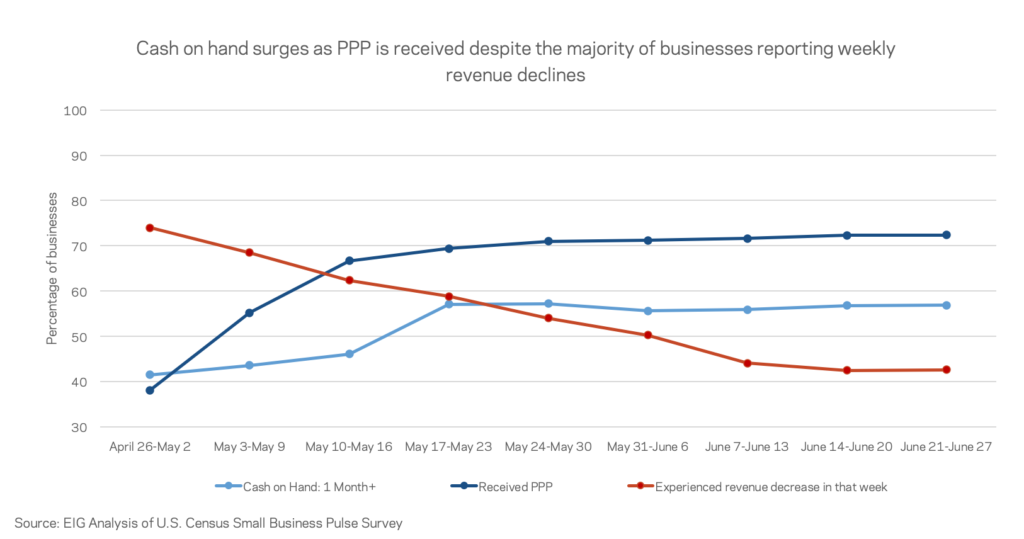

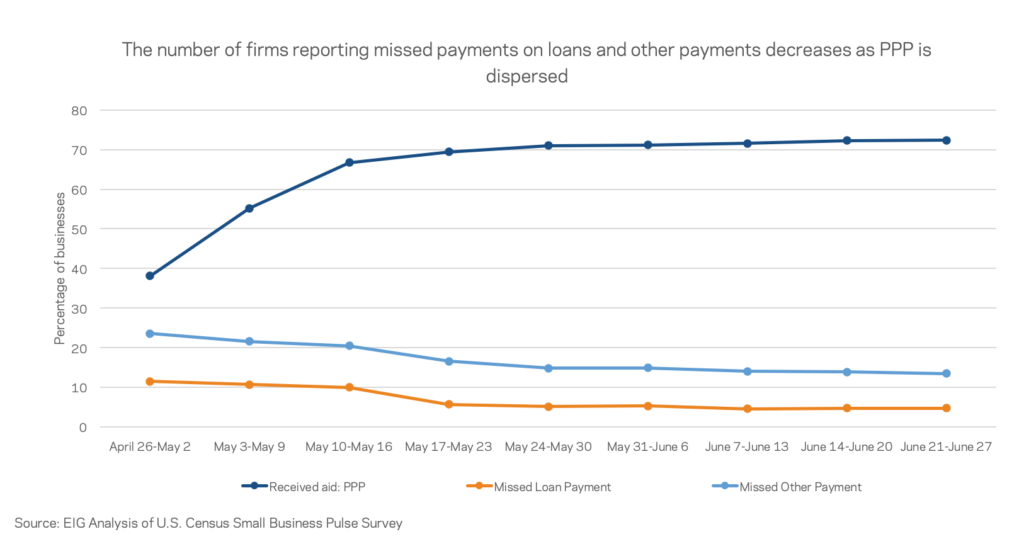

Data from the U.S. Census Bureau’s Small Business Pulse Survey shows that a surge of small businesses reported increases in cash on hand that correspond to Paycheck Protection Program (PPP) loans hitting accounts in early May. The stabilization in small business finances occurred even as the majority of businesses were experiencing week-on-week declines in revenue, leaving PPP and related relief as the likely explanation behind the development. PPP disbursements also track with decreases in the percentage of respondents reporting a missed loan or other payment in mid-May (lower chart). In addition to resulting in a decrease in delinquent payments, PPP may also explain the lack of any observed increase in small business defaults or accounts in arrears even as the crisis wore on into June.