Findings from EIG’s national survey of Opportunity Zones stakeholders

Key findings

- Recent economic conditions have had a chilling effect on the Opportunity Zones (OZ) marketplace, as 52 percent of respondents reported that the crisis had a negative impact on their OZ activities.

- While investors may be waiting for signals of market stability prior to finalizing investment decisions, most respondents report that investors remain engaged in the OZ marketplace and that some are still actively looking for new opportunities to place capital.

- The crisis has affected the work of OZ stakeholders in varying ways, and will likely cause some to reduce their level of engagement and others to double down over the long-term.

- The majority of respondents remain optimistic about the future of the OZ marketplace, and 49 percent of fund managers believe their OZ strategy is well-suited to the current environment.

- However, the prospects for sustaining and capitalizing on this enthusiasm may hinge on actions taken by the government in the near-term, most notably, whether Congress extends the OZ investment deadline beyond 2026.

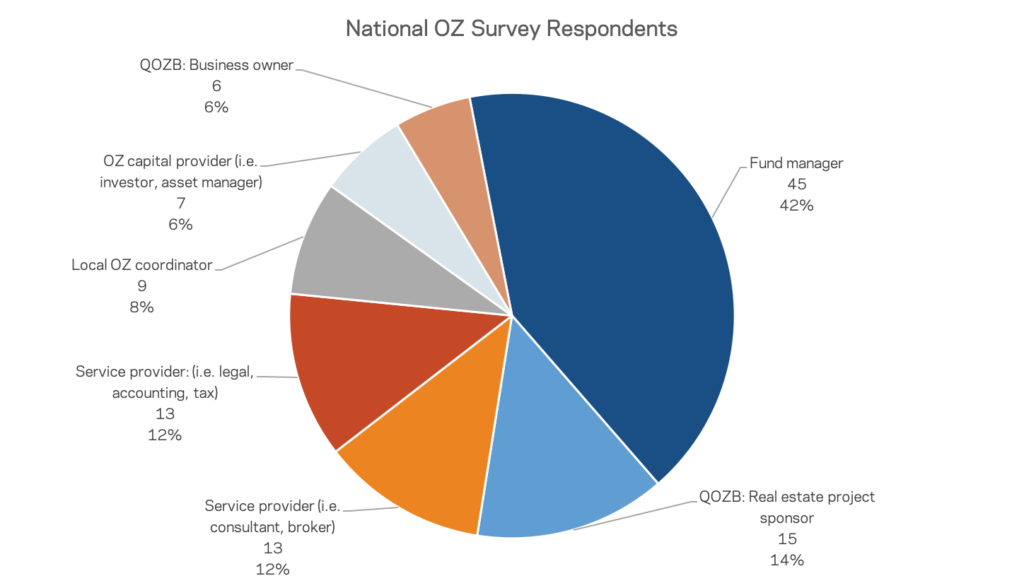

In this post, EIG provides an analysis of responses received from 108 OZ stakeholders, including investors, managers of Qualified Opportunity Funds (QOF), QOZ businesses (QOZB), service providers facilitating OZ transactions, and those charged with coordinating local OZ ecosystems.

Background

The OZ marketplace finally began to hit its stride late in 2019 as increased regulatory clarity, higher levels of investment, and emerging market norms combined to encourage broader participation from a diverse group of stakeholders. Though comprehensive data are not available, information provided by those operating within the OZ ecosystem, notably Novogradac & Company, indicated accelerated investment activity into Q1 2020 likely aided by the release of final IRS regulations in December 2019. However, broader economic conditions have changed dramatically due to the COVID-19 crisis, raising new questions about the potential near- and long-term effects of the pandemic on the OZ marketplace.

On May 18, 2020, the Economic Innovation Group (EIG) launched a national survey to gain insights from individuals and organizations closely involved with raising capital and facilitating deal flow in OZs. EIG asked survey participants to describe the effect recent economic conditions have had on OZ transactions and investor behavior, provide insights as to whether their level of engagement or their OZ strategy would be impacted as a result, and provide their perspective on the future of the OZ marketplace as well as which measures Congress should take in order to ensure the policy is an effective tool for economic recovery.

Insights from a Diverse Group of OZ Stakeholders

EIG analyzed responses submitted by 108 OZ stakeholders across multiple categories, including: OZ investors, fund managers, and businesses; service providers facilitating OZ transactions; and local OZ coordinators charged with implementing community-led OZ strategies. Thirty-one percent of respondents have a national OZ footprint, while 69 percent are focused on a regional strategy. Forty-five QOF managers participated in the survey, representing the single largest respondent group.

Respondents indicated they are targeting a wide variety of asset classes and impact areas. Mixed-use and residential real estate were the most commonly targeted asset classes (64 and 62 percent, respectively), while neighborhood revitalization (69 percent) and affordable housing (61 percent) were the top indicated impact areas, with other strong areas of focus including workforce housing (55 percent), blight remediation/adaptive reuse (41 percent), and innovation and technology (41 percent).

Although responses likely included aspirational activity in addition to completed transactions, it is encouraging to see continued interest in supporting entrepreneurship (54 percent) and investing in operating businesses (55 percent), as this segment of the market has been slow to gain traction.

Current Market Conditions

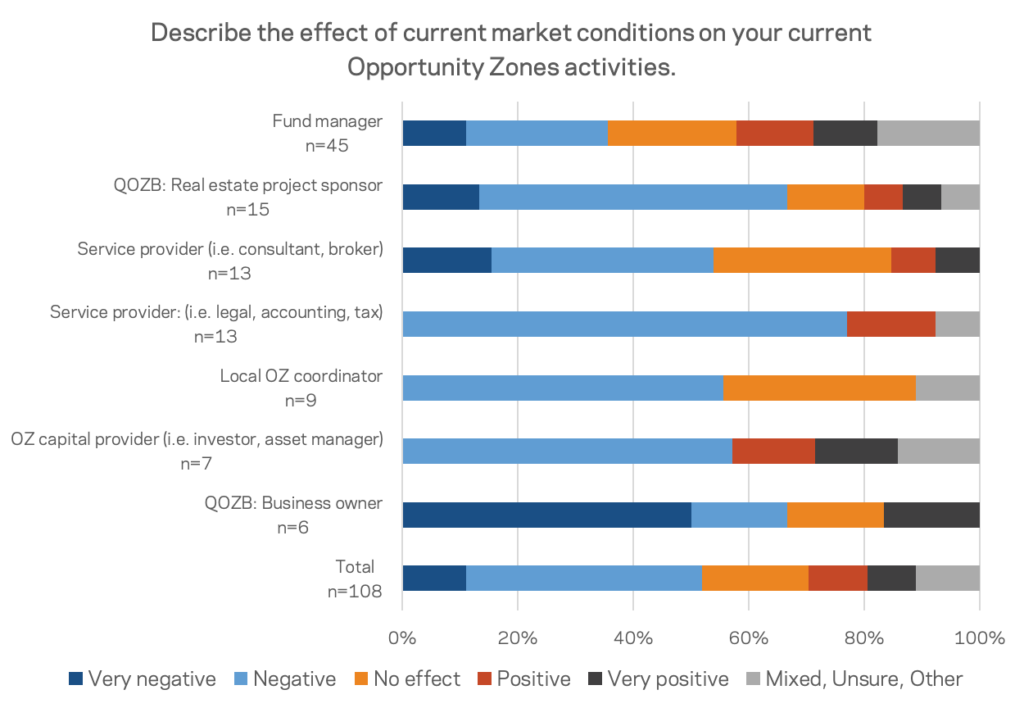

While a slight majority of respondents (52 percent) said that current market conditions are having a negative impact on their OZ activities, 48 percent reported a positive, mixed, or no effect. Given how rapidly the entire economy has been plunged into uncertainty, one could well have expected the negative impact rate to be higher.

Nearly one-quarter of fund managers (24 percent) reported positive or very positive impacts of the crisis on their OZ activities. At the other end of the spectrum, three out of the six responding QOZB owners reported very negative effects.

Investor Behavior

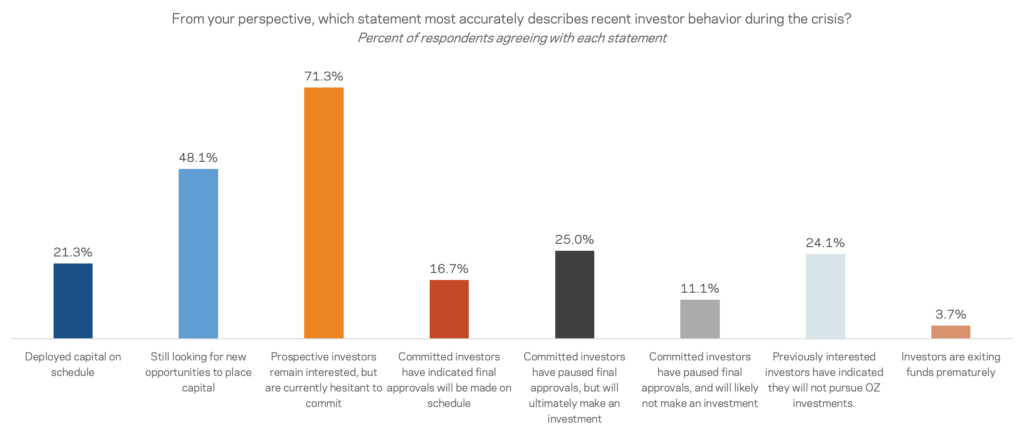

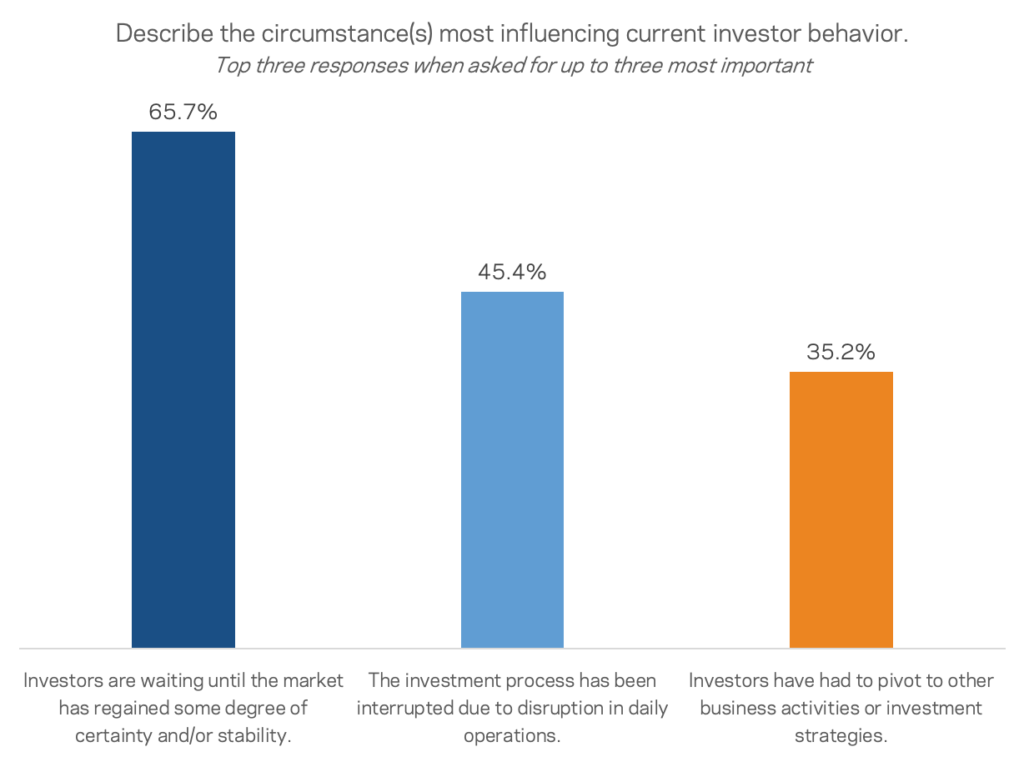

Investors are key to the viability of the OZ marketplace and are, of course, influenced by broader trends in the economy that are not specifically tied to OZs. Two-thirds of respondents believe investors are waiting until the market has regained some degree of certainty and/or stability prior to finalizing investment decisions. Forty-five percent of respondents said that the investment process has been interrupted due to disruptions in daily operations from the pandemic.

Nevertheless, investor behavior seems to signal that the long-term prospects for investment in OZs are positive. Seventy-one percent of respondents and clear majorities in every category reported that prospective investors remain interested, even if they are currently hesitant to commit. Even with the noted hesitancy, 38 percent of fund managers reported deploying capital on schedule during the crisis, and nearly half of respondents said that investors are actively looking for opportunities to place capital. Only one out of 45 fund managers stated that investors have chosen to withdraw previous investments prematurely.

Tempering that relatively positive news, nearly one-quarter of all respondents reported that previously interested OZ investors have decided against entering the market. Only 7 percent of all respondents believe the crisis has encouraged investors to prioritize OZs, and one out of ten respondents believe there is a risk that investors currently committed to OZs may ultimately not make an investment.

OZ Activity Over the Coming Year

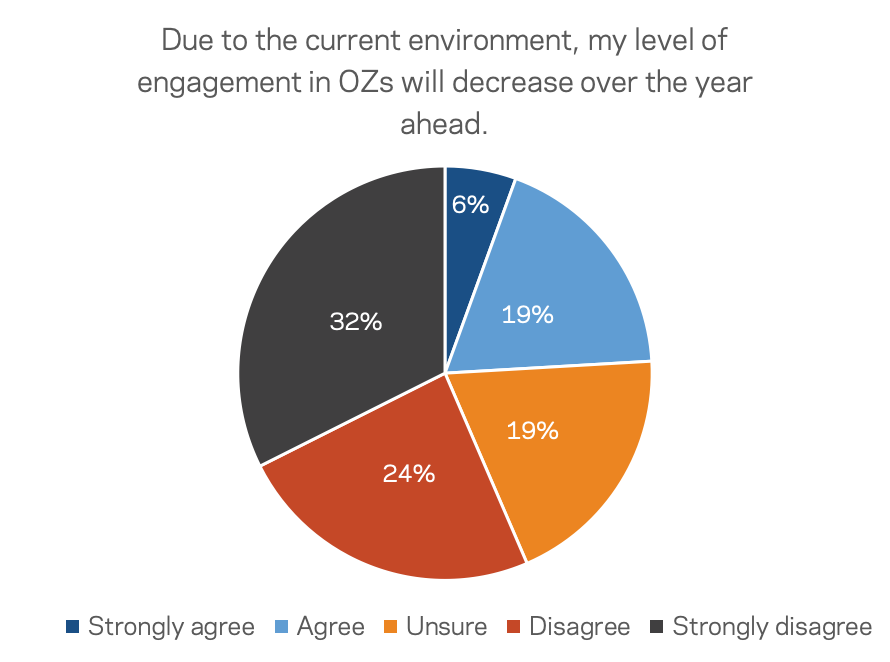

In general, respondents remain committed to their near-term OZ activities. Fifty-six percent of respondents reported that their level of engagement with OZs will remain undiminished and may even increase over the year ahead. Fourteen percent of OZ capital providers indicated they expect to engage less with OZs over the coming year.

Most of the nine responding local OZ coordinators, many employed on the community frontlines of the economic fallout from COVID-19, are unsure how their OZ engagement will evolve. Fund managers, investors, and legal, tax, and accounting service providers are the least likely to say they are stepping back over the next year. Promisingly, 16 percent of respondents including four out of nine local coordinators reported that their key stakeholders are more engaged with OZs now, following the crisis.

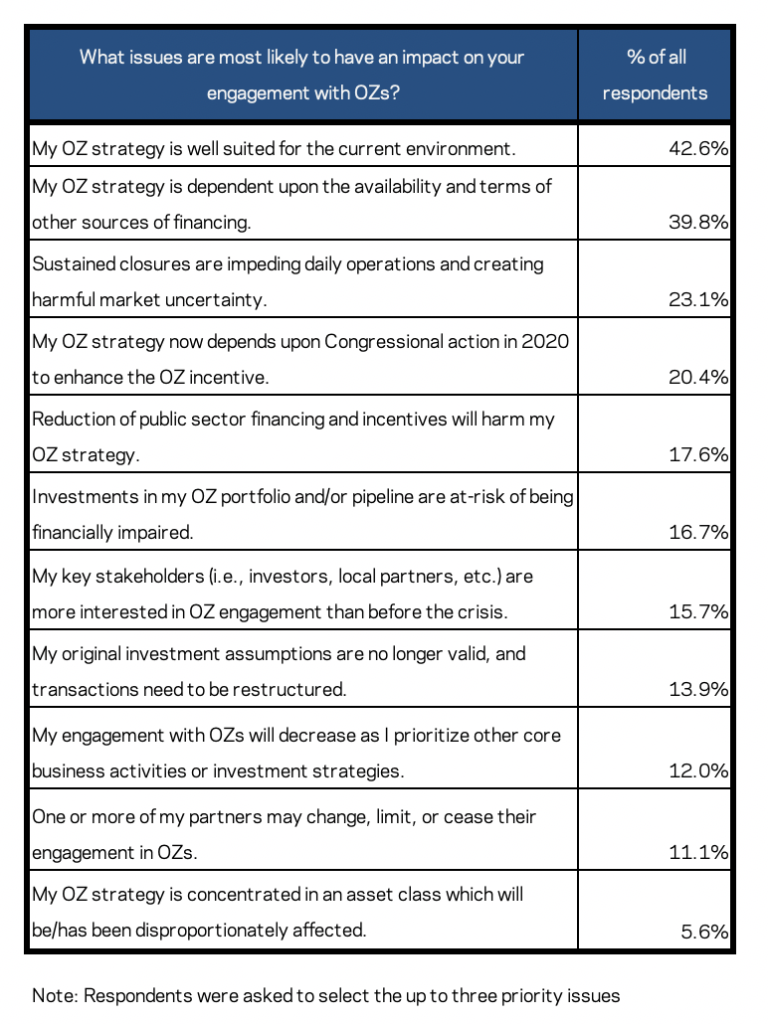

Across all respondents, 37 percent reported that the crisis has forced them to make significant changes to their core OZ strategies, while 33 percent disagree, and 30 percent remain uncertain. Nearly half of fund managers and real estate project sponsors affirmatively state that their OZ strategy is well-suited for the current environment (49 and 47 percent respectively). Few respondents feel that they are overexposed to the sectors most deeply affected by the crisis, and only 17 percent of respondents worry that investments in their portfolios or deal pipelines are at risk of being financially impaired.

Reinforcing the fact that the OZ investment ecosystem does not exist in a vacuum, 40 percent of respondents state that their OZ strategy is dependent on the availability and terms of other sources of funding, leaving their OZ activities at the mercy of broader trends in the financial markets and availability of public-sector resources.

A Cautiously Optimistic Outlook for the OZ Marketplace

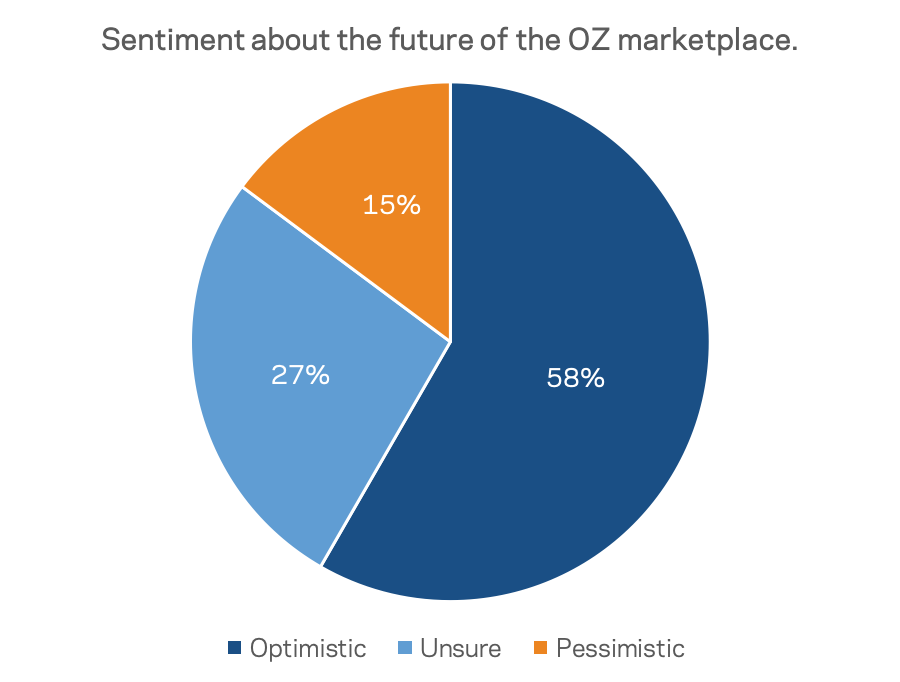

A majority of respondents (58 percent) report general optimism about the future of the OZ marketplace. Only 15 percent are actively pessimistic, while over a quarter remain uncertain.

The survey results suggest that the crisis has encouraged some OZ stakeholders to double down even as others step back. Thirty-two percent said that they envision increasing their engagement with OZs over the long-term. However, an almost equal number of respondents believe that the crisis will result in a mild to significant decrease in their engagement. A plurality of the largest respondent group, fund managers, anticipate no effect (40 percent).

A Clear Role for Policymakers

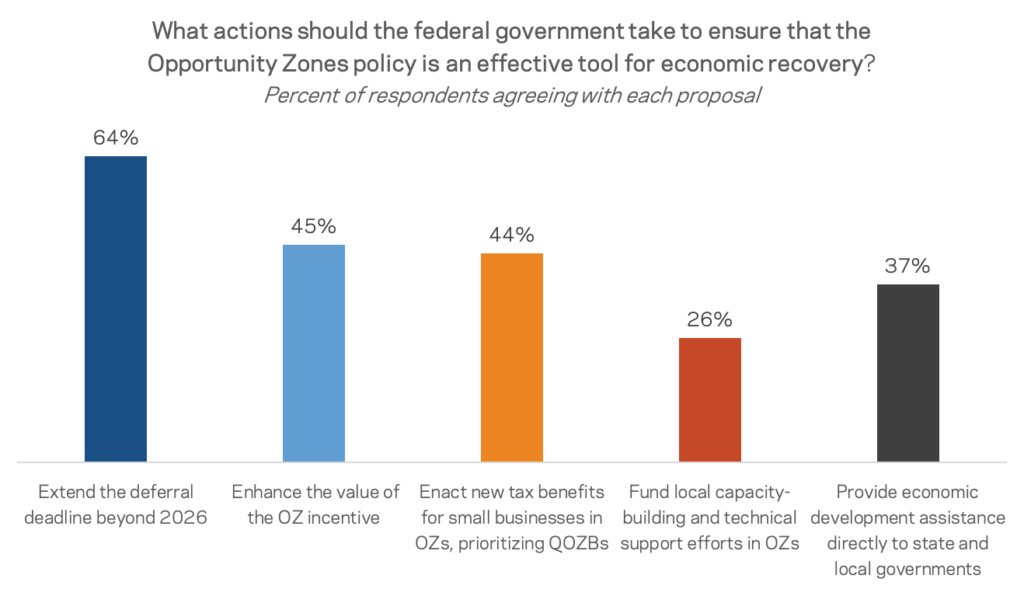

The majority of respondents (64 percent) agree that in order to ensure OZs are an effective tool for the economic recovery, Congress must extend the incentive’s deferral deadline beyond 2026. This sentiment is held by a substantial number of OZ investors (86 percent), fund managers (67 percent), and real estate project sponsors (73 percent). Forty-five percent believe that Congress should enhance the value of the incentive itself to encourage stronger market participation in response to COVID-19. Roughly the same share of respondents report wanting to see new tax benefits for small businesses located in designated communities.

A majority of responding investors, local OZ coordinators, and real estate project sponsors wish to see Congress provide direct assistance to state and local governments for economic development activities. More than one-quarter (26 percent) of respondents would like to see local capacity-building and technical support efforts in OZs. This is likely an acknowledgment of the interrelated dynamic between a private partner’s ability to successfully deliver transformational investment in distressed communities and the extent to which public-sector resources are available to complement those efforts.

Where the OZ Marketplace Goes From Here

The COVID-19 pandemic hit the young OZ marketplace just as momentum started to build in the first quarter of 2020. The overall effect of the pandemic has been negative, delaying investments, and sowing uncertainty. Nevertheless, the responses gathered here provide evidence of the underlying resiliency in a market made for long-term investing. Looking beyond the crisis, investors and other stakeholders show optimism. A large share see opportunity in crisis and a chance to make their OZ activities even more meaningful going forward.

The residents of communities designated as OZs are disproportionately likely to bear the brunt of the COVID-19 crisis, both in terms of public health and economic setbacks. The OZ incentive can help foster a stronger recovery in these areas—but this is not inevitable. OZs could just as easily fall short of their potential absent any extra catalyst to give purpose, direction, and guidance to the young market.

This is a time for policymakers to strengthen the policy and ensure it can serve as a tool for economic resiliency and recovery. Treasury has recently taken an important step in providing emergency regulatory relief. Now Congress should act by doing more to extend the policy’s timelines and support local capacity-building efforts to ensure communities are well-positioned for OZ investment. The OZ incentive has demonstrated its reach into all types of communities and the ability to support investment across a wide range of asset classes. Congress can take a small number of modest but meaningful measures to position the policy to meet the challenges that lie ahead for thousands of struggling communities across the country.

EIG Webinar – Results and Analysis: National Opportunity Zones Survey