By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from May 17th to May 23rd.

Here are five things we learned about the small business economy last week:

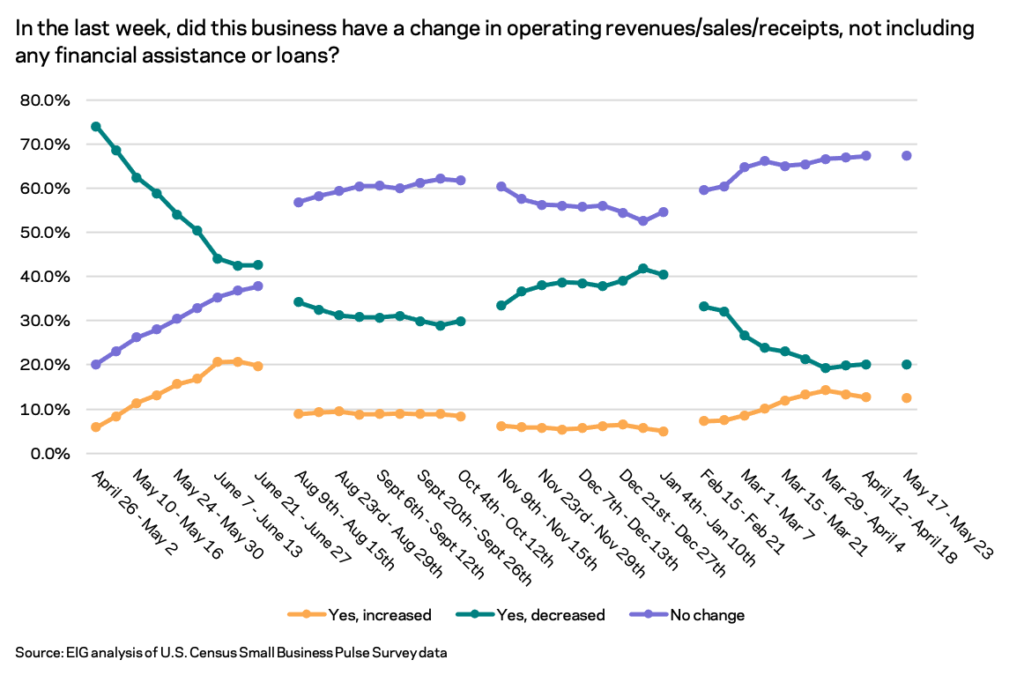

- There has been no improvement in the share of small businesses reporting weekly revenue declines in the past two months. One in five small businesses reported decreasing revenues the week of May 17th, virtually unchanged since the beginning of April. Over the course of the data series, the share of firms reporting decreasing revenues in any given week has consistently outpaced the share reporting revenue increases and, as the survey returned after a month hiatus, the size of the gap between the two lines remained unchanged. Stasis, rather than active growth, seems to be the order of the day, as two-thirds of firms reported no change in revenues. It remains to be seen whether a robust recovery is slow in coming for a large portion of the nation’s small business sector or whether many have instead settled into a disconcerting new normal.

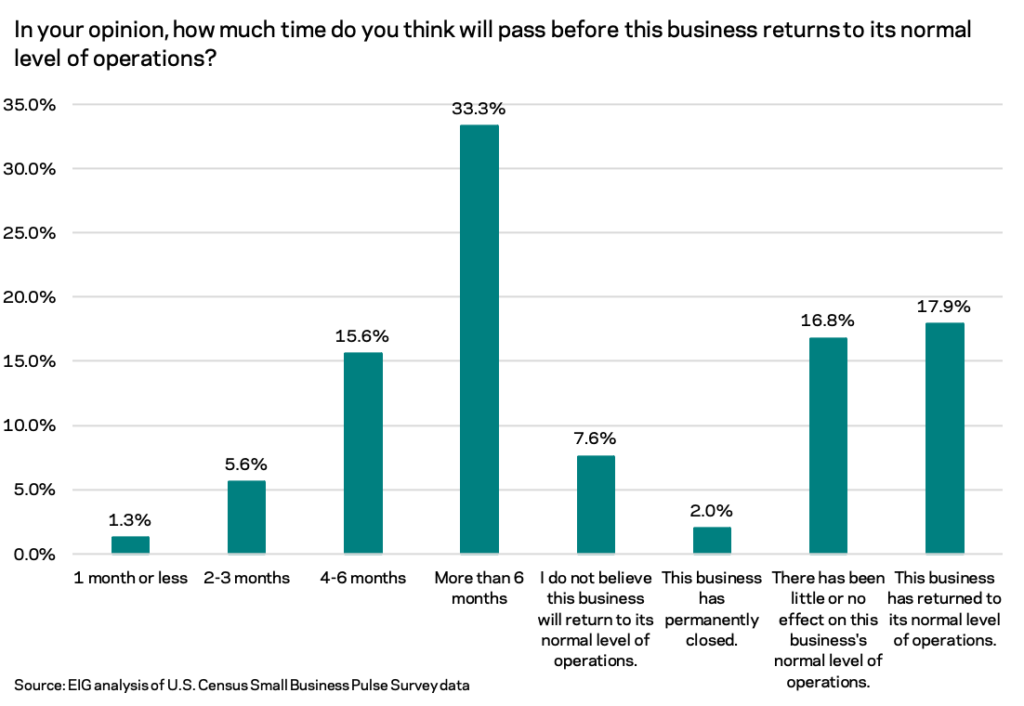

- One-third of small businesses still expect a full recovery to take six months or longer. While a total of one-third of businesses are either back up to their normal level of operations or experienced no significant effect of the COVID pandemic on their operations, another full third of surveyed small businesses still expect a return to normal level of operations to take six months or longer.

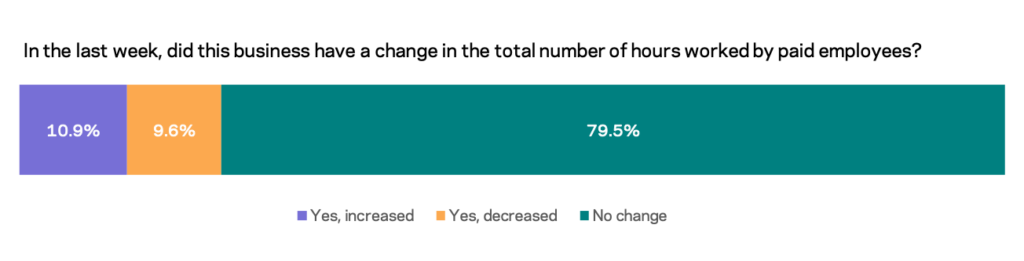

- The staffing picture offers a more hopeful look at recovery: In the week of May 17th, more businesses added employee hours than cut them for the first time in the data series. While the share of businesses increasing employee hours had been ticking up for much of March and April, the share of businesses adding employee hours had not surpassed the share of businesses cutting them for any week on record until May 17th. While these shifts are promising, just under 80 percent of small businesses reported no change in employee hours last week.

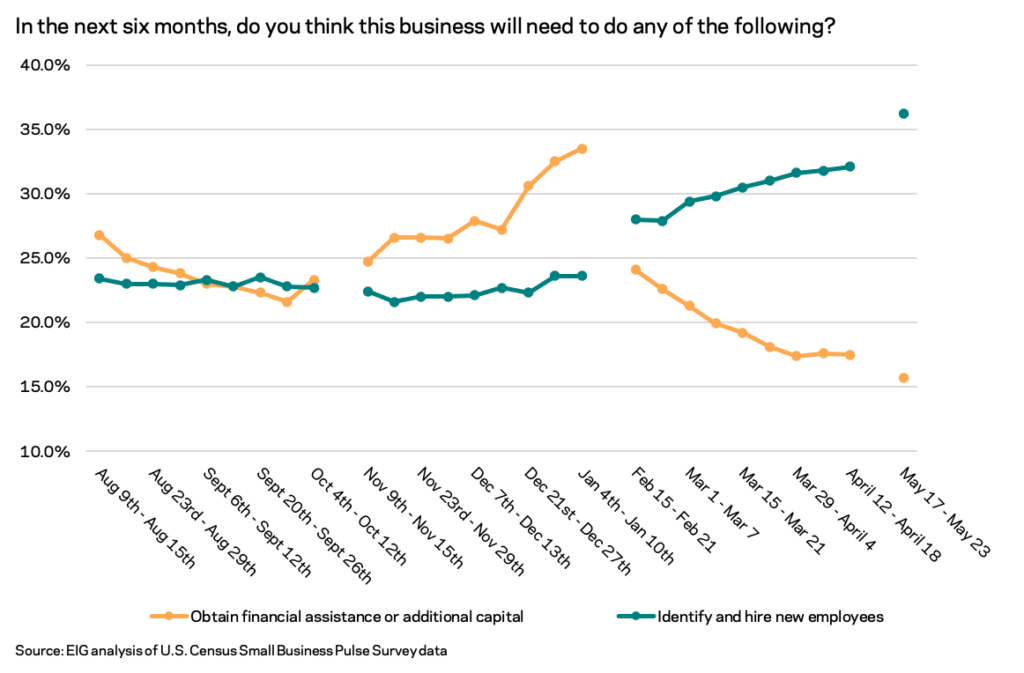

- Over a third of small businesses (36 percent) expect to need to identify and hire new employees in the next six months. While economists and policy wonks debate over the real magnitude and causes of reported labor market shortages, one-third of surveyed small businesses face the very real need to hire in coming months. In the accommodation and food sector, the share of businesses expecting to need to identify and hire new employees rises to well over half (59.3 percent). As the recovery has taken hold, hiring has become the primary short term preoccupation of small businesses. In the late fall and early winter, the share expecting to need additional financial support was consistently higher than the share expecting to need to hire. Since February, however, the relationship between the two needs has flipped. As of the week of May 17th, fewer than half as many businesses expected to need to find additional financial assistance or capital.

- Fewer than five percent of surveyed small businesses are requiring employees to have proof of COVID-19 vaccination before physically coming to work. As of the week of May 17th, only 3.8 percent of small businesses required employees to have proof of vaccination before coming to work, only a one percent increase over the month since the survey last asked the question. As the share of businesses requiring a vaccine remained low, the share requiring a negative COVID test before coming to work dropped two percentage points from 7.5 percent to 5.5 percent. Both questions focus on concrete proof of vaccination or testing as opposed to informal requirements, so honor-based systems between employee and employer may be more common.