By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from March 29th to April 4th.

Here are six things we learned about the small business economy last week:

1. The last two weeks represent the first time in the Small Business Pulse Survey data series that more firms have added employees than cut them. In the week of March 29th to April 4th, 7.9 percent of businesses increased the number of paid employees they had while 7.3 percent decreased the number of paid employees. As has been the case throughout the pandemic, the majority of firms had no change in the number of paid employees in that given week. Six sectors had an above national average share of firms increasing the number of paid employees: accommodation and food services, arts, entertainment, and recreation, education, manufacturing, construction, and administrative and support and waste management services.

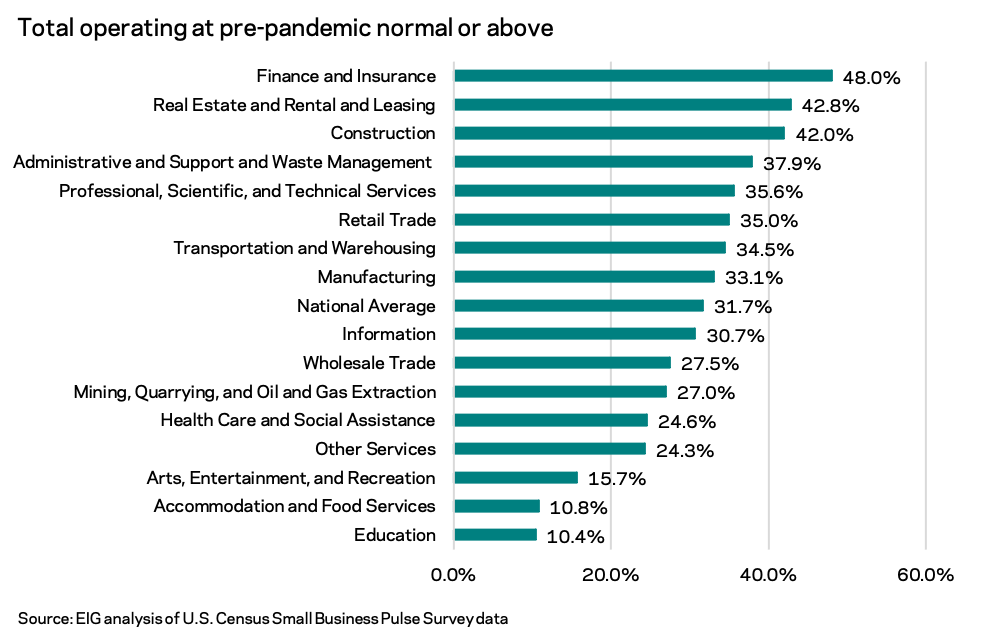

2. Nearly one-third of businesses are at their normal level of operations relative to pre-pandemic but 58.3 percent could handle at or above their pre-pandemic operating capacity. Just under 32 percent of businesses are operating at the normal level of operations, having either returned to their normal level of operations or having experienced little to no effect of the pandemic on their operations. By contrast, 58.3 percent report possessing the ability to operate at or above their pre-pandemic operating capacity, defined here as the maximum amount of activity a business could conduct under realistic operating conditions. The large gap between the share of firms with the capacity to operate at their pre-pandemic normal compared to the share of firms actually returned to their normal level operating demonstrates the lingering effects of the pandemic recession in depressing demand for many businesses. It may also bode well for recovery, suggesting that many businesses still retain the capacity to meet anticipated increases in demand.

The finance and insurance, real estate, and construction sectors have the highest share of businesses operating at pre-covid levels while education, accommodation and food services, and arts entertainment, and recreation have the smallest share of businesses operating at pre-covid levels.

3. The biggest gaps between the share of businesses able to operate at full capacity and those actually operating at full capacity are in the wholesale trade, information, retail trade, and manufacturing sectors. In the wholesale trade sector, 63.6 percent of businesses feel they still could operate at pre-pandemic levels or above but only 27.5 percent of businesses report actually doing so, meaning 36.1 percent of businesses in the sector are in a position to further ramp up production in the near term. Wholesale trade, retail, manufacturing, and accommodation and food services look to be among the sectors best poised to be able to absorb increases in demand as the recovery proceeds. With smaller shares of businesses currently able to operate at full capacity, the return to full fledged operations for the arts and entertainment, health, education, and transportation sectors may be more difficult. The construction sector has some of the least slack, as two-thirds of respondents that still feel they have the ability to operate at pre-pandemic capacity are already doing so.

4. The share of businesses expecting to need financial assistance in the next six months has been gradually falling over the past seven weeks as additional waves of aid hit businesses and recovery optimism improves. The share of businesses expecting to need to obtain financial assistance or additional capital in the next six months has drifted downwards as, among other things, the share receiving assistance through the Paycheck Protection Program (PPP) since December 27th has risen. Meanwhile, just under 50 percent of firms have not received financial assistance from any source since December 27th. The share of businesses receiving PPP loan forgiveness has also risen over the period.

5. In the next six months, three out of every ten businesses expect to have travel expenses. Just over 30 percent of surveyed businesses across the nation expect to have business travel expenditures in the next six months for air, rail, car rental, or lodging, a slightly elevated share from when the question was first asked in mid-February. States throughout the Northeast lag behind their peers across the country when it comes to travel expenditure expectations, while the South and interior Western states have the highest shares of businesses planning to spend on travel.

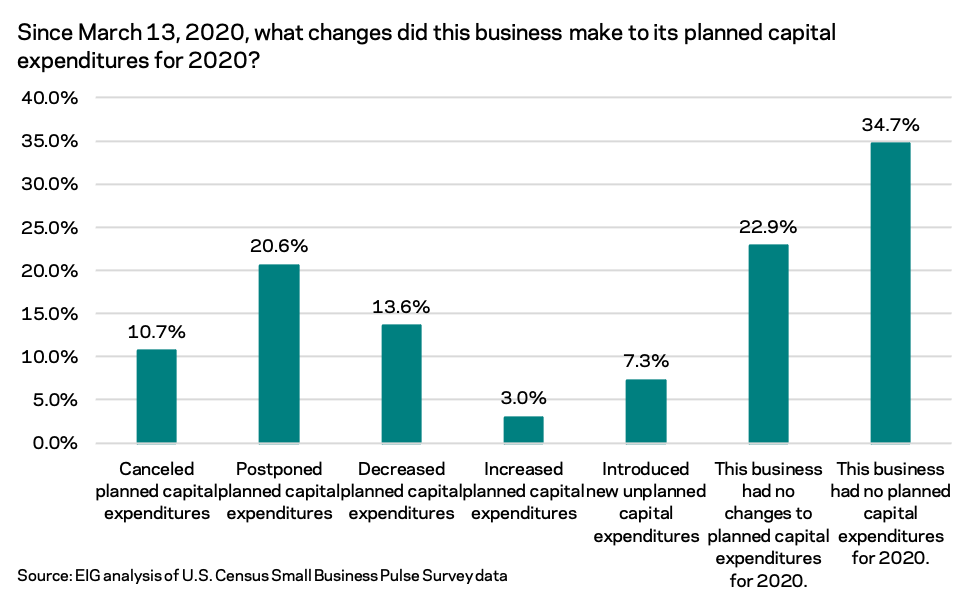

6. Only 10.3 percent of small businesses have actually increased their planned investments and capital expenditures or added new ones during the pandemic. One in five businesses postponed a planned capital expenditure in 2020 while 10.7 percent canceled them outright. On the flip side, 3.0 percent of surveyed businesses increased planned capital expenditures and 7.3 percent introduced new unplanned capital expenditures. This suggests that only a narrow slice of the country’s small business sector has been in a position to use the pandemic as an opportunity to pivot or expand. While at 34.7 percent the plurality of business had no planned capital expenditures in 2020, 22.9 percent did not change their planned capital expenditures in the face of the pandemic.