By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of June 7th to June 13th.

Here are five things we learned about the small business economy last week:

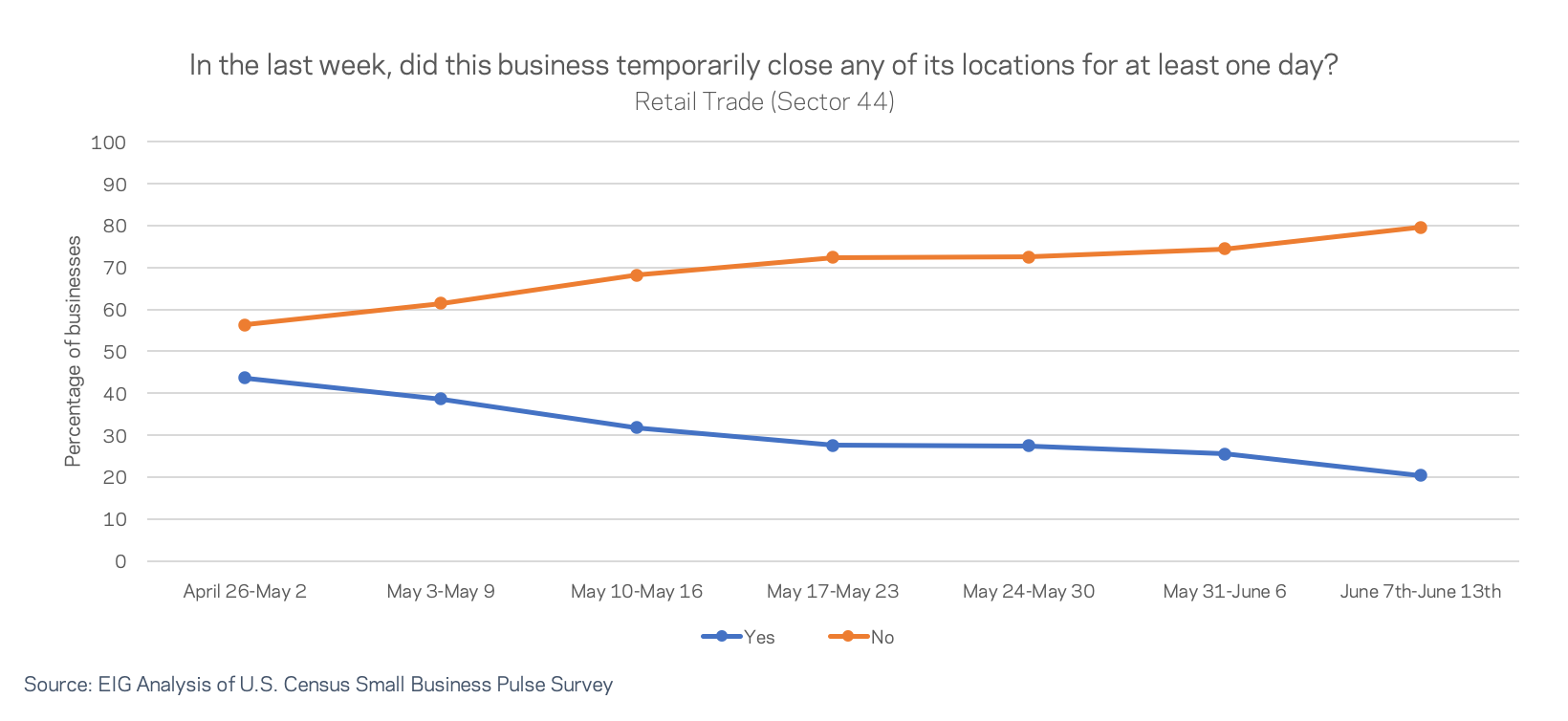

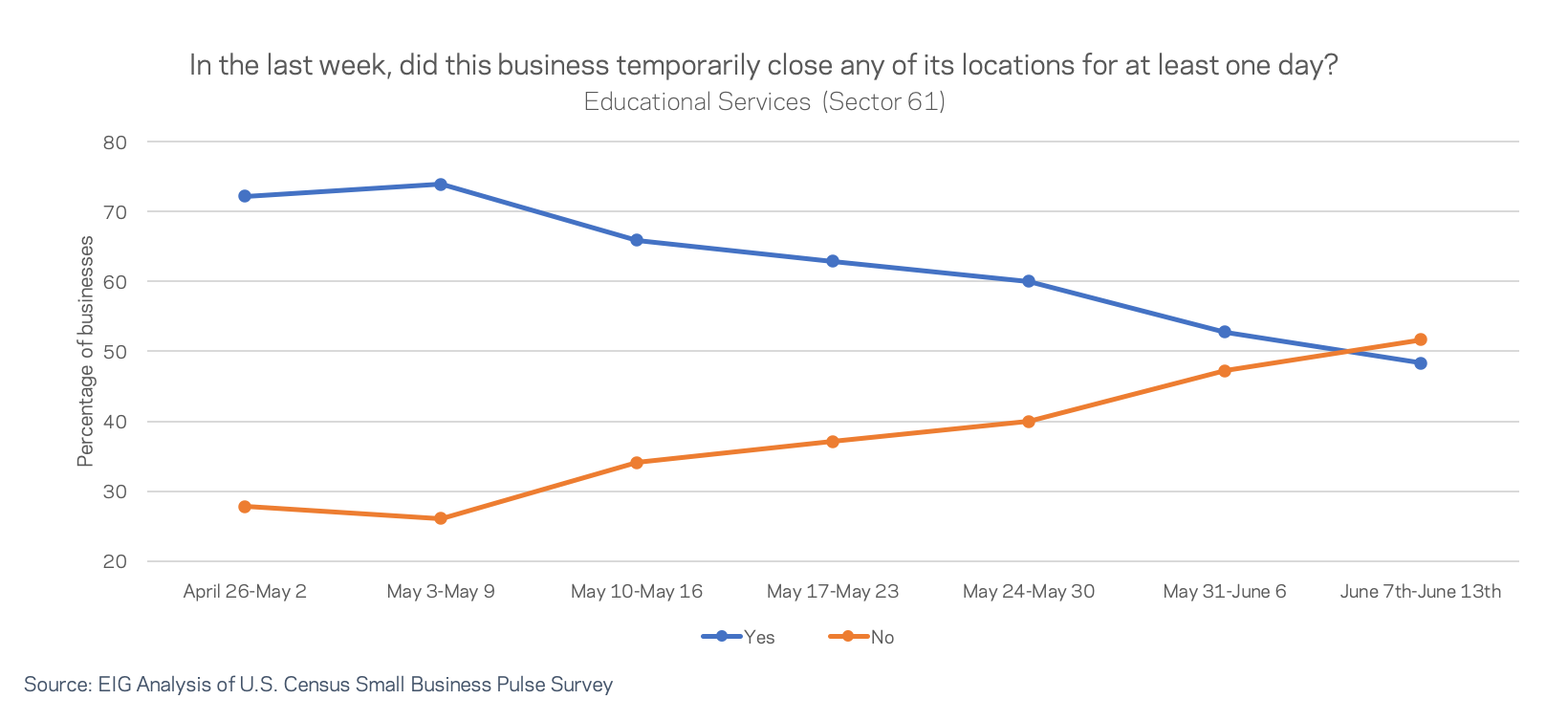

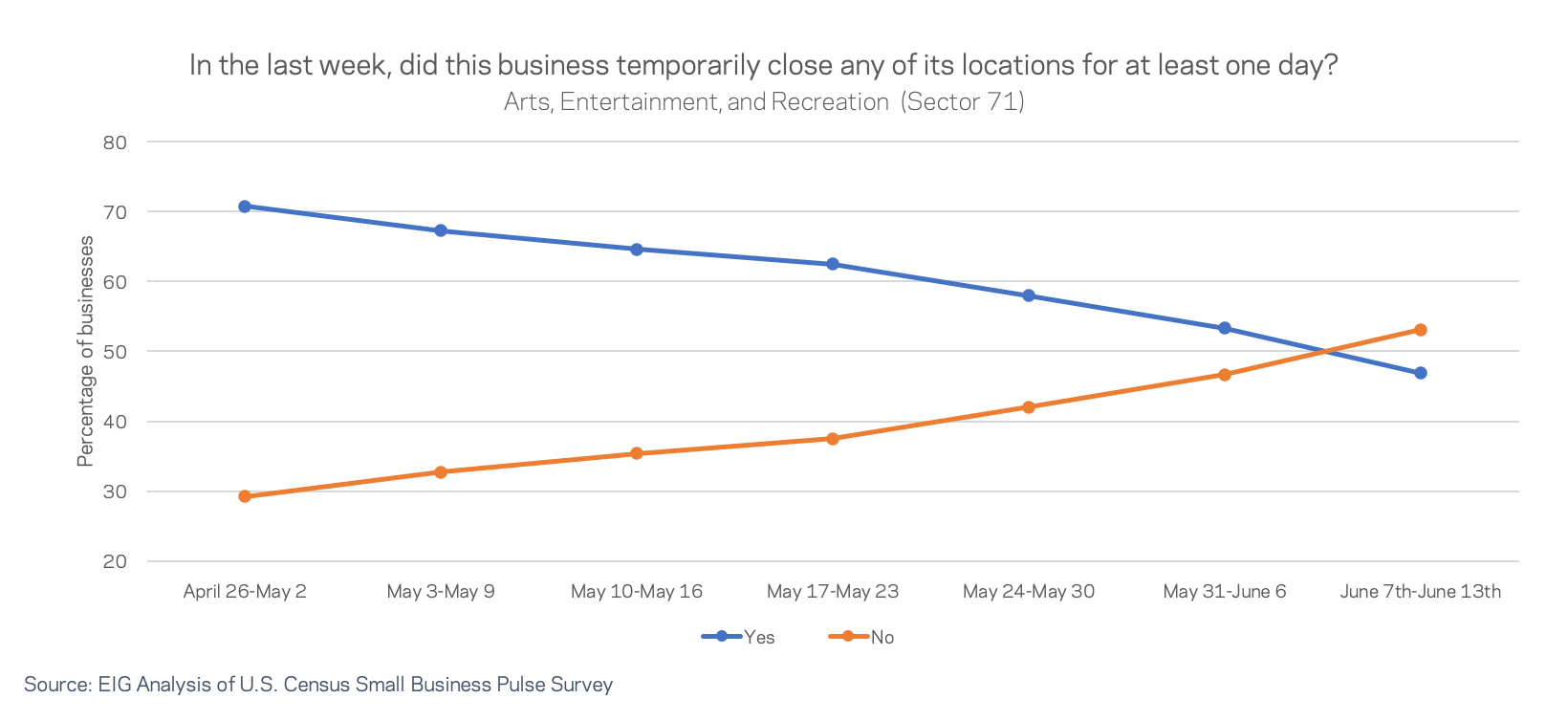

- For the first time since the crisis began, the majority of businesses across all sectors reported not having experienced a temporary closing in the past week. Nationwide, 22 percent of small businesses reported at least one day of temporary closure last week, the lowest share yet. However, even though all sectors are on the way to resuming partial operations, some sectors remain more shutdown than others. Retail has undergone one of the most significant transitions. At the end of April it had more shutdowns than the national average, but by the first week of June it had fewer and now three-quarters of retailers are back open. Education and the arts, entertainment, and recreation sectors were the last to cross the majority open threshold, only reaching that benchmark during the week of June 6th.

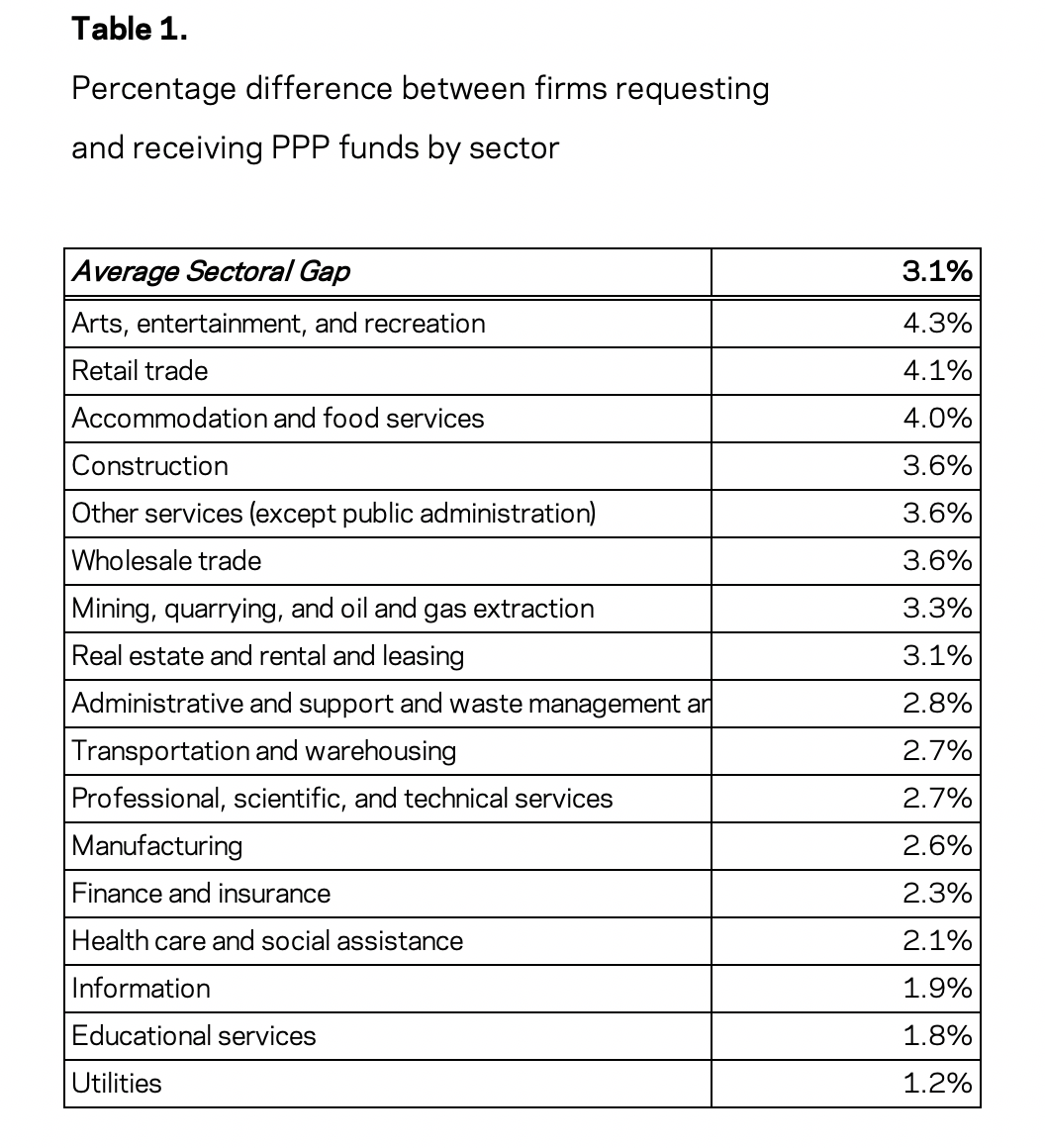

- The relative gap between the percentage of businesses who requested PPP funds and those that received them varies across sectors. The sectors most directly impacted by stay-at-home orders show the greatest residual between businesses that requested PPP and those that report having received assistance through the program. The gap is largest in the arts, entertainment, and recreation sector, where 70.5 percent of businesses surveyed have requested PPP funds but only 66.2 percent of businesses have received them. In the utilities sector, by contrast, 24.4 percent of businesses requested PPP funds and 23.2 have received them.

- Nearly one in five surveyed small businesses in the accommodation and food services sector self-financed to some extent during the crisis. While the national percentage of small businesses supporting themselves with self-financing has hovered around 11 percent for several weeks, the number jumps to 19 percent in the accommodation and food services sector. By contrast, two of the other hardest hit sectors—retail and arts, entertainment, and recreation—only saw around 10 percent of respondents self-finance. Other sectors have sought support from other sources. The largest shares of small businesses requesting support from state and local governments can be found in the education (12.5 percent) and accommodation and food services and arts, entertainment, and recreation sectors (roughly 10.5 percent each).

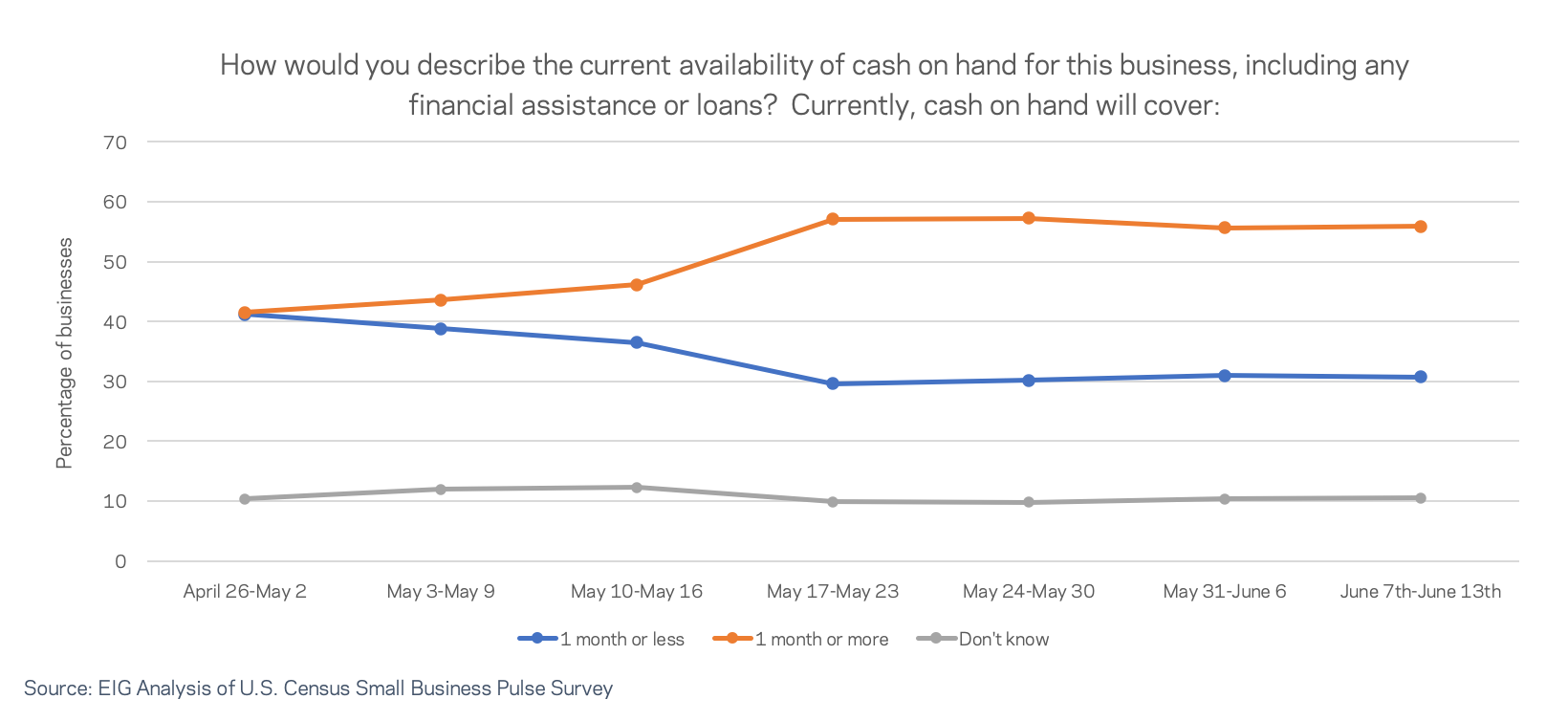

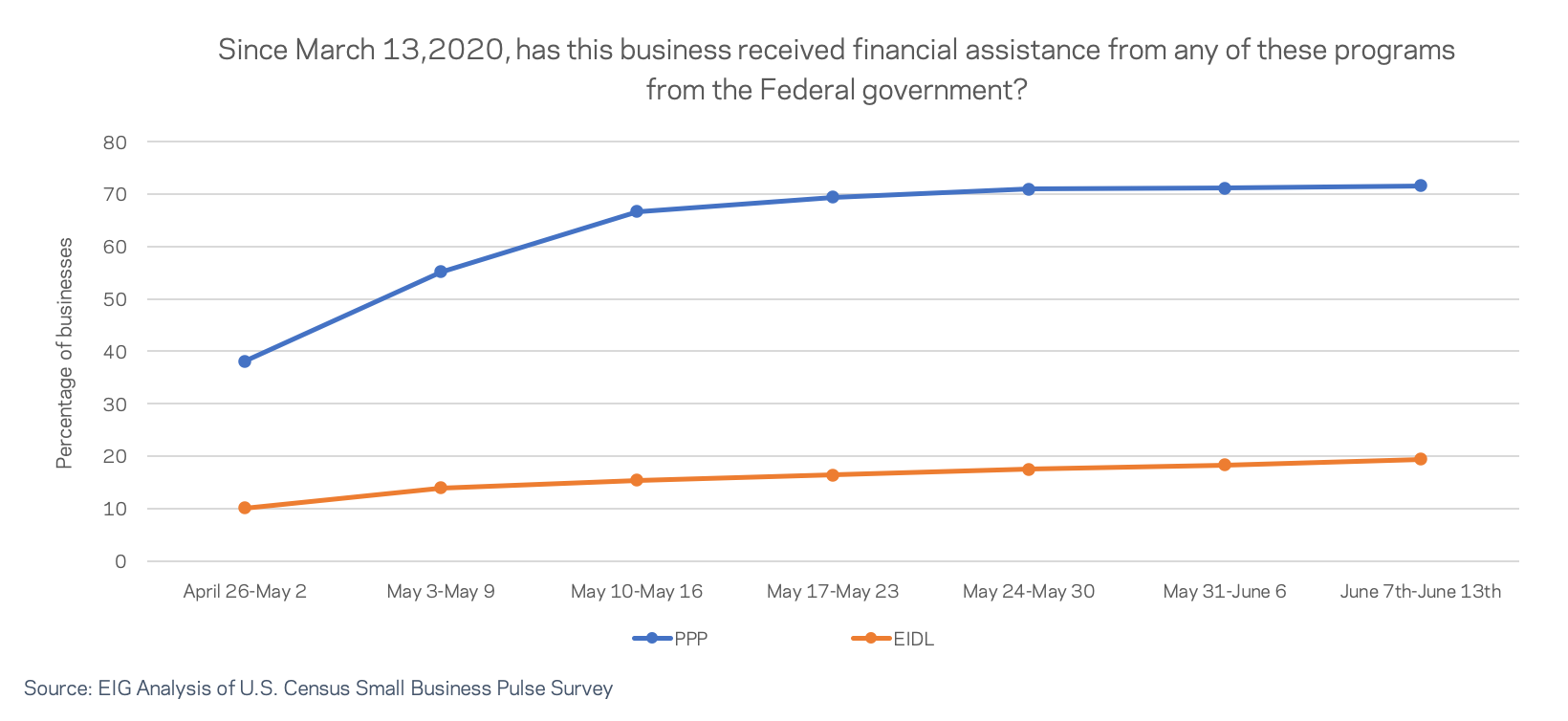

- Cash on hand appears to have jumped following the dispersion of PPP funds. Fifty-six percent of respondents report having enough cash on hand to cover at least one month of operation, up from 42 percent at the end of April. Looking back over the past seven weeks, cash on hand appears to have improved substantially in the middle of May, roughly a week after PPP funds were widely distributed (compare the two charts below). PPP disbursements are not the only possible explanation for improved cash on hand, of course. Other relief; infusions from owners, friends, and families; cost-cutting measures; and many other factors may have bolstered companies’ accounts as well. Nevertheless, with the window of covered support from PPP coming to a close, the future course of the virus uncertain, and consumer demand still unsettled, there is some question as to how durable these improved cash on hand metrics really are.

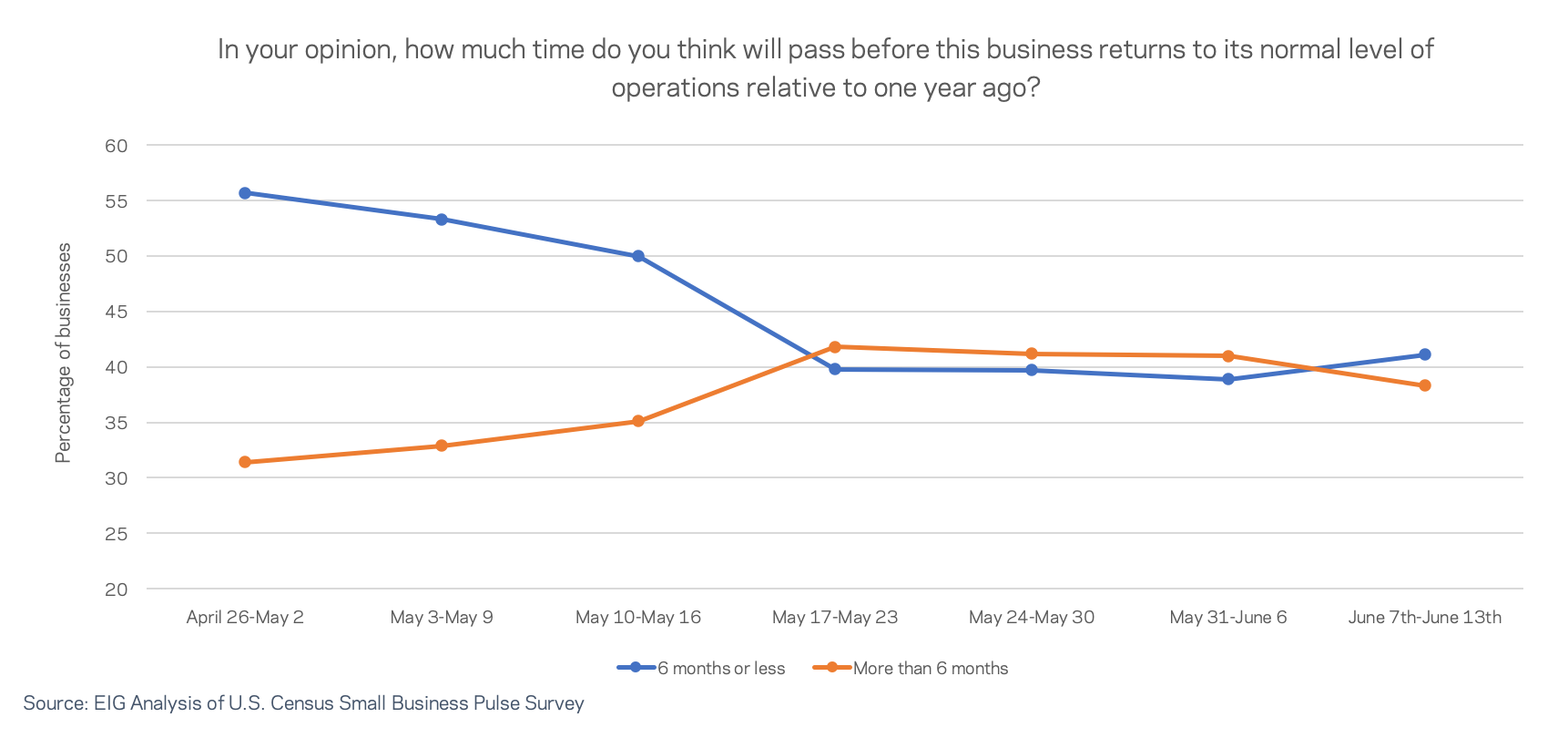

- Small business sentiment continued to improve last week, but cases have since spiked in a number of states. Last week, before the full extent of new case spikes in states such as Arizona, Florida, and Texas was apparent, outlooks were improving across the small business sector on the back of continued reopenings. However, the past several days have brought new pauses in certain states’ openings, and recent improvements in sentiment may prove short-lived. Next week’s data release will give a better idea how new stumbles in the fight against the virus may affect business optimism.