By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of June 14th to June 20th.

Here are five things we learned about the small business economy last week:

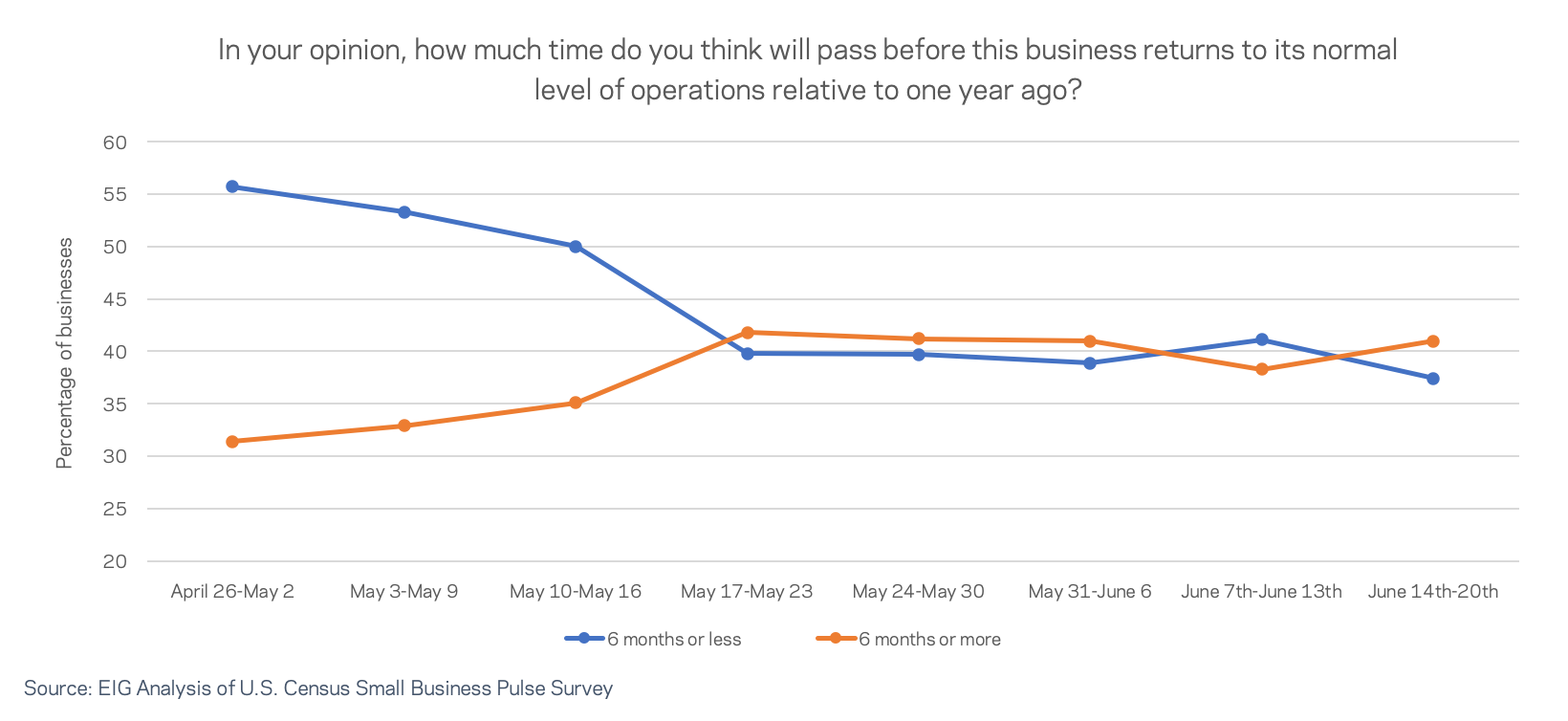

- Small business outlooks took a turn for the worse last week. The number of businesses expecting the return to normal operations to take longer than six months jumped by almost three percentage points last week. Reversing the prior week’s small positive turn in recovery outlook, the percentage expecting recovery to take six months or longer is now approaching the highs reached in mid-May. With news breaking yesterday of Texas’ statewide pause in reopening and the virus continuing to spike in regions across the country, these numbers may continue to worsen as companies suffer through a second wave of the closures and current support streams time out.

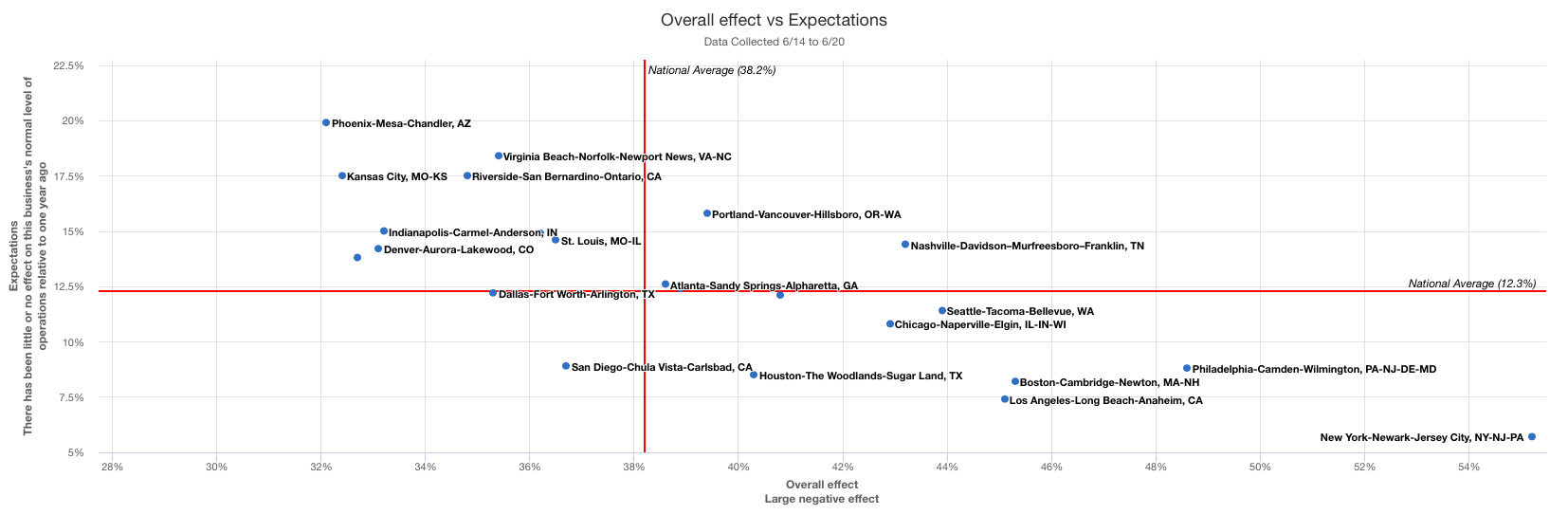

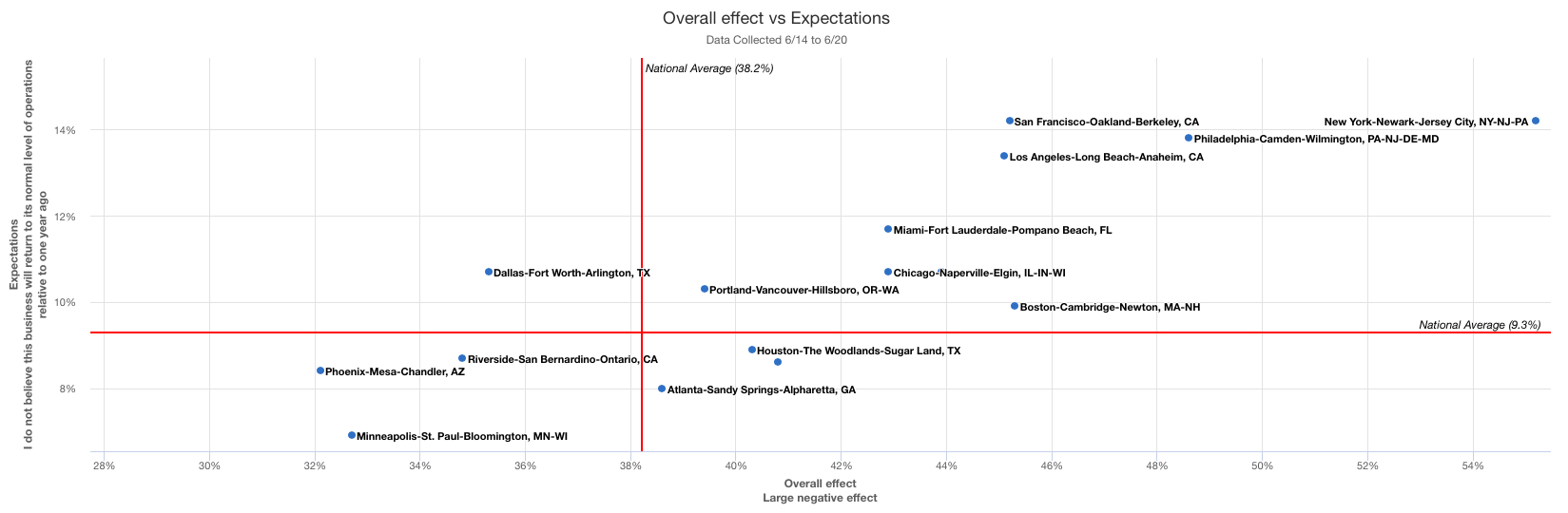

- Sun Belt optimism may be challenged in the weeks ahead. The share of businesses indicating a large negative impact of the crisis on their operations only correlates weakly with the percentage of businesses indicating a more pessimistic outlook over the long term. Nevertheless, several interesting stories stand out. First, up through last week, small businesses in Phoenix—the country’s new epicenter of the pandemic—were still some of the most optimistic in the country. Phoenix businesses were one of the least likely to say they fear they will never recover, the second least likely to expect the recovery to take as long as six months, and the most likely to say they have experienced no negative effects. By contrast, businesses in large, dense metro areas such as New York, San Francisco, Los Angeles, and Philadelphia were most pessimistic about their long-term recovery prospects.

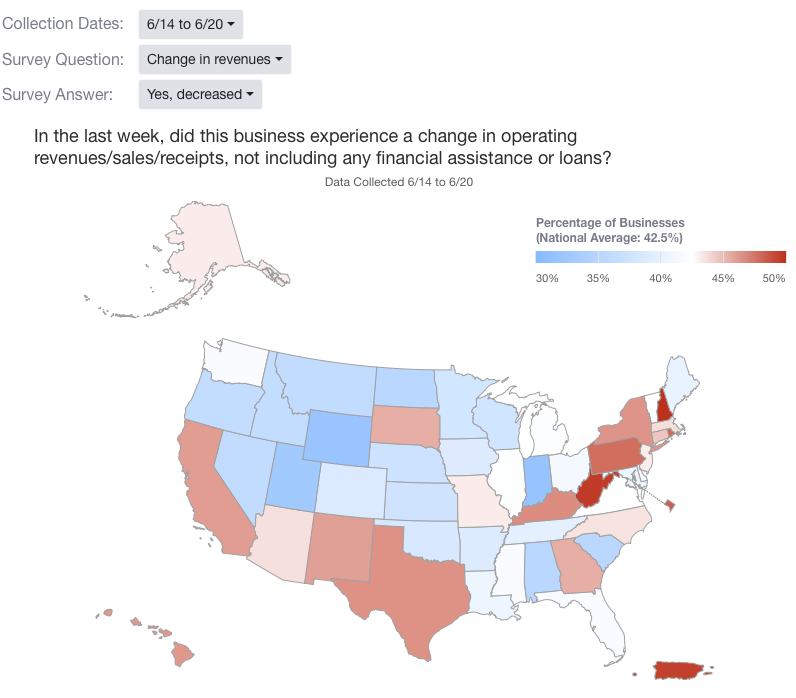

- While many commentators are focused on the recovery, 42.5 percent of businesses nationwide continued to see week-on-week decreases in revenue. Nationally, just over four out of ten businesses surveyed saw decreases in revenues during the week of June 14th. The brunt of falling sales appears to have been felt most acutely in the Southwest and the Northeast, while the Midwest and Mountain West generally appeared to be doing better. Indiana, Wyoming, and Utah saw the lowest percentages of businesses report a drop in revenue while New Hampshire, West Virginia, and Puerto Rico saw the highest. In Arizona and Texas, where the virus is gaining steam, 44 and 46 percent of small businesses reported revenue declines.

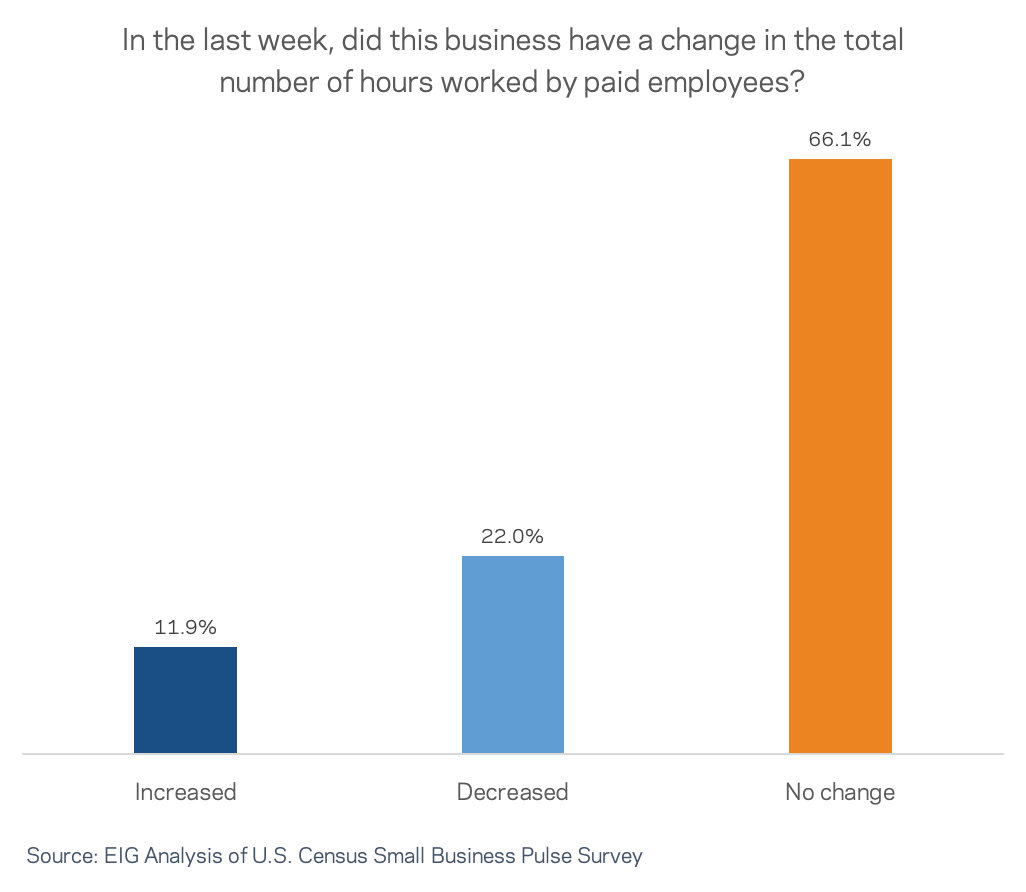

- Employers are still reducing employee hours at a greater rate than they are adding them. More than three months into the pandemic, only 12 percent of firms reported scaling up employee hours last week compared to 22 percent of firms who reported cutting them further. The percentage of firms reducing employee hours peaked at 51 percent in the final week of April. The majority of small businesses now report that hours have stabilized, often at reduced levels. Only a small fraction of employers are actually increasing hours; since April, no more than 13 percent of businesses have reported adding employee hours in any given week.

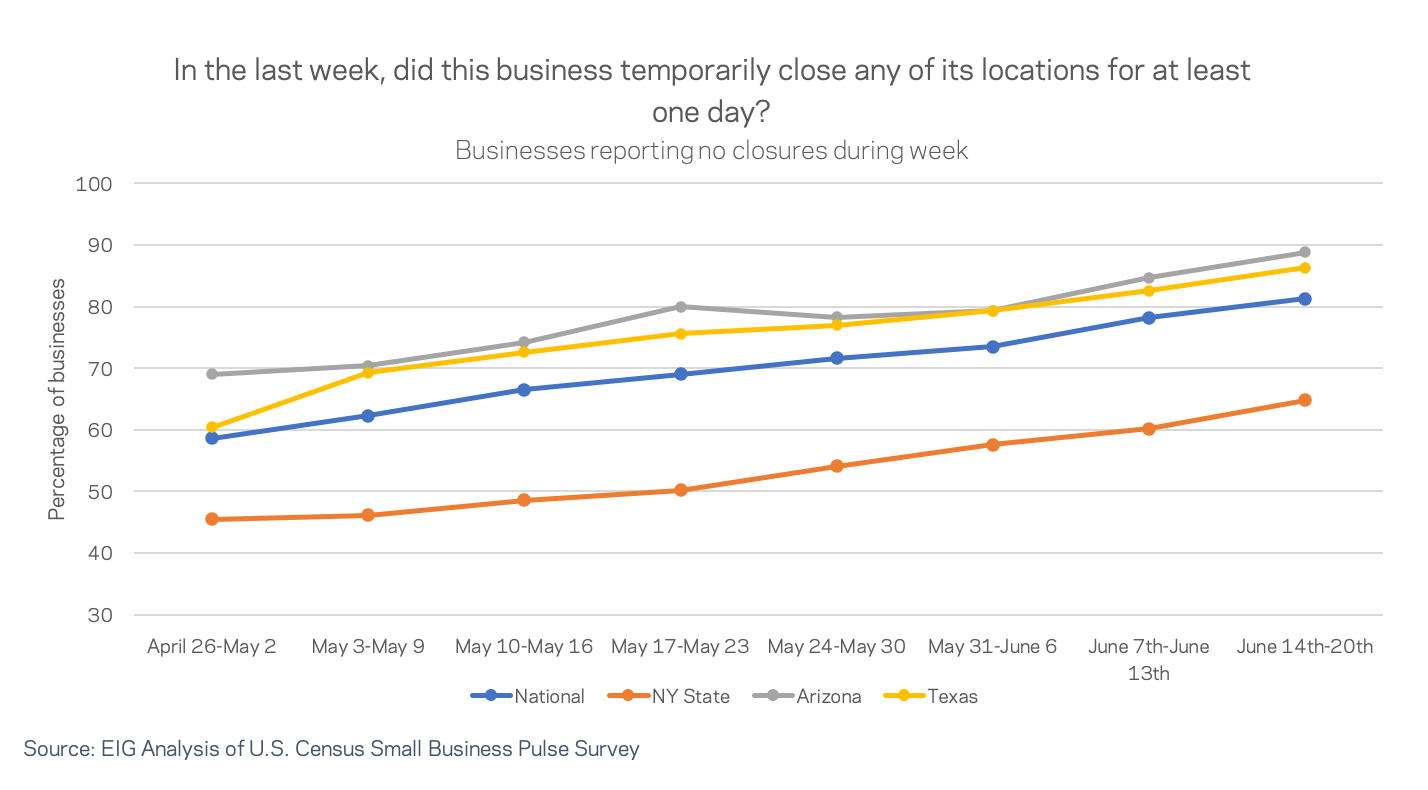

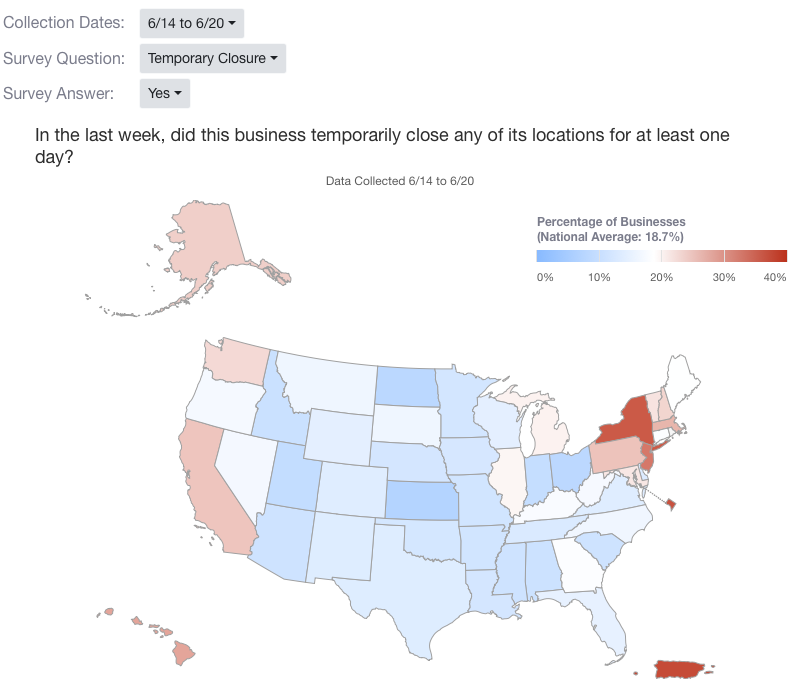

- Four out of five small businesses are now open, and the national trend towards reopening continues. Despite rising case numbers, states, sectors, and communities continued to reopen. Last week the share of all responding small businesses that reported no shutdowns over the prior seven days rose to 81 percent. New York and New Jersey still stand out from other states, with over 30 percent of respondents in both states still reporting temporary closures the week of June 14th. Only Puerto Rico and DC had more closures (37 percent).