th to September 26th.

Here are five things we learned about the small business economy last week:

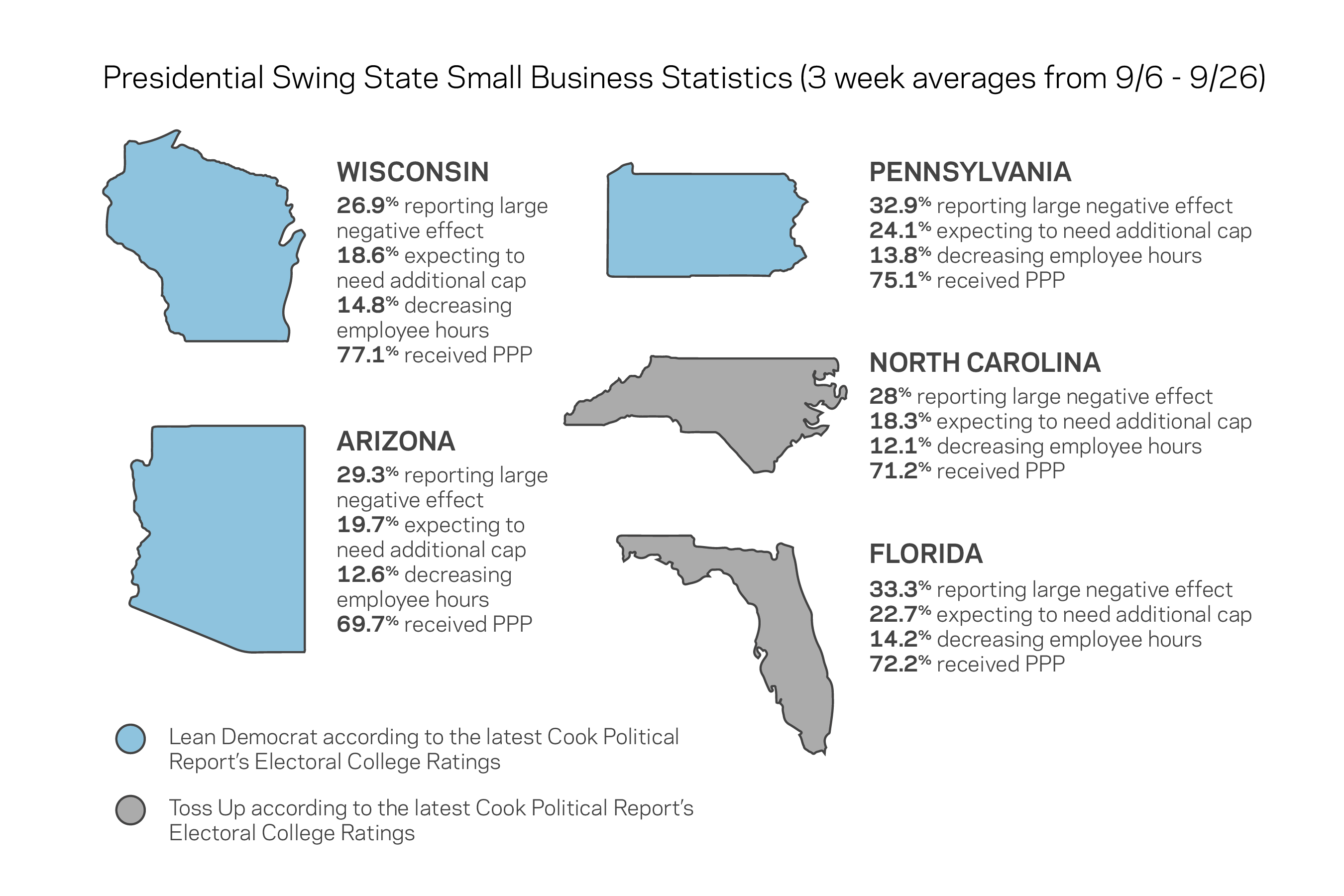

- The economic impact of the pandemic on small businesses varies across presidential swing states. Pennsylvania and Florida are the two swing states in the presidential race that have an above average share of small businesses reporting a large negative effect of the pandemic on their operations. The Keystone and Sunshine states are also the only two states with an at or above average share of businesses expecting to need additional capital or financial assistance in the next six months. Wisconsin is the only state at or near the 3-week national average for the share of businesses reporting further decreases in employee hours and also leads the group with the highest share of businesses reporting having received a PPP loan.

Note: Swing states were identified using Cook Political Report’s initial Electoral College Rankings. (Source)

Note: Swing states were identified using Cook Political Report’s initial Electoral College Rankings. (Source)

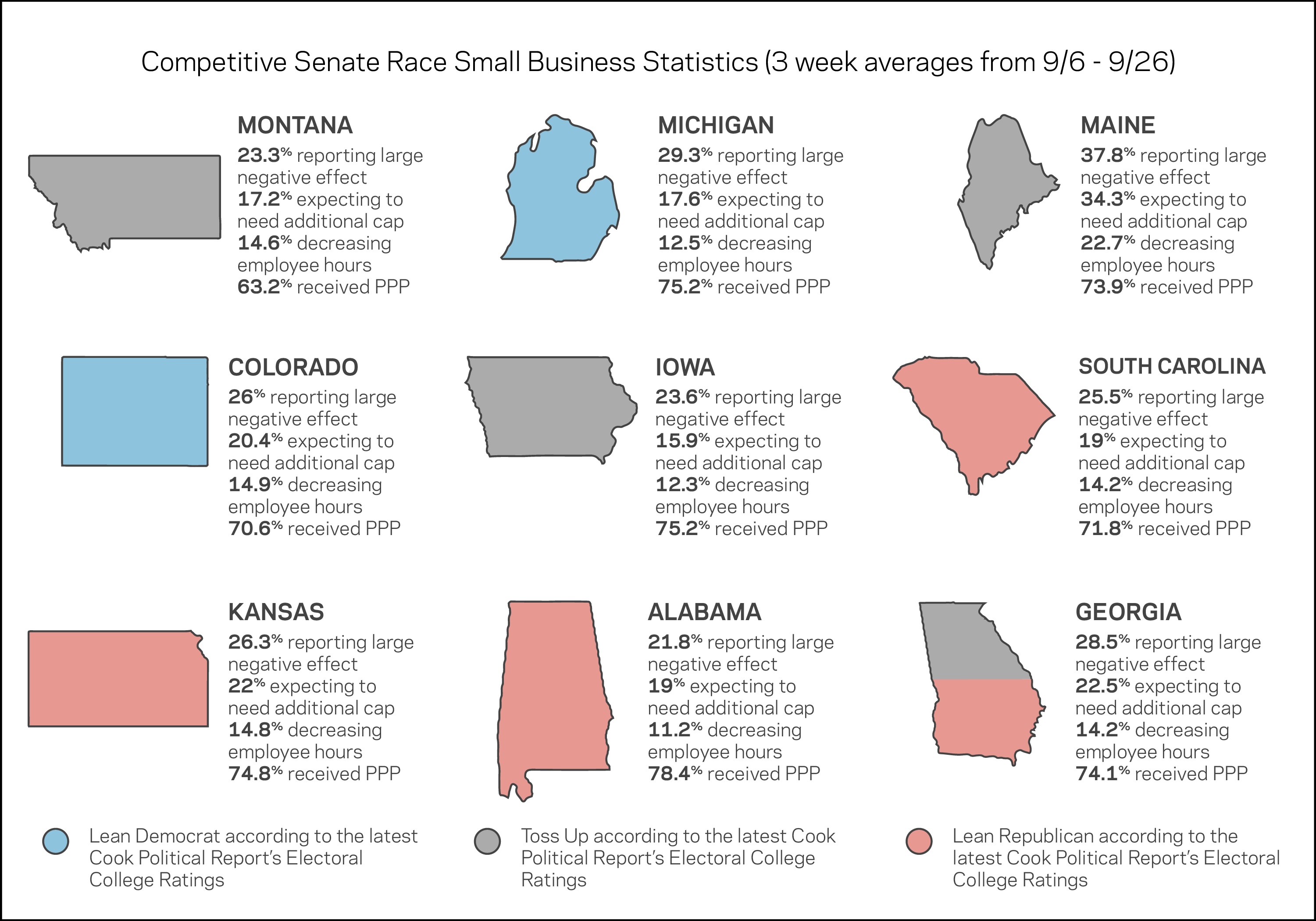

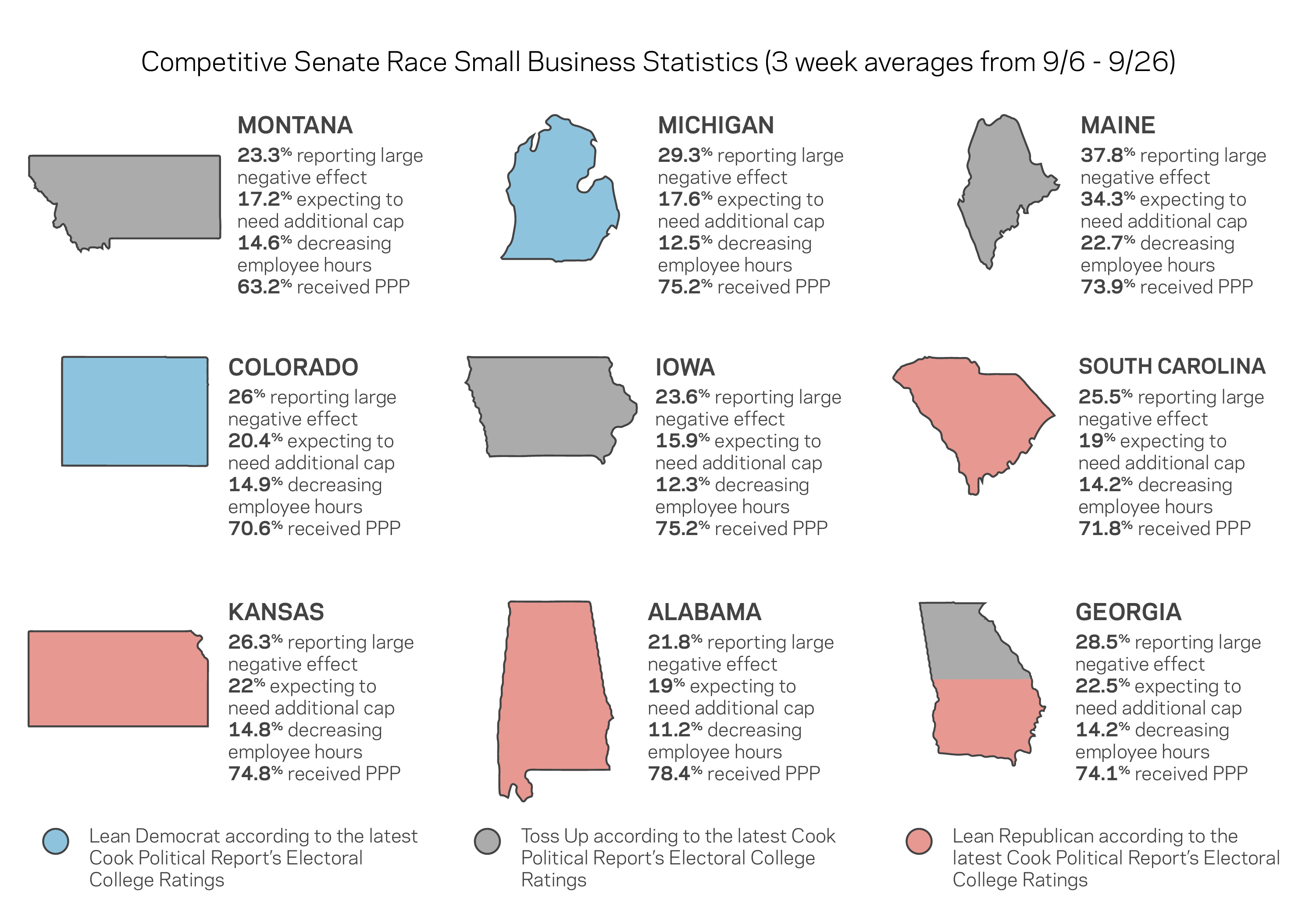

- Among the competitive Senate seats, fortunes vary as well, although most states with competitive seats are faring somewhat better than the broader country. Maine stands out among the competitive senate races on many of the three-week averages as particularly hard hit, although small sample sizes for the smaller state do warrant caution in drawing too much attention to the high numbers. The state with a competitive Senate race and the highest share of businesses receiving PPP is Alabama, while Montana lags behind the rest of the pack on the same measure.

Note: The four data points are provided for all states with competitive senate races as determined by Cook’s Political Report (any state listed as Lean D, Tossup, or Lean R, not including Arizona and North Carolina, which can be found in the previous table). (Source)

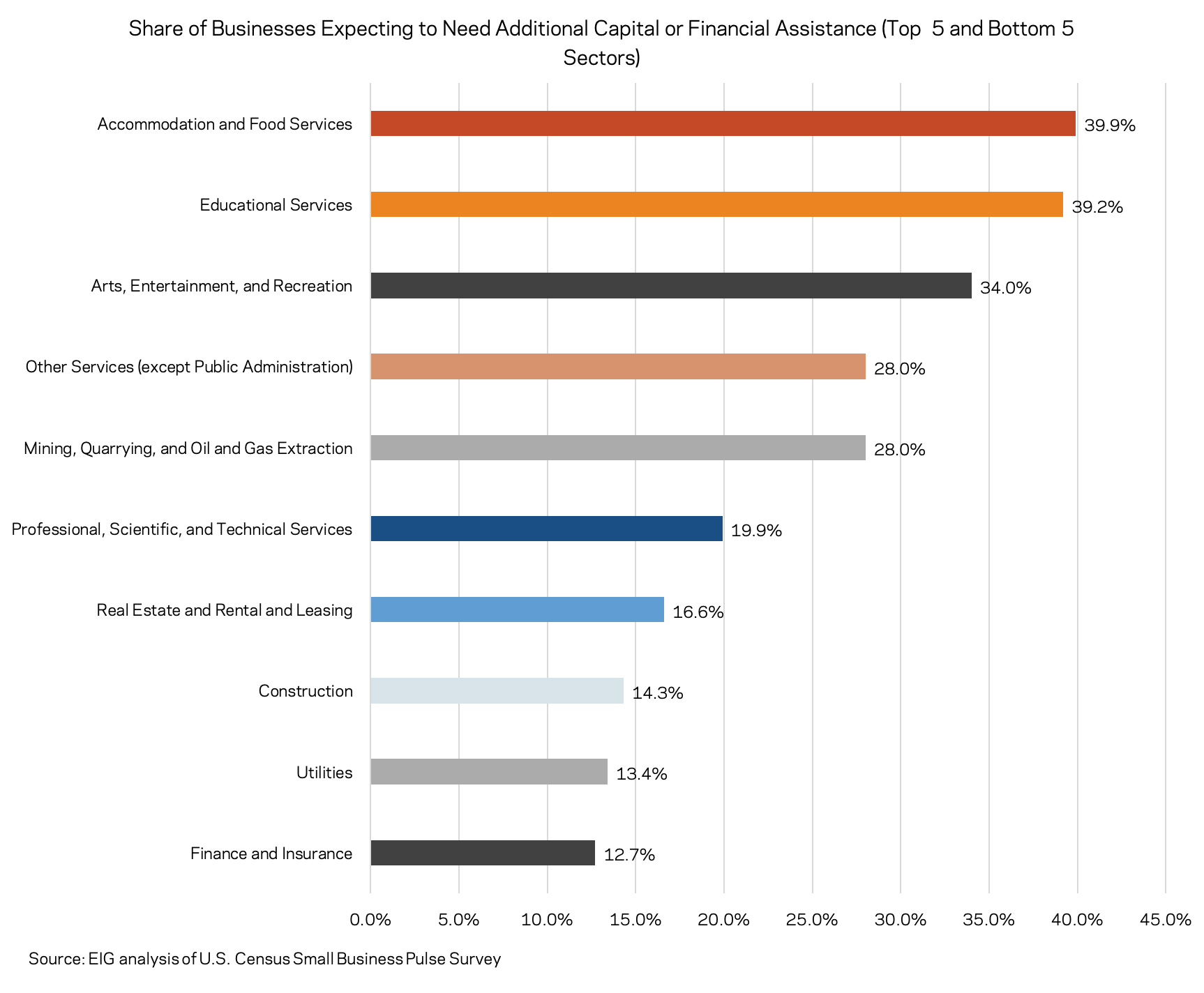

- Small businesses in the accommodation and food services and education sectors are the most likely to expect to need additional capital or financial assistance in the next six months. On the other end of the spectrum, less than 20 percent of small businesses in the professional services, real estate, construction, utilities, and finance and insurance sectors expect to need further support.

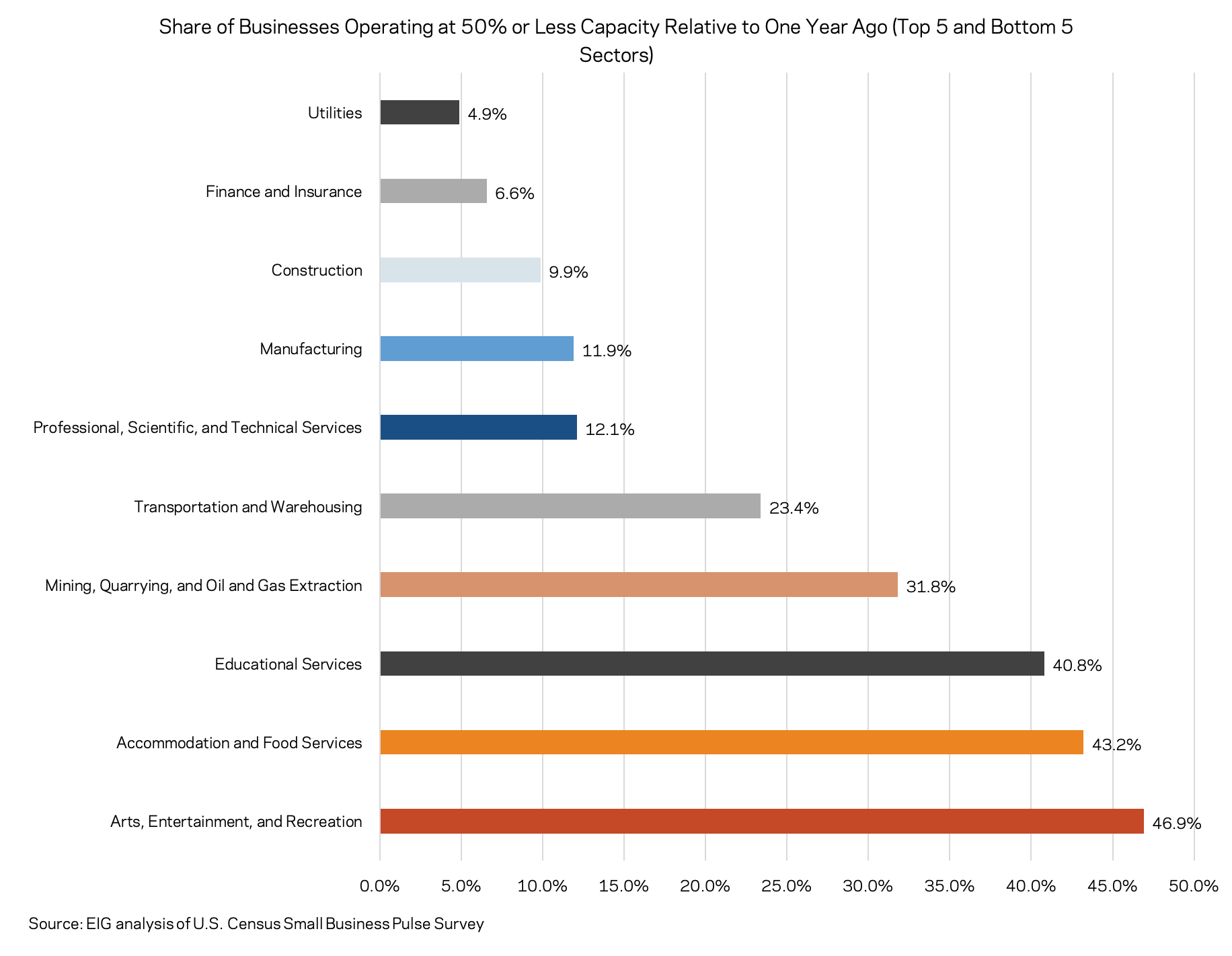

- In the hardest hit sectors, large shares of small businesses are not even operating at half of their former capacity. More than 40 percent of businesses in the arts, entertainment, and recreation; accommodation and food services; and education sectors report operating at 50 percent or less of their capacity relative to the same time last year. Unsurprisingly, the more crisis-insulated utility sector finds itself among those with the lowest shares reporting such a profound decrease in operation. Manufacturing businesses tend to be among those most severely impacted by recessions, but the nature of the pandemic-induced one—the country’s first ever services-driven downturn—has allowed many small manufacturers to escape its worst effects.

- The sectors with the highest share of businesses adding employee hours are also the sectors with the highest share cutting hours as volatility upends the hardest hit corners of the economy. The educational services, accommodation and food services, and arts, entertainment, and recreation sectors are some of those with the highest share of firms reporting adding employee hours. They also have some of the highest shares of businesses cutting employee hours. These figures suggest that many small businesses in vulnerable sectors may be struggling to find their footing as the pandemic continues. More insulated sectors such as finance and insurance, on the other hand, appear to have stabilized, with 91 percent reporting no change in employee hours. Unsurprisingly, the sectors in flux also tend to have the longest expected recovery timeline.