By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from February 22nd to March 7th.

Here are seven things we learned about the small business economy last week:

- In the last two weeks, the share of businesses expecting recovery to take longer than six months finally started to fall after hardly any movement for six consecutive months. In a sign that optimism may be finally reaching the small business community in the wake of stimulus and the acceleration of the vaccine rollout, the share of businesses expecting to need longer than six months to return to their normal level of operations ticked down and the share expecting a shorter recovery began to climb up. The share of small businesses expecting recovery to take longer than six months fell from 45.8% the week of February 15th to 41.6% the week of March 1st, the fastest two week improvement on record.

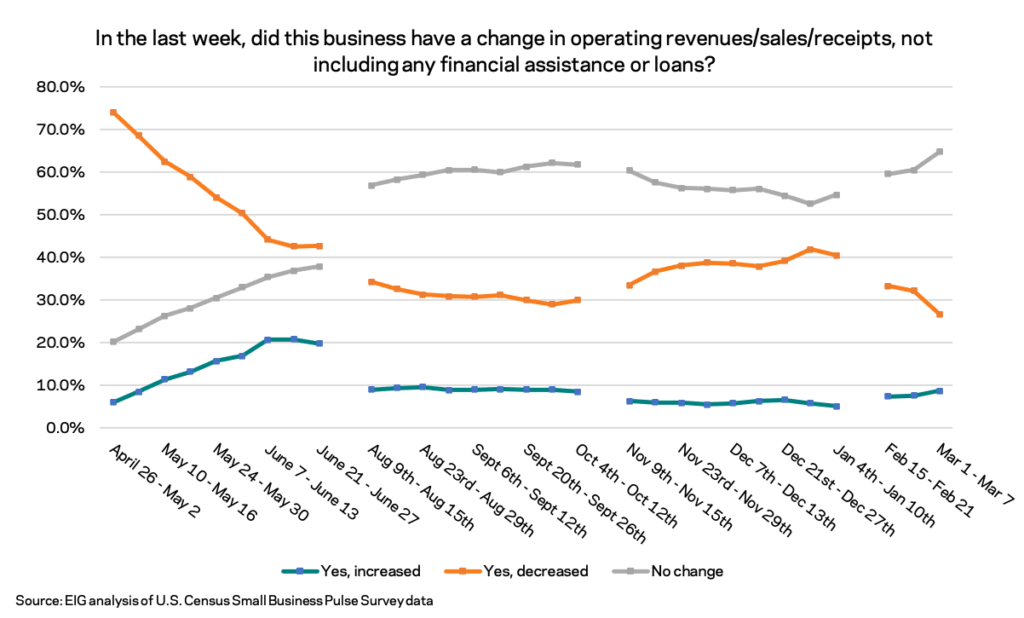

2. In the week of March 1st to March 7th the share of businesses reporting decreasing revenues dropped to its lowest point on record during the pandemic. Only 26.6 percent of businesses reported decreasing revenues during the week beginning March 1st, the lowest share recorded in the Small Business Pulse Data series, which reaches back to the end of April 2020. While the downtick is undoubtedly positive, the share of businesses reporting increasing revenues has not ticked up by the same margin. The downtick in the share of businesses reporting decreasing revenues thus likely implies stabilization rather than growth. Stabilization is a necessary step towards recovery, but to make up for the losses of the past year, a far larger share of businesses will likely need to increase revenues.

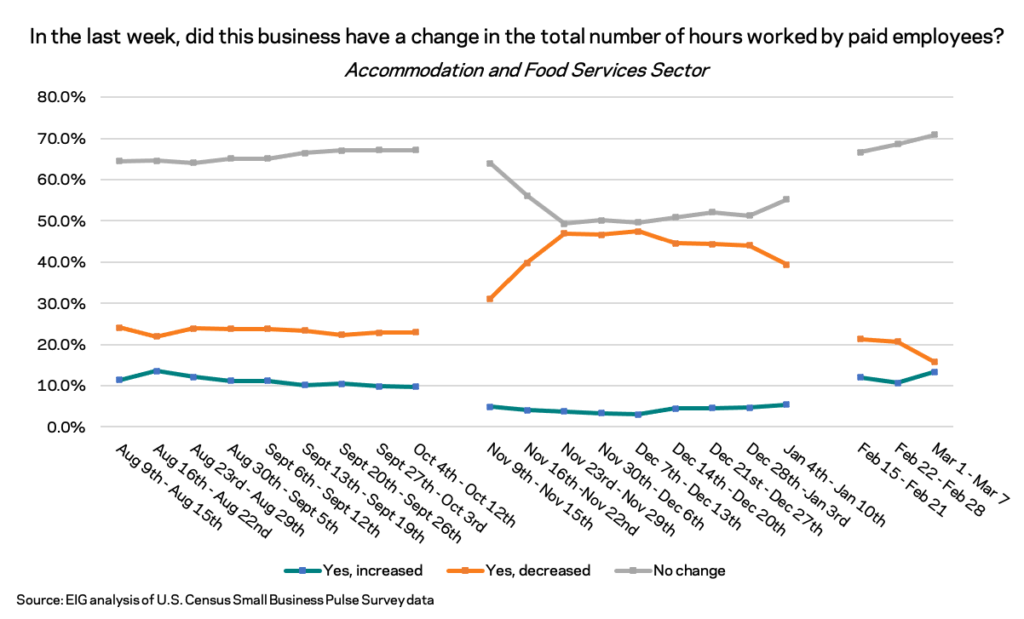

3. After being battered for months, the share of businesses in the accommodation and food services sector that reported cutting employee hours in a given week fell to its lowest point in the data series. Following several months in which over 40 percent of businesses in the sector cut employee hours, the share of businesses cutting employee hours in the accommodation and food services sector fell as the share adding hours ticked up slightly to nearly match it. The accommodation and food services sector actually led all sectors on the measure, recording the highest share of businesses adding employee hours the week of March 1st. While the share adding hours rose, the high point in the data series to date was recorded in June 2020 and the recent rebound has not yet matched it.

4. Nationally, 5.6 percent of businesses have decreased the amount of square footage they lease or rent but that varies by sector and metro area. In the San Francisco metro area, over 11 percent of all businesses have decreased the square footage they rent or lease and that figure is around 8 percent in the Los Angeles and New York metro areas. At least 10 percent of businesses in the information and education sectors have decreased the amount of square footage they lease or rent for operations.

5. Recovery expectations are worst along each of the coasts. While interior states may recover faster, the strength of the overall national recovery will likely be hobbled by the large lagging states. The 18 states with an above national average share of businesses expecting recovery to take longer than six months were responsible for 59.5 percent of national GDP in 2019.

6. As of last week, only 2.0 percent of businesses required employees to provide proof of vaccine before physically coming to work. Nationally, 8.1 percent of businesses required employees to test negative for COVID-19 before coming to work. Around 18 percent of businesses did not have employees coming into work at all in the last week. New data in the coming weeks will allow tracking of vaccine requirement changes as the share of workers coming to work in person increases, as well as the share of individuals receiving the vaccination.

7. The economic consequences of a harsh winter storm and power outages are apparent in heightened shares of businesses reporting decreasing revenues and cutting employee hours in Texas, Oklahoma, and Arkansas. The week of February 22nd to February 28th, 50.5 percent of businesses in Texas reported decreasing revenues and that share stood at 45.9 in Oklahoma and 42.8 percent in Arkansas. The region led the nation again the following week, with 35.3 percent of surveyed businesses in Texas reporting decreasing revenues that week. Over 30 percent of businesses in Oklahoma and Texas cut employee hours in the last week of February and while that share fell in the first week of March, the states in the region still sit among the worst off states on the measure. A small surge in domestic supplier delays at the national level in the last week of February may also have been related to the storm and its fallout.