By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the two week period from November 16th to November 29th.

Here are six things we learned about the small business economy last week:

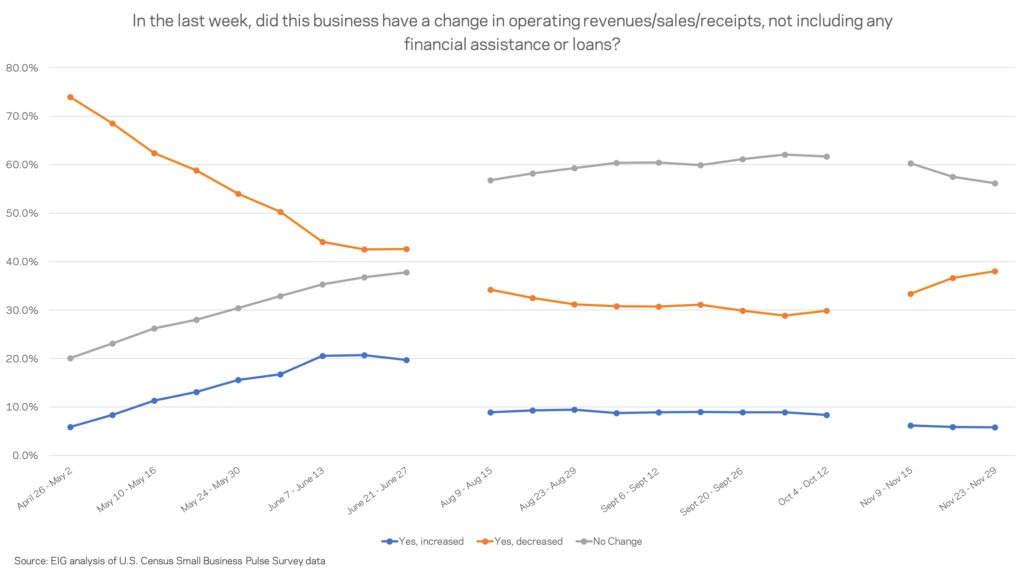

1. The share of firms reporting declining revenue in the week of November 23rd rose to 38 percent, the highest recorded share in the last four months. Over the course of November the share of small businesses reporting increased revenue fell to levels not seen since late April and the share of businesses reporting declining revenue ticked up to 38 percent. While November revenue losses were clearly not as pervasive as they were in the spring, the directional shift and nine point jump since late September is a definitive sign of increasing distress.

2. At no point on record during the last seven months have more than roughly 20 percent of businesses reported increasing revenue in a given week. The share of firms reporting increased revenue is an indicator of what percentage of businesses are actively bouncing back in a given week. That share rose steadily from late April to the end of June, stagnated through the early fall, and has fallen to its lowest recorded monthly average in November. The highest monthly average share was in June, during which an average of 19.5 percent of businesses reported increasing revenue. At 6.0 percent, the average for November based on the three available weeks of data is less than one-third of that.

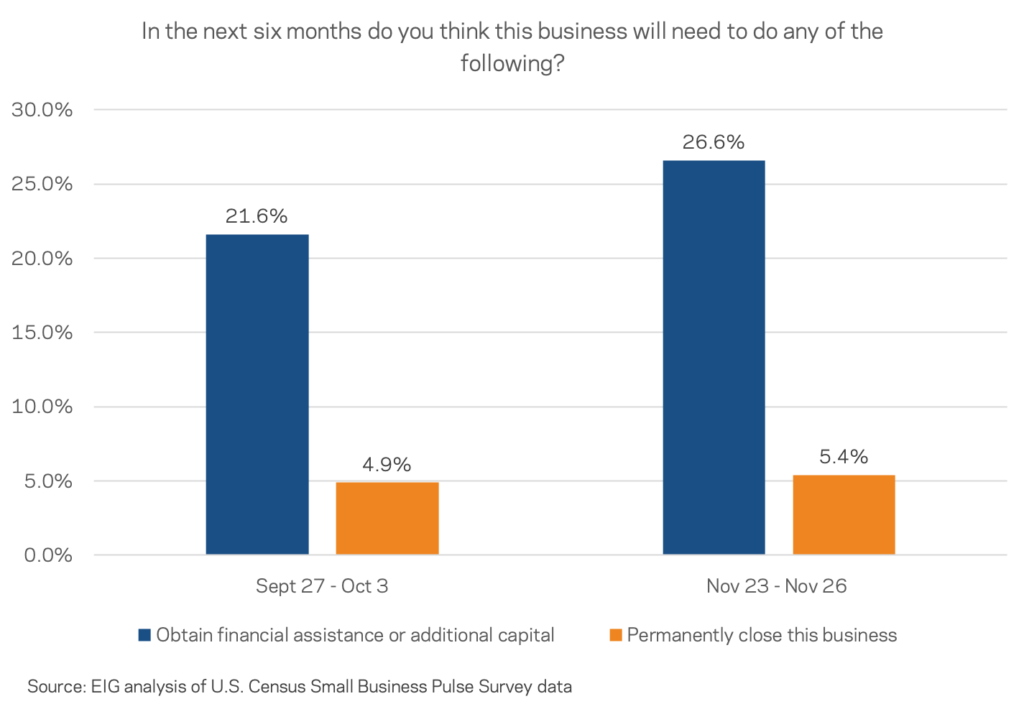

3. The share of firms expecting to need to obtain financial assistance or additional capital in the next six months to stay afloat reached its highest point since mid-August. After months of slow decline, November saw the share of firms expecting to need additional financial assistance or capital rise to 26.6 percent. This number rose even as the number of firms expecting to close in the next six months held steady, meaning that the shift is being driven by more firms falling deeper into uncertainty.

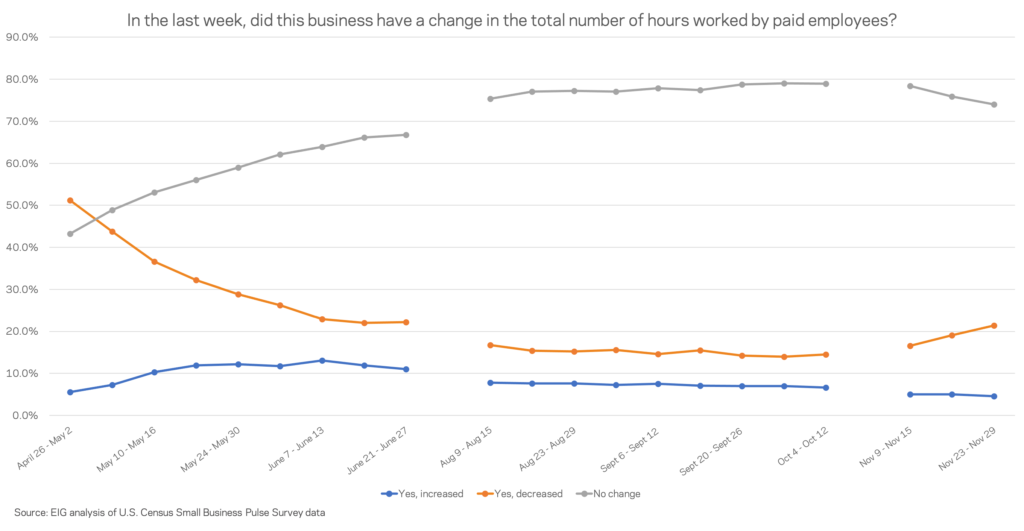

4. Four times as many small businesses decreased employee hours last week as increased them. The persistent gap between the share of firms reporting adding versus cutting employee hours yawned wider as the virus and the economy took a turn for the worse. While, as usual, the vast majority of businesses reported no change in hours or employees, 21.4 percent of responding businesses cut the total number of hours worked by paid employees and only 4.6 percent increased them in the final week of November. At the same time, 12.2 percent decreased their actual number of paid employees. When it came to hiring, only 4.3 percent of firms added workers, nearly tying the earliest and lowest recorded figure in the data series from late April.

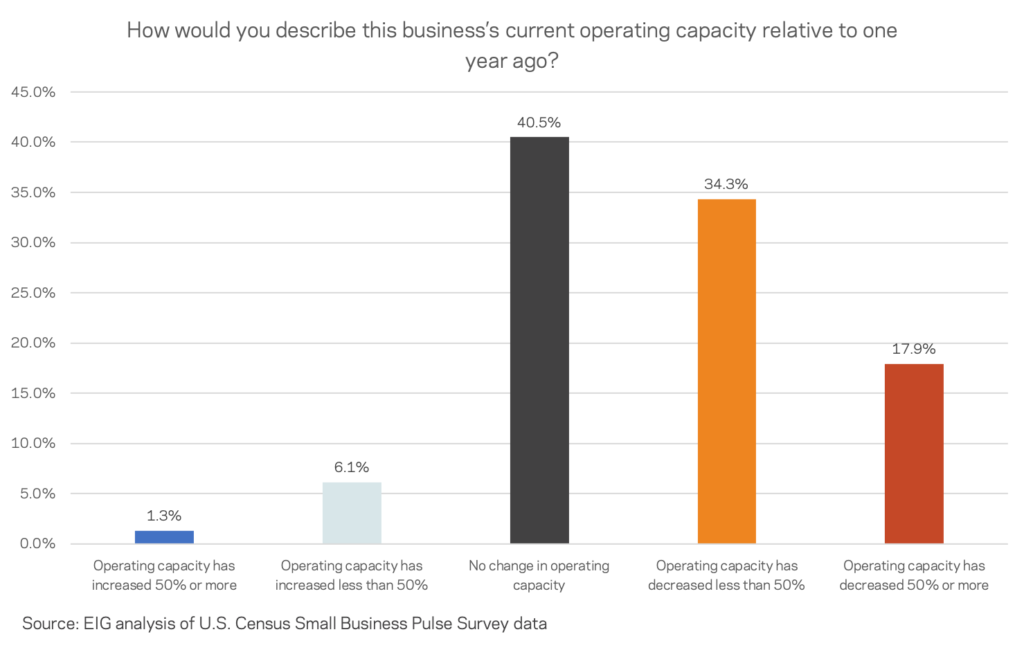

5. While a sizable share of businesses are capable of operating at full capacity, a majority are operating with decreased capacity and only one in four businesses are actually operating at normal levels. Most respondent businesses that are open report operating at decreased capacity, with 17.9 percent of businesses operating at a dramatic 50 percent or less of previous capacity. Only 7.4 percent of businesses have expanded their operating capacity relative to a year ago—a share that has varied little since August. Two-fifths of all small businesses report not having made any changes to capacity, but only 25.6 percent report actually operating at or above their normal level of operations relative to a year ago. The remainder either expect eventual recovery, do not believe their business will return to its previous level of operations, or have permanently closed. Responses to these two questions thus indicate that a clear majority of the small business economy has been stunted by the crisis.

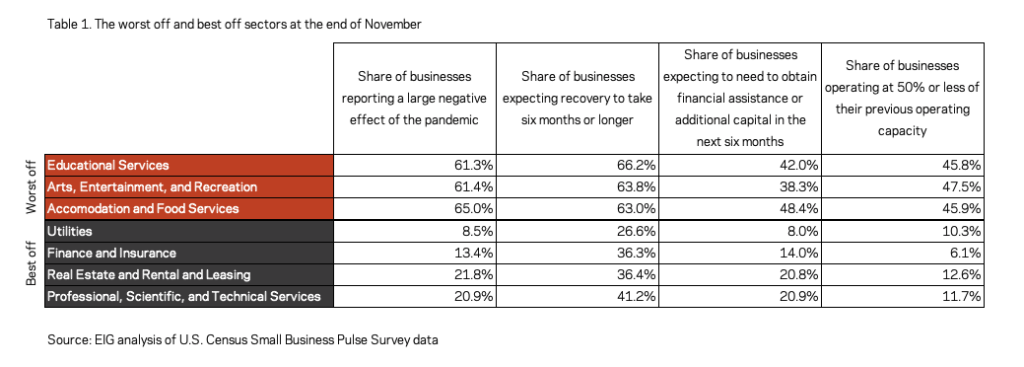

6. A trio of sectors including education, arts, entertainment, and recreation, as well as accommodation and food services continue to bear the brunt of the prolonged crisis. The trio of sectors have consistently reported the highest shares of businesses experiencing a large negative effect of the pandemic, the highest share expecting recovery to take six months or longer, and the highest share expecting to need to obtain additional financial assistance or capital in the next six months. Hovering just above 45 percent, these three sectors also report the highest share of businesses operating at 50 percent or less of their previous capacity. While these sectors are particularly distressed, many other businesses and sectors have struggled too, of course, and the next-most widely affected tier of sectors includes mining, quarrying, and oil and gas extraction and other services.