By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of May 31st to June 6th.

Here are five things we learned about the small business economy last week:

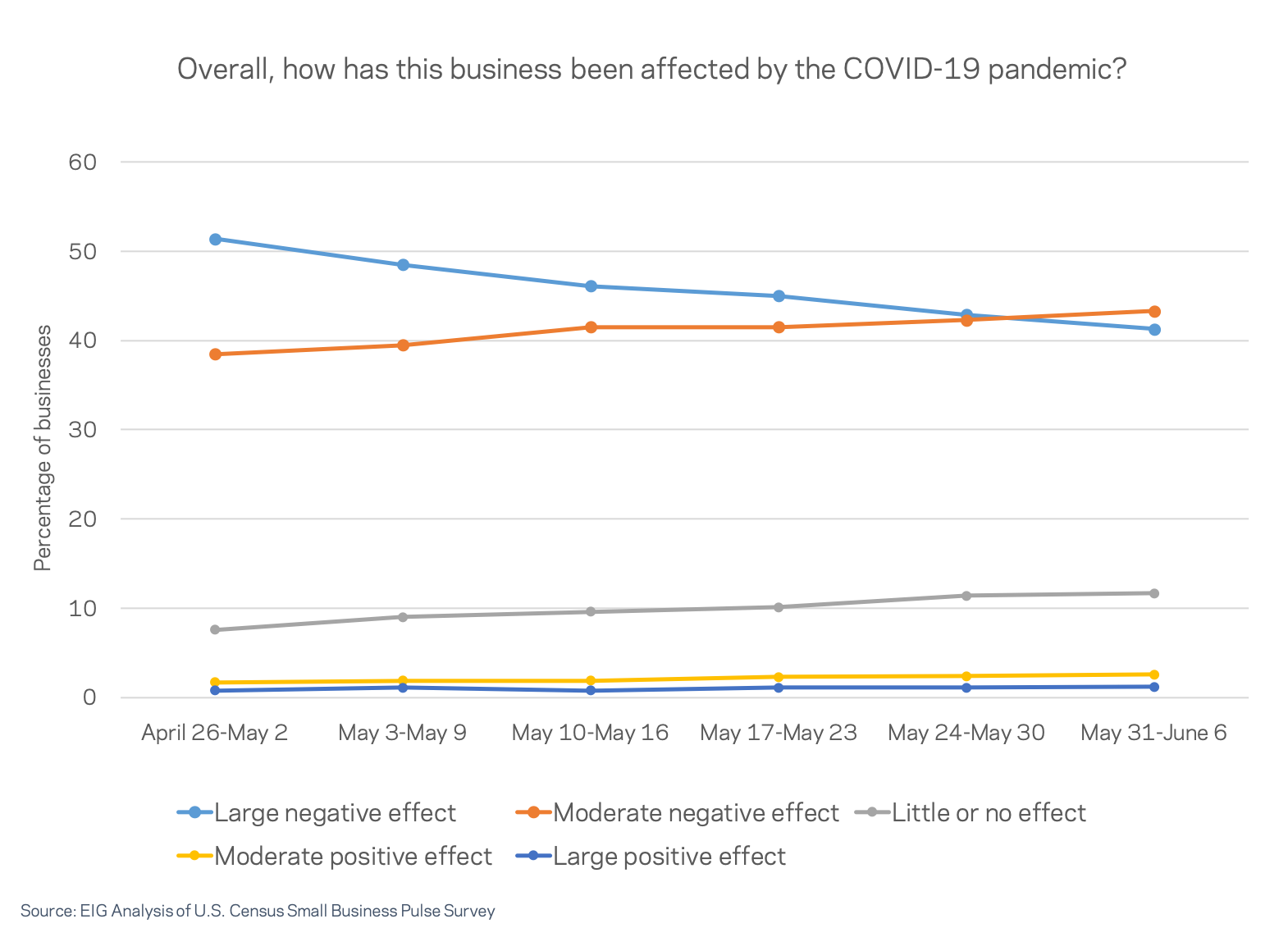

- Small businesses are growing slightly less negative about the economic impact of the COVID-19 crisis. For the first time since April, more companies report a “moderate negative effect” of the COVID-19 pandemic as opposed to a “large negative effect.” This shift in perspectives likely stems from multiple factors, including gradual reopenings, the large infusion of individual and small business relief flowing into the economy, and natural adjustment to a new normal. Sentiment may easily deteriorate again if a second wave of the virus materializes or the recovery proves more protracted than expected.

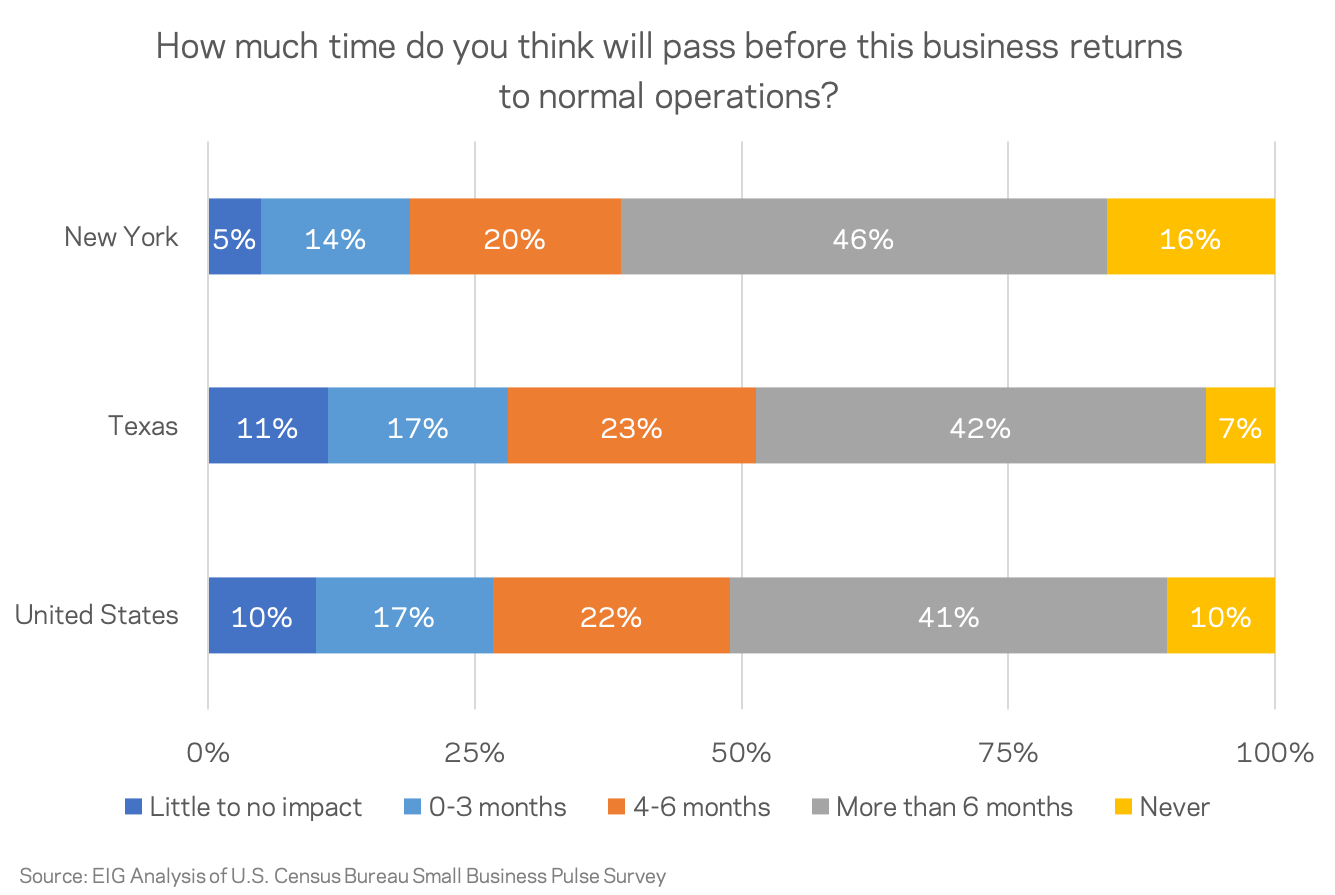

- NY businesses are signaling a slow and only partial rebound. New York remains the epicenter of the pandemic in the United States, but with case numbers rising in other parts of the country, its experience may foreshadow what lies in store elsewhere. Small businesses in New York state are among the most likely to believe it will take at least six months for operations to return to normal levels (46 percent versus 41 percent nationally) and the most likely among large states to accept that business may never return to pre-COVID levels (16 percent versus 10 percent nationally). By contrast, only 7 percent of respondents in Texas yet believe their businesses may never recover to pre-pandemic levels.

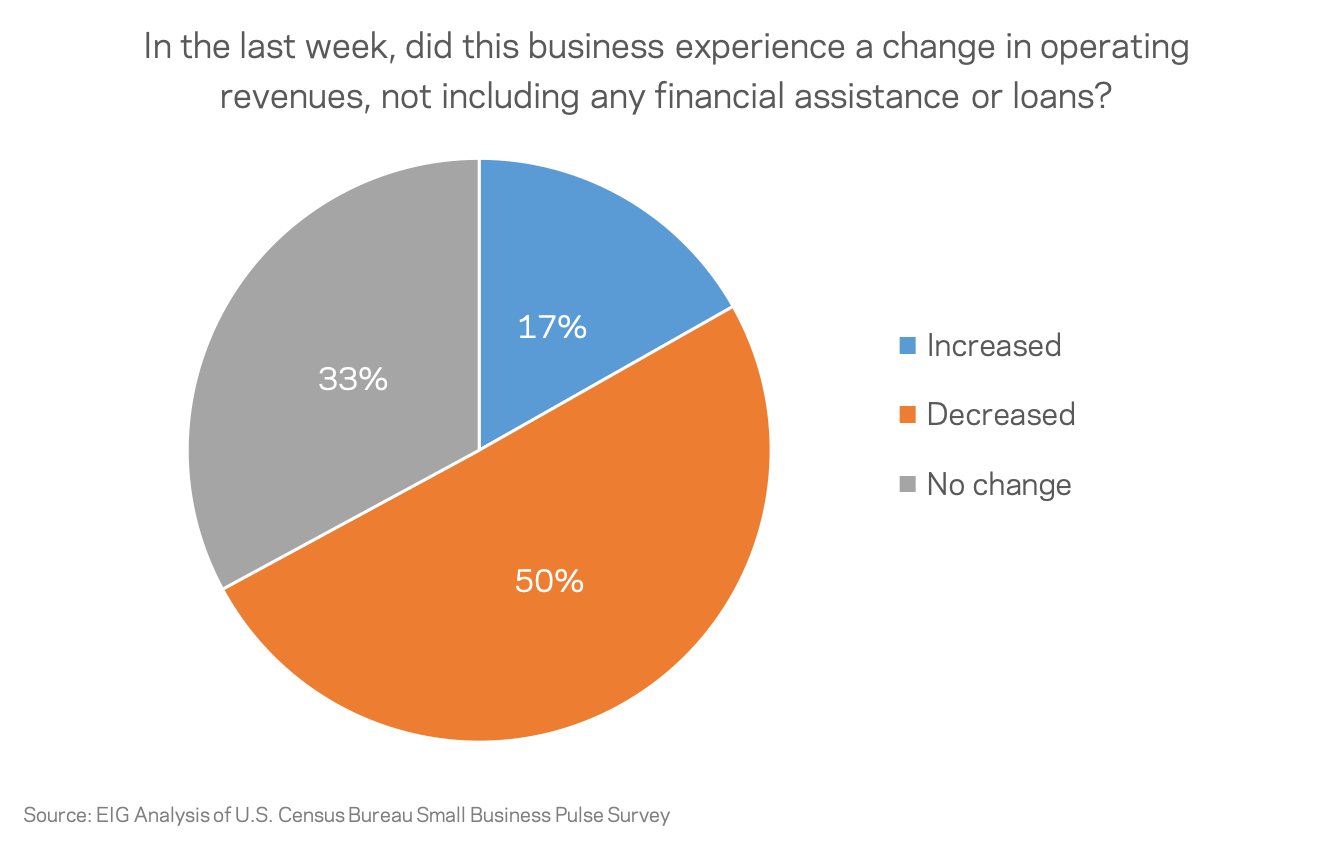

- Revenues are still falling for more than half of small businesses. The number of businesses reporting a decrease in operating revenues over the past week remains just above 50 percent, as it has for over five weeks running. This figure stands in contrast to reports of consumer spending ramping up significantly in May and June. Nevertheless, only 17 percent of small businesses reported an increase in revenues last week. It seems the crisis is still compounding its impact on many small businesses, and that they may not be capturing a large share of the consumption rebound.

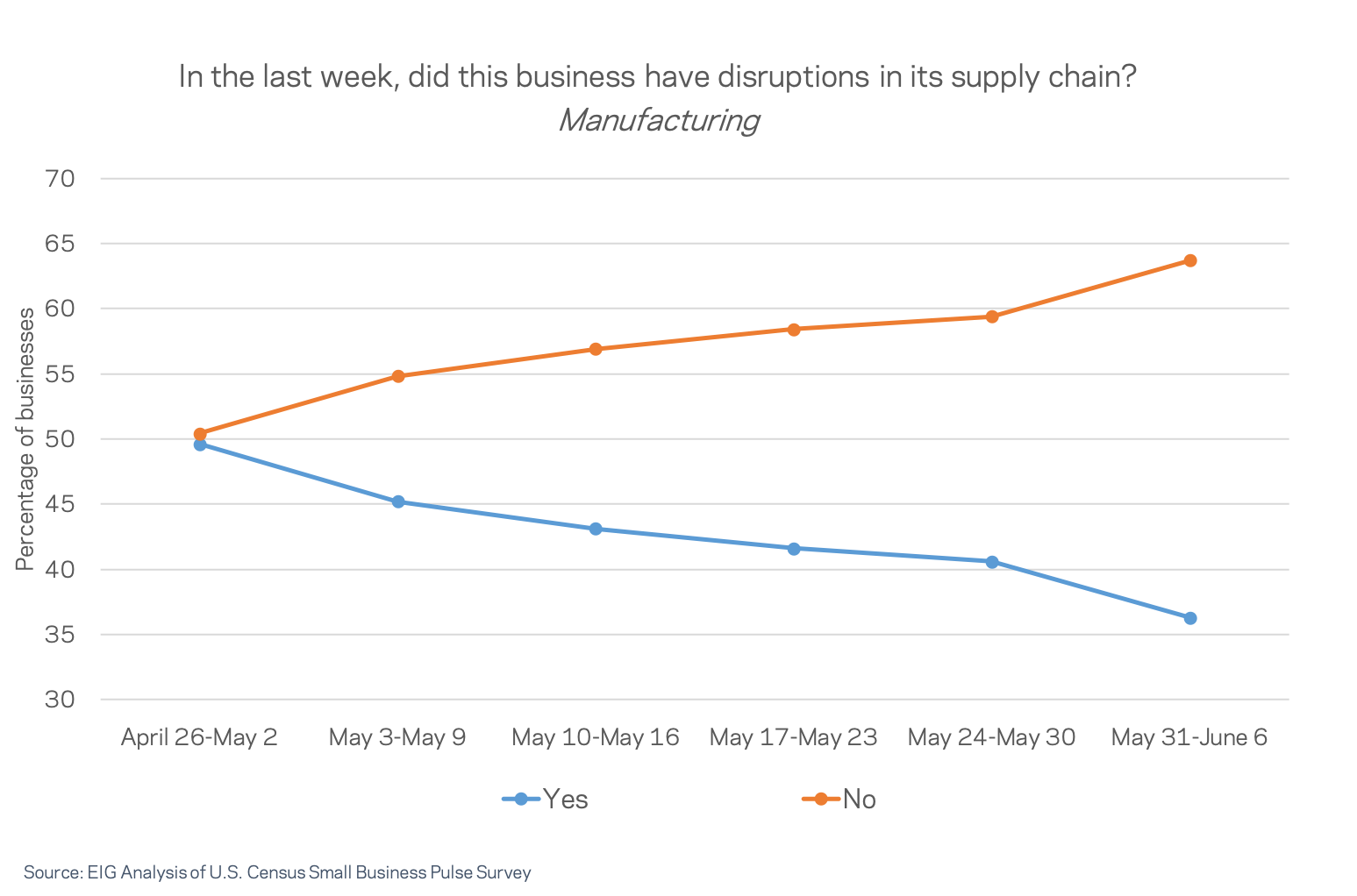

- The first week of June saw the most significant improvements in manufacturing sector supply chains since early May. Among small manufacturers, 4 percent fewer companies reported disruptions in their supply chains last week compared to the week prior. In late April, half of manufacturing firms reported supply chain disruptions; now 36 percent do, a 14 percentage point fall.

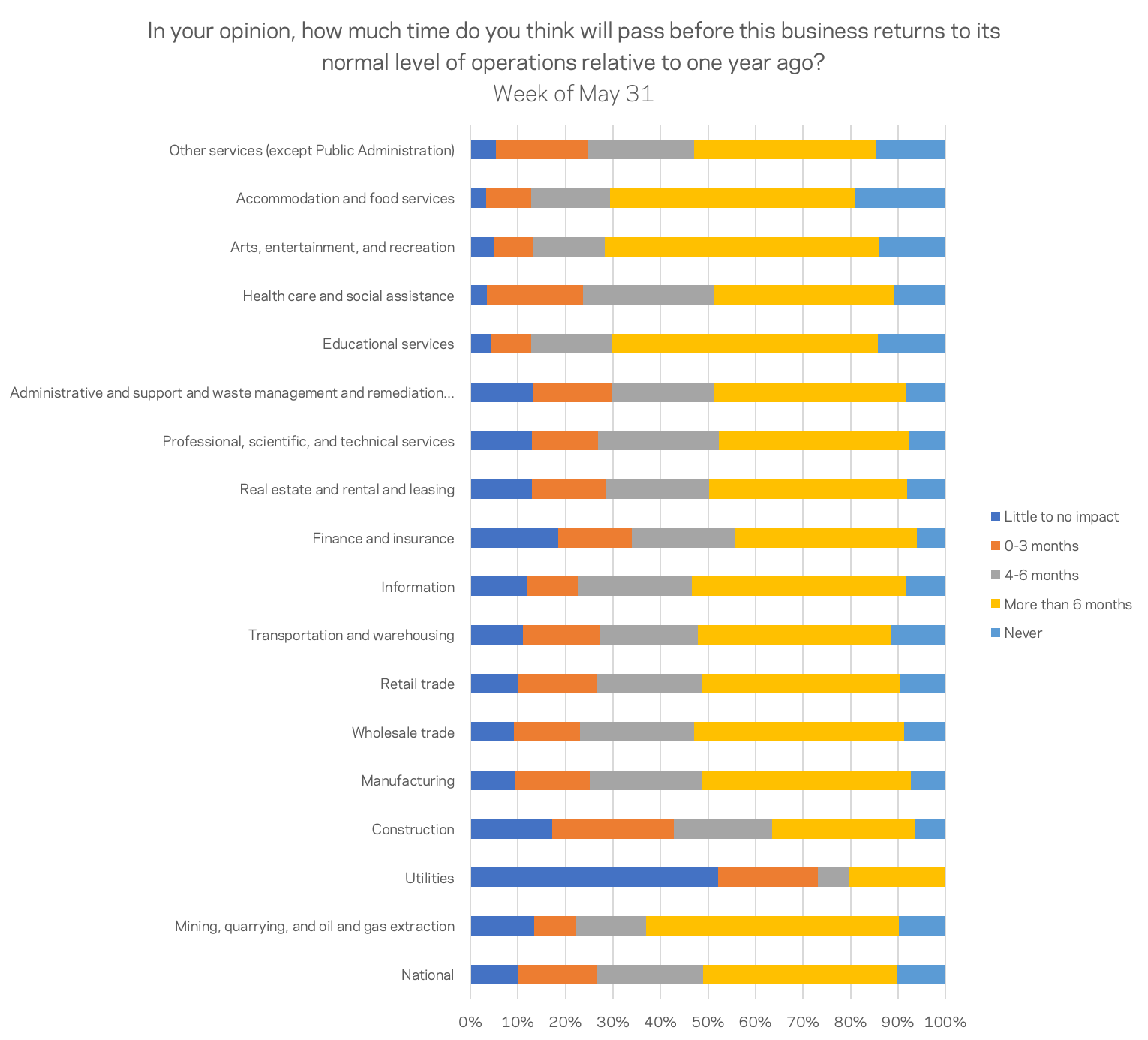

- Utilities, finance, and construction anticipate the quickest return to normal. Expectations about when small businesses will resume normal levels of operations differ immensely across sectors. A mix of blue (utilities and construction) and white (finance) collar industries are most optimistic, while people-facing education, arts, accommodation, and other services are the most pessimistic. Mining is a blue-collar exception, foreseeing a long road to recovery but potentially due to other trends not related to the pandemic that are roiling the sector. Of the people-facing services industries, healthcare expects significant near-term disruption but stability soon after.