By Daniel Newman

The U.S. Census Bureau’s Small Business Pulse Survey provides timely insight into the condition of the country’s small business sector as economic conditions continue to evolve. This analysis primarily covers data from November 29th to December 5th.

Here are five things we learned about the small business economy this week:

- Though supply chain issues have ebbed somewhat in recent weeks, disruptions and price increases continue to burden the small business sector. More than half of small businesses experienced common disruptions overall last week, with domestic supplier delays most prominent. Nearly 44 percent of small businesses reported domestic supply delays, down slightly from the peak share of 46.3 percent recorded in mid-November. Disruptions and other difficulties are most impactful in those industry sectors highly reliant on raw materials and complex supply chains such as manufacturing, wholesale and retail trade, construction, and accommodation and food services.

a

a

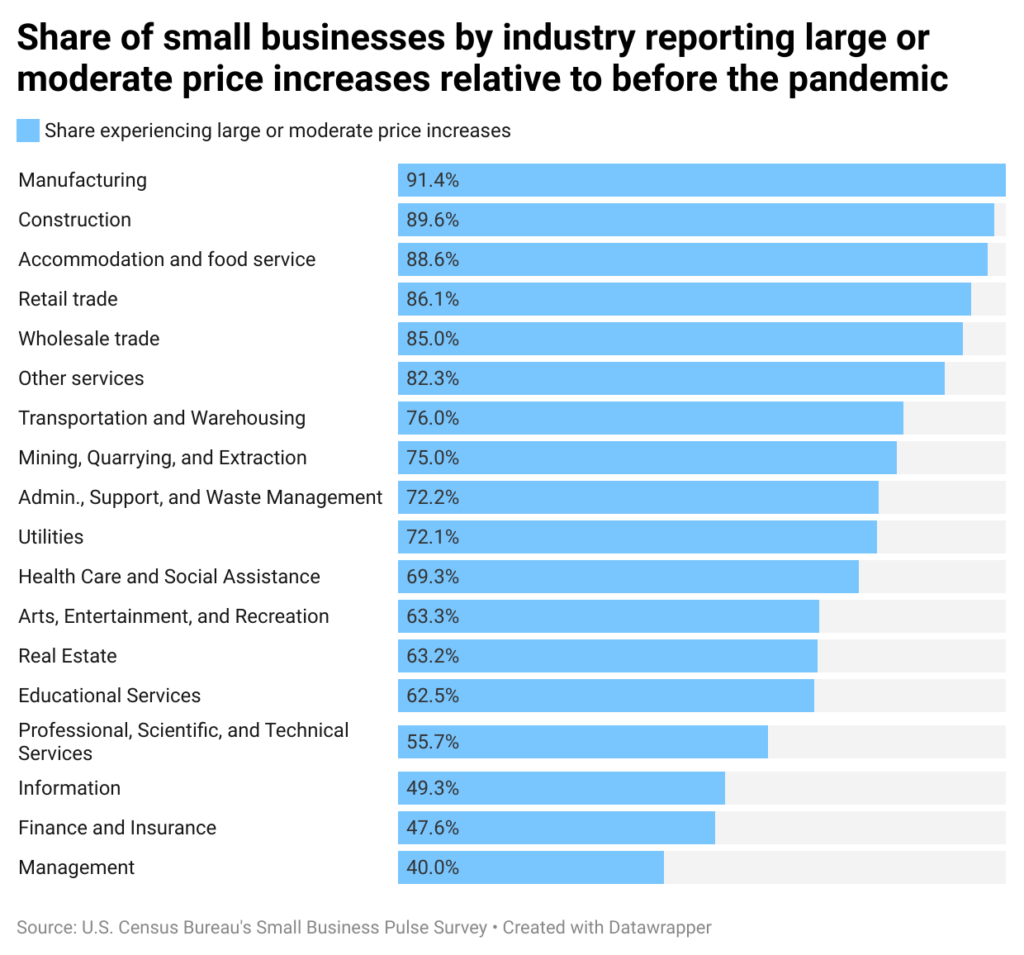

Nationwide price increases are further compounding these challenges. Nearly three-quarters of small businesses indicated they are grappling with large or moderate price increases for goods and services relative to before the pandemic. The rising cost of doing business is nearly uniform across the three most highly-impacted sectors: manufacturing (91.4 percent), construction (89.6 percent), and accommodation and food services (88.6 percent).

a a

a - Unfilled job openings continue to challenge small businesses, particularly in the accommodation and food services, health care, and manufacturing sectors. Nearly one third of small businesses (31.7 percent) have experienced difficulty hiring amid a tight labor market, with record-high job openings and jobless claims falling to a 50-year low. Since late summer, employers experiencing difficulties hiring paid employees have consistently outnumbered those employers who have not struggled to hire; however, the share of small businesses facing difficulty hiring paid employees has ticked down and is now nearly equal to the share that have not faced hiring difficulties. Small businesses in the accommodation and food services (57.9 percent), health care and social assistance (41.1 percent), and manufacturing (39.8 percent) sectors have indicated the greatest difficulty hiring paid employees.

a

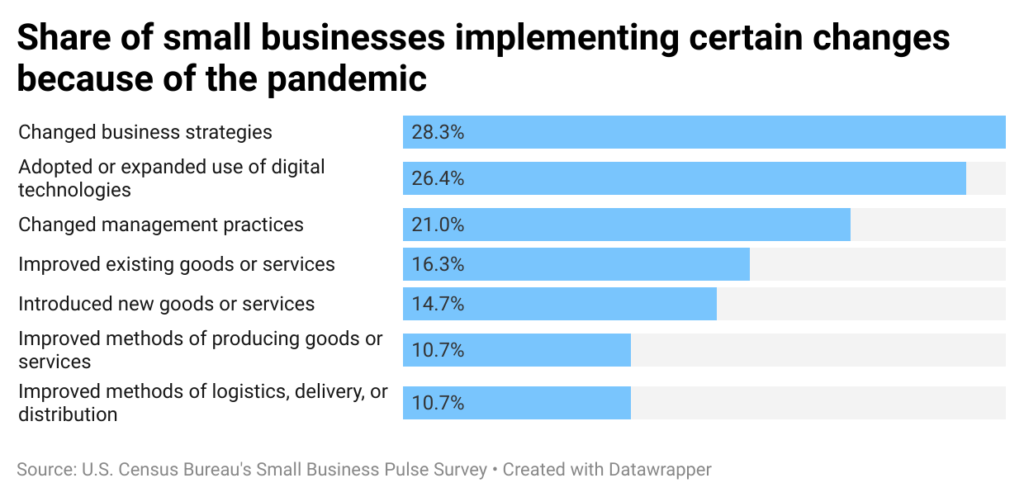

a - More than half of businesses have adapted in some way to the changing economic realities of the pandemic. Just over half of small businesses have changed their operations to adapt to pandemic-induced circumstances. The most common adaptations have been to change their overall strategies, adopt or expand use of digital technologies, and change their management practices.

a

a

a

One of the most visible aspects of the evolving business landscape has been the rise of remote work. Nationally, 15.2 percent of small businesses reported that there was still a moderate-to-large increase in the number of hours that employees spent working from home the week ending December 5th. This shift is more prevalent in some industries than others—greater shares of employees are still working from home relative to pre-pandemic times in white-collar sectors including professional services (32.9 percent), educational services (31.8 percent), and information (29 percent).

a - The share of small businesses requiring proof of vaccination has plateaued in recent weeks, although requirements vary widely among states. Just over 12 percent of small businesses required proof of COVID-19 vaccination before coming to work in the past week, amid growing uncertainty over the severity of the Omicron variant and the Biden administration’s vaccine mandate. The patchwork of rules and regulations that has developed across states, counties, and other local governments in recent months has generated a stark variation in the share of businesses requiring vaccinations across states. Small businesses in Western states and those in the Northeast and Mid-Atlantic are much more likely to require proof of vaccination to work in person.

a

a - A growing share of small businesses think that operations will never return to levels seen before the pandemic. The share of small businesses reporting a return to normal operations (19.5 percent) continues to lag behind its summer peak, when almost one-quarter of survey respondents felt that current conditions resembled pre-pandemic operations. Troublingly, the share of small businesses believing that a return to pre-pandemic operations will never be achieved ticked up slightly to 12.3 percent last week. This figure is nearly double that of December 2020, when only around 7 percent of businesses feared they would never achieve a full recovery. This sentiment was strongest among small businesses in the education sector.

a