By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from August 16th to August 22nd, the first week of the data’s return since late July.

Here are six things we learned about the small business economy last week:

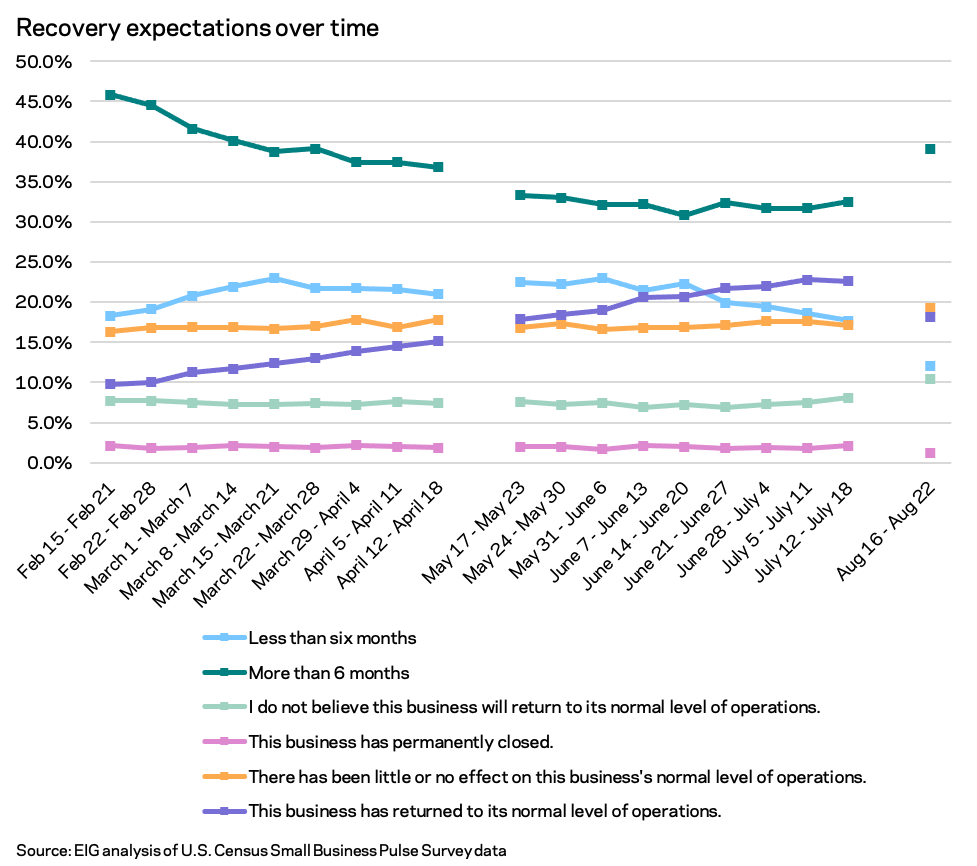

- The Delta variant’s surge has erased all progress on small business recovery expectations made during the spring and early summer. After improving from February to May and stabilizing through the summer, recovery expectations took a turn for the worst in August. The share of small businesses expecting a return to normal operations to take six months or longer rose almost seven percentage points, from 32.5 to 39.1 percent from mid-July to mid-August. To put the backslide in perspective, that matches the recovery expectations in March, representing a loss of almost five months of progress on the metric. The share of businesses reporting a return to normal operations backslid as well. Troublingly, the share of survey respondents who do not believe their business will return to its normal level of operations at all moved above 10 percent for the first time since June 2020.

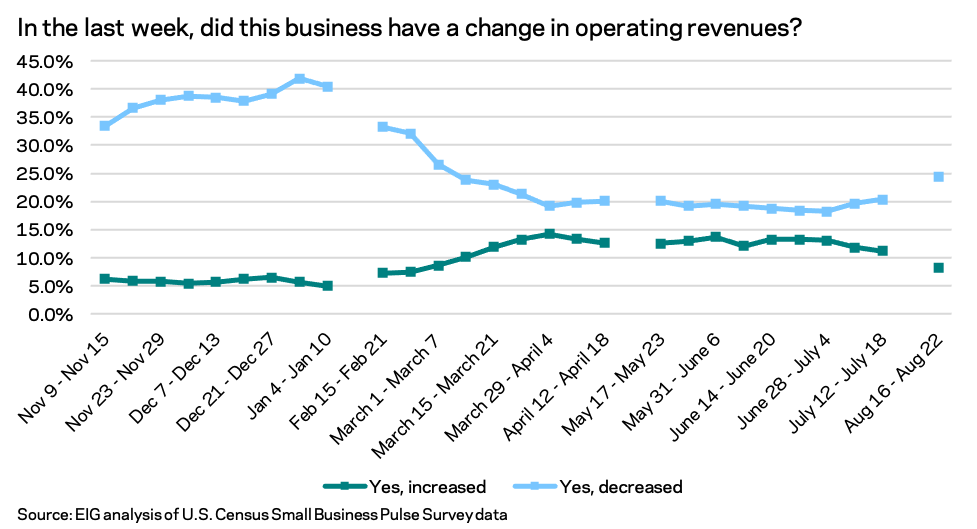

- The share of businesses reporting a decline in revenues is at its highest point since early March. The broader economic situation for small businesses has noticeably worsened since mid-July, with almost a quarter of small businesses reporting a decrease in revenues the week of August 16th. Likewise, the share reporting increases in revenue fell.

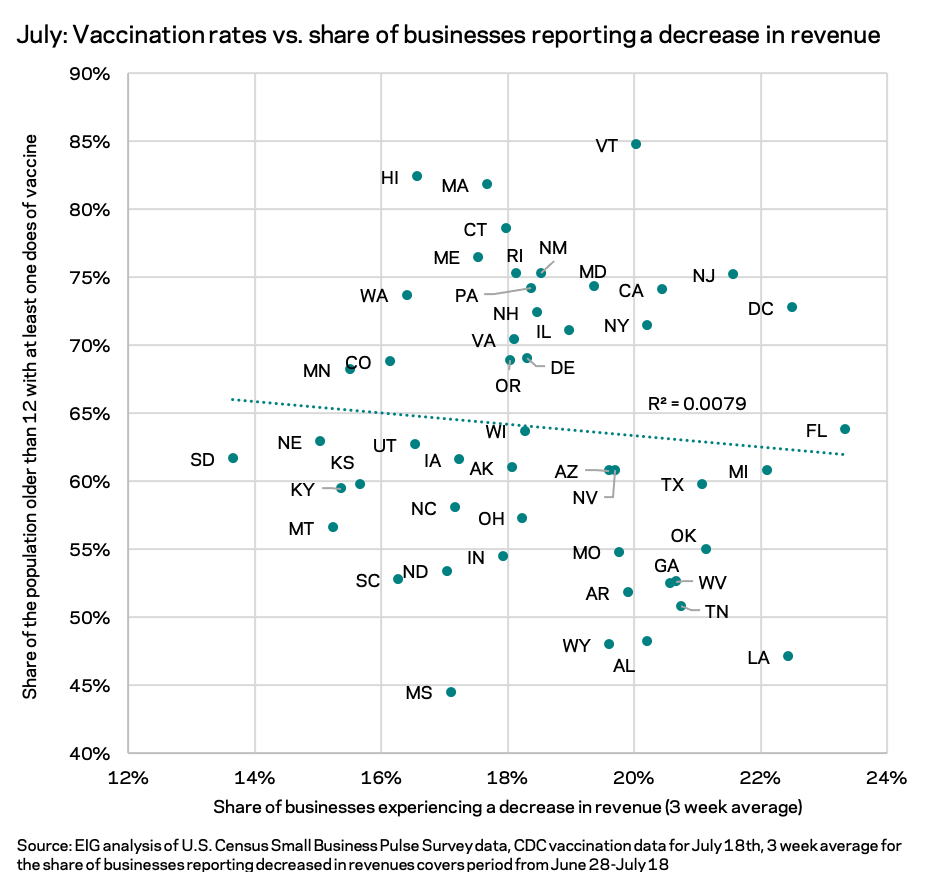

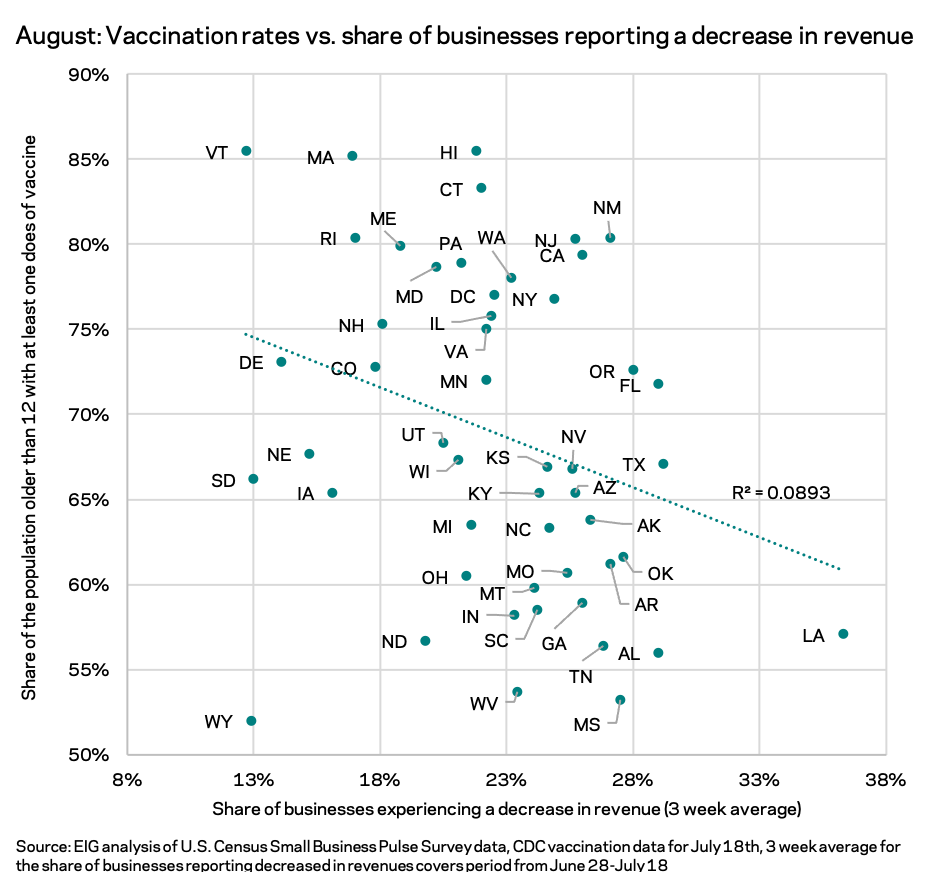

- There’s an emerging relationship between vaccination rates and short term economic pain for small businesses that wasn’t present in July. It appears that the relationship between short term economic distress, proxied here by the share of businesses reporting decreasing revenues in a given week, and state level vaccination rates may be changing. Growing shares of small businesses are reporting revenue losses across the country, but many states with lower vaccination rates appear to be registering the greatest distress on this indicator for the week of August 18th. Other structural factors like local economic orientation and supply chain issues are also driving distress, and more weekly observations will be needed to confirm whether a new relationship between vaccination rates and small business health is emerging.

a

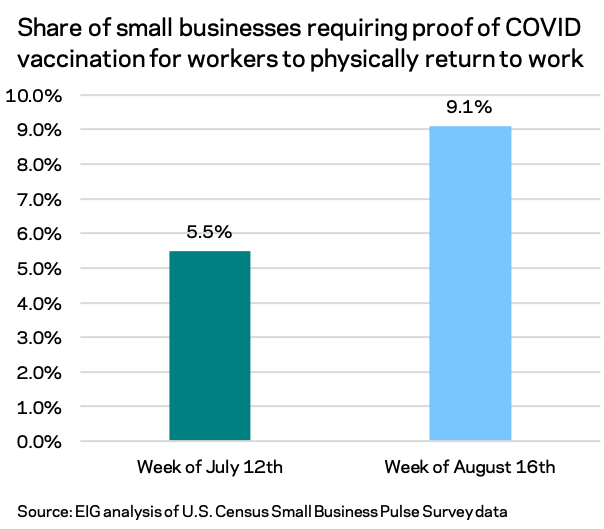

- The share of small businesses requiring proof of COVID vaccination before employees come to work jumped several percentage points in the last month. Nine percent of small businesses required employees to have proof of COVID-19 vaccination before physically coming to work the week of August 16th, up from 5.5 percent the week of July 12th. The share of businesses requiring a negative COVID test before physically coming to work also rose, up to 8.5 percent from 4.7 percent in the week of July 12th. The top four sectors that required employees to provide proof of COVID vaccination before returning to work were health care and social assistance (15.8 percent of surveyed small businesses), information (12.1 percent), education (11.5 percent), and accommodation and food services (11.5 percent).

a

- Rapidly shifting fortunes in the accommodation and food services sector are an ominous sign for the small business recovery. Perhaps the most responsive sector to the summer’s fledgling recovery was the accommodation and food services sector. In mid-July the sector led on hiring, with 18.2 percent of small businesses in the sector reporting adding employees in a given week, comfortably outpacing the11.9 percent that reported trimming headcount. By mid-August, the situation had reversed, and the accommodation and food services sector led on layoffs. Only 10.5 percent of businesses in the sector reported adding employees while 18.8 percent reported cutting them the week of August 16th.

- Supply chain pressures on small businesses have only worsened since July, with four out of ten small businesses reporting domestic supplier delays. Supply chain issues for small businesses worsened from July to August across all industries. Around 43 percent of small businesses reported experiencing domestic supplier delays the week of August 16th, while 24.5 percent reported delays in delivery to customers and 17.5 percent reported foreign supplier delays. In total, only 50.6 percent of small businesses reported operating without some kind of production or supply difficulty. Domestic supplier delays are up 15 percentage points from the start of the year and up almost four percentage points from mid-July.