By Kenan Fikri

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This write-up covers data from the week of May 17th to May 23rd.

Here are five things we learned about the small business economy last week:

- Another 16 percent of businesses decreased their employee headcount last week. As the economic fallout from the pandemic evolves and spreads, 15.8 percent of small businesses shed more workers last week. This is down from 18.4 percent the week prior, but still represents a sizable fraction of responding companies. Alternatively, 9.2 percent of respondents reported more paid employees than the prior week, potentially attributable to modest re-staffings in line with gradual economic reopenings.

- Only about 1 in 20 companies report missing a loan payment; this figure is closer to 1 in 10 in Nevada. As the Census Bureau refined this question last week, the share of respondents reporting defaults on a loan payment fell to 5.7 percent nationally. In travel and tourism-dependent Nevada, however, the figure was 9.4 percent.

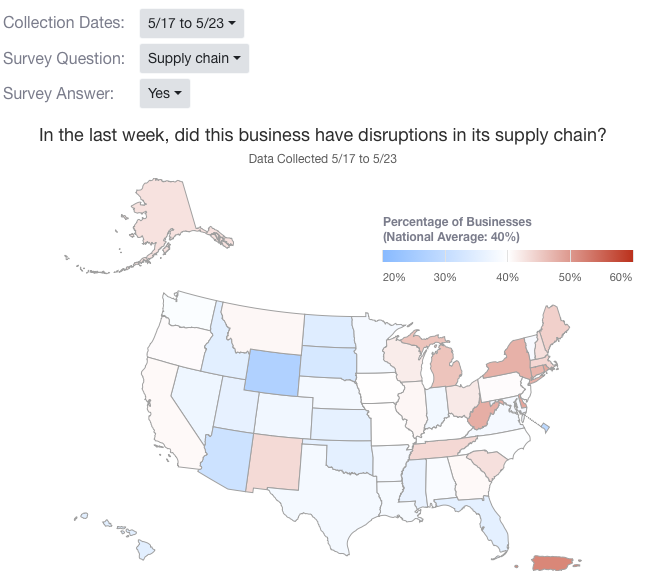

- Supply chain disruptions are showing up in unexpected places. In a testament to the wide-reaching economic ramifications of the pandemic, small businesses in West Virginia reported the greatest incidence of supply chain disruptions for two weeks in a row despite having very few COVID-19 cases and a relatively brief and standard lockdown.

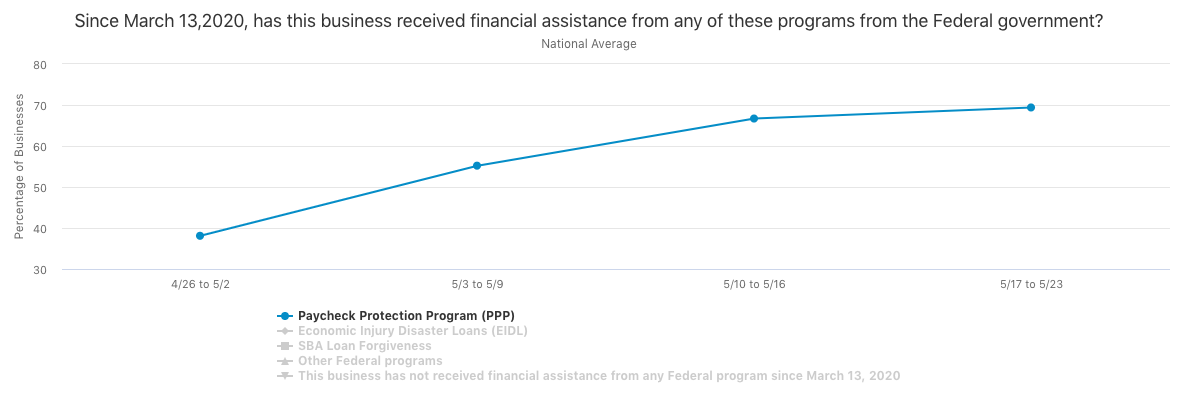

- The share of businesses that report having received financial assistance from PPP continues to increase, but at a slower rate. Last week, 69.4 percent of businesses reported receiving financial assistance from the Paycheck Protection Program (PPP), up from 66.7 percent the week prior. Over three-quarters of manufacturing, healthcare, and accommodation and food services respondents have received help from PPP.

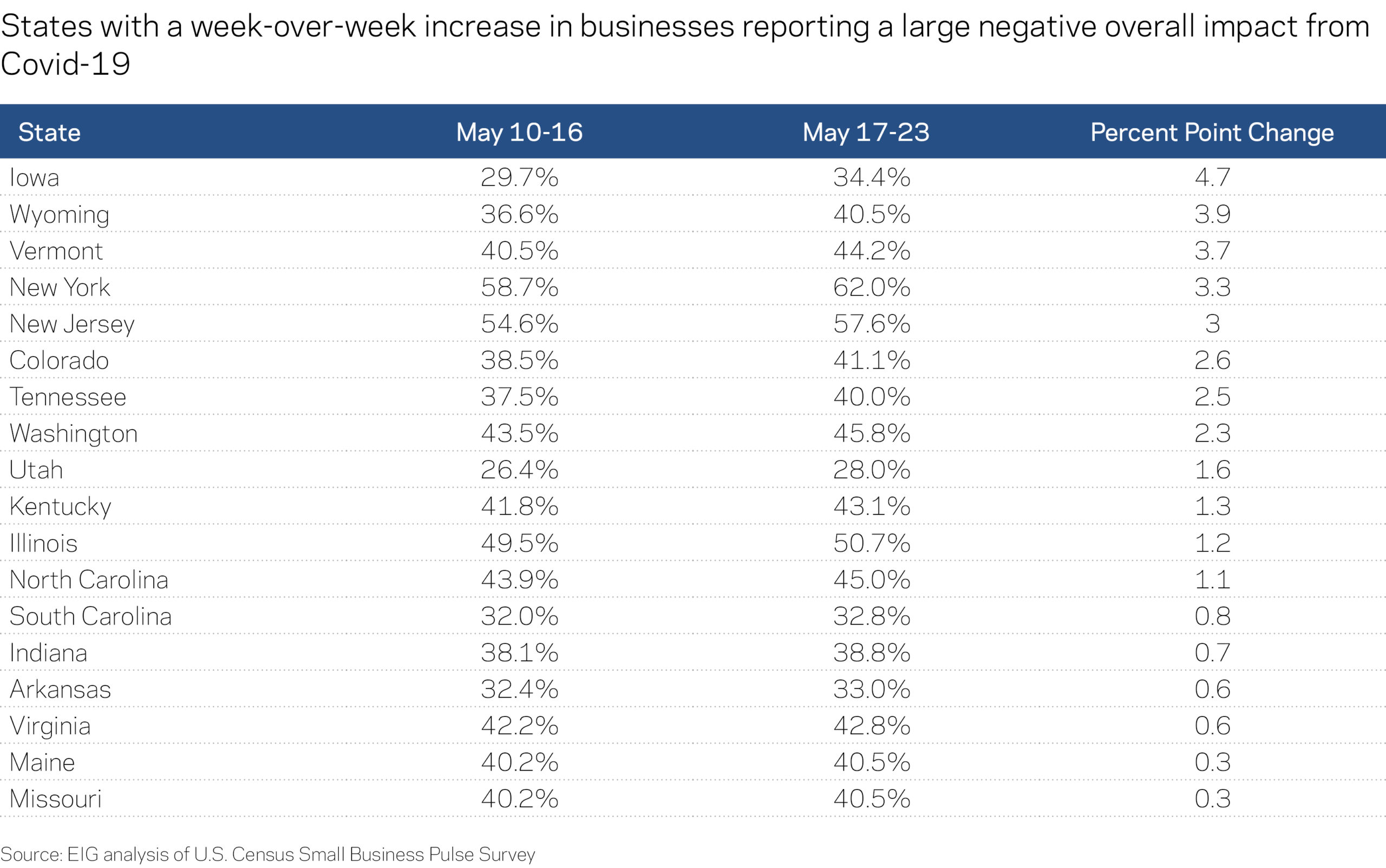

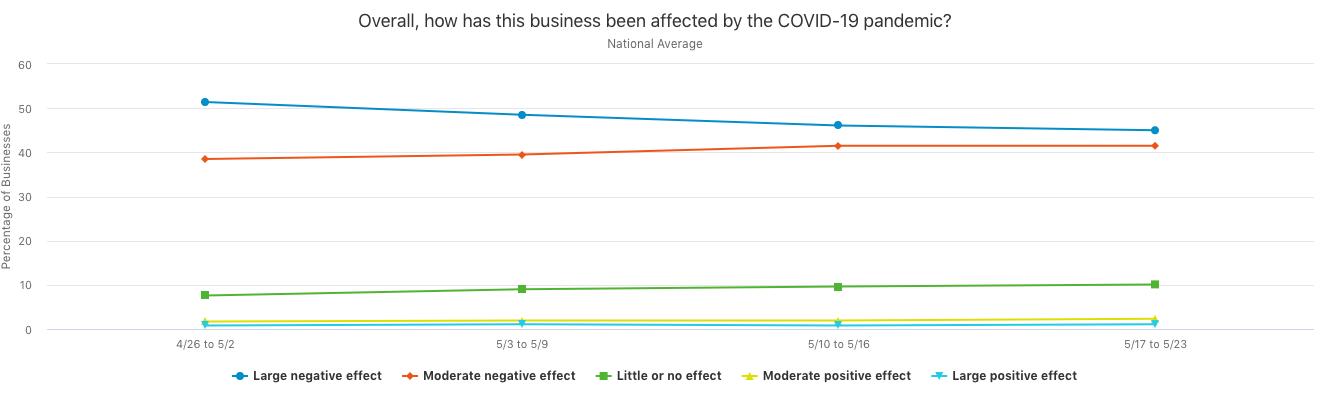

- The share of businesses reporting large negative impacts of the pandemic has actually fallen slightly each week at the national level, but results vary widely by state. Nationally, 45 percent of responding businesses reported a large negative impact of the crisis on their bottom-lines last week. Businesses in New York, New Jersey, and Michigan report the greatest harm. These states have been severely hit by the virus and put in place stringent lockdowns accordingly.

Economic conditions for small businesses seem to be worsening in 18 states, where more businesses reported strong negative impacts of the pandemic last week than over the week prior. These included pandemic hotspots, such as New York and New Jersey, as well as less afflicted states, such as Iowa and Colorado.

Economic conditions for small businesses seem to be worsening in 18 states, where more businesses reported strong negative impacts of the pandemic last week than over the week prior. These included pandemic hotspots, such as New York and New Jersey, as well as less afflicted states, such as Iowa and Colorado.