By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of November 9th to November 15th.

Here are five things we learned about the small business economy last week:

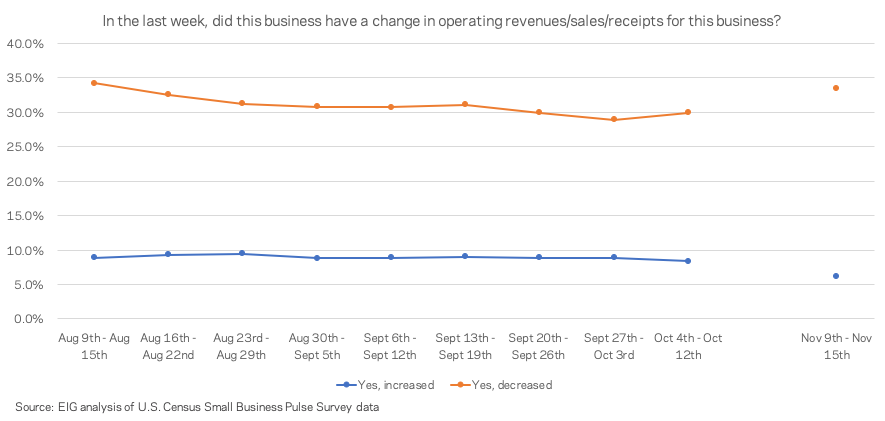

1. One-third of businesses reported falling revenues for the first time since mid-August, while the share of firms reporting increasing revenues sunk to its lowest point since the end of April. For the first time since mid August, one-third of respondents reported falling revenues over the course of a week of business. Perhaps even more troublingly, the share of businesses reporting increasing revenues—an approximate gauge of how many firms are actively recovering—fell to its lowest point since the end of April. The remaining 60 percent of firms reported no change in revenue, a sign that, at least for now, the majority of firms are neither actively recovering nor relapsing into economic decline.

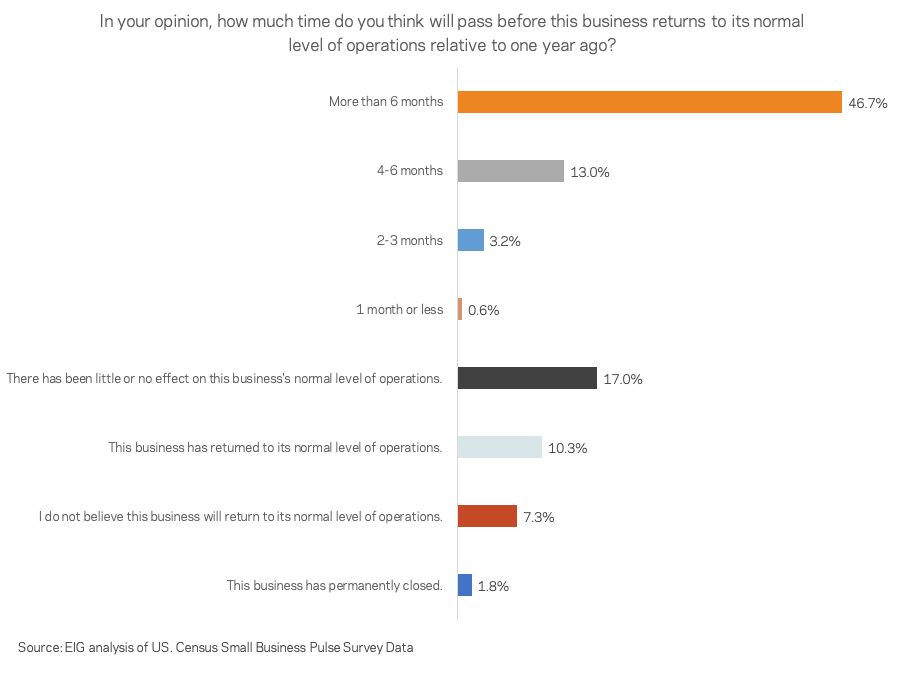

2. Nearly half of businesses do not expect a return to normal operations for over six months, the highest share since August. 46.7 percent of surveyed businesses expect a return to normal operations to take more than 6 months. The share of businesses reporting a full return to normal operations ticked down slightly from mid October to mid November, likely a result of surging cases across the United States. This turn towards slightly worse expectations nationally came without any meaningful change in the share of businesses reporting a large or moderate negative effect of the pandemic.

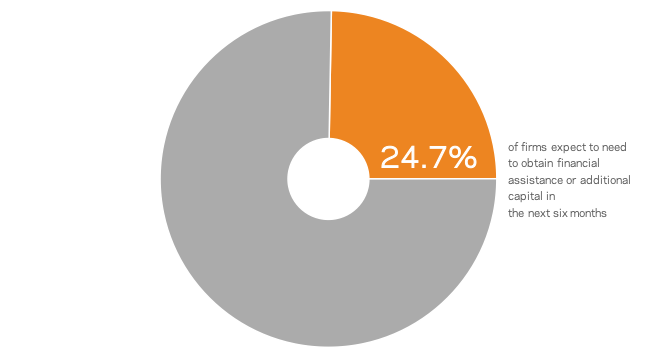

3. Nearly one-quarter of businesses expect to need financial assistance or additional capital in the next six months, the highest point in roughly three months. About one quarter of firms (24.7 percent) expect to need to obtain financial assistance or additional capital in the next six months, up from a trough of 21.6 percent in the final week of September. In addition, the number of firms expecting to need to permanently close in the next six months remained worryingly high around 1 in 20.

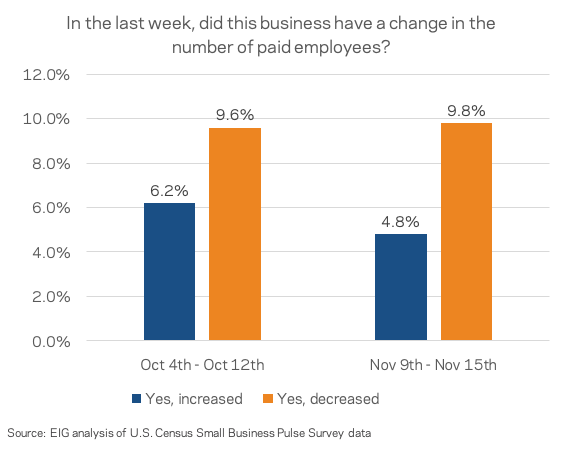

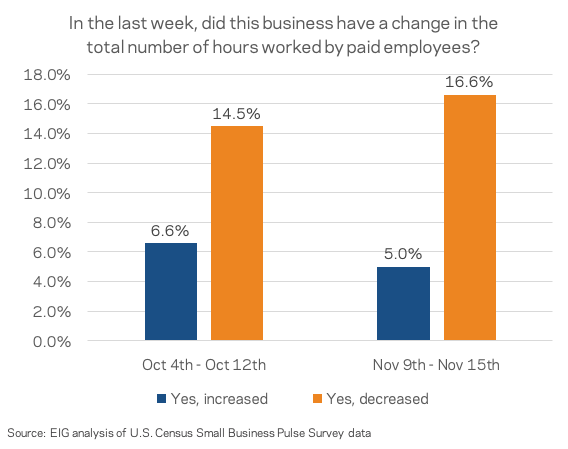

4. The share of firms cutting employee hours ticked up as the share of firms hiring employees ticked down. More firms have been firing than hiring employees throughout the course of the pandemic, but the most recent data shows the gap widening as the share of firms hiring grows smaller. The share of firms adding or cutting employer hours took a similar turn, with 16.6 percent of firms reporting cutting employee hours the week of November 9th compared to just 5 percent adding them. The changes are relatively slight but after months of only marginal changes, the distinct negative movement could be a harbinger of changing economic tides.

5. Revenue declines are now particularly widespread in the upper Midwest and parts of the West, marking a dramatic shift in the geography of the pandemic’s impact relative to even a month ago. In Alaska, Illinois, Oregon, Wisconsin, West Virginia, and North Dakota more than 40% of surveyed businesses reported further decreasing revenues the week of November 9th. Other parts of the West, South, and Northeast that suffered more throughout the spring and summer are now beating the curve.