By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from July 5th to July 18th, the final weeks before the survey will go on hiatus.

Here are five things we learned about the small business economy last week:

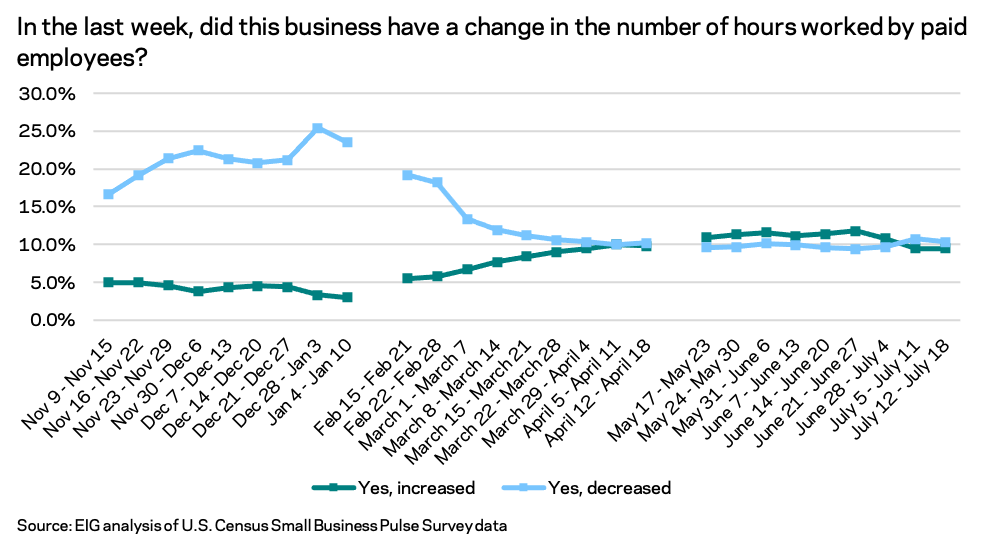

- The summer staffing surge is slowing down. The Small Business Pulse Survey has two key metrics by which to measure staffing changes: the share of firms adding employees in a given week and the share of firms adding employee hours. After several weeks where more firms added employee hours than cut them, in the week of July 5th, that pattern reversed. At 10.3 percent, the share of firms cutting hours remained higher than the share adding them through the week ending July 18th.

- One in five small businesses continue to report that employee availability is impacting operating capacity. There is evidence that the staffing snag is limiting recovery in the small business sector, with over 20 percent of surveyed small businesses reporting that the availability of employees to work is impacting their operating capacity. If the speed of matching between employees and employers does not improve, labor shortage-related pressures may further hamper the small business recovery, as over one-third of small businesses expect to need to hire new employees in the next six months.

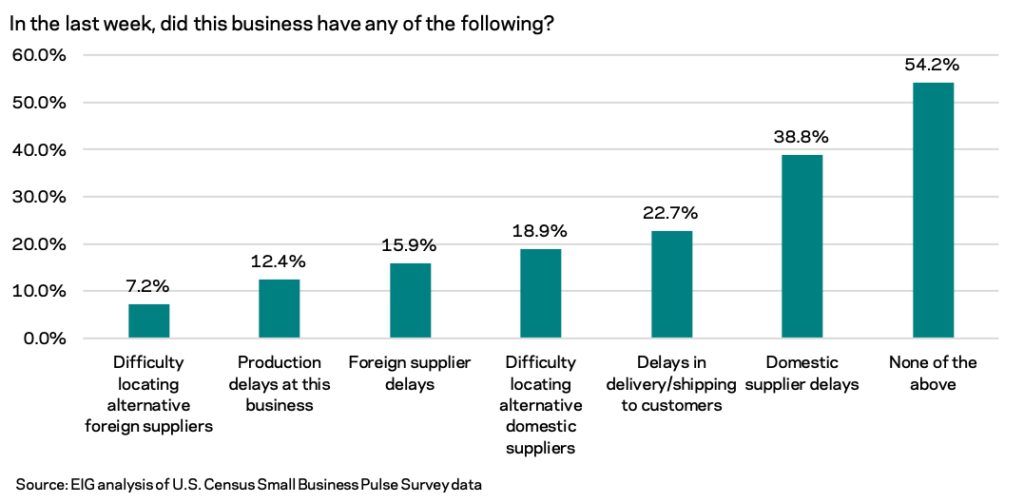

- There appear to be no signs of relief for small businesses struggling under supply chain pressures. For every week on record since mid-May, more than one-third of businesses have reported domestic supplier delays. Over the same period, around one-fifth of small businesses reported difficulties delivering products to customers and around 15 percent have reported foreign supplier delays. These shares show no improvement over the past nine weeks and have instead worsened slightly across the board. In further signs that supply chain improvement or adjustment is proving difficult, the shares of firms reporting difficulty identifying new domestic and foreign suppliers has also not declined over the period.

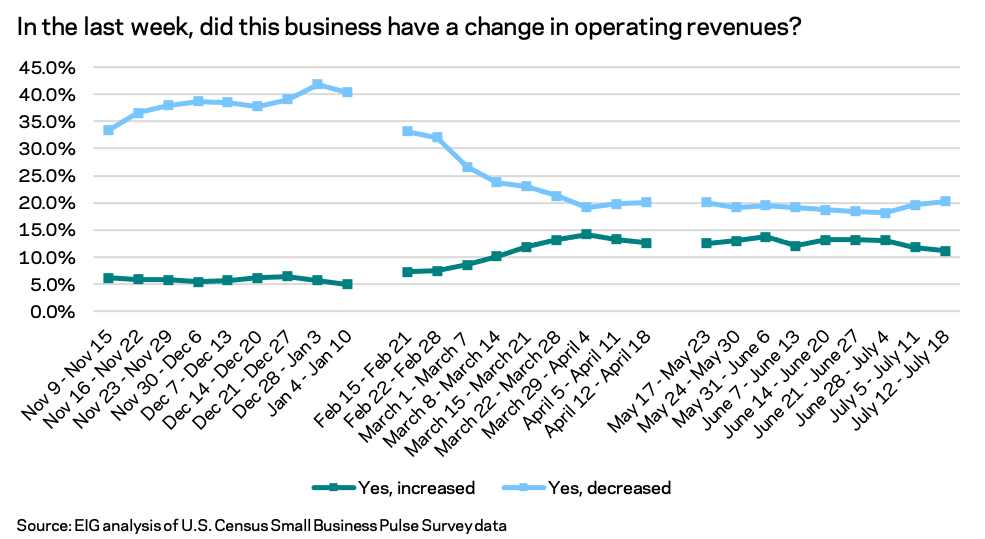

- The share of firms reporting decreasing revenues in a given week climbed higher, a warning signal for the ongoing recovery. In the past two weeks, the share of firms reporting decreasing revenue in a given week rose as the share reporting increasing revenues fell. While at no pandemic-era point on record has the share of businesses reporting increased revenues surpassed the share reporting decreased revenues, the gap between the two shares had narrowed significantly and stabilized. This re-widening of the gap, while small, is notable after months of relative stability. Many largely in-person sectors including accommodation and food services, health care and social assistance, education, and retail trade are driving the shift as they are among the sectors where the negative turn is most pronounced.

- For the moment, state level vaccination rates don’t seem tied to short term economic distress. The relationship between short term economic distress, proxied here by the three week average share of businesses reporting decreasing revenues in a given week, does not seem to have a consistent relationship with state level vaccination rates. With the Delta variant of the coronavirus sweeping through the unvaccinated population in the country, the small business recovery may falter in states where high shares of the population are unvaccinated. For now, however, there seems to be little connection between the two, with other structural factors like local economic orientation and supply chain issues potentially driving distress. This relationship will be one to watch when the survey returns.