By Daniel Newman and Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from June 14th to 20th.

Here are five things we learned about the small business economy last week:

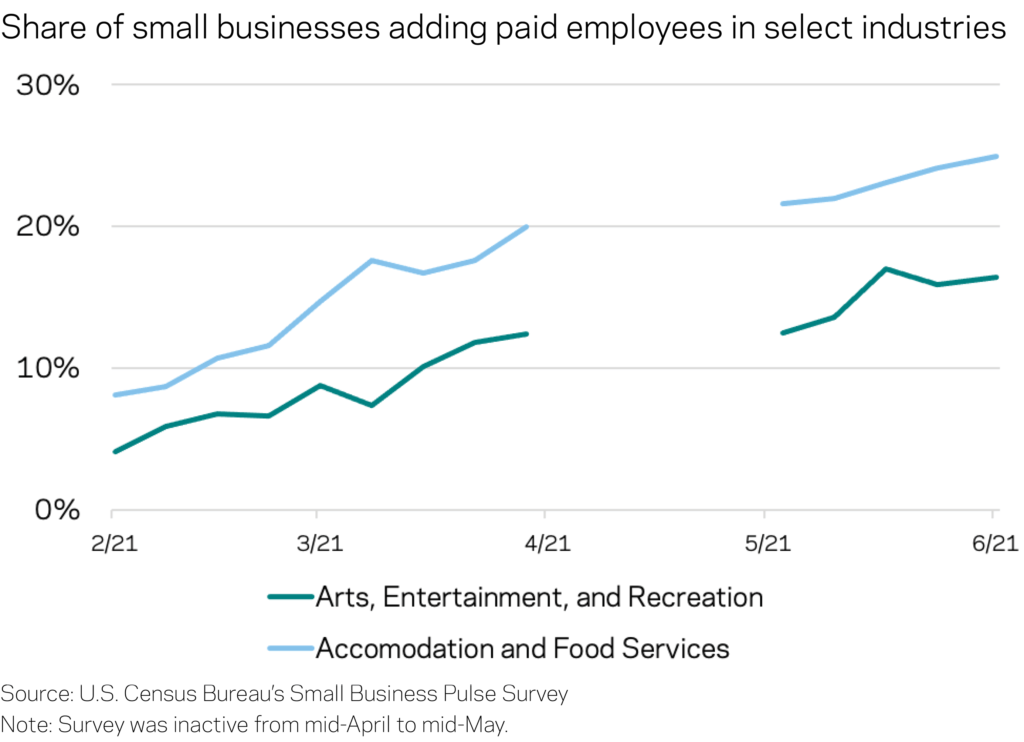

- The share of small businesses nationally that added new employees reached 10.8 percent—a highpoint in the survey. The accommodation and food services sector led the pack, as one-quarter of those small businesses expanded their payrolls over the past week. The arts, entertainment, and recreation sector also continued to see a strong uptick in hiring, with 16.4 percent adding paid workers. Both industry sectors have steadily increased their hiring in recent months.

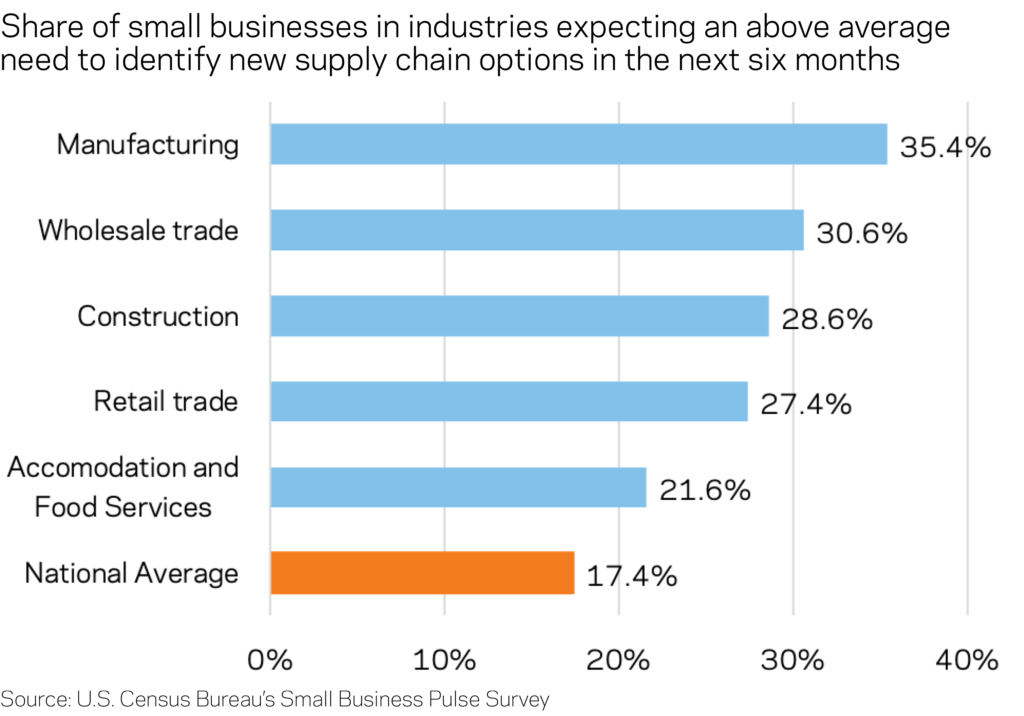

- Supply chain pressures are another major concern that has pushed many small businesses to seek out new ways to sustain their operations. Throughout June, domestic and foreign supplier delays remained elevated relative to prior months. Just under 37 percent of small businesses experienced domestic supplier delays in the past week, while 15.1 percent experienced similar delays from foreign suppliers. These levels are near or at peak for the survey history, and as a consequence, 17.4 percent of small businesses nationwide expect to identify new supply chain options in the coming months, just slightly off from the highpoint of 17.5 percent reported in the prior week’s survey. Some industry sectors have been disproportionately affected by these supply chain delays. More than one in three small businesses in manufacturing expect to reconfigure supply chains due to disruptions. Meanwhile more than one in four businesses in the wholesale trade, retail trade, as well as accommodation and food services sectors reported a similar worry for the coming months.

- While a majority of small businesses (68 percent) reported no change in revenues relative to the prior week, 13.2 percent experienced an increase and 18.7 percent a decrease, extending the general trend since late March. Shifts in consumer behavior are benefiting some businesses and regions of the country more than others, rather than boosting revenues across the board. With pandemic-related restrictions largely coming to an end in many states over the course of June, many firms in highly impacted sectors reported an increase in receipts, including accommodation and food services (32.5 percent), arts and entertainment (19.9 percent), educational services (16.5 percent), and retail trade (15.3 percent). Across most states in the Northeast and Mid-Atlantic, the percentage of small businesses reporting a bump in revenues from the prior week was above the national average—a promising sign that the recovery in these regions is gaining steam.

- Just 13.8 percent of small businesses anticipate a need for financial support in the next six months—a low point in the survey—and a steep drop from the start of the year when one-third of the sector was expecting to require future aid. Even as most continue to anticipate a lower need for financial assistance or additional capital in the coming months, other worries have become more acute. One of the biggest concerns over the next six months will be the need to identify and hire new employees. Nationally, the share of small businesses that anticipate needing to ramp up hiring has held steady around 36 percent since early June.

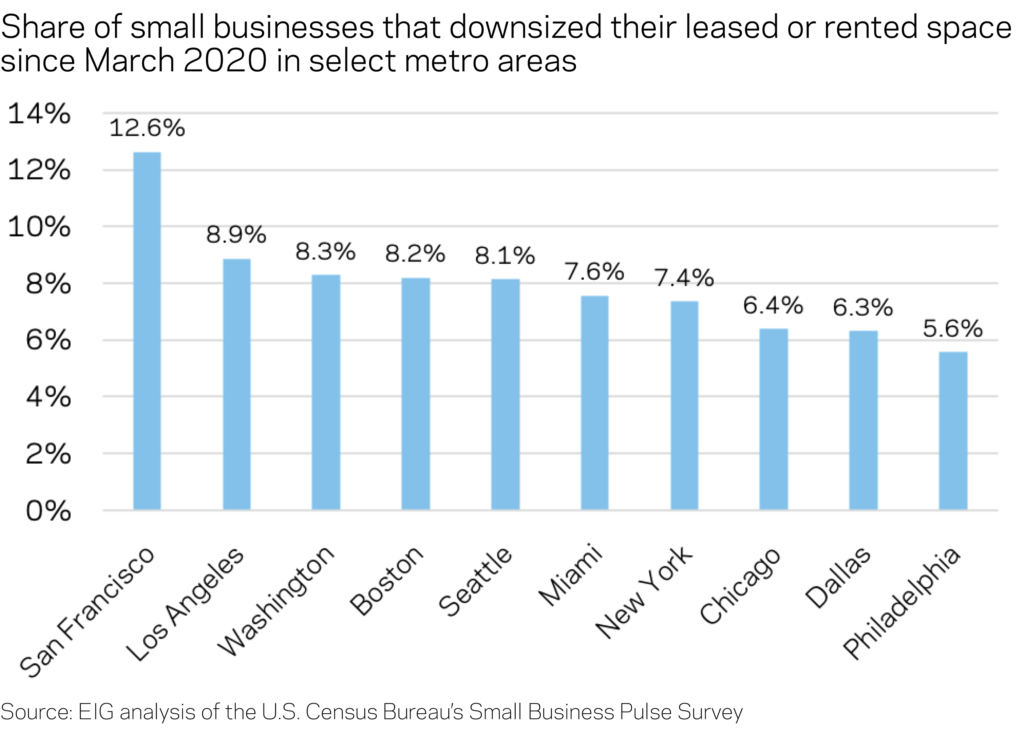

- As many places begin to roll out their plans for returning to the office, small businesses in some major metro areas are more likely to have downsized their real estate footprint than others, particularly in cities that tend to have a higher prevalence of professional and management occupations. The San Francisco metro area predictably led the pack for the share of firms that decreased the amount of square footage leased or rented for operations since the pandemic began, based on the most recent three-week average of survey results. With the rise of remote work particularly shaking up the tech industry, 12.6 percent of small businesses in the Bay Area reported downsizing their real estate footprint since last March. Meanwhile, just 5.6 percent in the Philadelphia area reported doing the same.