By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds.

A month of data has been released since the Small Business Pulse Survey’s return. This analysis identifies three critical observations from that period. First, distress remains acute for a small but meaningful subset of businesses. Second, stagnation, not recovery, is the best characterization of how small businesses are experiencing the economy right now. Lastly, businesses appear to be adapting to varying degrees to the reality of the pandemic but face residual demand shortages that are likely driving some of the stagnation in recovery.

Distress Persists In Certain Sectors And Some Businesses Remain On The Brink Of Collapse

One in 20 businesses expect to need to close in the next six months. Extrapolating from the survey to the full universe of small businesses, which the Small Business Administration estimated at 30.7 million in 2019 (including non-employers), this could equate to up to 1.5 million threatened small businesses, on top of the 1 million business owners who have already disappeared during the pandemic. That number shoots up to 1 in 10 businesses in the food and accommodation sector and 9 percent of businesses in the arts, entertainment, and recreation sector.

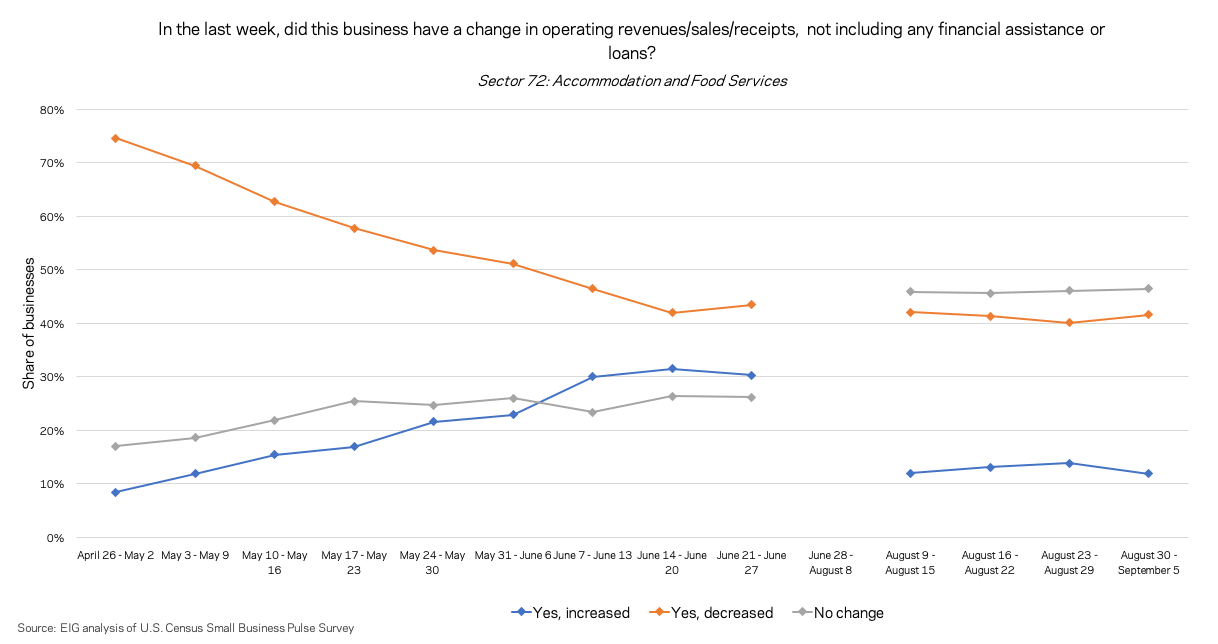

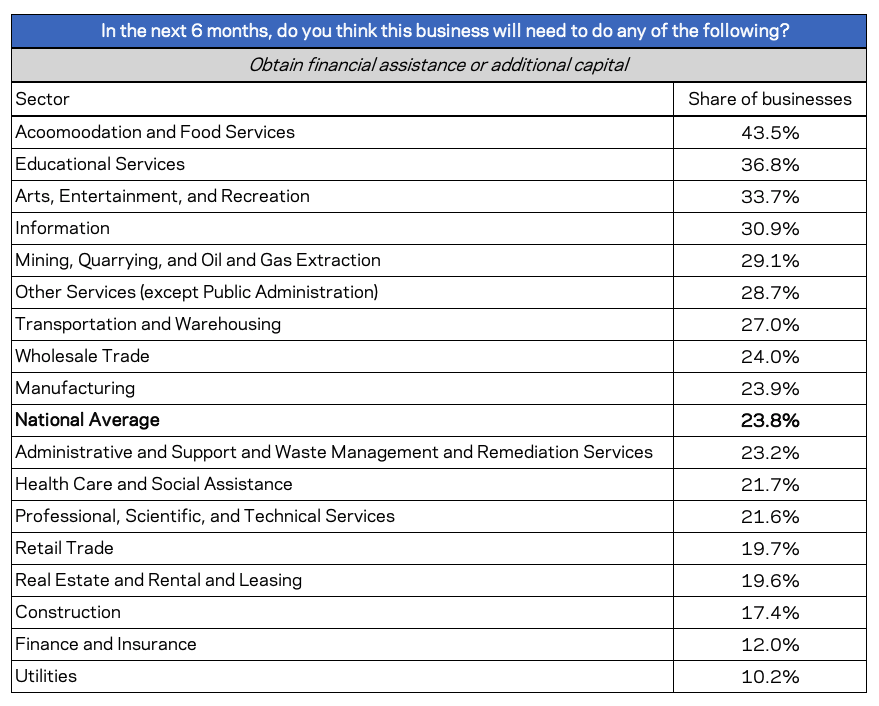

Last week, over 40% of businesses in the accommodation and food sector reported further decreases in revenue. The accommodation and food services sector is experiencing the most widespread and acute distress, as indicated by consistently falling revenues for more than 4 out of every 10 small businesses. Rather than improving, this number has essentially flatlined since June. In response to this distress, 44 percent of small businesses in the sector expect to need additional capital or financial assistance in the next six months.

Revenues are only increasing week-on-week for 9 percent of small businesses. That figure has held steady for the past four weeks. Triple that number of respondents — 31 percent — reported revenue declines last week, with the remaining 60 percent in a holding pattern, reporting no increases but no declines. Given the breadth and magnitude of the declines registered in the spring and early summer, it can be assumed that many firms are still far from recovered. The survey indicates as much: roughly 3 out of 4 respondents have not recovered from the crisis, with the remainder consisting of the 16 percent reporting little to no effect of the pandemic on operations and only 10 percent reporting an actual return to normal levels of operations. The inference is borne out in operating capacity as well — only 47.5 percent of firms report operating at pre-pandemic capacity or higher. The share of firms that have experienced growth, as measured by increases in their operating capacity, stands at a paltry 7.5 percent. They are vastly outnumbered by the 18.9 percent of businesses operating at less than 50 percent of their previous capacity.

1 in 4 (24%) respondents expect to need to find additional capital or financial assistance in the next six months. Several sectors including accommodation and food, arts, entertainment, and recreation, and educational services are well above the national average.

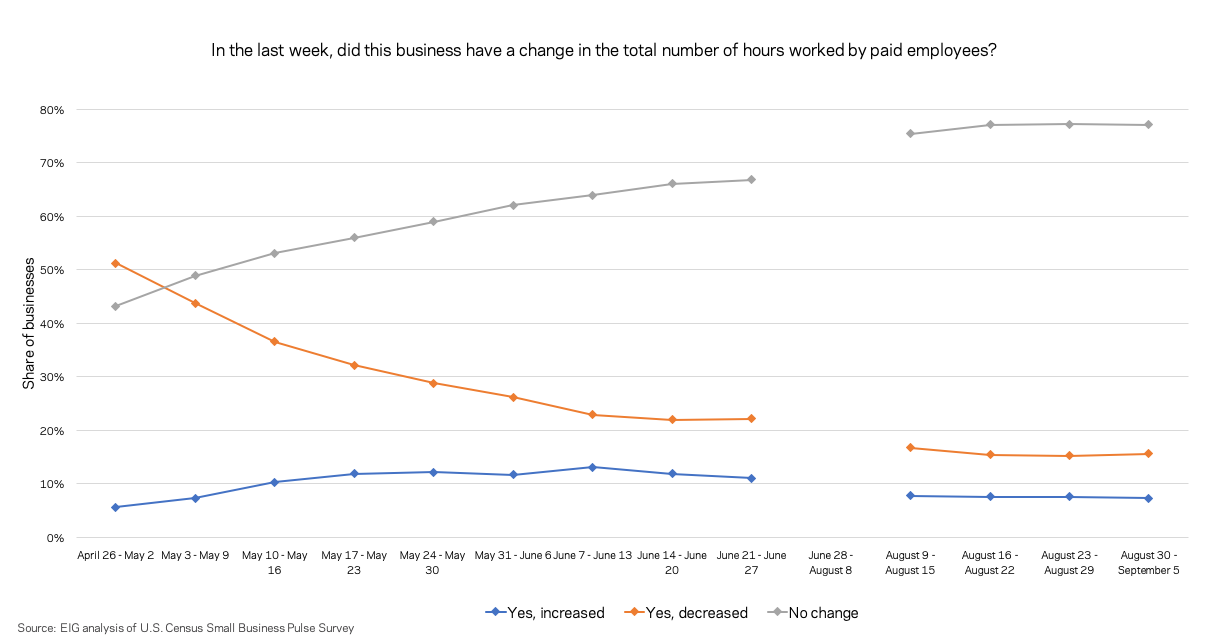

Stagnation Is Now The Best Characterization Of The Market, Not Recovery

An early recovery has given way to stagnation. The share of businesses hiring employees or increasing employee hours has flatlined in the past four weeks. The share of firms increasing employee hours has hovered between 7 and 8 percent, while the share of respondent employers who report continuing to shed jobs every week has stabilized around 15 to 16 percent. A similar pattern holds for hiring employees generally. This represents a kind of stagnation in a state of net job decline — not only has the rate of hiring not increased, but the small business sector now finds itself in a situation where more businesses are being forced to lay off rather than hire every week.

This recent flatlining occurs across a variety of metrics. The U.S. Census Bureau’s financial stress index, a consolidated measure of the stress businesses are experiencing, has stopped improving in recent weeks as well. The percentage of firms missing a loan payment and missing other payments including rent, utilities, and payroll have also stabilized in recent weeks at 3 and 10 percent respectively.

While stabilization is preferable to further decline, it should not be misconstrued as growth or active recovery, since that stabilization has generally occurred at levels of economic activity that were only fractions of pre-pandemic baselines for many small businesses.

Although Disruptions To Supply Chains Are Still Plaguing Some Businesses, The Driving Force Behind Stagnation Appears To Be Depressed Demand

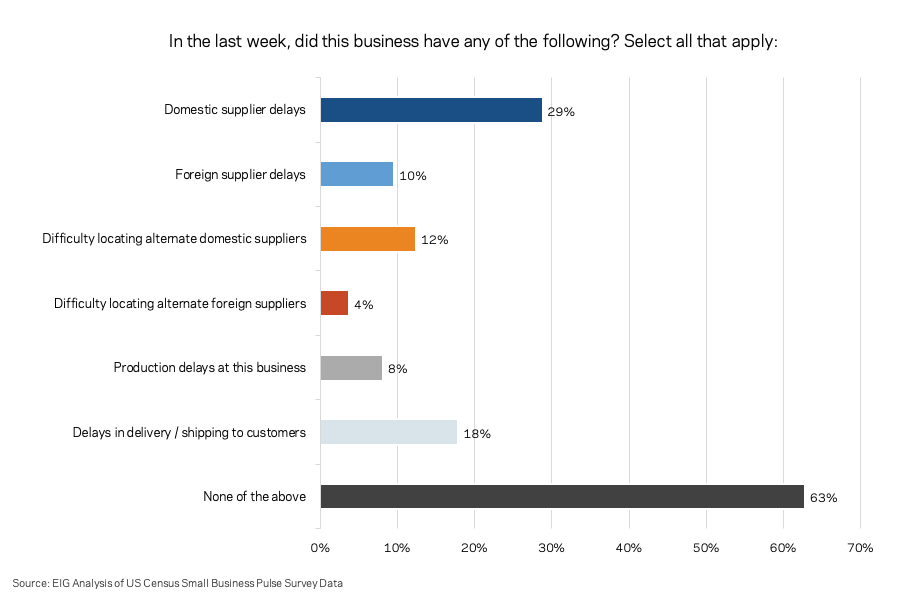

Production, supply, and delivery delays are not impeding the businesses of over 60% of respondents, reinforcing the belief that for the market writ large, the stalling recovery is demand- rather than supply-driven. While 29 percent of small businesses report domestic supplier delays, 18 percent report delays in delivery/shipping to customers, and 10 percent report foreign supplier delays, 63 percent of responding businesses report experiencing none of these or similar production/supply delays.

However, while production, supply, and delivery toplines imply a substantial portion of the market is operating unimpeded by such delays, that varies across sectors. The retail trade sector led the pack on experiencing domestic supplier delays, with 49 percent reporting such problems. Foreign supplier delays hit the wholesale trade sector hardest, with one in four respondents (25 percent) reporting the issue. Manufacturing led on production delays, with over 20 percent reporting the issue. In terms of delays in deliveries to customers, all three sectors as well as the construction and other services sectors were above the national average.

On the metro scale, reports of large negative effects of the pandemic do not track with limits on operating capacity based on physical distancing of customers, implying that stricter distancing protocols do not directly relate to continued suffering among small businesses. Places with the highest share of businesses reporting a large negative effect of the pandemic aren’t necessarily those with the most concerns about social distancing affecting operating capacity, implying that rules and regulations alone are not driving stagnation.

*****

Depressed demand is likely to continue until the public health crisis is resolved through a widely-available vaccine and effective therapeutic treatments. Given the dire situation of some sectors and businesses as well as the stagnating recovery, further interventions must offer longer-term support to businesses so that they can survive the pandemic and a prolonged period of muted economic activity. Preserving viable businesses while allowing new ones to emerge and grow is the best guarantor of a strong recovery.