By Kenan Fikri

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This write-up covers data from the week of May 24th to May 30th.

Here are five things we learned about the small business economy last week:

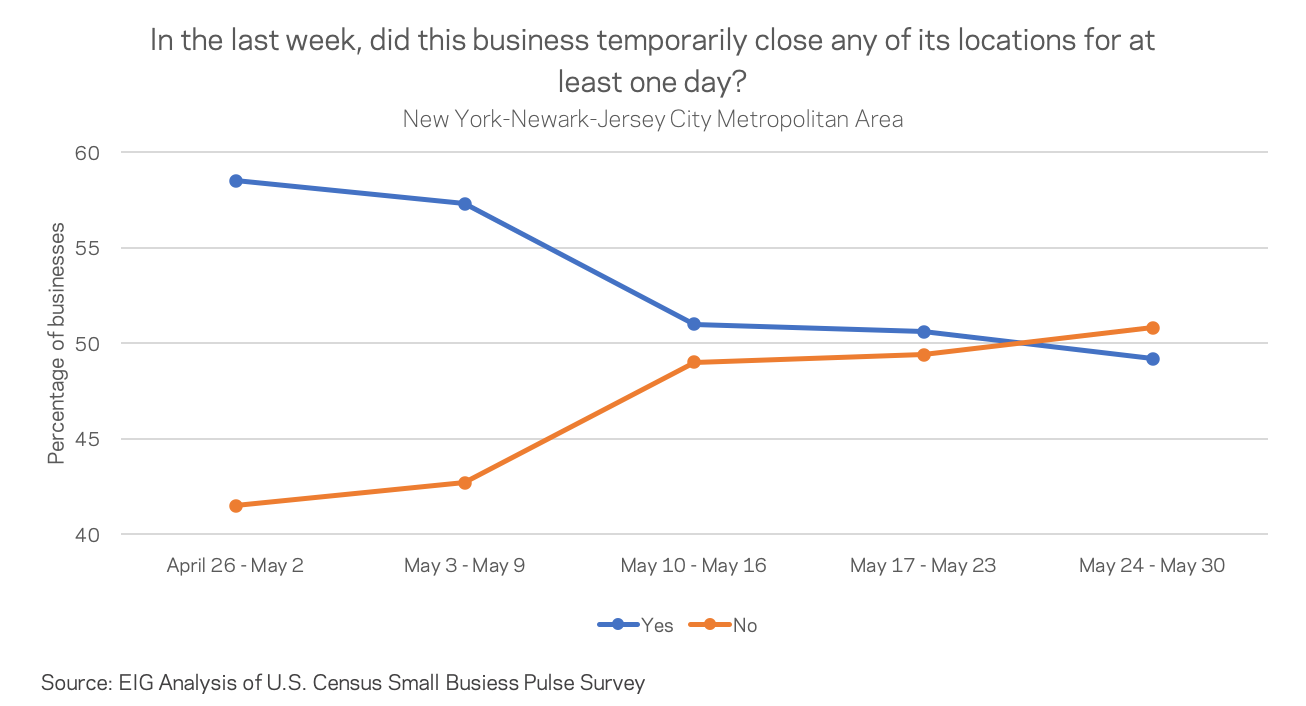

- The share of businesses shut down fell below 30 percent. The share of small businesses reporting at least one day of temporary closure in the past week dropped below 30 percent for the first time since April. This trend varied across the nation as states and metros reopened at different intervals and to different degrees. In North Dakota, 13 percent of small businesses were temporarily closed for at least one day last week, while in Georgia, an early reopener, 28 percent were. In New York City, the percentage of small businesses temporarily shut down dipped below 50 for the first time since April.

- Federal assistance has reached three-quarters of small businesses. 3 out of 4 small business respondents have received some kind of financial assistance from the federal government. The majority of this assistance has come from the Paycheck Protection Program, but businesses have also received support in the form of Economic Injury Disaster Loans, SBA Loan Forgiveness, and other federal programs. However, federal programs are not the only support that small businesses are turning to in this time of crisis. The survey shows that 11 percent of business owners have at least to some degree self-financed their survival while 4 percent have turned to family and friends. Only 18 percent of respondents have not requested financial assistance from any source since mid-March.

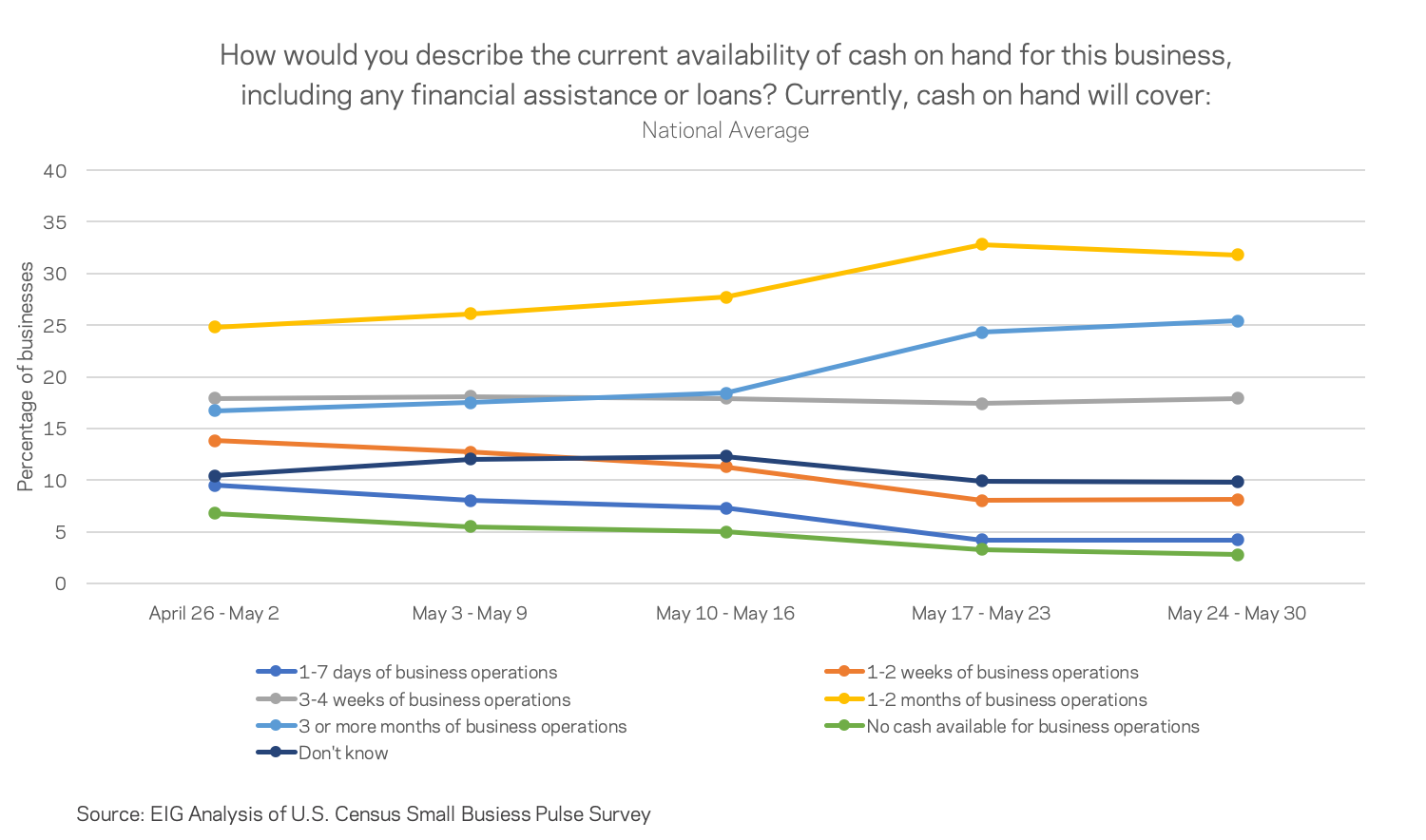

- In a sign of stabilization, a clear majority of small businesses now have at least one month’s cash on hand. The percentage of small businesses with cash on hand to survive at least 3 months of operations has increased almost nine percentage points over the past five weeks, while the share of small businesses reporting either no cash or 1-7 business days of operation has steadily decreased. These changes remain relatively gradual over time.

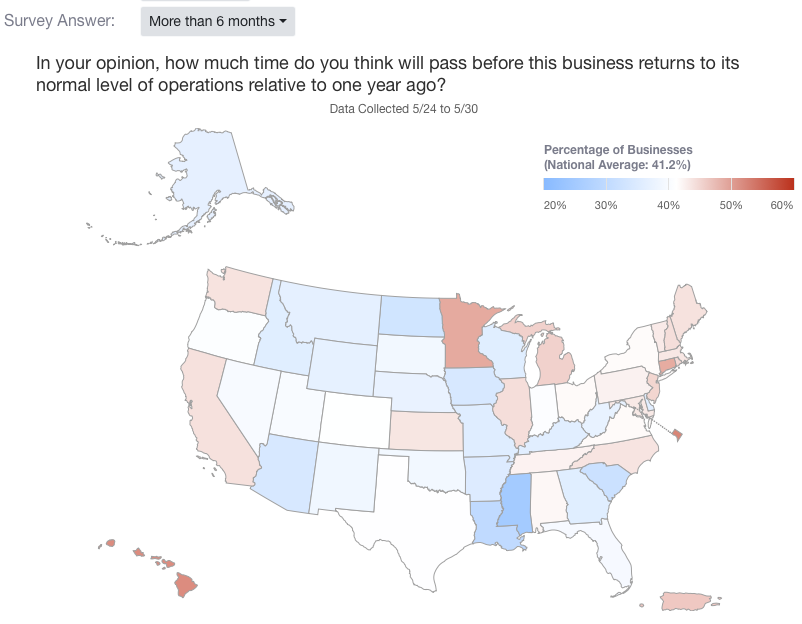

- Businesses see a long, slow recovery ahead. Seventy-eight percent of businesses think it will take at least two months for them to resume normal operations, and 41 percent think it will take six or more months. On the extremes, roughly one out of every 10 small businesses report no impact from the crisis, a figure mirrored by another one in 10 that believe their businesses will never fully recover.

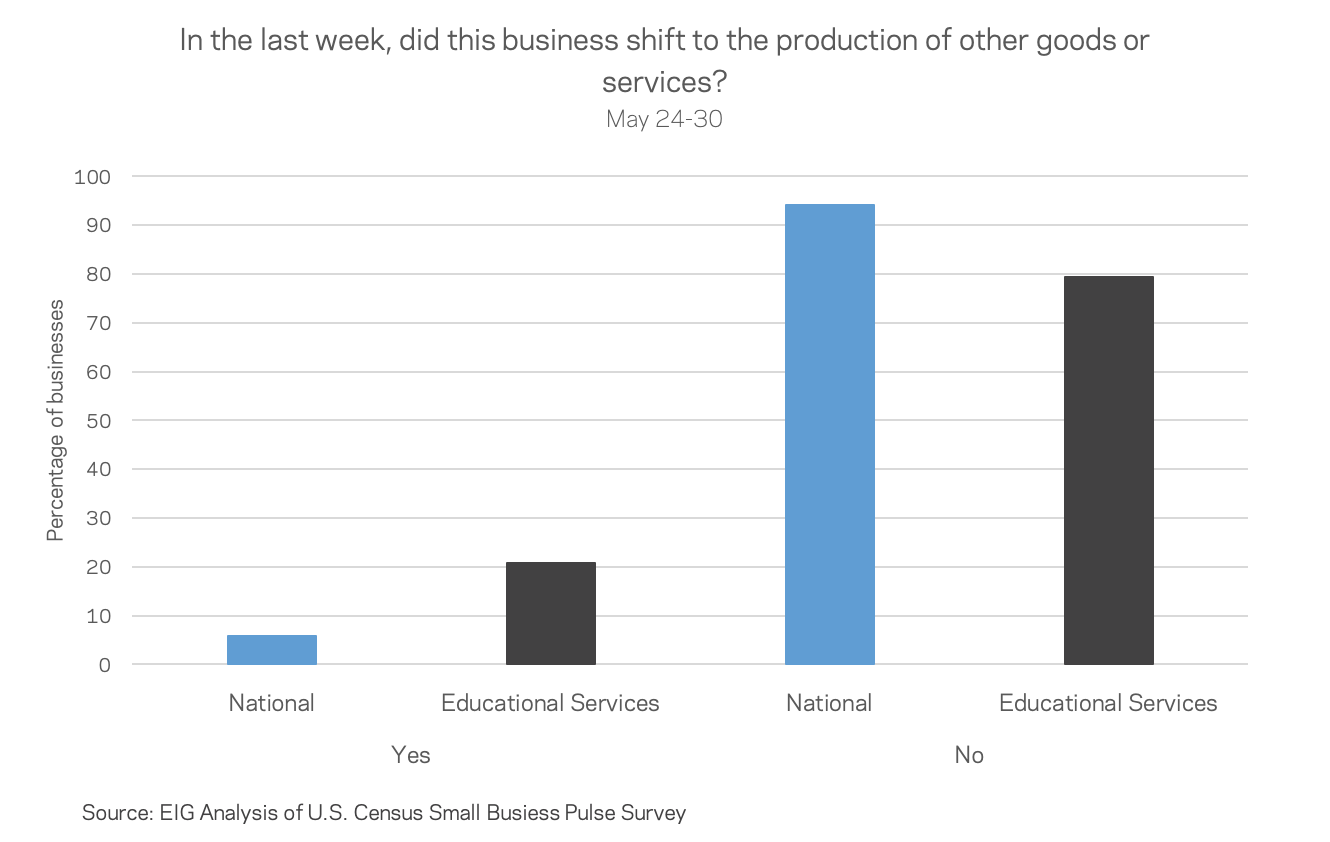

- Just over one in 20 small businesses tried something new this week. News coverage of the COVID-19 crisis has highlighted adaptation across industries throughout the pandemic. In the past week, 6 percent of small businesses seem to have been engaged in such experimentation, reporting that they shifted to provide other goods or services in the past week. This is down slightly from 7 percent in earlier weeks. The education services sector leads in experimentation by a dramatic margin—over 20 percent of firms report shifting production of their goods and services in just the past seven days.