By Kennedy O’Dell

The U.S. Census Bureau’s new and experimental Small Business Pulse Survey (SBPS) provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of August 9th to August 15th.

After the SBPS’ six-week summer hiatus, here are six things we learned about the small business economy last week:

- Over a quarter of small businesses expect they will need to obtain financial assistance or additional capital in the next six months. Demonstrating a need for continued relief, 27 percent of respondents anticipate needing additional capital over the months ahead for their business to stay afloat. One in 20 businesses surveyed expects to have to close permanently in the next six months.

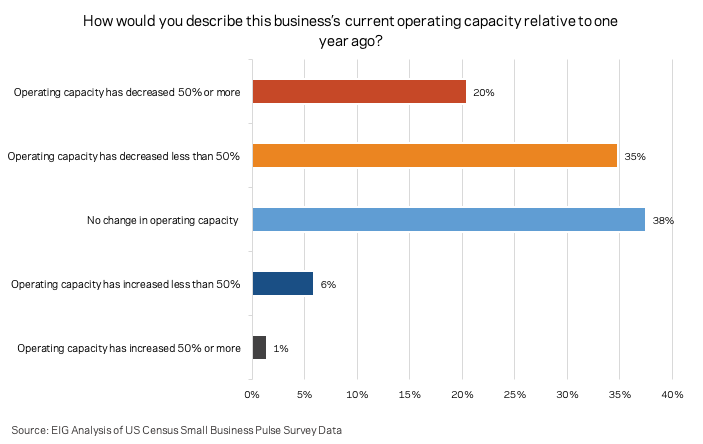

- One out of every five responding businesses is operating at less than 50 percent capacity relative to a year ago. A majority of businesses surveyed remain below max operating capacity with 20 percent of businesses experiencing a 50 percent or more drop in operating capacity. On the flip side, only 7 percent of respondents had expanded operating capacity, a striking indicator of stalling growth in the face of the COVID-19 pandemic.

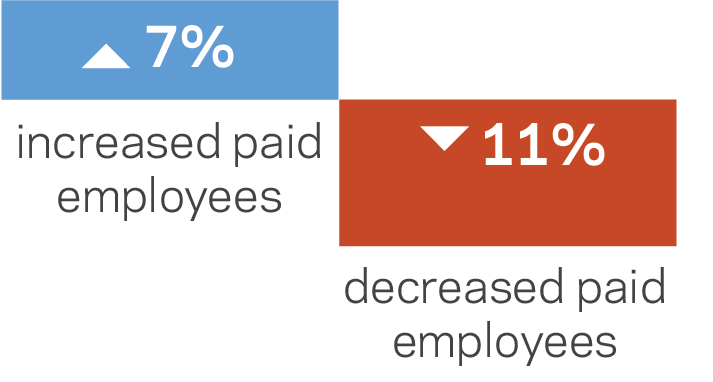

- More firms are firing than hiring. Across all respondents, 11 percent of small businesses decreased the number of paid employees in the week of August 9th, while only 7 percent increased the number of employees on their payroll. The same pattern holds in employee hours — 17 percent of respondents decreased the number of hours worked by employees, while 8 percent increased them.

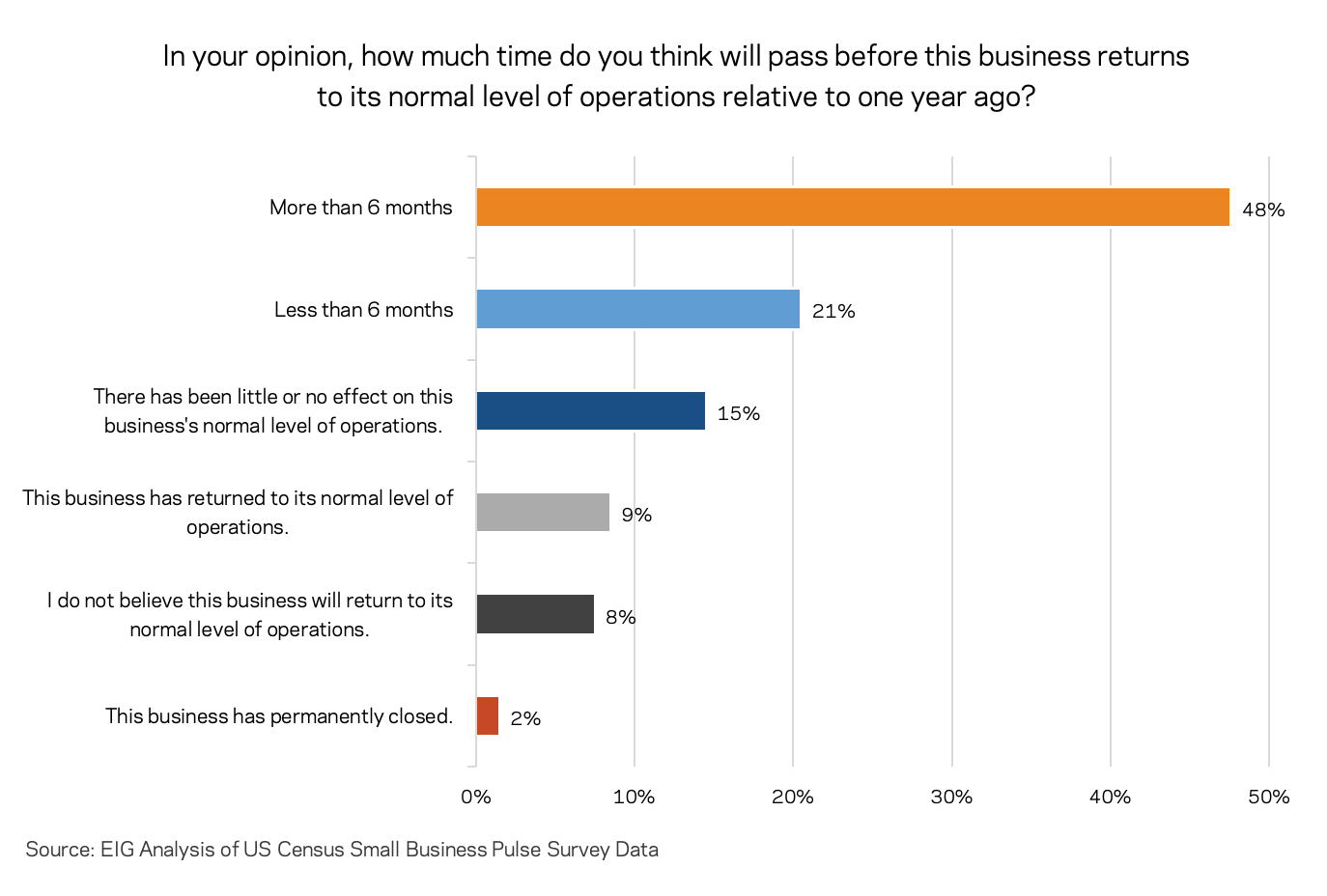

- As the fight against the virus stalls, the share of small businesses expecting depressed levels of activity to continue for six months or longer is rising. At the end of June, 44 percent of respondents expected a full recovery in their business to be at least six months out. By the week of August 9th, that figure had risen to 48 percent. On the flip side, only 9 percent of businesses have returned to their normal level of operation. Those fully recovered firms are almost entirely offset by the 8 percent who do not believe they will ever match pre-pandemic levels of operations.

- Stagnating and declining revenues across businesses send a clear message: the small business recovery is stalling. Attesting to the protracted economic trouble being wrought on the country’s small business sector, revenues fell again for over one-third (34 percent) of responding businesses last week. Only 9 percent of firms reported revenue increases, down significantly from the 20 percent that enjoyed recovering receipts at the end of June. The stalled fight against the virus appears to be leaving the majority of small businesses in a holding pattern, however, as 57 percent of respondents saw no change in revenues over the week.

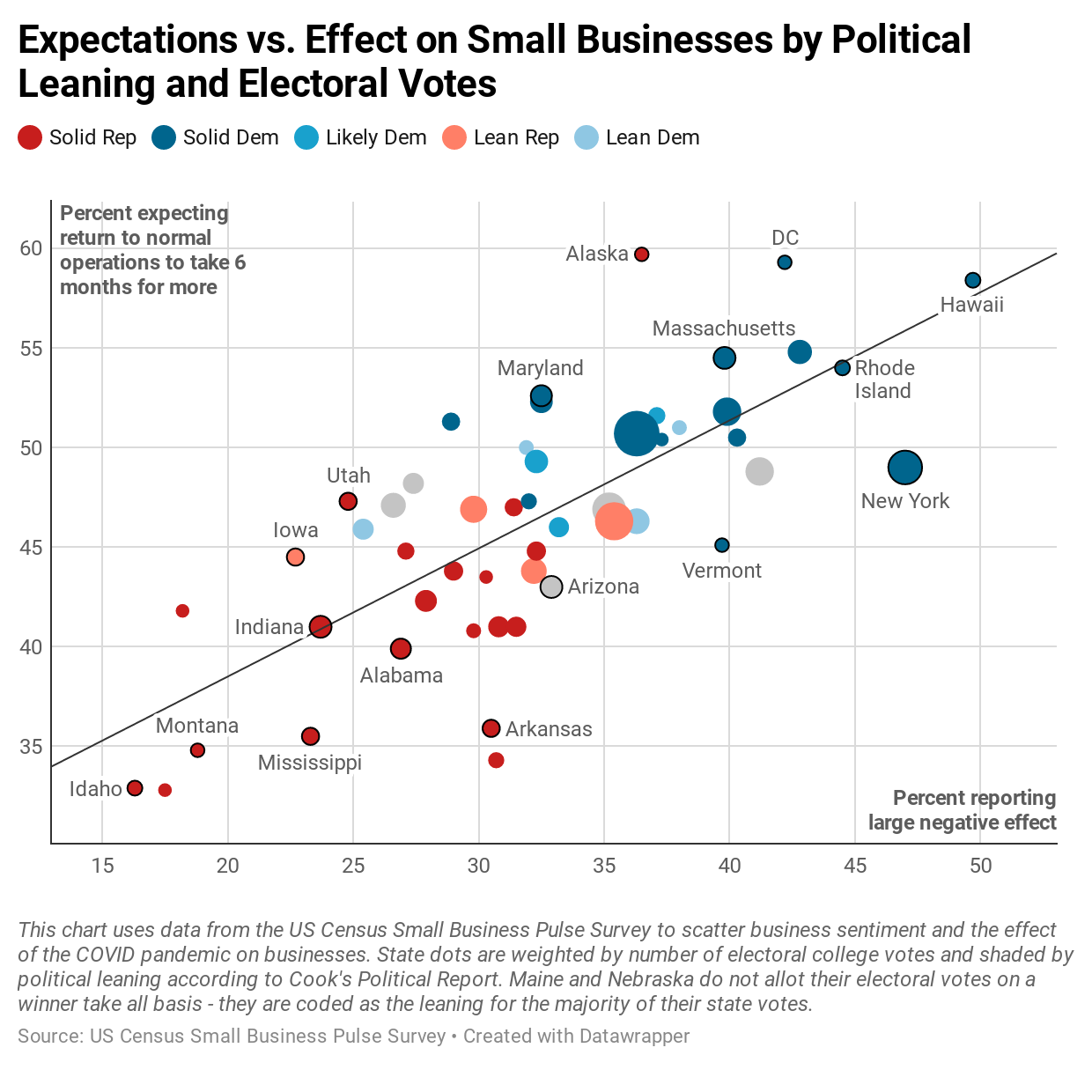

- Small businesses in red states report less severe downturns and more medium-term optimism; blue states the opposite. Businesses in smaller population Republican leaning states appear to have been less affected by the pandemic and correspondingly have a somewhat more positive economic outlook. This may be driven by the tendency for these states to be more rural and to have enacted shorter lockdowns to control the virus. Densely populated, Democratic-leaning states have higher shares of businesses reporting that they have experienced large negative effects tied to the pandemic and correspondingly higher shares of businesses expecting to need more than 6 months to return to their normal level of operations. Despite spikes in caseload, businesses in Texas and Florida are more optimistic about returning to normal operations than half of U.S. states.