By Jimmy O’Donnell

Although the U.S. economy is still in a deep hole from the COVID-induced recession, there are signs of light at the end of the tunnel: employment grew by more than 900,000 in March, new unemployment claims recently reached its lowest level since March 2020, and vaccine rollout is ramping up across the country. In another positive sign for the nascent recovery, the apparent surge in business formation that began in mid-2020 has continued through the first few months of 2021. The lack of strong new business formation in the wake of the Great Recession hindered the country’s economic recovery for years, but it looks as if the coming economic resurgence is shaping up to be quite different from last time around.

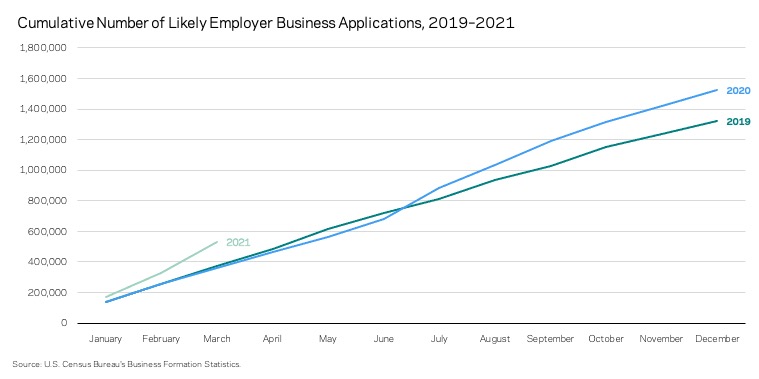

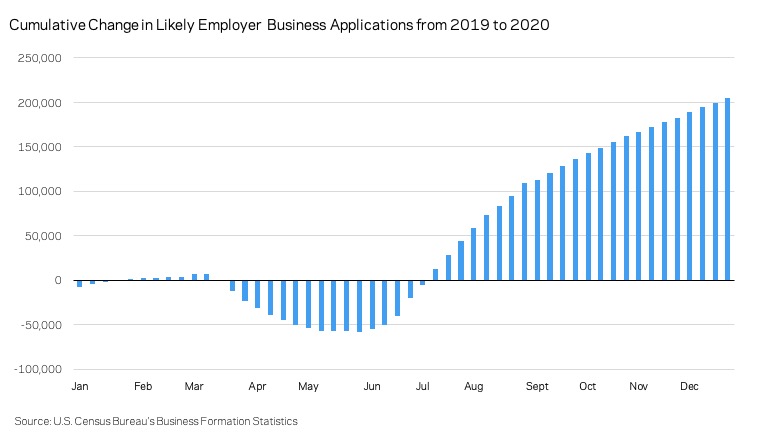

As EIG showed previously, 2020 was an unusual year on a number of fronts, including in the realm of new business formation. According to data provided by the U.S. Census Bureau’s Business Formation Statistics, the number of applications to form new businesses among likely employers—a subset of total applications that represents those most likely to hire employees in the near future—declined substantially in the early months of the COVID-19 pandemic. But beginning last summer, business applications bounced back, ultimately reaching unprecedented levels. Applications to form new businesses totaled around 1.5 million by year’s end—nearly 205,000 more than the 2019 total (see figure 1).

Figure 1.

In a promising development, the surge in likely employer business formation that began in the middle of 2020 shows no signs of letting up three months into 2021, suggesting it could have some staying power. As shown in figure 2, new business formation among likely employers remains elevated relative to the previous two years, and by the end of March 2021, total new business applications among likely employers stood just above 532,000—roughly 160,000 more than this point in 2019 and 173,000 more than in 2020.

Figure 2.

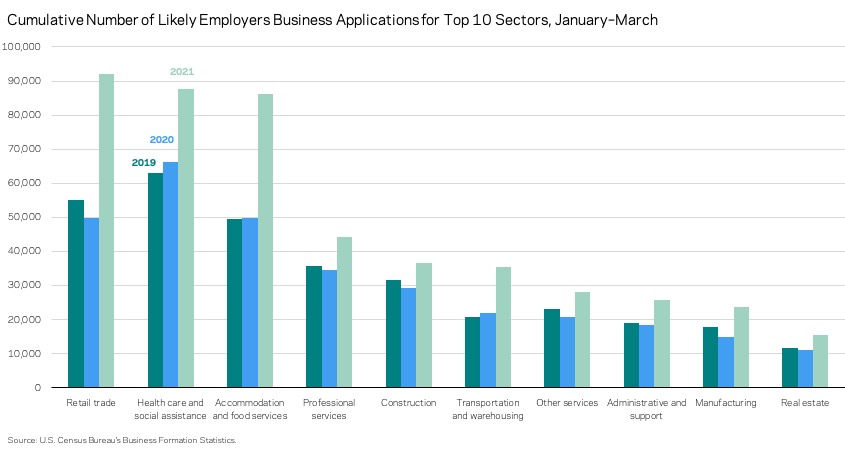

The industry composition of these new likely employer business applications provides a few clues into the types of businesses fueling the unusually fast pace of potential startup activity. The 2021 figures show that the increase is occurring across most industries—potentially good news that the surge in business startups will be broad-based. In each of the top 10 major industries by likely employer business applications, cumulative applications during the first three months of this year exceeded their 2019 and 2020 totals for the same time period (see figure 3). Even as the increase is occurring across most sectors of the economy, three, in particular, stand out as having the largest total increase in applications by far: retail trade; health care and social assistance; and accommodation and food services.

Figure 3.

Yet another positive sign is the fact that every state in the country has recorded an increase in likely employer business applications, although there has been significant regional variation (figure 4). Sustaining a trend from 2020, the southeastern states seem to be experiencing the fastest growth. The four states with the largest year-over-year percent change in February 2021 were all located there: Alabama, Georgia, Louisiana, and Mississippi. By contrast, several states in the Pacific Northwest, Upper Midwest, and New England regions are seeing their likely employer business application grow at a much slower rate.

Figure 4.

While the surge in new business applications is certainly promising, only time will tell how many of these expressions of entrepreneurial intent actually turn into new businesses that go on to hire workers. However, ensuring that many of these likely employer applications do turn into successful businesses with paid employees will help smooth our transition out of this pandemic recession. With economists and policymakers confident that the United States should be well-poised for an economic boom in the next few months as vaccinations get rolled out nationwide, maintaining this high level of new business formation will be crucial in placing the economy on a strong and durable path to recovery.