By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from May 24th to June 6th.

Here are six things we learned about the small business economy last week:

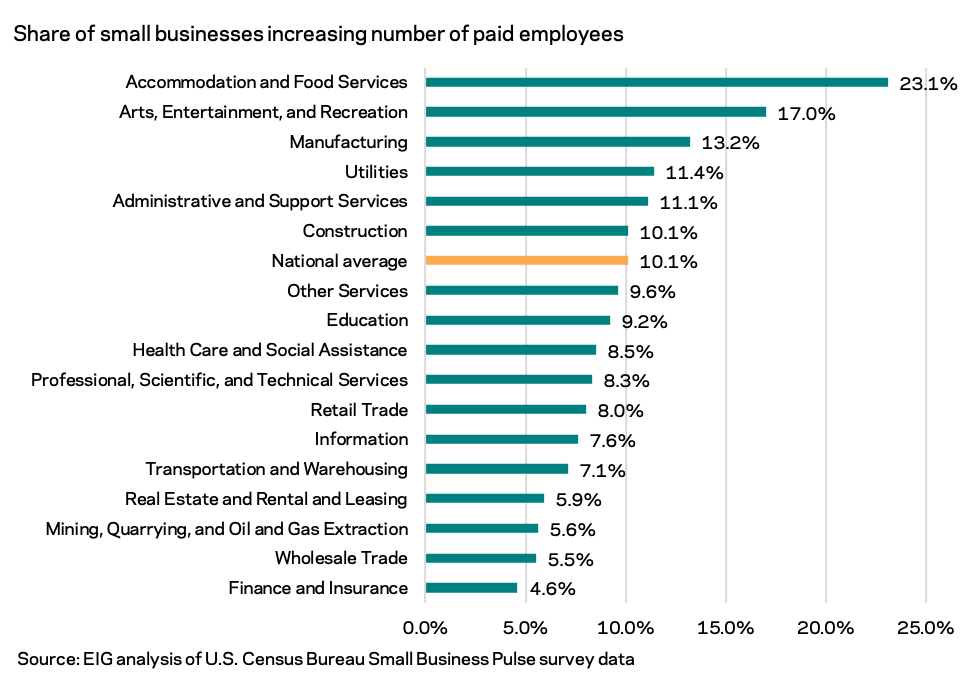

- More than one in five small businesses (23.1 percent) in the accommodation and food services sector increased the number of paid employees on staff last week. Nationally, 10.1 percent of small businesses increased the number of paid employees on staff. The hiring surge was led by six sectors: accommodation and food services, arts, entertainment, and recreation, manufacturing, administrative and support services, construction and utilities all beat the national numbers. The same cohort of sectors, along with education, were also those reporting the highest share of businesses increasing hours.

- DC led the nation with the highest average share of small businesses adding employees in the past three weeks, with Alaska, Colorado, New Hampshire, and Wisconsin just behind. While a collage of states from across the country are in the top spots in terms of the average share of businesses reporting adding an employee in the past three weeks, the broader tier of leaders is packed with northeastern states such as Massachusetts, Pennsylvania, and Connecticut. The hiring bump in the northeast may be a sign that the recovery is finally taking hold in some of the nation’s states that were hit hardest and longest by the economic side effects of the pandemic. A slate of states are scheduled to end federal unemployment benefits in the coming weeks in an effort to kickstart hiring. This average sets a baseline to compare against after those policy changes come into effect.

A cohort of smaller population states show some evidence of even greater shares hiring but fewer available data points and larger margins of error in those states caution against any conclusions without further data. That group of states includes South Dakota, Hawaii, and Delaware.

- Just over half of the small businesses that usually have business travel expenditures are planning to get back on the road in the next six months. In total, 35.3 percent of small businesses plan to incur travel expenses in the next six months, just over half of the roughly 70 percent of businesses that indicate they usually would have had such expenditures during the period. In two sectors, more than half of all surveyed small businesses expect to have travel expenses in the next six months: wholesale trade and professional, scientific, and technical services.

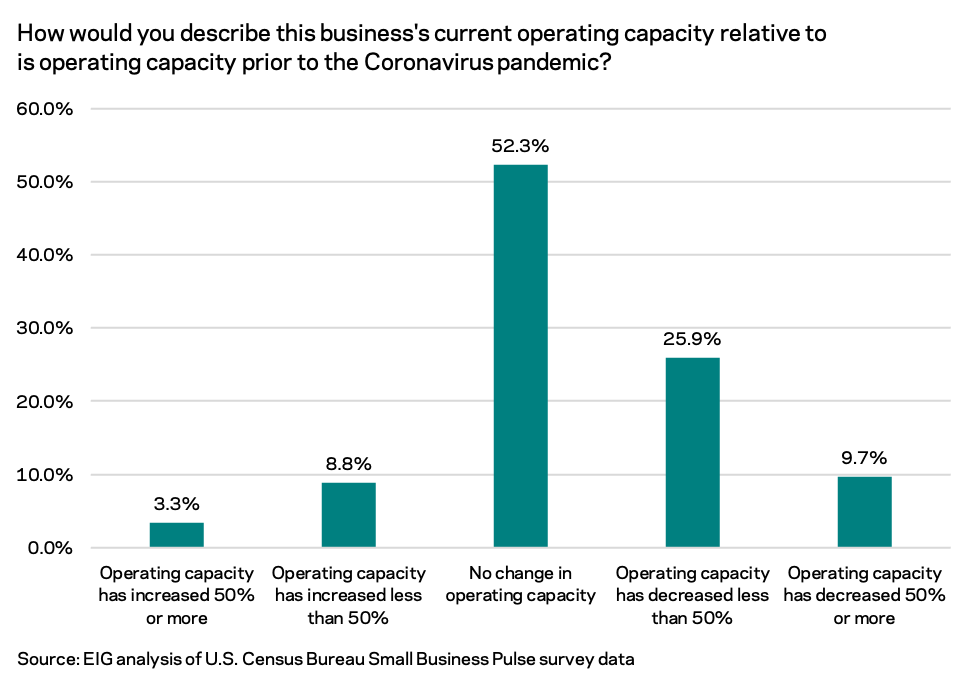

- Despite reported hiring shortages, a solid majority (64.4 percent) of surveyed small businesses are operating at or above their pre-pandemic capacity. The slow drift back to business as usual has continued over the last two weeks, with the total share of firms reporting a decrease in capacity relative to prior to the COVID pandemic meandering downwards and the share reporting increases in capacity inching upwards. While this is a positive sign, the ability to handle business is not the same thing as actually experiencing that level of business. Despite the solid majority with the capacity to operate at pre-pandemic levels, only 35.6 percent of surveyed small businesses actually report operating at their pre-pandemic normal level of operations.

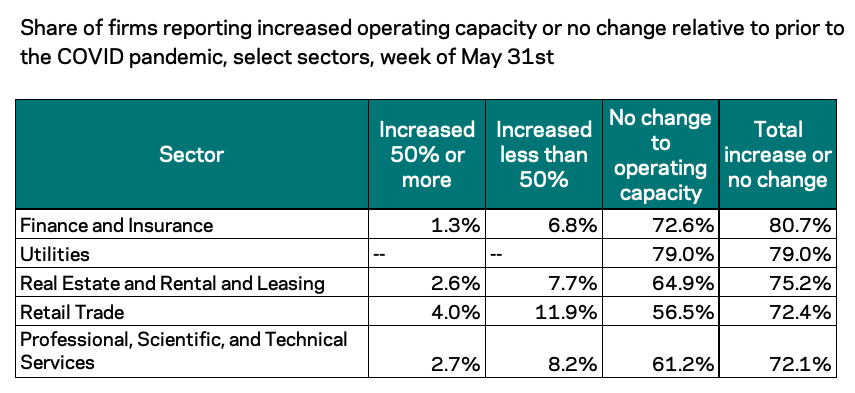

- White collar sectors such as finance, real estate, and professional services are largely back to business as usual in terms of capacity. Across a cohort of white collar sectors that were uniquely poised to weather the pandemic thanks in part to compatibility with remote work more than 70 percent of small businesses were operating at or above their pre-pandemic capacity. These sectors had some of the highest shares of businesses reporting little to no effect of the pandemic on their level of operations as well as some of the highest shares reporting a full return to normal operations after a decline. The recession-resilient utilities sector also falls into this top tier.

- Over half of all small businesses in the manufacturing, construction and retail trade sectors are reporting domestic supplier delays. As supply chain delays have come into focus with the national press, small businesses have been feeling the crunch in real time. Over 50 percent of surveyed small businesses in the manufacturing, construction, and retail trade sectors experienced domestic supplier delays the week of May 31st. The wholesale trade sector was not far behind at 49.2 percent of surveyed businesses. A significantly smaller share of businesses report foreign supplier delays across all sectors. Recent action by the Biden administration has taken aim at international supply delays which are likely linked to some of the domestic supplier delays hitting small businesses. More broadly, the delays indicate that there is a general gap domestically between the supply for intermediate goods and the booming demand for them as the summer begins. Nationally, 16.6 percent of small businesses expect to need to identify new supply chain options in the next six months.