By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from October 4th to October 17th and is the last before the survey goes on hiatus.

Here are five things we learned about the small business economy last week:

- As of the week of October 11th, 12 percent of small businesses require proof of vaccination before an employee returns to work. Despite President Biden’s vaccination push, the share of small businesses that require employees to have proof of COVID-19 vaccination before physically coming to work has risen only 2 percentage points since the announcement in early September. President Biden’s mandate required all businesses with 100 or more workers to require employees to get vaccinated or get tested for the virus weekly and the Pulse survey respondent universe includes businesses with anywhere from 1 to 499 employees. Vaccination requirements are most common in the healthcare sector, but even in that sector the share stands at only 24 percent. The sectors with the next highest shares of small businesses requiring proof of vaccination are education (19 percent), arts, entertainment, and recreation (14 percent), and accommodation and food services (14 percent).

a

a

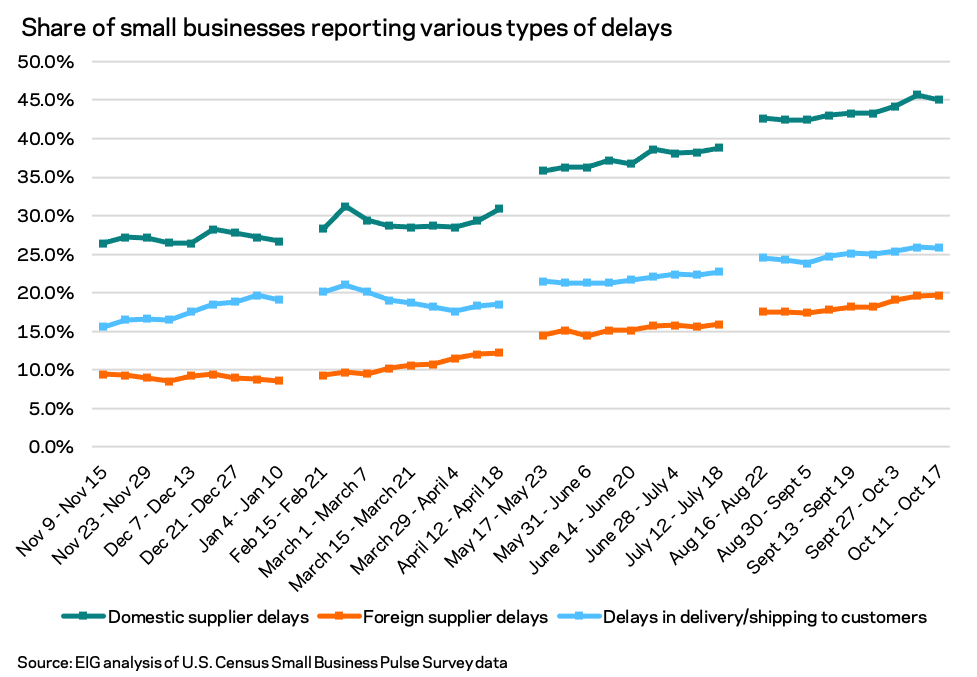

a - Supply chain pressures continue to affect a large share of small businesses, with an overwhelming majority feeling the crunch in particular sectors. Over 45 percent of small businesses experienced domestic supplier delays in the last two weeks, a share 1.5 times higher than during the tumultuous winter months of 2020. Domestic supplier delays are affecting 60 percent or more of small businesses in five sectors: manufacturing, retail trade, accommodation and food services, construction, and other services. Foreign supplier delays and customer delivery delays have also impacted an increasing share of small businesses in recent months.

a

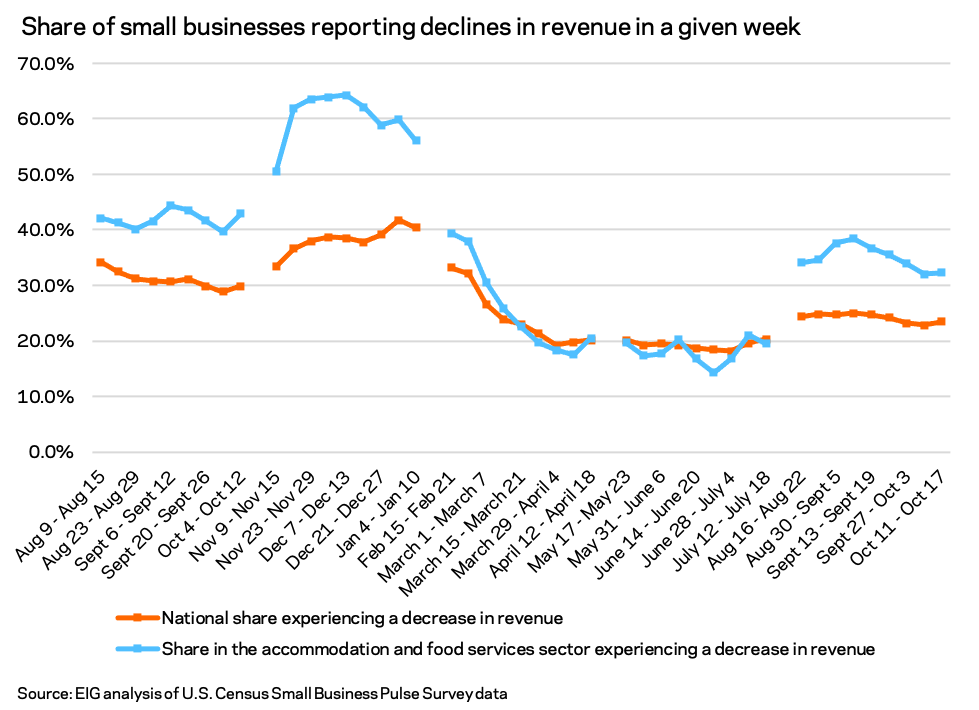

a - Reports of small business distress are growing less responsive to COVID-19 case numbers. Despite national COVID-19 case numbers declining in recent weeks, short term small business distress is persisting. Potentially as a result of the additional labor market and supply stressors, improvements in COVID-19 case numbers have not been associated with a strong improvement in the share of businesses experiencing short term economic distress (proxied here as the share of businesses experiencing revenue declines in a given week). From September 14th to October 14th, the 7-day average daily caseload dropped by nearly 68,000, a 45 percent decline. Over that same period, the share of small businesses experiencing weekly revenue declines only dropped a percentage point, from 24.7 percent to 23.5 percent. While there may be a lag, the accommodation and food services sector, perhaps the most timely in responding to previous improvements in case numbers, saw only slight improvements in short term distress over the past month that leveled out in the most recent week.

a

a

a

- One-third of small businesses reported difficulties hiring paid employees the week of October 11th. With 40 percent of small businesses expecting to need to identify and hire new employees in the next six months, the small business economy’s labor struggles are unlikely to be resolved anytime soon. This restaffing comes after significant shedding across the small business sector during the pandemic: since the start of the pandemic, almost 30 percent of small businesses have had a moderate to large decrease in their number of paid employees.

a - The Northeast and West coast remain the places where the largest shares of small business expect an extended recovery timeline. Over 40 percent of small businesses in several Northeastern and West Coast states such as California and New Jersey expect a recovery to pre-pandemic level of operations to take longer than six months. By contrast, in some states in the Northern Plains and interior West such as Wyoming and Nebraska, less than 30 percent of small businesses expect a full recovery to take longer than six months. The areas with the longest recovery timelines appear to be among those hit hardest by the pandemic in 2020, as evidenced by the similarity between the list of states that saw the greatest declines in personal consumption expenditure from 2019 to 2020 and the list of states with larger shares of small businesses reporting an extended recovery timeline. While it is encouraging that some geographies have better outlooks, the national recovery is likely to be seriously hampered by the places with extended recovery timelines: the 20 states (plus DC) where small business recovery expectations were worst were responsible for 63 percent of the nation’s GDP in 2020.

a