By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey (SBPS) provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of August 16th to August 22nd.

Here are six things we learned about the small business economy last week:

- The online transition is limited. While much attention has been paid to the shift of white collar employees to working from home, the Small Business Pulse Survey reveals the limits of the broader trend. Nationally, 53 percent of respondents reported having no employees who worked from home last week. The high percentage alludes to just how hard it is for many segments of the economy and workforce such as the accommodation and food services and retail trade sectors to go online (79 and 69 percent of businesses in each sector respectively do not have employees who work from home). These industries contrast sharply with professional, scientific, and technical services where only 23 percent of businesses reported not having employees who work from home. When it comes to respondents shifting business online, 45 percent report that their business does not use online platforms to offer goods or services. Roughly 1 in 4 businesses report increasing their use of online platforms to offer goods and services, implying that the nation’s small business sector has only partially adjusted to the new normal.

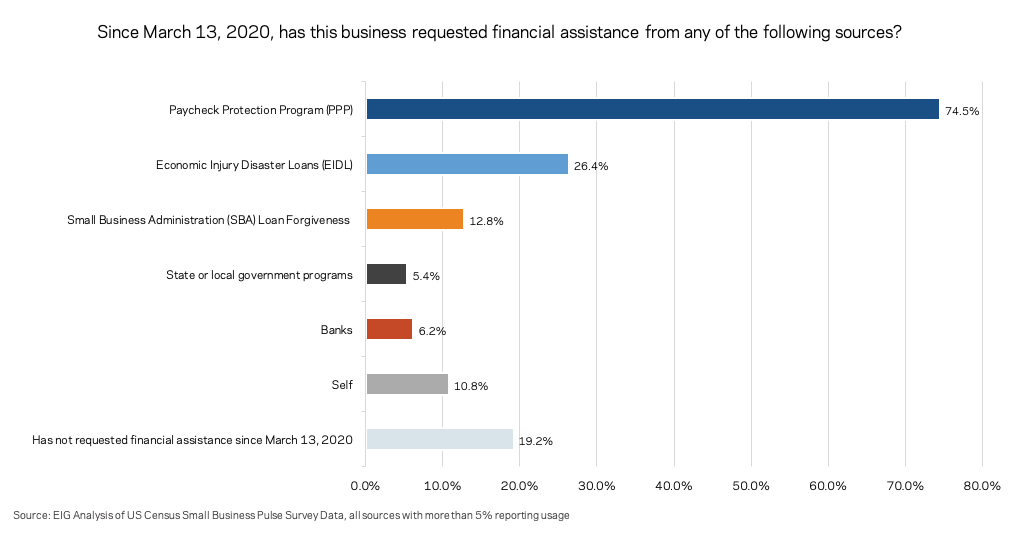

- Fewer than 1 in 5 businesses have been able to weather the pandemic without asking for some kind of assistance. Around three quarters of businesses requested assistance through the Paycheck Protection program while more than 25 percent have sought Economic Injury Disaster Loans. More than 1 in 10 businesses have turned to some form of self-financing, a higher percentage than have used state and local government programs or banks outside of a federal program.

- Even in rural areas most insulated from the virus itself, the share of businesses back up and running at their pre-pandemic level of operation is below 15 percent in all but one state. The good news is that some businesses don’t expect to return to normal operating levels— they already have. The bad news is that this share is 9 percent nationally and, while it varies somewhat across states, the state with the highest share of businesses reporting such a return (North Dakota) has only 16 percent of businesses operating at pre-pandemic levels.

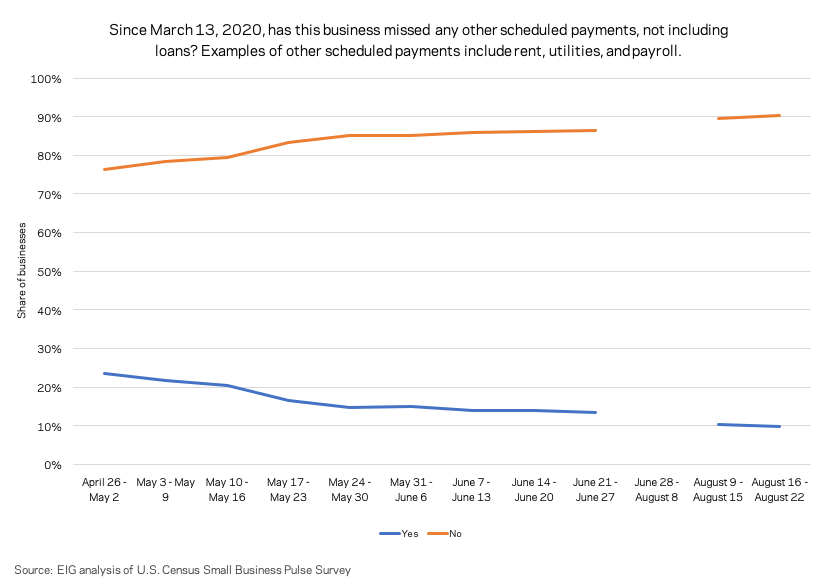

- The share of businesses missing loans or other payments is at its lowest since the end of April, despite relief phasing out. The share of businesses missing payments including rent, utilities, and payroll dropped beneath 10 percent for the first time since late April when it peaked at 24 percent. The share of businesses missing a loan payment is also down to its lowest point. As of the week of August 16th, only 3 percent of businesses report missing a loan payment while that number stood at 11.5 percent at the end of April.

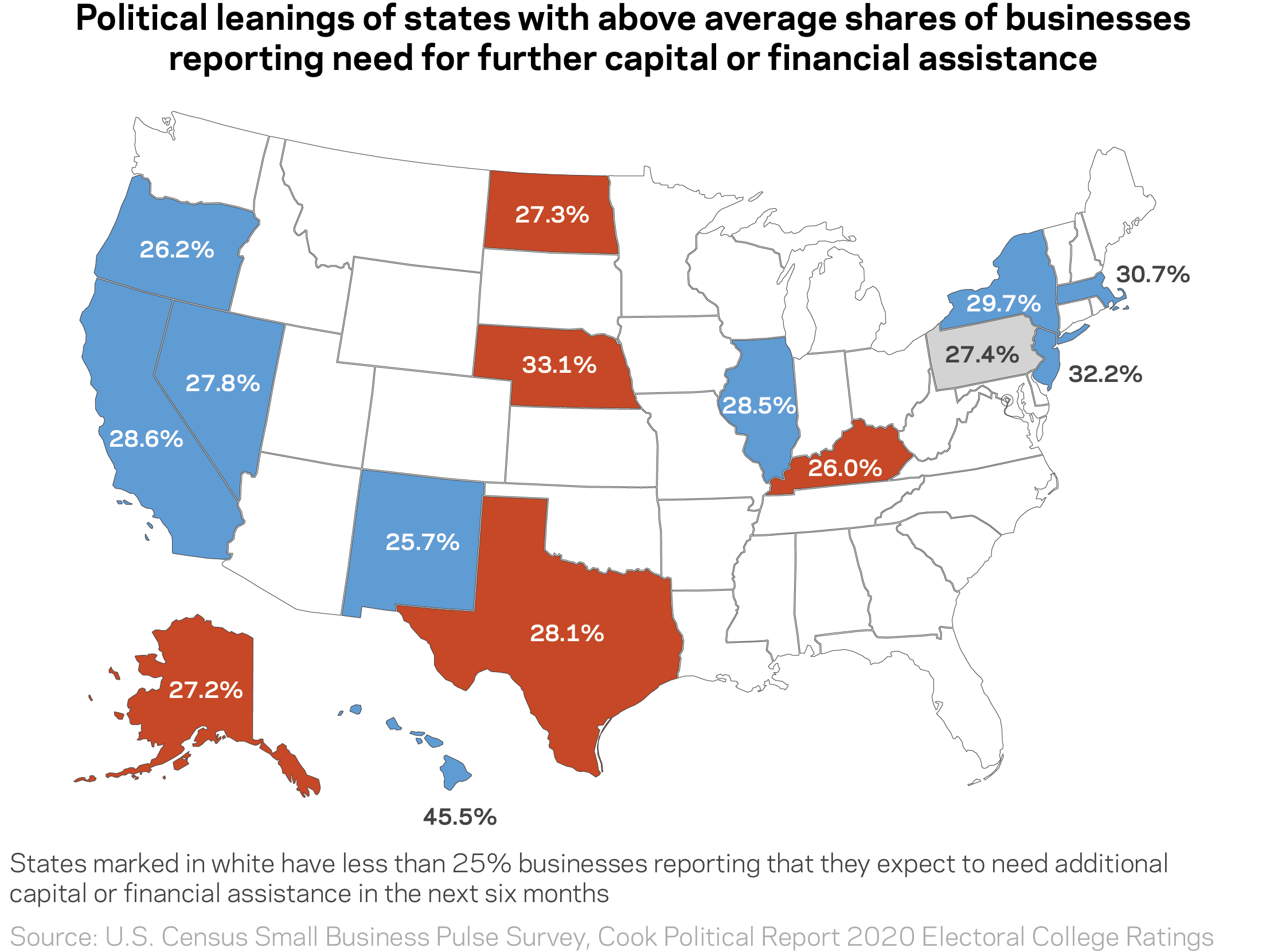

- Of the states with a high share of businesses expecting to need additional capital or financial assistance in the next six months, nine are likely to vote Democratic, five are likely Republican, and one is a swing state. At the national level, 25 percent of businesses report expecting to need additional capital or financial assistance in the next six months. Fifteen states have shares higher than the national average. Of these states, nine states including New York and California are likely to vote Democratic while four states including Texas and Kentucky are likely Republican votes in the presidential election according to Cook Political Report. Pennsylvania stands alone as the only swing state with an above average share of businesses expressing the need for further financial assistance.

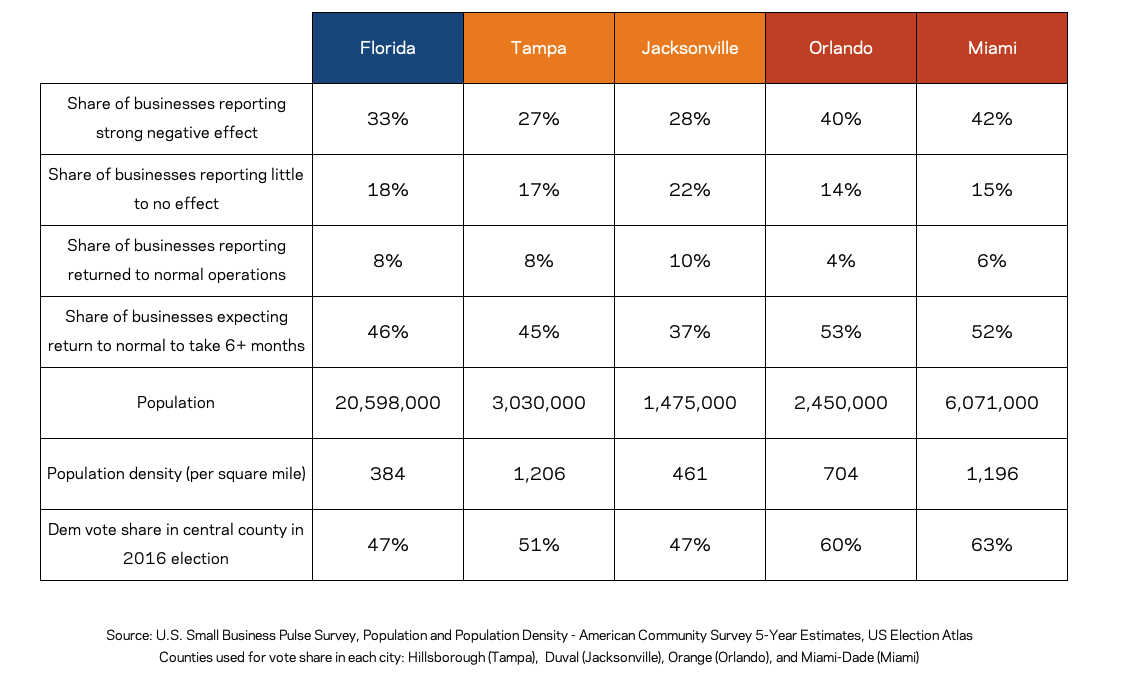

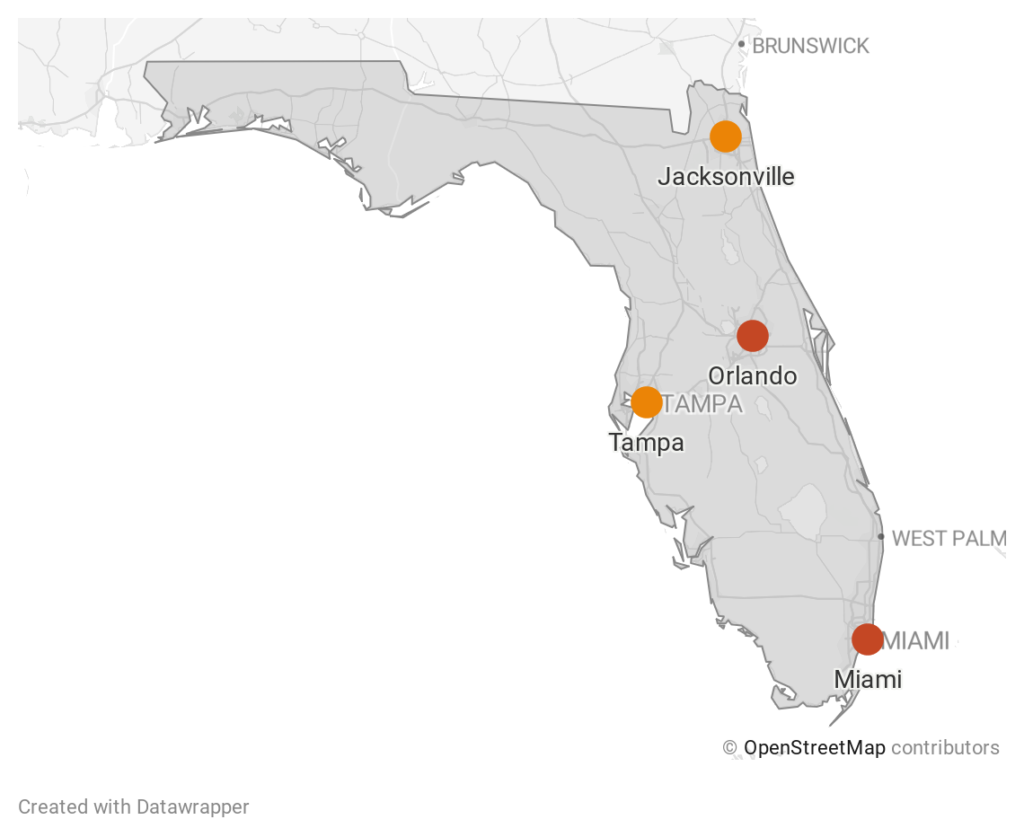

- Metro-level perspectives on the pandemic diverge strongly across swing-state Florida. In Florida, there are distinct gaps in reported negative effect and resulting long-term recovery outlook across metro areas. In the state as a whole, 33 percent of businesses report a large negative effect of the pandemic and 46 percent report expecting a return to normal operations to take longer than six months. Beneath those toplines, however, a split is evident. In one camp, businesses in Republican-leaning Jacksonville and more contested Tampa report much lower shares of businesses experiencing strong negative effects and lower shares expecting an extended recovery. Democratic-leaning Orlando and Miami, on the other hand, have much higher shares of businesses reporting strong negative effects and expecting longer recoveries. Per capita case counts are highest in Miami but roughly comparable across the other three metro areas. The Orlando and Miami economies are more dependent on the reeling tourism sector, which may help explain the difference. Regardless, if you asked a Floridian business owner how they are feeling about the crisis, their answer depends on where they are.